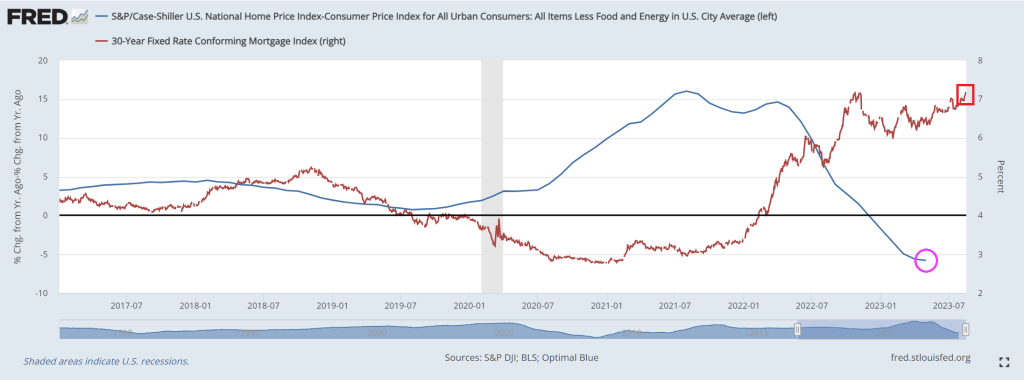

But REAL home price growth (Case-Shiller National HPI YoY – Core CPI YoY) has been declining as The Fed helped jack up mortgage rates above 7%. REAL home price growth was last reported as -5.8% YoY.

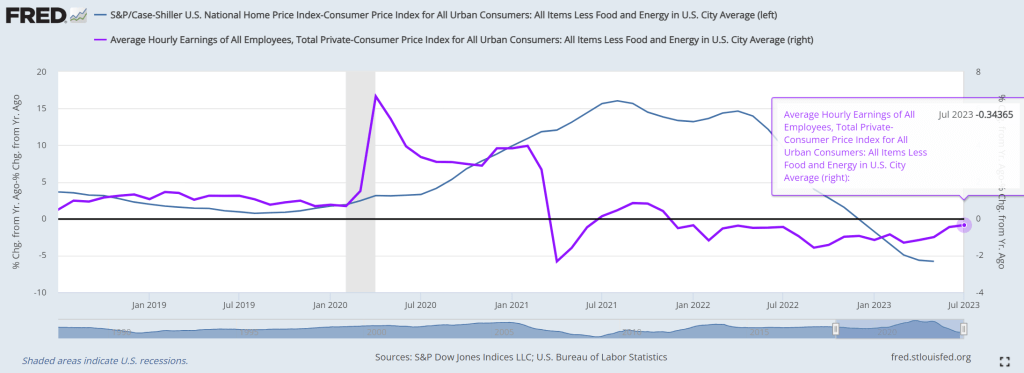

And real home price growth corresponds to negative REAL hourly earnings growth YoY.

The source of funding for mortgage lending is bank deposits. But bank deposit growth remains negative, along with M2 Money growth.

What has Bidenomics and The Fed brought us? DECLINING REAL home price growth as bank deposit growth has stalled.

Let’s see what The Fed does.

You must be logged in to post a comment.