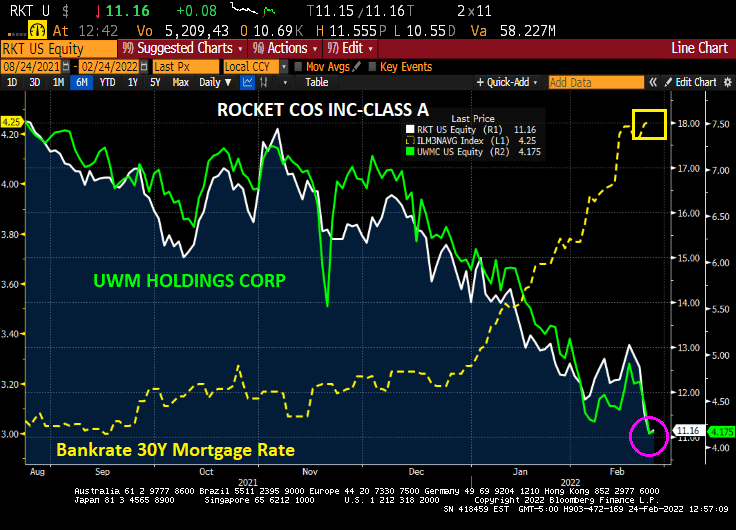

As The Federal Reserve threatens to tighten monetary policy, 30-year mortgage rates have risen to 4.25% leading two major mortgage companies, Rocket Mortgage and United Wholesale Mortgage, to decline to all-time lows.

But wait, Federal Reserve officials signaled they remain on track to raise interest rates next month despite uncertainty posed to the global economy by Russia’s invasion of Ukraine.

While acknowledging the risks created by the conflict, which has triggered one of the worst security crises in Europe since World War II and caused oil prices to surge, U.S. central bankers stressed the need to confront the hottest U.S. inflation in 40 years.

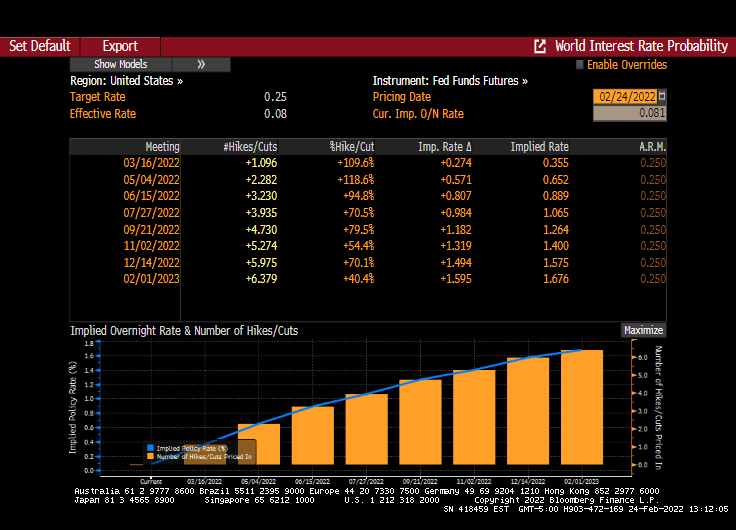

So, The Fed plans to raise rates to fight inflation, even if it tanks the housing and mortgage markets? Fed Funds Futures are still signaling 6 rate hikes over the next year.

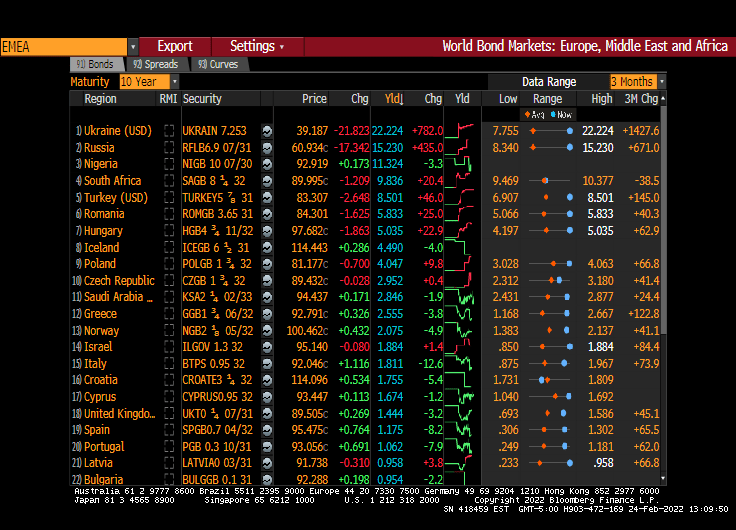

At least US Treasury 10Y yields are down just 7.6 bps. Look at 10Y Russian and Ukraine sovereign yields. Now THAT is a yield surge!

3 thoughts on “Rocket And United Wholesale Mortgage Equity Drop To All-time Low On Fed Tightening (Despite Ukraine, Fed Looks To Keep Tightening)”

Comments are closed.