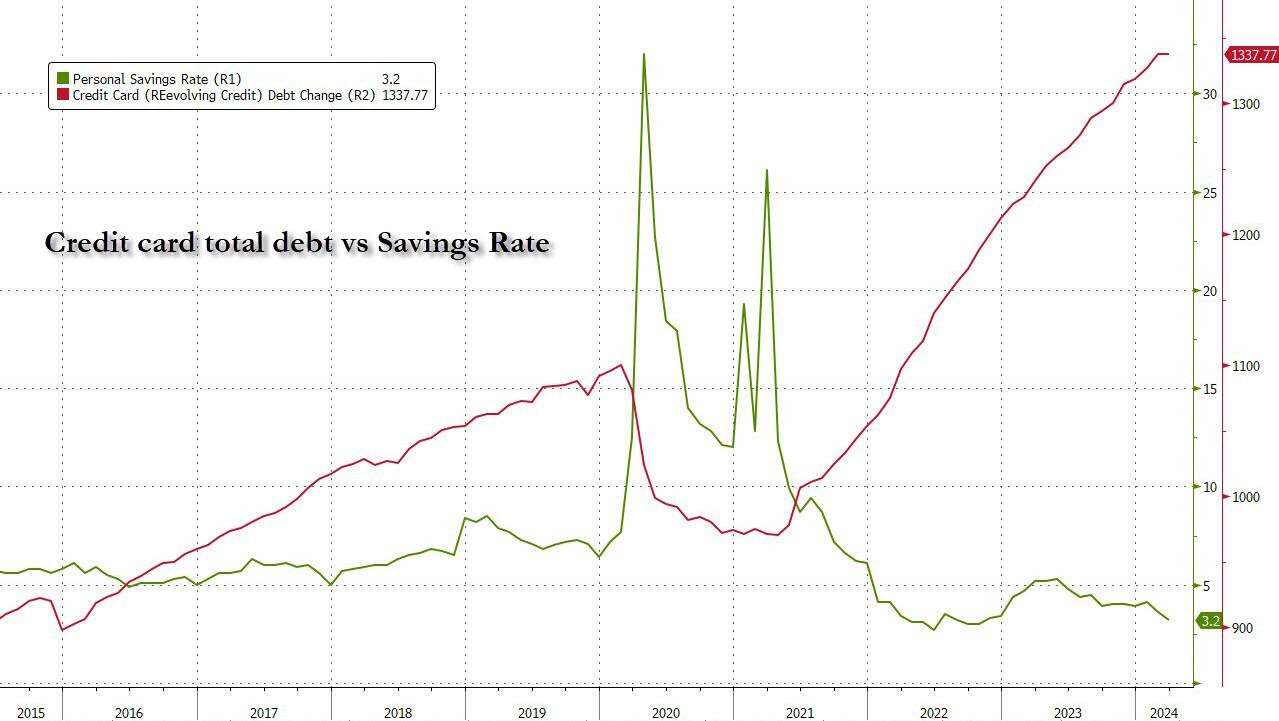

Biden, talking to CNN’s Erin Burnett, made light of America’s struggles with Bidenflation (higher home prices, higher mortgage rates, higher energy and food costs, higher …) caliously saying that “they can afford it.” Well Joe, your big donors (the top 0.5% can afford it! But not the middle class that you have abandoned. In fact, much of America has drained their savings and run up massive debt to cope with your terrible economic policies.

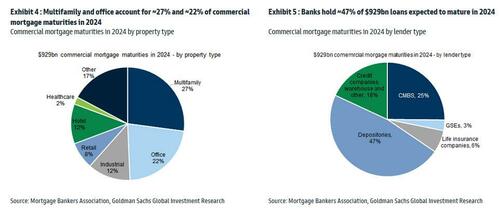

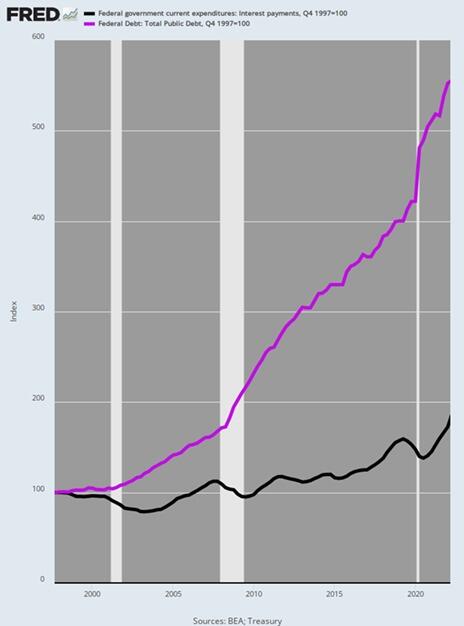

To be sure, credit card debt is just a small portion (~6%) of the total household debt stack: as the next chart from the latest NY Fed consumer credit report shows, the bulk, or 70%, of US household debt is in the form of mortgages, followed by student loans, auto loans, credit card debt, home equity credit and various other forms. Altogether, the total is a massive $17.5 trillion in total household debt.

But staggering as the mountain of household debt may be, at least we know how huge the problem is; after all the data is public. What is far more dangerous – because we have no clue about its size – is what Bloomberg calls “Phantom Debt“, and have repeatedly called Buy Now, Pay Later debt. How much of that kind of debt is out there is largely a guess.

But while it is easy to ensnare young, incomeless Americans into the net of installment debt where they will rot as the next generation of debt slaves for the rest of their lives, there is an even more sinister side to this extremely popular form of debt which allows consumers to split purchases into smaller installments: as Bloomberg reports in a lengthy expose on installment debt, the major companies that provide these so called “pay in four” products, such as Affirm Holdings, Klarna Bank and Block’s Afterpay, don’t report those loans to credit agencies. That’s why Buy Now/Pay Later credit has earned a far more ominous nickname:

It’s hard enough for central bankers and Wall Street traders to make sense of the post-pandemic economy with the data available to them. At Wells Fargo & Co., senior economist Tim Quinlan is particularly spooked by the “phantom debt” that he can’t see.

Which is not to say that we have no idea how much “phantom debt” is out there: according to the report, it is projected to reach almost $700 billion globally by 2028, and yet, time and again, the companies that issue it have resisted calls for greater disclosure, even as the market has grown each year since at least 2020. That, as Bloomberg accurately warns, is masking a complete picture of the financial health of American households, which is crucial for everyone from global central banks to US regional lenders and multinational businesses.

In fact, the recent explosion in installment debt may explain why the US consumer remains so resilient even when most conventional economic metrics suggest consumers should be struggling: “Consumer spending in the world’s largest economy has been so resilient in the face of stubbornly high inflation that economists and traders have had to repeatedly rip up their forecasts for slowing growth and interest-rate cuts.”

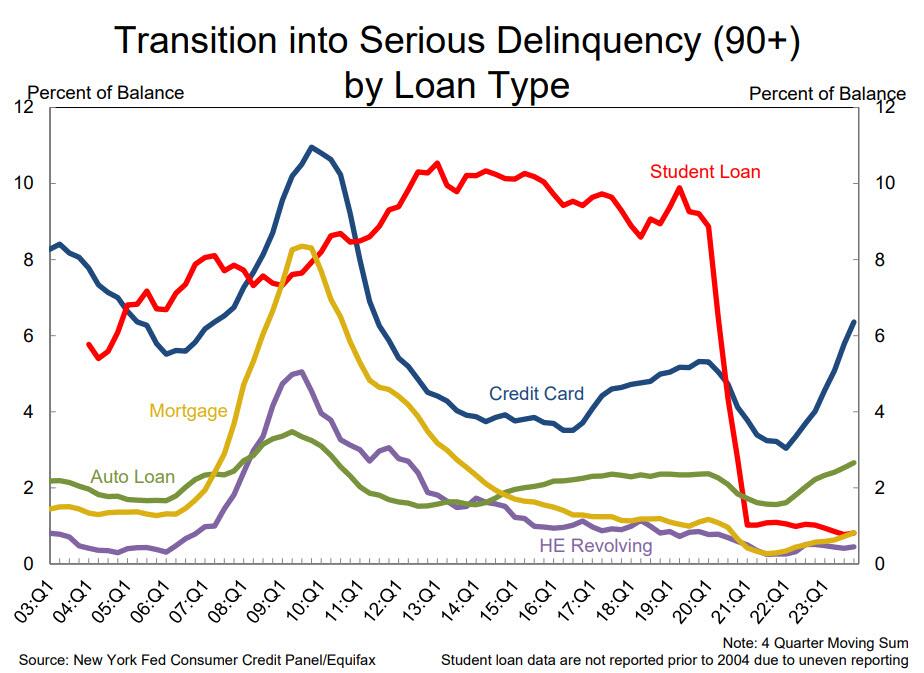

Still, cracks are starting to form. First it was Americans falling behind on auto loans. Then credit-card delinquency rates reached the highest since at least 2012, with the share of debts 30, 60 and 90 days late all on the upswing.

And now, there are also signs that consumers are struggling to afford their BNPL debt, too. A recent survey conducted for Bloomberg News by Harris Poll found that 43% of those who owe money to BNPL services said they were behind on payments, while 28% said they were delinquent on other debt because of spending on the platforms.

For Quinlan, a major concern is that economic experts are being “lulled into complacency about where consumers are.”

“People need to be more awake to the risk of BNPL,” he said in an interview.

Well, those who care, are awake – we have written dozens of articles on the danger it poses; the problem is that those who are enabled by this latest mountain of debt – such as the Biden administration which can claim a victory for Bidenomics because the economy is so “strong”, phantom debt be damned – are actively motivated to ignore it.

So why is this latest debt bubble called a “phantom”?

Well, BNPL is a black box largely because of a longstanding blame game among BNPL providers and the three major credit bureaus: TransUnion, Experian and Equifax. The BNPL companies don’t provide data on their installment loans that are split into four payments, which were used by online shoppers to spend an estimated $19.2 billion in the first quarter, according to Adobe Analytics, up 12.3% compared with the same period last year.

The BNPL giants say credit agencies can’t handle their information — and that releasing it could harm customers’ credit scores, which are key to securing mortgages and other loans. The big three bureaus say they’re ready, while two of the major credit scoring firms, VantageScore Solutions and Fair Isaac Corp. (FICO), say they’re equipped to test how the products will affect their figures. Meanwhile, regulation is looming over the industry, but this stalemate has left the status quo mostly in place.

In other words, not only do we not know just how big the BNPL problem is, it is actively masked by credit agencies which can’t accurately calculate the FICO score of tens of millions of Americans, and as a result their credit capacity is artificially boosted with far more debt than they can handle… and that’s why the US consumer has been so “strong” in recent years, defying all conventional credit metrics.

The good news is that despite the tacit pushback of the administration, there has been some signs of progress. Apple earlier this year became the first major BNPL provider to furnish transaction and payment data to Experian. As of now, it provides a snapshot of consumers’ overall debt load from Apple Pay Later transactions, but the information won’t be used for consumer credit scores. In separate statements to Bloomberg, Klarna, Affirm and Block said they want assurance that consumers’ credit scores and their data would be protected before reporting customer information. Representatives for TransUnion, Experian and Equifax said they’ve updated their structures and the data would be secure.

Still, the lack of transparency has researchers at the Federal Reserve Bank of New York, which publishes a comprehensive quarterly report on the $17.5 trillion in US household debt, convinced they’re missing some of what’s happening in the economy.

“They’ve reached a certain scale that they could impact economists’ assumptions about their economic outlooks,” said Simon Khalaf, Chief Executive Officer of Marqeta Inc., a firm that helps BNPL providers process their payments.

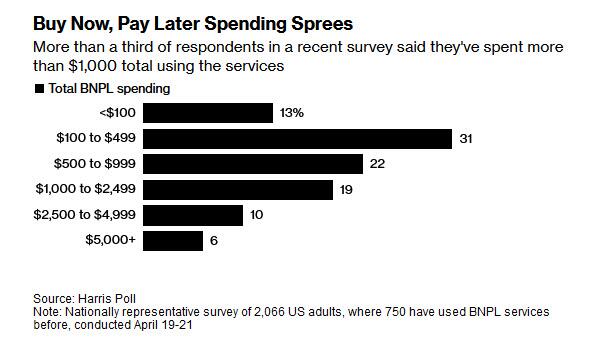

Meanwhile, the pernicious effects of BNPL credit are piling up: the Harris Poll survey conducted last month, provides some crucial clues about how Americans use BNPL. For one, splitting payments into smaller chunks encourages more spending, obviously.

More than half of respondents who use BNPL said it allowed them to purchase more than they could afford, while nearly a quarter agreed with the statement that their BNPL spending was “out of control.” Harris also found that 23% of users said they couldn’t afford the majority of what they bought without splitting payments, while more than a third turned to the services after maxing out credit cards.

The findings also show that the spending, which for more than a third of users has exceeded $1,000, isn’t entirely on big-ticket items. Almost half of those using BNPL say they’ve started, or have considered, using it to pay bills or buy essential items, including groceries.

Translation: Americans are no longer even charging everyday purchases they traditionally used cash and savings to pay for; now they are using installment plans to pay for bread!

It’s not just the lower classes that are abusing BNPL credit: while whatever small pockets of consumer distress have emerged so far in the US, have been chalked up to a bifurcated economy where working class Americans struggle to make ends meet, the survey found that middle-class households are relying on BNPL, too. The shocking punchline: about 42% of those with household income of more than $100,000 report being behind or delinquent on BNPL payments!

“BNPL essentially lets people dig a deeper and deeper hole of credit, which will be harder and harder to climb out of,” said Ed deHaan, a professor of accounting at Stanford Graduate School of Business, adding that it happens “more easily when there’s no transparency.”

Of course, installment debt is nothing new: the option to pay in installments using short-term loans has been around for a ong time, but it exploded in popularity during the pandemic, especially with younger, digitally savvy consumers who gravitated to the services as an alternative to credit cards. The pioneering BNPL companies, including Afterpay, Klarna and Affirm, launched with trendy retailers, partnered with social media influencers and became a common option on apps and online checkouts.

BNPL offers quick credit approvals and lets consumers pay in installments. The first is usually due right away, and the others are often collected once every two weeks for the popular “pay in four” loans. There’s typically no interest or fees, as long as payments are made on time. Like credit card companies, BNPL firms make money on fees from merchants — and some have steep penalties for missed payments.

While normally larger banks would avoid this kind of “new and much more dangerous subprime”, this time is different: the rapid adoption of the products has enticed major financial institutions to offer the option to split payments, even as regulators warn them of the risks. That includes PayPal, U.S. Bancorp and Citizens Financial. Even big banks like Citigroup and JPMorgan have similar capabilities on their credit cards.

The industry has branded itself a financial equalizer. They argue that “soft-credit checks” — when a lender runs a consumer’s credit history without affecting their score — expand credit access to those underserved by traditional lenders, while zero-interest provides a better deal than many cards.

Affirm said its customers have an average outstanding balance of $641, while Afterpay and Klarna put the figure at $250 and $150, respectively. Unfortunately, there is no way to check these numbers. And while the average credit card balance was $6,501 in the third quarter of 2023, according to Experian data, the BNPL balances mean that most Americans can’t even afford a weekly outing to their grocery store without putting it on an installment plan, a truly terrifying scenario.

Critics naturally argue that BNPL is particularly attractive to the financially vulnerable. The Consumer Financial Protection Bureau has flagged risks to consumers, including surprise late fees and “hidden interest” — or when BNPL purchases are made with credit cards charging high interest rates. The CFPB has also expressed concern about “loan stacking,” when individuals take out several BNPL loans at once with different providers, which is most of them.

Some BNPL services, including Afterpay and Klarna, require borrowers to agree to “mandatory autopayment,” meaning the companies can automatically charge the credit card or bank account on file when a payment is due. Those who link the latter are potentially vulnerable to overdraft fees.

Meanwhile, as rates remains sky high, even Wall Street’s perpetually cheerful analysts are wondering where is all the consumption coming from?

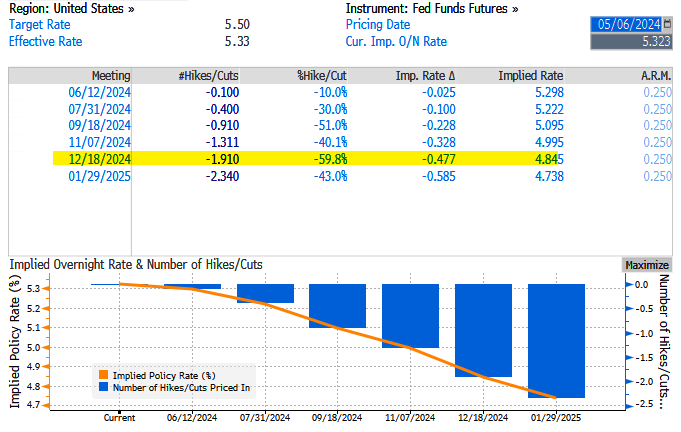

Robust consumer spending and low unemployment rates have many economists convinced the US consumer remains strong, making Wall Street bullish on the economy. But lately, stubbornly persistent inflation has dialed back expectations for imminent interest-rate relief.

That’s set to ramp up pressure on households that are already stretched thin by higher prices for everything from gas and food to rent and apparel. As of the end of December, almost 3.5% of credit-card balances were at least 30 days past due, according to the Philadelphia Fed, the most since the data began in 2012. Nominal card balances also set a new high.

For those who are falling behind, BNPL offers what appears to be a no-brainer decision: space out payments… at least until this last credit buffer fills up and bankruptcy is the only possible outcome.

That was the thinking of Hayden Waschak, a 23-year-old in Pittsburgh. Even though he said it felt “dystopian” to use BNPL to pay for food, he began using Klarna in February to spread out payments on a grocery delivery app. It helped his finances — at first. After he lost his job as a documents processing specialist at University of Pittsburgh Medical Center in March, he relied more heavily on the service. And without any income, he became delinquent on payments and started racking up late charges. He eventually paid off the nearly $200 balance, but he said his credit score dropped.

“Unexpected life events caused me to lose income,” Waschak said. “I ended up paying more than if I had paid for it all at once.”

Meanwhile, the fact that BNPL balances do not count against your credit rating, means users get little upside when it comes to their credit — paying on time won’t help them build up their score. On the other hand, the downside is still there for falling behind: not only can they get charged late fees, but delinquent BNPL loans can be turned over to debt collectors.

The latter is what Fabrizio Lopez said happened to him. He used Affirm to split up a $500 online payment for used-car parts in 2019. The Long Island-based mechanic, who doesn’t have a traditional credit card, said that while he received the items a week later, he never got a bill. That is, until debt collection letters started pouring in from across the US.

Lopez said he primarily relied on cash before that purchase, so the unpaid loan stands out on his credit profile. Now 30, he worries that a the BNPL purchase has created “invisible barriers” to the financial system.

“They hook you with the idea of no interest rates,” he said. “I thought that I would be able to build my credit if I paid it back — I was so wrong.”

He is not the only one who is “so wrong”: just as wrong are all those Panglossian economists at the Fed and Wall Street who believe that the US economy is growing at what the Atlanta Fed today laughably “calculated” was a 4.2% GDP, even as the DOE found that the most accurate indicator of overall economic strength, diesel demand, was the lowest since covid, an glaring paradox… yet glaring to all except those who refuse to see just how rotten the core of the US economy has become, and will be “absolutely shocked” when the next credit crisis destroys tens of millions of Americans drowning in what is now best known as “phantom debt.”

You must be logged in to post a comment.