Zowie!

Mortgage applications increased 29.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 12, 2025. Last week’s results included an adjustment for the Labor Day holiday.

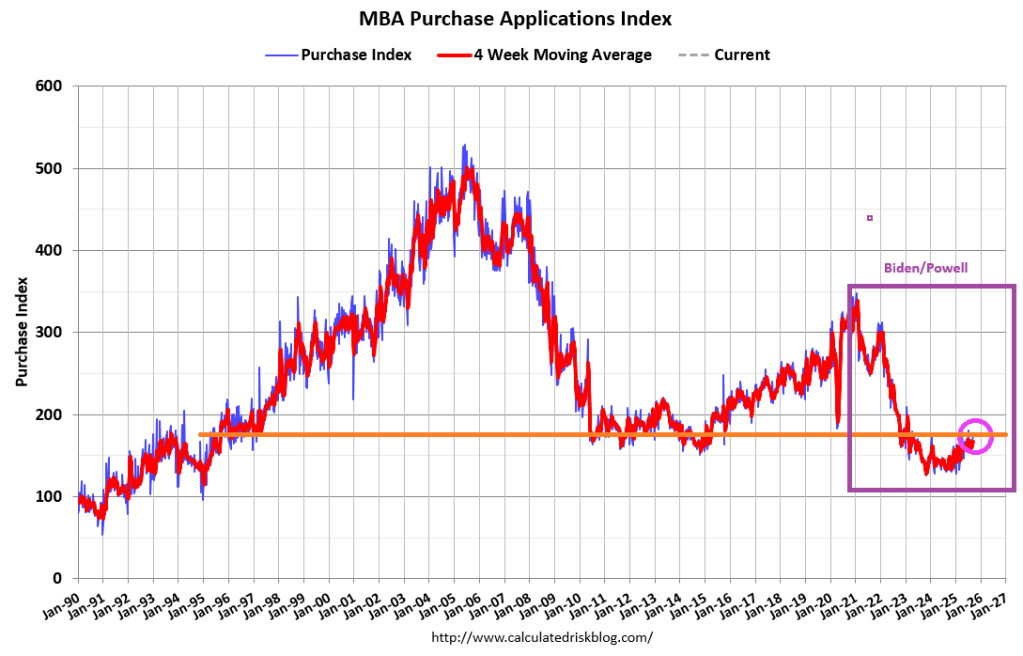

The Market Composite Index, a measure of mortgage loan application volume, increased 29.7 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 43 percent compared with the previous week. The seasonally adjusted Purchase Index increased 3 percent from one week earlier. The unadjusted Purchase Index increased 12 percent compared with the previous week and was 20 percent higher than the same week one year ago.

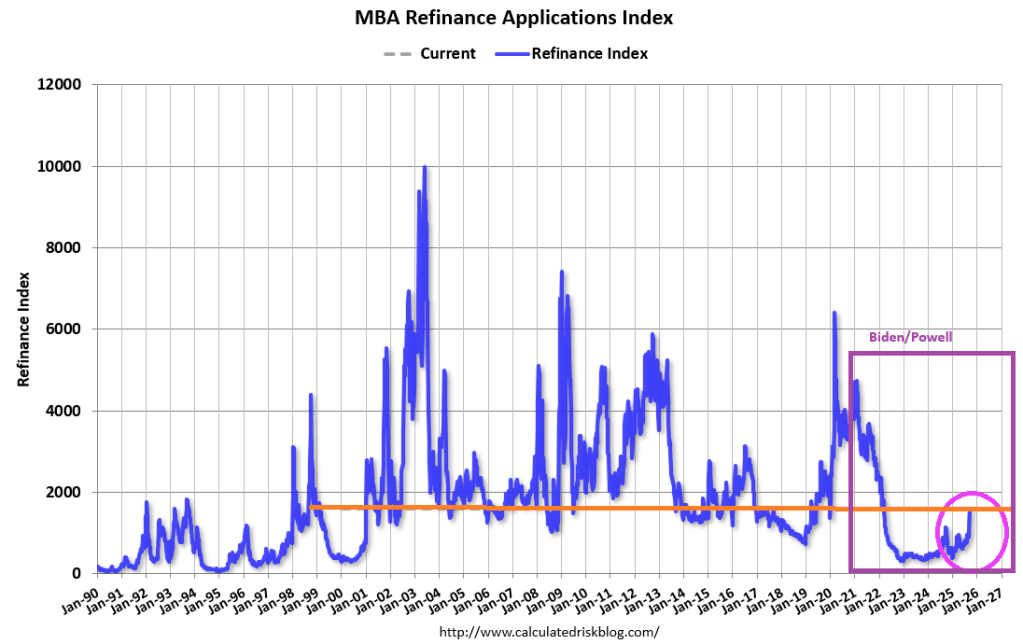

The Refinance Index increased 58 percent from the previous week and was 70 percent higher than the same week one year ago.

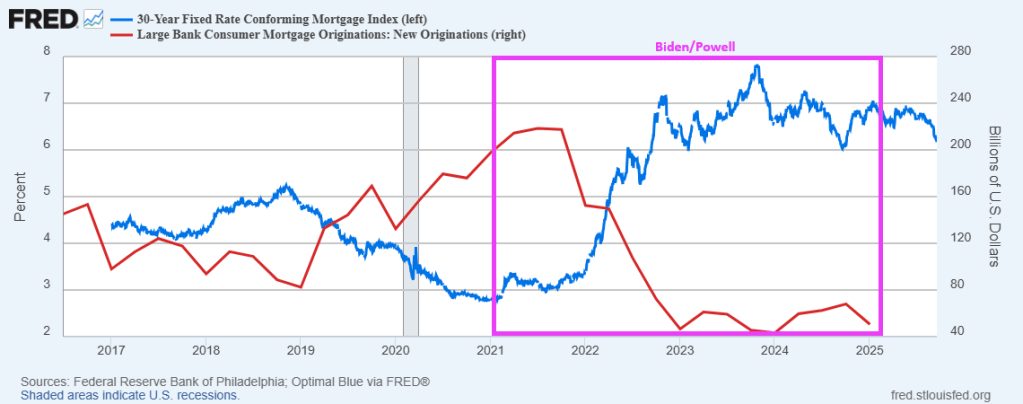

Indicative of the weakening job market, and in anticipation of a rate cut from the Federal Reserve, mortgage rates last week dropped to their lowest level since last October, with the 30-year fixed rate declining to 6.39 percent. Homeowners responded swiftly, with refinance application volume jumping almost 60 percent compared to the prior week. Homeowners with larger loans jumped first, as the average loan size on refinances reached its highest level in the 35-year history of our survey. Almost 60 percent of applications were for refinances, but there was also a pickup in purchase applications.

The Biden/Powell “reign of error” is ending.

You must be logged in to post a comment.