It has been a grim Friday. The Dow fell 900 points, 10Y Treasury yields fell 16.1 basis points and West Texas Crude fell to $68.17.

Bitcoin tumbled 20% from record highs notched earlier this month as a new variant of the coronavirus spurred traders to dump risk assets across the globe.

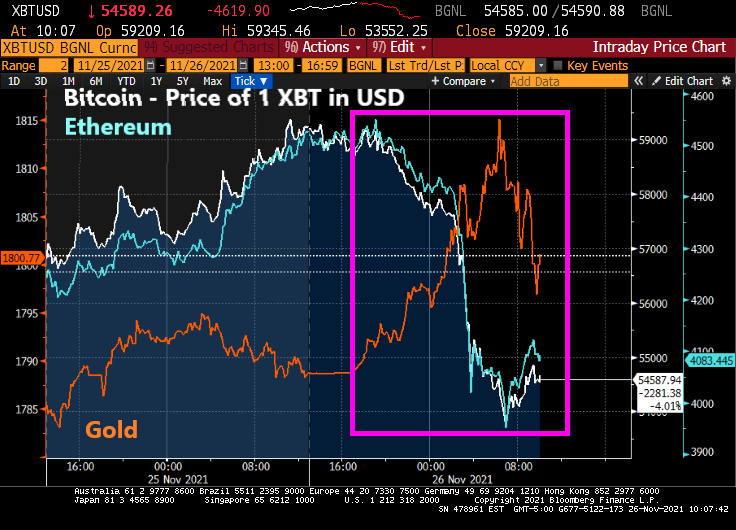

The world’s largest cryptocurrency fell as much as 8.9% to $53,624 on Friday during London trading hours. Ethereum, the second-largest digital currency, dropped more than 12%, while the wider Bloomberg Galaxy Crypto Index declined as much as 7.5%. On the other hand, gold rose as cryptos fell, then retreated as cryptos rebounded.

A new variant identified in southern Africa spurred liquidations across markets, with European stocks falling the most since July and emerging markets also slumping.

The Dow is down around 900 points … and look at Europe!

The 10-year Treasury yield is down 16.1 basis points. Most of Europe is down around 8-9 basis points while the UK is down 14.5 BPS.

And West Texas Intermediate crude futures are down to 68.17 from 78.39. No Jen Paski, this isn’t due to Cousin Eddie (Biden) releasing the Strategic Petroleum Reserve (SPR).

Maybe it was all the tryptophan released by eating turkey.

A day to remember.

3 thoughts on “Bitcoin Retreats 20% From All-Time High as Risk Assets Slump (Dow Retreats Almost 1,000 Points, Gold Advances)”

Comments are closed.