The Biden regime highlights the problem of politicians running the economy. Call it “Tumbling Markets.”

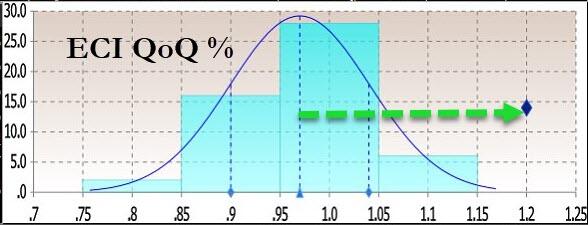

The ECI rose from +0.9% QoQ in Q4 to +1.2% QoQ in Q1 (well above the +1.0% QoQ expected). That is the biggest QoQ jump in a year…

That was higher than the highest forecast…

Which leaves the civilian worker ECI up 4.2% YoY, stalling the disinflationary path it had been on…

In other words, persistent wage pressures are keeping inflation elevated.

This sent stocks tumbling lower…

Just add this data point to the ‘the disinflation narrative is dead’ side of the ledger.