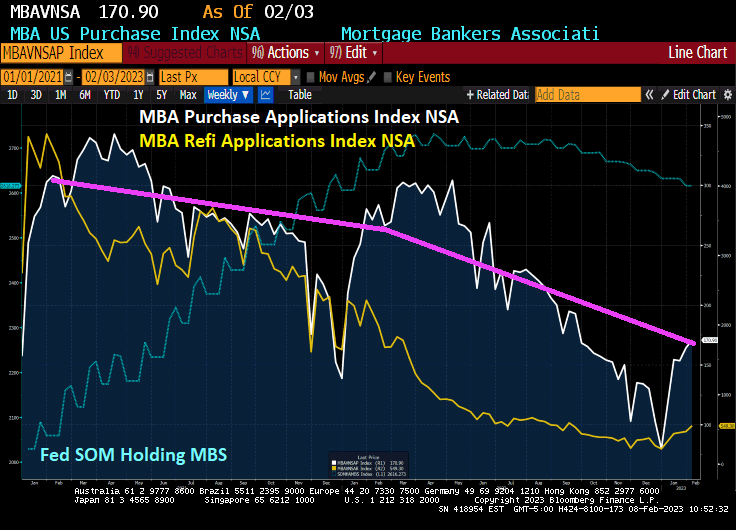

Starting in 2009 with the housing bubble burst and ensuing financial crisis, The Federal Reserve bought agency mortgage-backed securities (MBS) in an effort to provide stability to the then suffering housing and mortgage markets. Flash forward to today and The Federal Reserve still has $2.62 TRILLION in Agency MBS in its System Open Market holdings. And declining very slowly.

All this is happening as M2 Money growth YoY has gone negative and both mortgage rates and home price growth are slowing.

Is the US mortgage market that fragile that requires The Fed to support it?

The answer is yes if we look at the Mortgage Bankers Association weekly applications index. The Refinance Index increased 18 percent from the previous week and was 75 percent lower than the same week one year ago. The unadjusted Purchase Index increased 4 percent compared with the previous week and was 37 percent lower than the same week one year ago.

I noticed that Biden didn’t mention how mortgage purchase applications since he was installed as President have fallen -45%. Mortgage refi applications have dropped -88% since February 5, 2021.

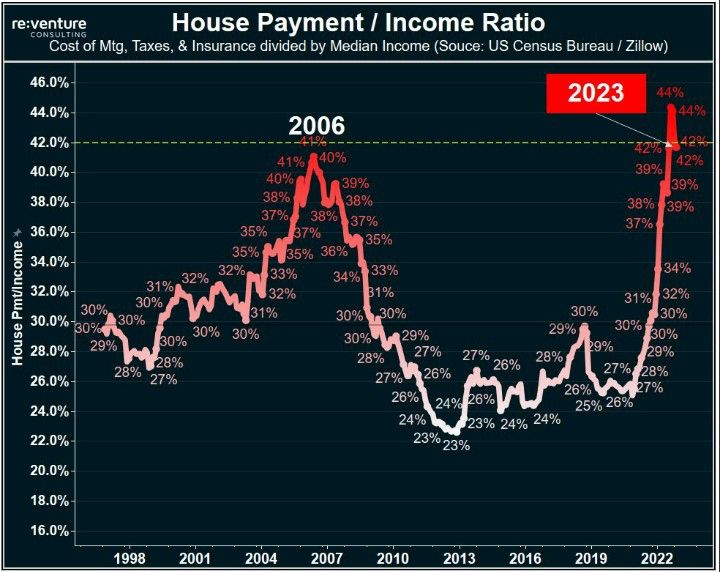

At least the US house payment to income ratio has declined since the peak. But still higher than at the peak of the US housing bubble in 2006.

6 thoughts on “Fragility! The Federal Reserve Is Slow-Walking Its Shrinking Of Mortgage-backed Securities As M2 Money Growth Goes Negative (Mortgage Purchase Demand Down -37% Since Last Year And Down -45% Since February 5, 2021)”

Comments are closed.