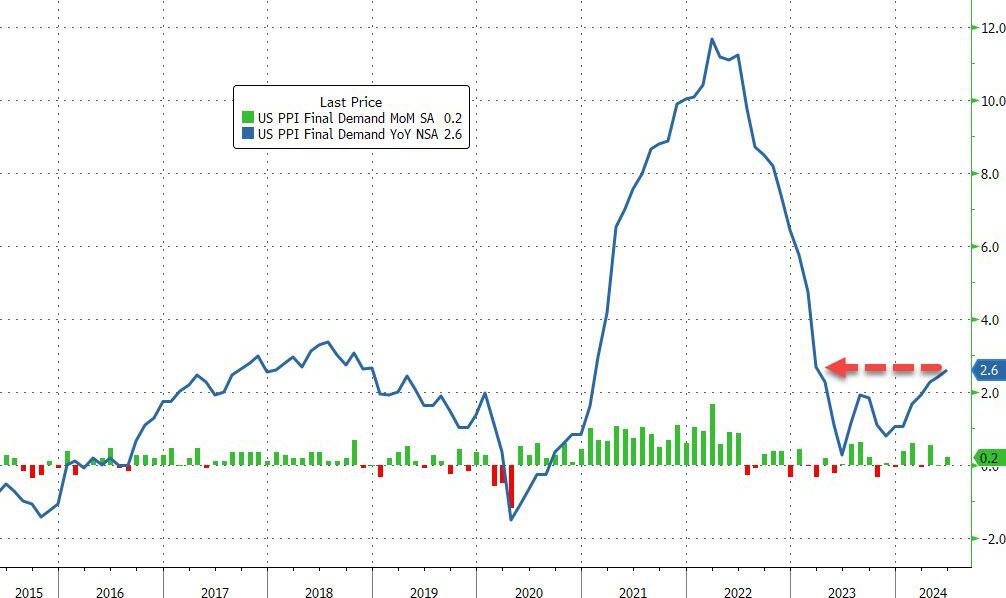

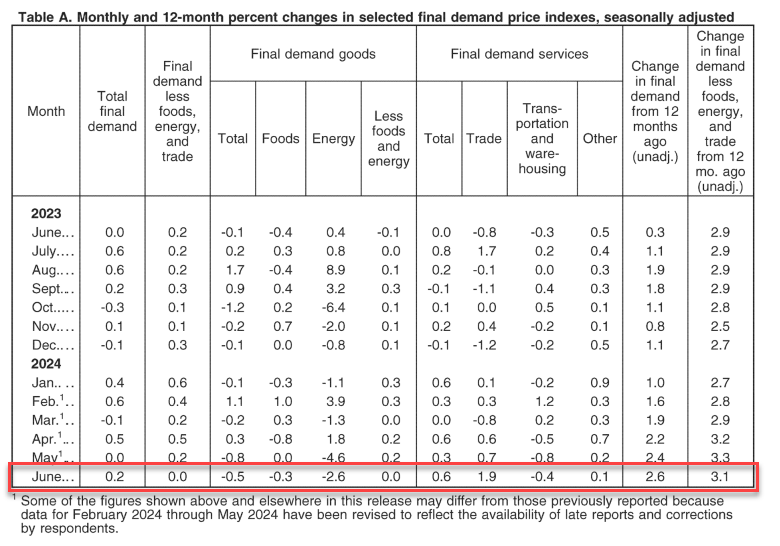

After May’s MoM deflationary impulse (thanks to a plunge in energy costs), June was expected to see a modest 0.1% rise (and we have seen energy prices starting to rise again). Sure enough, headline PPI printed HOT at +0.2% MoM (and May was revised higher), pushing the YoY print up to 2.6% (well above the 2.3% expected)…

That is the highest PPI since March 2023.

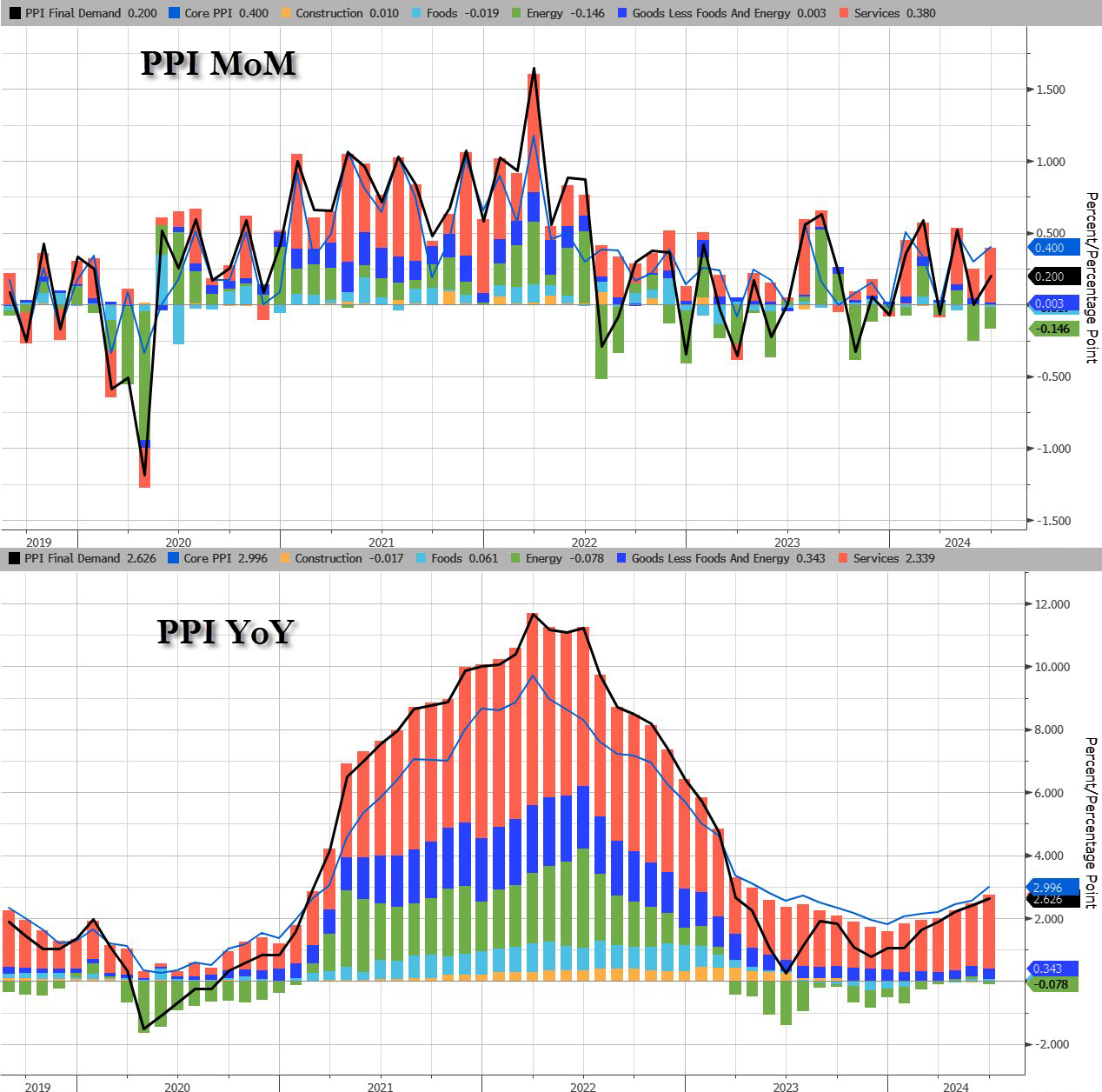

Core PPI rose by 0.4% MoM (double the 0.2% exp), sending the YoY price rise up by 3.0% (also the hottest since March 2023)…

The jump in PPI was driven by a resurgence in Services costs as Energy remains deflationary (for now)…

The June rise in the index for final demand can be traced to a 0.6-percent increase in prices for final demand services. In contrast, the index for final demand goods decreased 0.5 percent

Perhaps worse still, the pipeline for PPI (intermediate demand) is accelerating…

On the housing side, buying conditions for housing tanks to all-time low.

You must be logged in to post a comment.