The US mortgage market is “livin’ on a prayer.” As a result, former homebuilder and current FHFA Director Bill Pulter has suggested 2 mortgage products to make US homes more “affordable”, adding to the legacy of stupid government policies to increase homeownership.

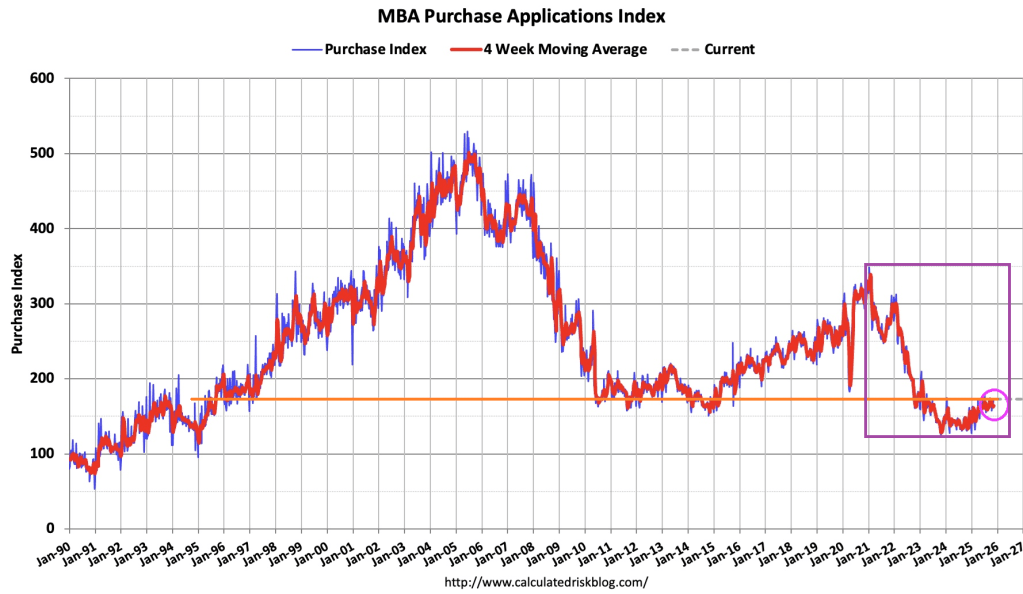

But first, current mortgage demand. Mortgage applications increased 0.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 7, 2025.

The Market Composite Index, a measure of mortgage loan application volume, increased 0.6 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 1 percent compared with the previous week. The seasonally adjusted Purchase Index increased 6 percent from one week earlier. The unadjusted Purchase Index increased 3 percent compared with the previous week and was 31 percent higher than the same week one year ago.

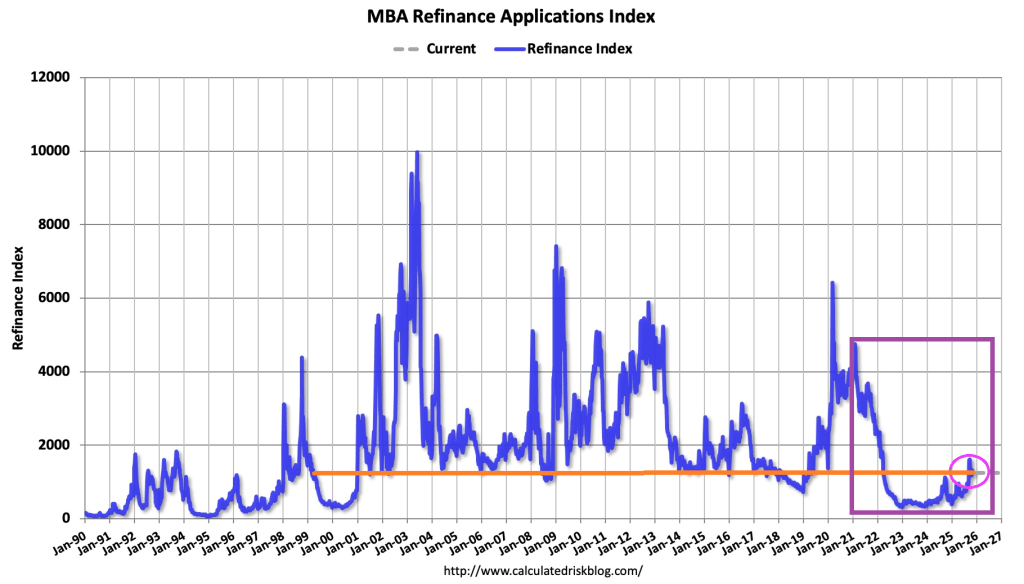

The Refinance Index decreased 3 percent from the previous week and was 147 percent higher than the same week one year ago.

Now on to Pulte’s stupid mortgage proposals.

Pulte Doubles Down After 50-Year Backlash, Proposes “Layaway Mortgage”

The 50-year mortgage is a stupid idea. True, it can reduce the monthly mortgage payment by several hundred dollars. But it extends the life of the mortgage from 30 to 50 years, keeping the outstanding mortgage balance elevated for longer, exposing the lender (or mortgage owner) to greater losses in the case of default. Not surprising since the duration risk of a 50-year mortgage is greater than on a 30-year mortgage. Who is going to hold these mortgages??

So, Pulte hearing that the mortgage market thinks this is a stupid idea, introduced another stupid mortgage idea: the “layaway mortgage” where buyers make payments for 5-10 years before they’re allowed to move into the home. This is a variation of “rent to own.”

Under Pulte’s Layaway Mortgage program:

▪️ Buyers select a home and begin making monthly payments immediately

▪️ They continue paying for 5-10 years (the “layaway period”)

▪️ During this time, they cannot live in the home, modify it, or even visit without an appointment

▪️ After the layaway period ends, buyers can move in and begin their 40-year mortgage

▪️ If they miss a payment during layaway, they forfeit everything and the home goes back on the market.

So, in other word, a 50-year mortgage (40+10 layaway).

Note: Japan used to offer 100-year mortgages during their housing bubble, but now 35-year mortgages are more common.

You must be logged in to post a comment.