Under Bidenomics, with its high inflation rate and crushing negative wage growth, consumers are draining their savings and living on a prayer …. and consumer credit to cope.

US consumer credit just rose to $17.3 trillion, up dramatically since Biden’s inaugaration as El Presidente of the United Banana Republics of America.

What is worriesome in the transition rates (like current to 90-days delinquent) Credit cards (blue) and auto loans (red).

A closer look at credit card delinquency rates on a year-over-year (YoY) basis, showing the fastest growth in delinquencies since the Covid economic lockdowns.

Then we have commercial real estate delinquencies are now the highest the have been since 2013.

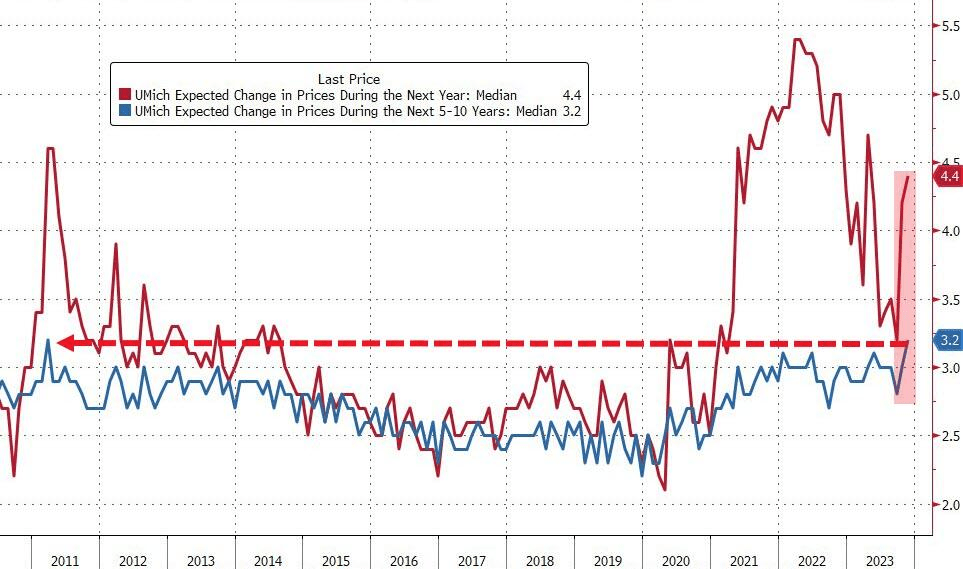

Meanwhile, University of Michigan consumer sentiment about inflation spiked to 4.4%. That is the highest medium-term inflation expectation since 2011.

The US consumer is being shot through the heart and Biden and The Fed are to blame. Biden gives gov a bad name.

You must be logged in to post a comment.