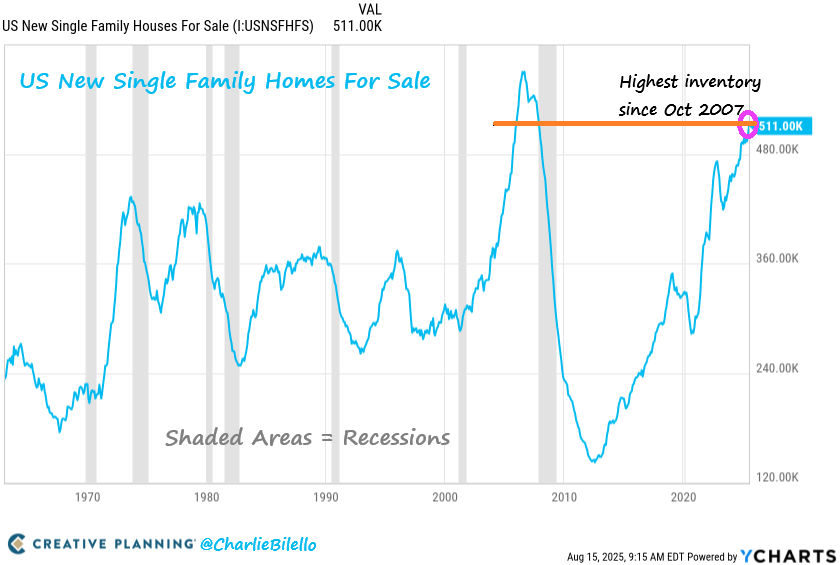

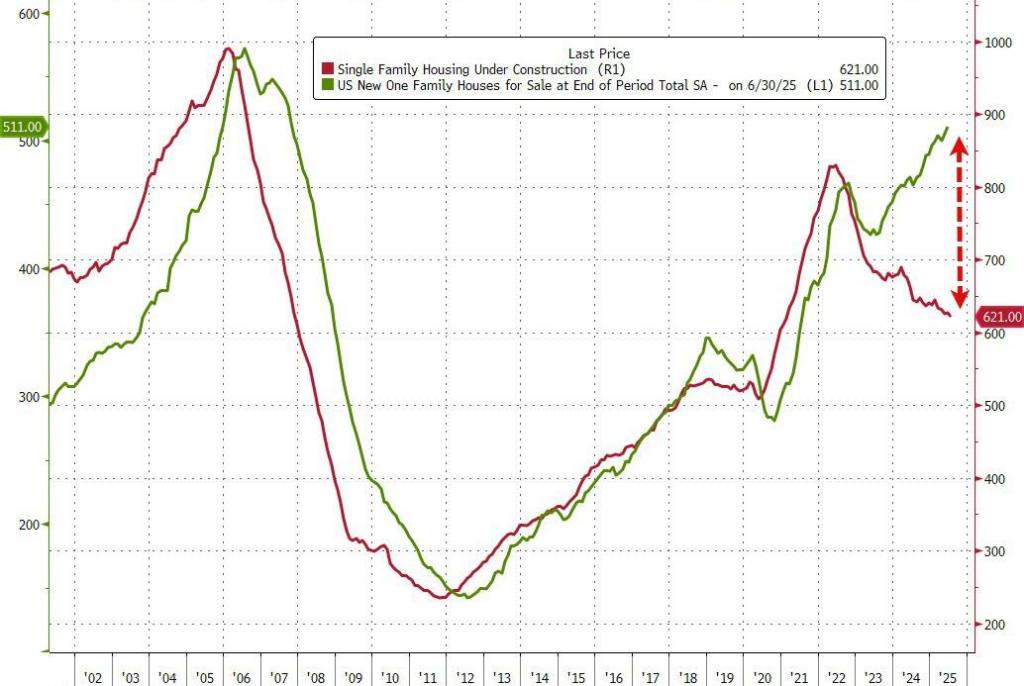

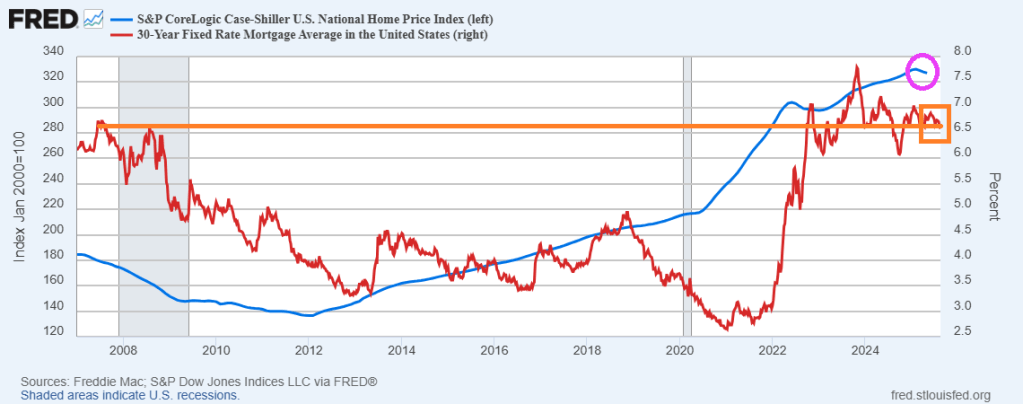

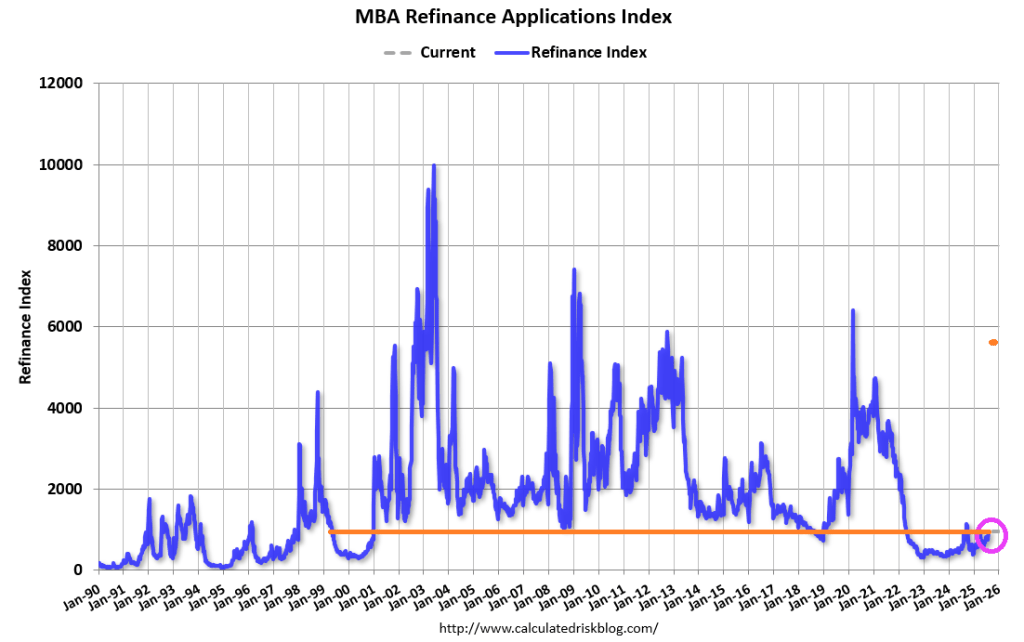

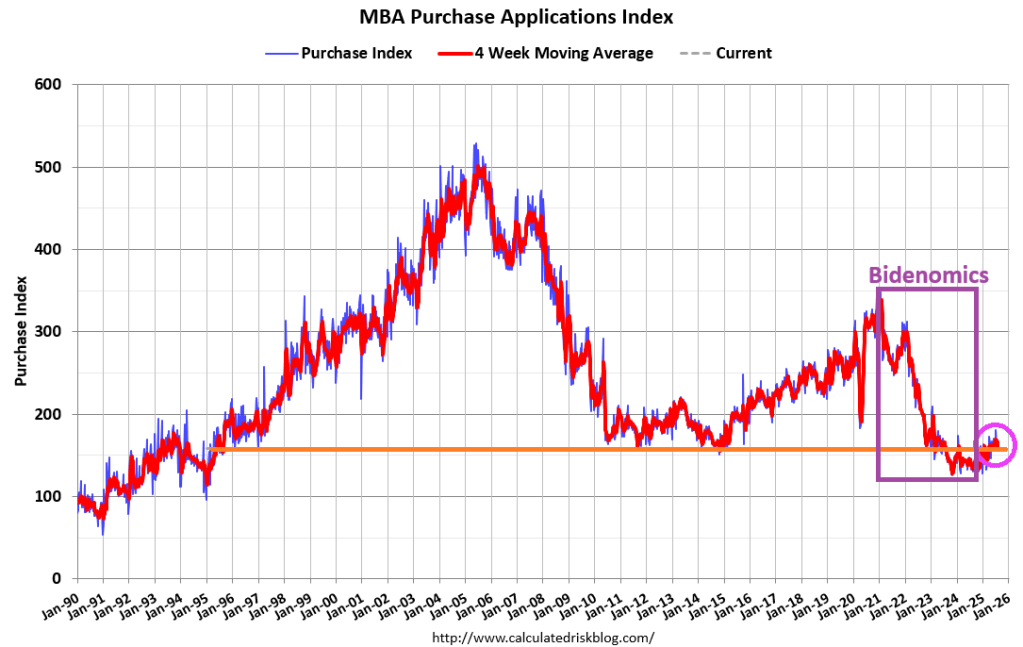

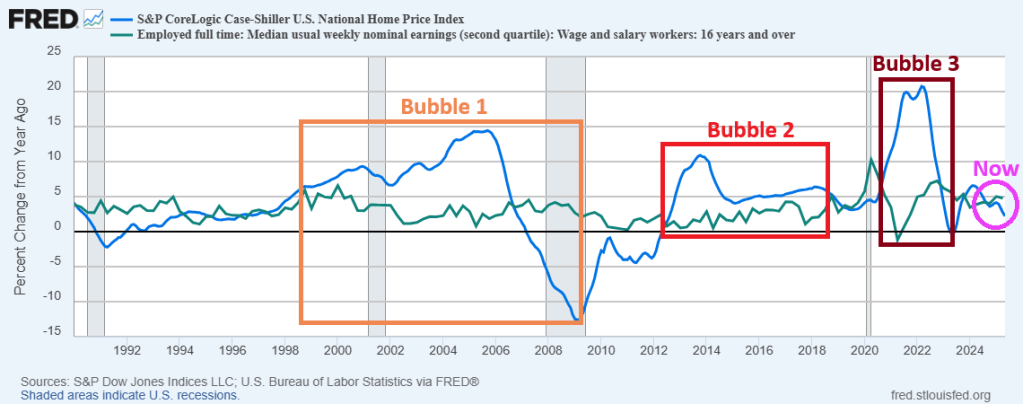

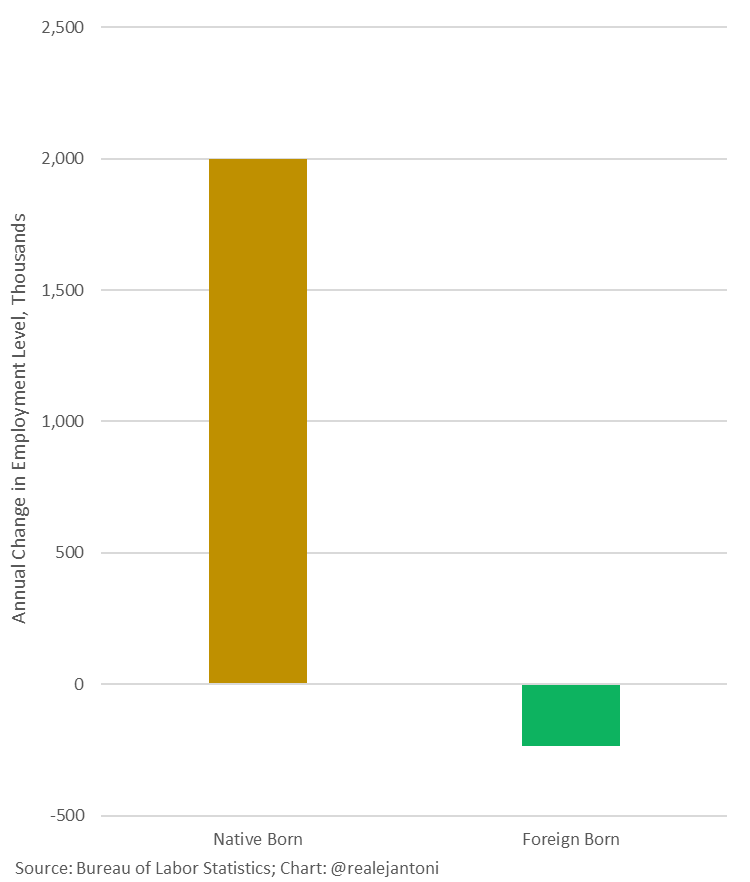

The Federal Reserve is Dazed and Confused. Their money printing is making housing progressively more expensive and unaffordable.

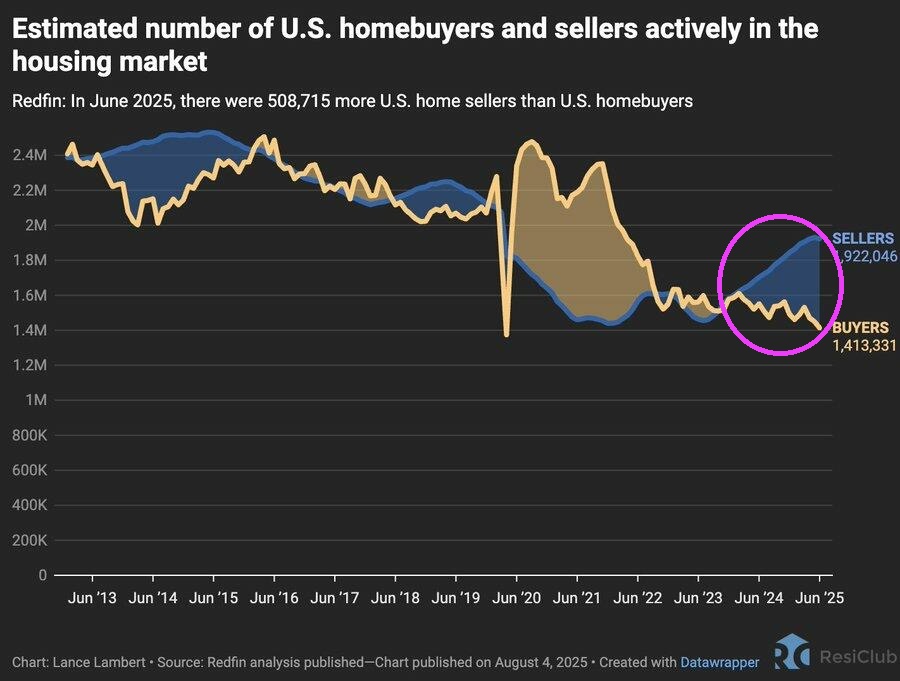

Existing-home sales increased by a measley 2.0% in July, according to the National Association of REALTORS® Existing-Home Sales Report.

Month-over-month sales increased in the Northeast, South, and West, and fell in the Midwest. Year-over-year, sales rose in the South, Northeast, and Midwest, and fell in the West.

• 2.0% increase in existing-home sales – seasonally adjusted annual rate of 4.01 million in July.

• Year-over-year: 0.8% increase in existing-home sales

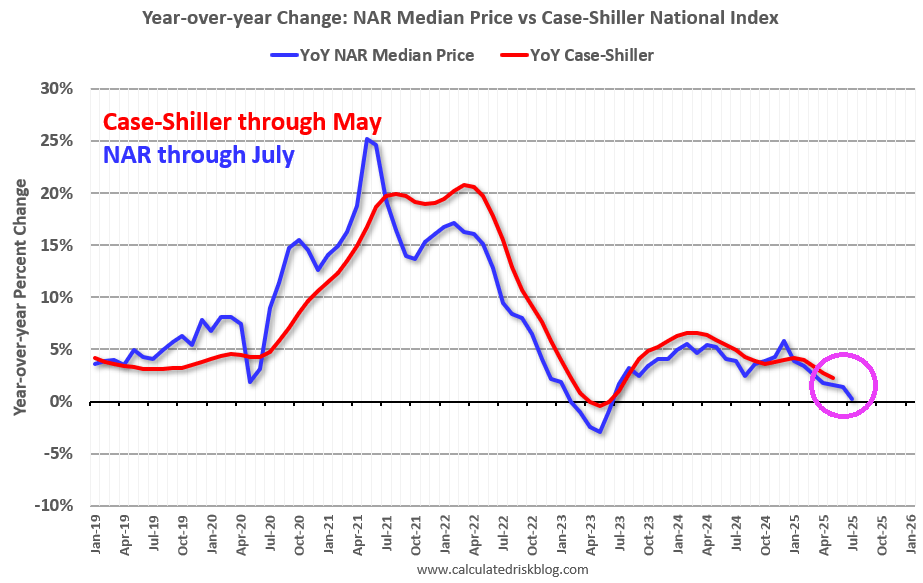

Median existing-home price for all housing types, up 0.2% from one year ago ($421,400) – the 25th consecutive month of year-over-year price increases.

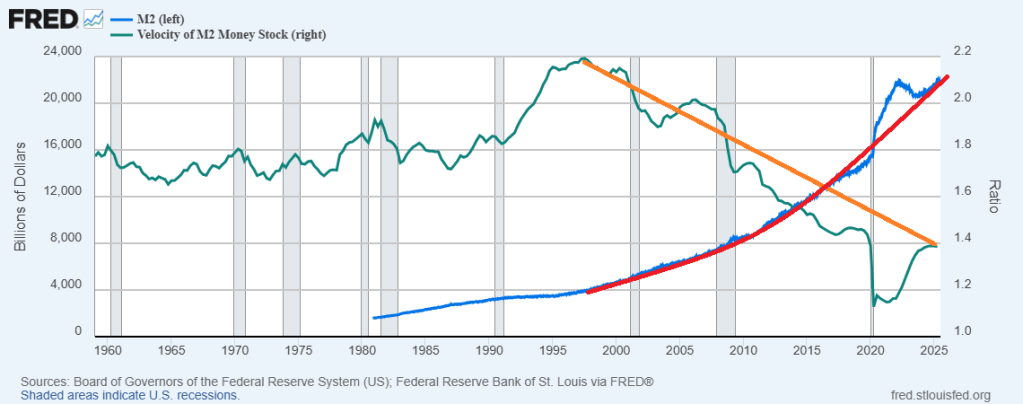

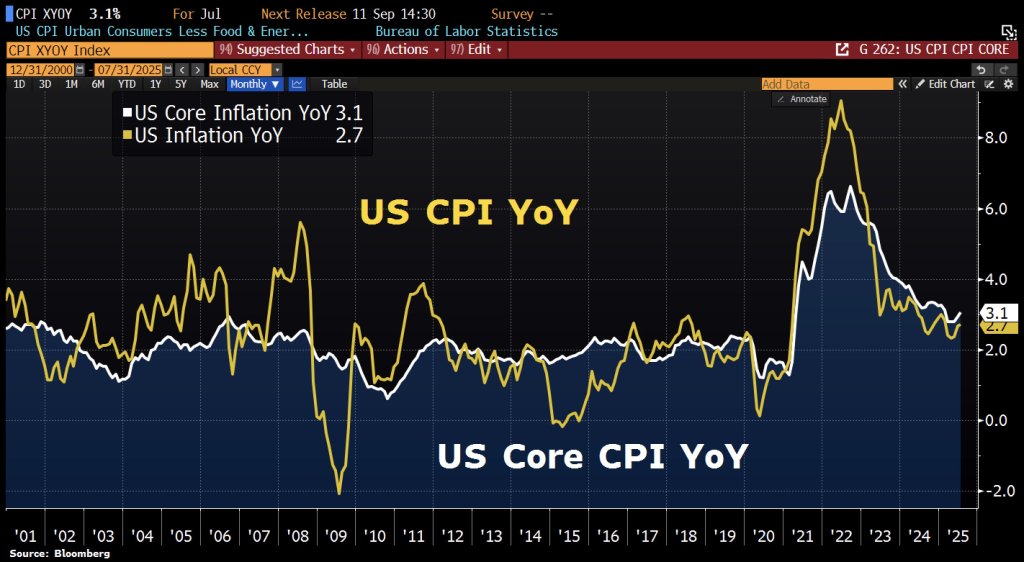

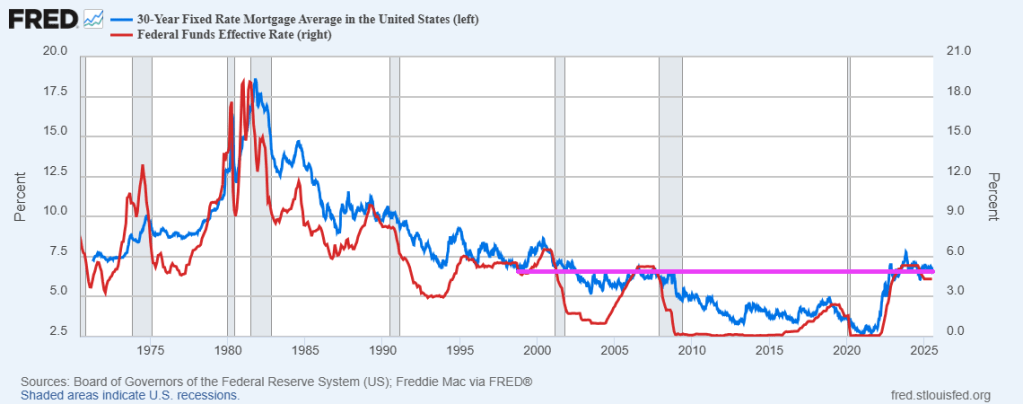

It will be hard to make housing more affordable as long as The Fed keeps printing money.

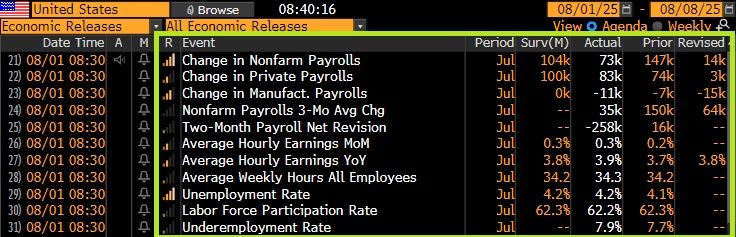

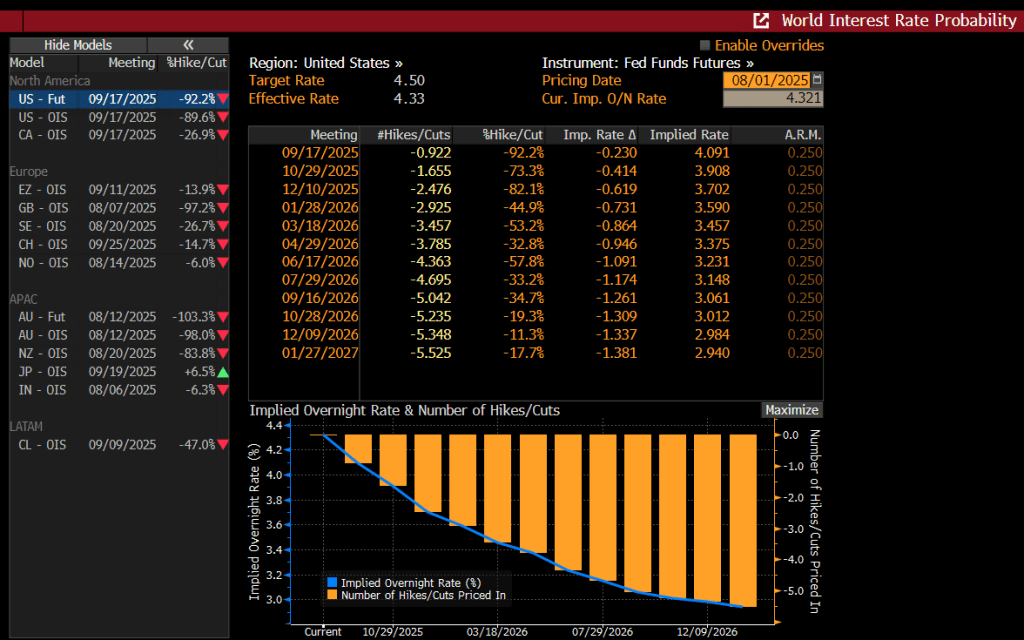

Powell et al cutting rates 25 basis points won’t really matter as long as they continue to print money. Unfortunately, M2 VELOCITY peaked under the Clinton Administration and has declined since despite frantic money printing.

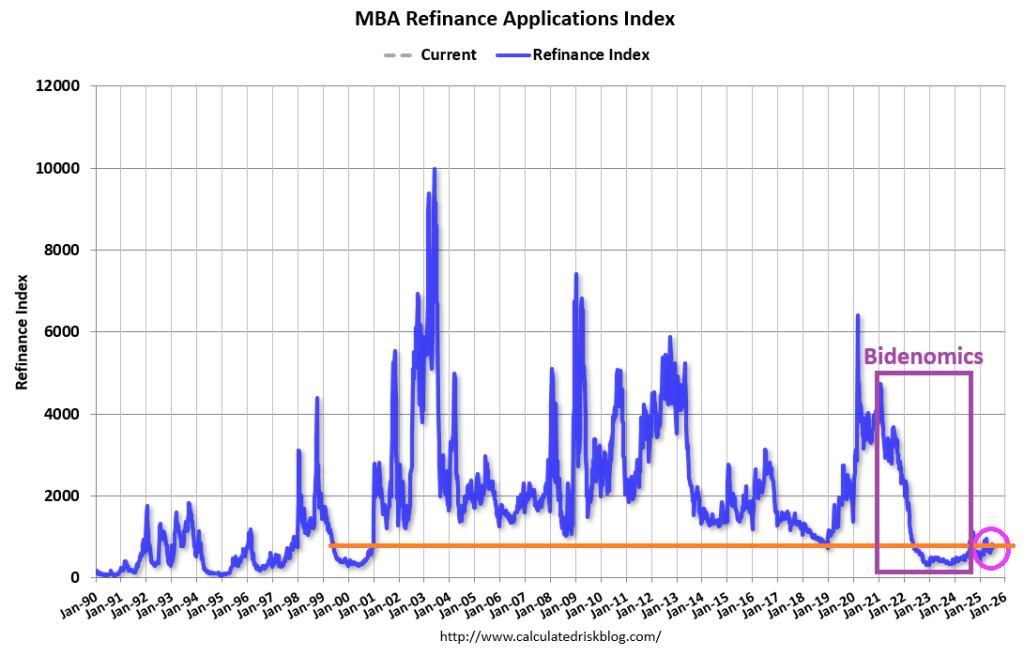

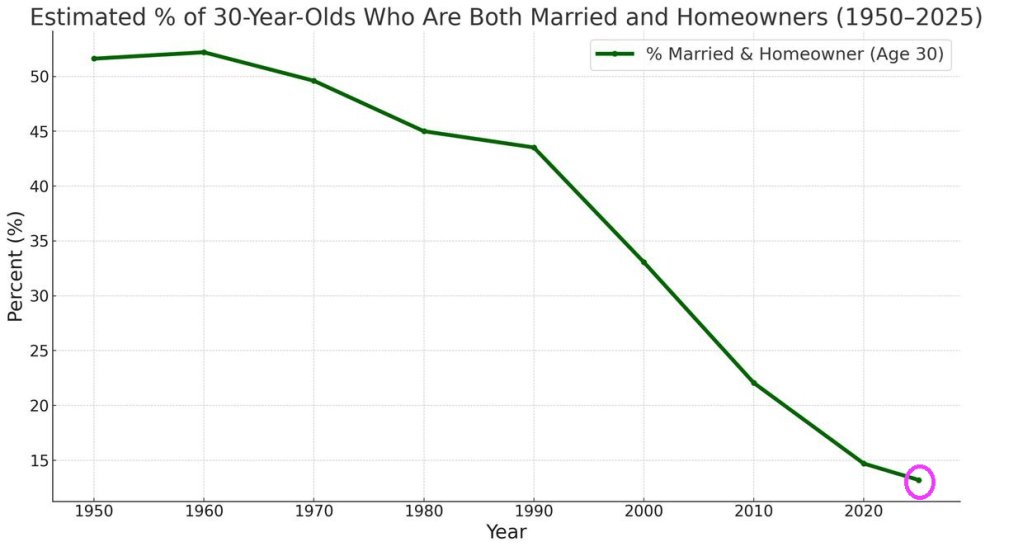

What happended in 1995? Clinton’s National Homeownership Strategy that mandated HUD partners (GNMA, FHA, Fannie Mae, Freddie Mac, banks, etc.) to lower credit standards to encourage homeownership.

We need FHFA Director Bill Pulte to avoid doing what Democrats love (everything free or cheap).

You must be logged in to post a comment.