Chuck Schumer and Liz Warren will be salivating over the July jobs report. The US added only 73k jobs in July (versus an expected add of 104k jobs).

This should get The Fed off its flabby buttocks and lower rates.

Confounded Interest – Anthony B. Sanders

Financial Markets And Real Estate

Chuck Schumer and Liz Warren will be salivating over the July jobs report. The US added only 73k jobs in July (versus an expected add of 104k jobs).

This should get The Fed off its flabby buttocks and lower rates.

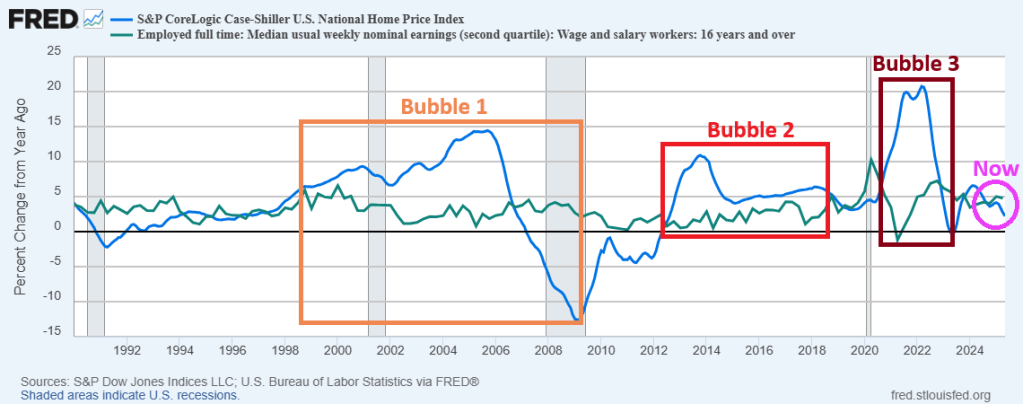

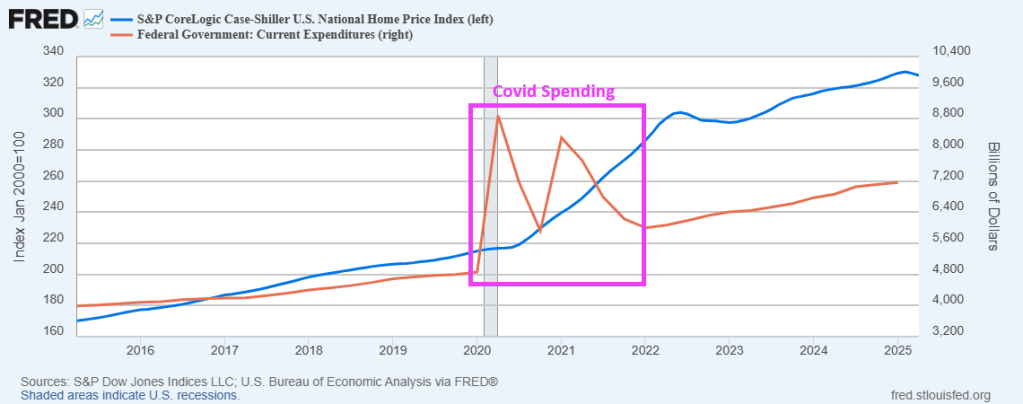

Yes, the US housing market is in a price bubble. If we compared home price growth with median earnings.

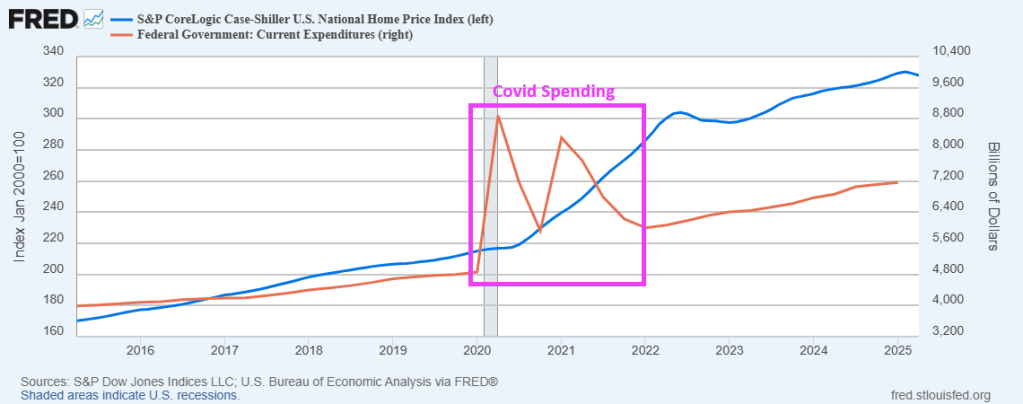

The financial crisis was spawned by a home price bubble where home price growth was faster than median earnings growth (see Bubble 1). After home price growth cooled in 2007-2009, the cycle started again (Bubble 2). But the current bubble (Bubble 3) is related to the Covid outbreak and massive spending binge by Congress (and The Fed). Notice that median earnings dropped (green line) post Covid.

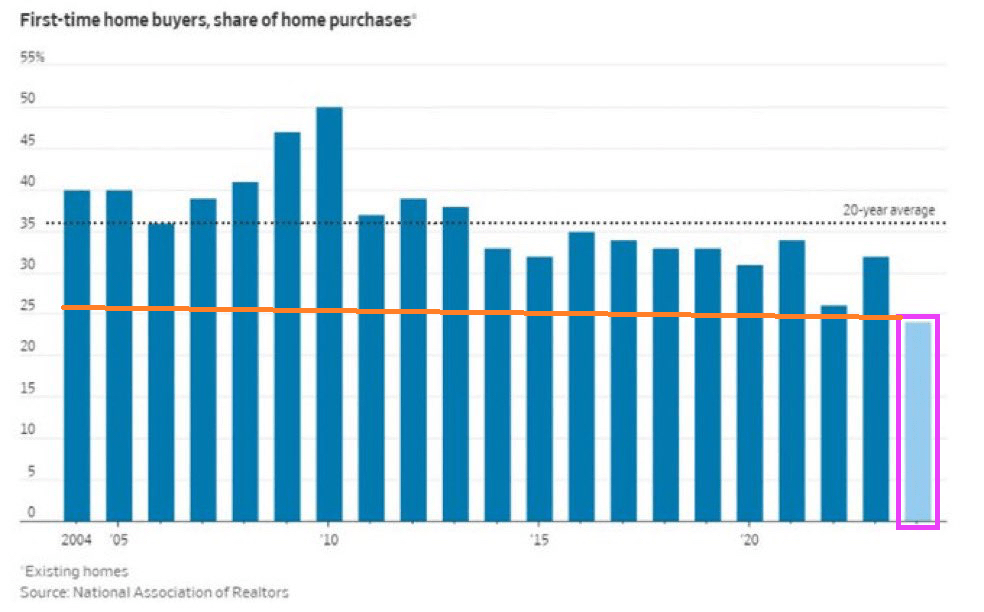

But while we have normalized home price growth and median earnings, the LEVELS are still unaffordable for millions of households.

Poor Bill Pulte (FHFA Director). He has to work with an uncooperative Fed under Foul Powell, and local politivcians like Greasy Gavin Newsom (Democrat Gov of California), JB Pritzker (Democrat Gov on Illinois), Kathy Hocul (Democrat Gov of New York), and the assorted lunatic Mayors like Karen Bass (D, Mayor Los Angeles), Zohran Kwame Mamdani (D, presumptive Mayor New York City), etc.

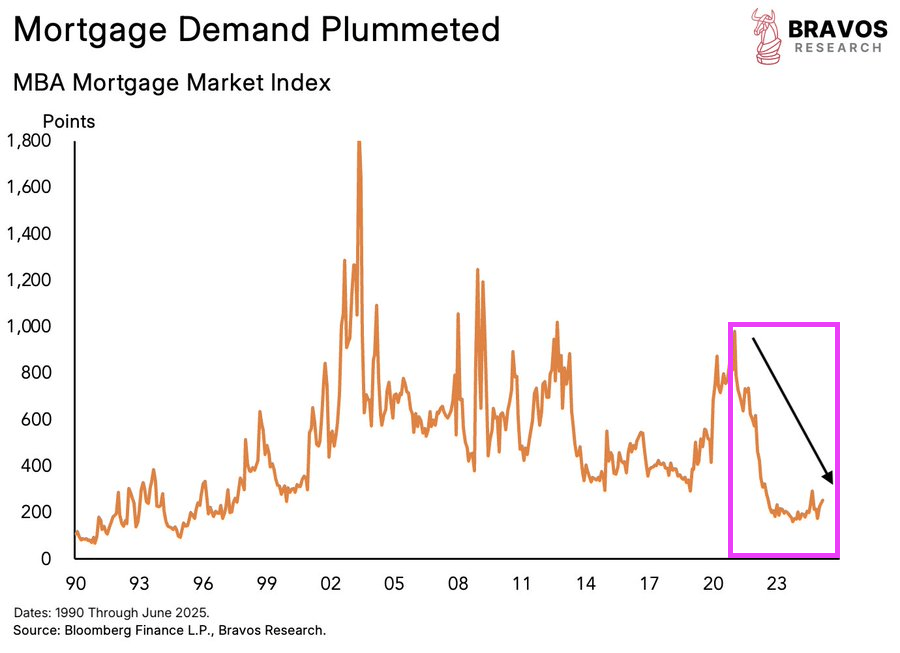

Mortgage applications decreased 3.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 25, 2025.

The Market Composite Index, a measure of mortgage loan application volume, decreased 3.8 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 4 percent compared with the previous week. The seasonally adjusted Purchase Index decreased 6 percent from one week earlier. The unadjusted Purchase Index decreased 6 percent compared with the previous week and was 17 percent higher than the same week one year ago.

The Refinance Index decreased 1 percent from the previous week and was 30 percent higher than the same week one year ago.

Between Powell keeping rates high and Biden’s grossly incompetent management, the mortgage market remains in the doldrums.

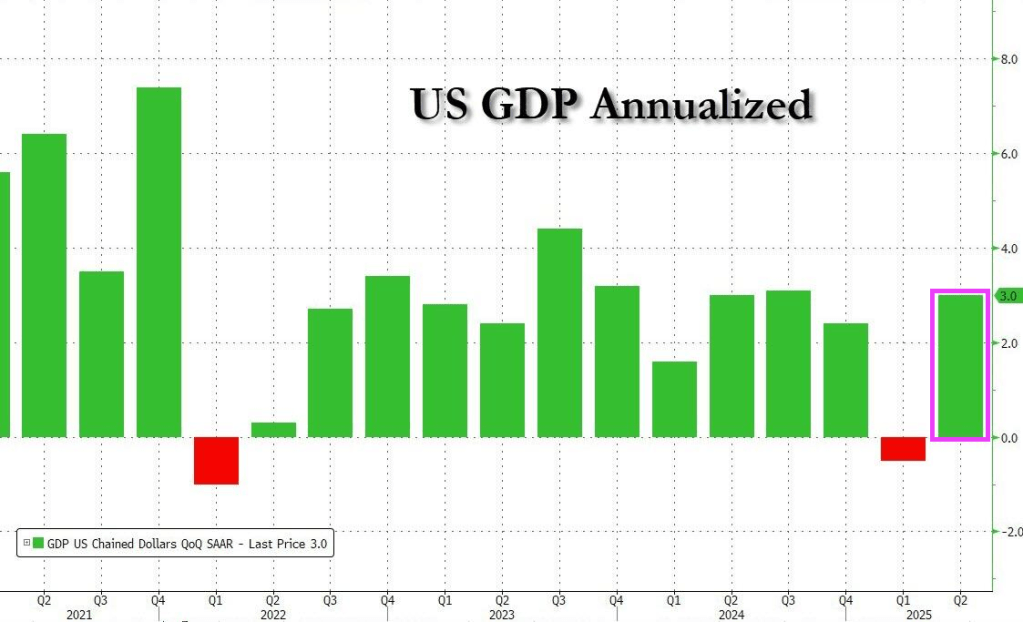

The Bureau of Econ Analysis reported that the first estimate of Q2 GDP came in at an unexpectedly brisk 3.0%, a complete reversal of the -0.5% decline in Q1.

Personal Consumption added 0.98% to the bottom line GDP, up from 0.31% in Q1.

Fixed Investment came at 0.08%, a big drop from the 1.31%, and perhaps the only concerning point in today’s report: was there really no major data center investments in the second quarter… and if so what are the hyperscalers doing?

The change in private inventories was a big drop, printing at -3.17% in the first estimate, up from 2.59% in the first quarter, and an expected reversal as retailers unloaded all that inventory they piled up ahead of tariffs.

Trade or net exports (exports less imports), came at a whopping 4.99% – the biggest addition to the bottom line GDP number – as imports collapsed and added 5.18% to GDP, a stark reversal to the -4.66% contraction in Q1.

Finally, government added just 0.08% to GDP, a reversal of the 0.10% subtraction in Q1.

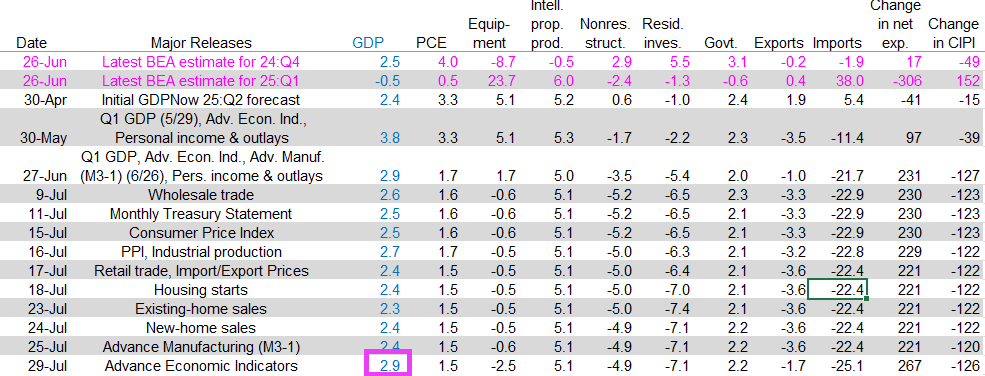

So, the BEA reported 3.0% real GDP growth, `the Atlanta Fed’s GDP Now latest estimate was 2.9 percent. Pretty close!

The US Real GDP report is out tomorrow. Here is an advanced estimate of Q2 US Real GDP, courtesy of The Atlanta Fed. It is forecast to be 2.9%. Despite dire forecasts by Democrats and the media.

Latest estimate: 2.9 percent — July 29, 2025

The final GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2025 is 2.9 percent on July 29, up from 2.4 percent on July 25. After this morning’s Advance Economic Indicators report from the US Census Bureau, a decline in the nowcast of real gross private domestic investment growth from -11.7 percent to -12.7 percent was more than offset by an increase in the nowcast of the contribution of net exports to real GDP growth from 3.31 percentage points to 4.04 percentage points.

My knucklehead Congressional Rep Joyce Beatty (Democrat) says that Trump is lying about the economic data, but was silent about Biden’s inflated jobs numbers. So Ms Beatty, is the Atlanta Fed lying too??

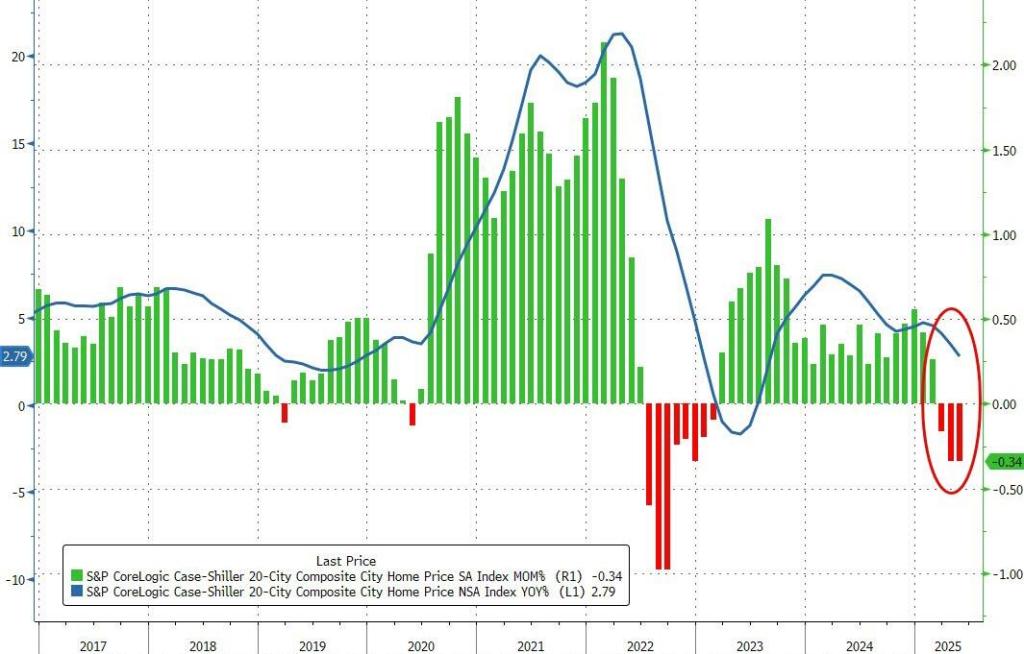

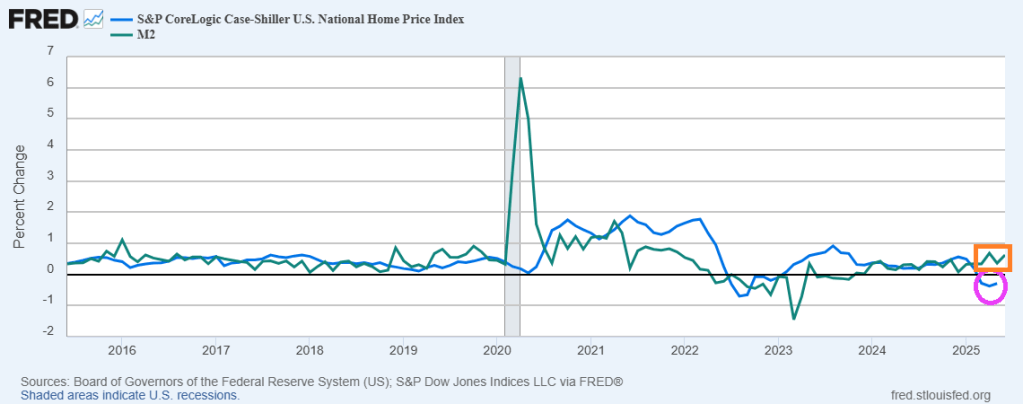

US home prices fell for the 3rd straight month In May. The MoM decrease in the seasonally adjusted (SA) Case-Shiller National Index was at -0.29% (-3.5% annual rate).

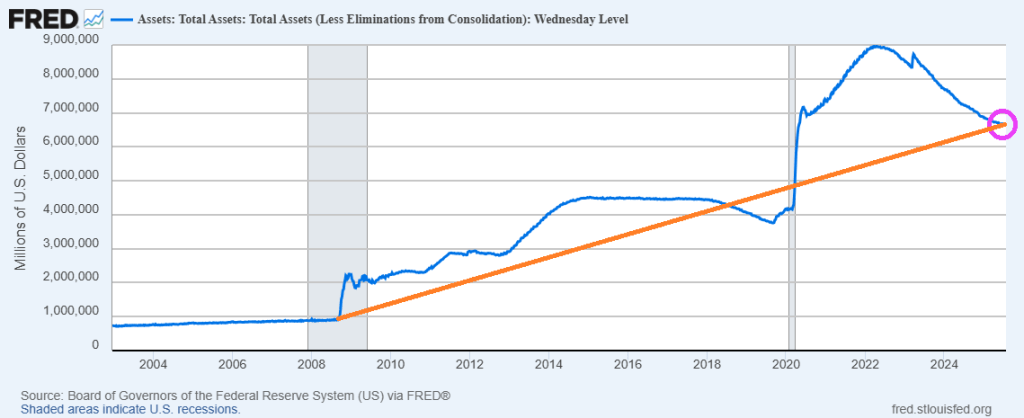

Despite continued money printing by The Fed.

kkk

Nobody pisses away money like Washington DC.

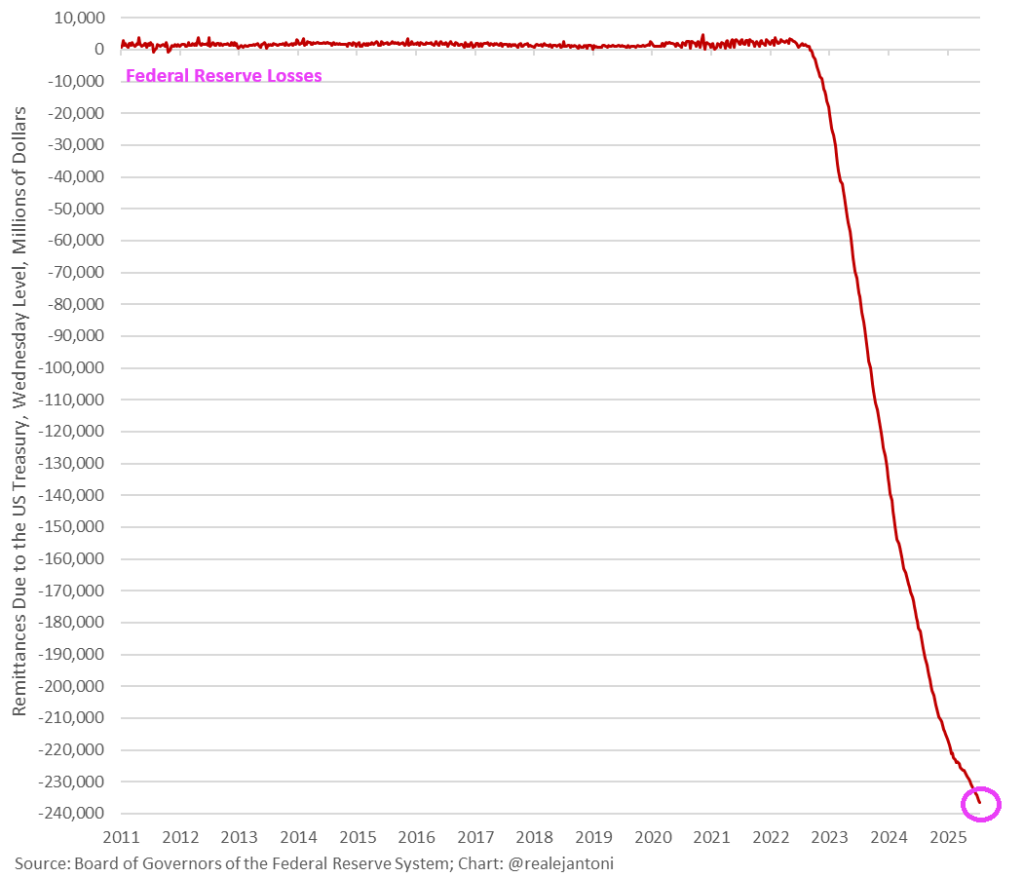

The Fed lost another $653 million last week, bringing total realized losses to more than $236 billion since Sep ’22.

Nothing has been the same since the financial crisis and Bernanke’s overreaction.

California Governor “Greasy Gavin” Newsom wants to be President of the USA. He will fit right in with the other spendthrifts in Washington DC.

China unleashed the Wuhan virus on the globe, Anthony Fauci convinced Congress to binge spend like drunken sailors on Covid prevention and relief. Homes prices soared, mortgage demand sank and nothing has been the same.

Here is a chart of the Case-Shiller national home price index post Covid outbreak and the hysterical overreaction by Congress and the Administration (including Anthony Fauci).

Another example? New home sales are down 6.6% YoY.

Who do we blame? China? Yes. Anthony Fauci? Yes. Congress? Yes.

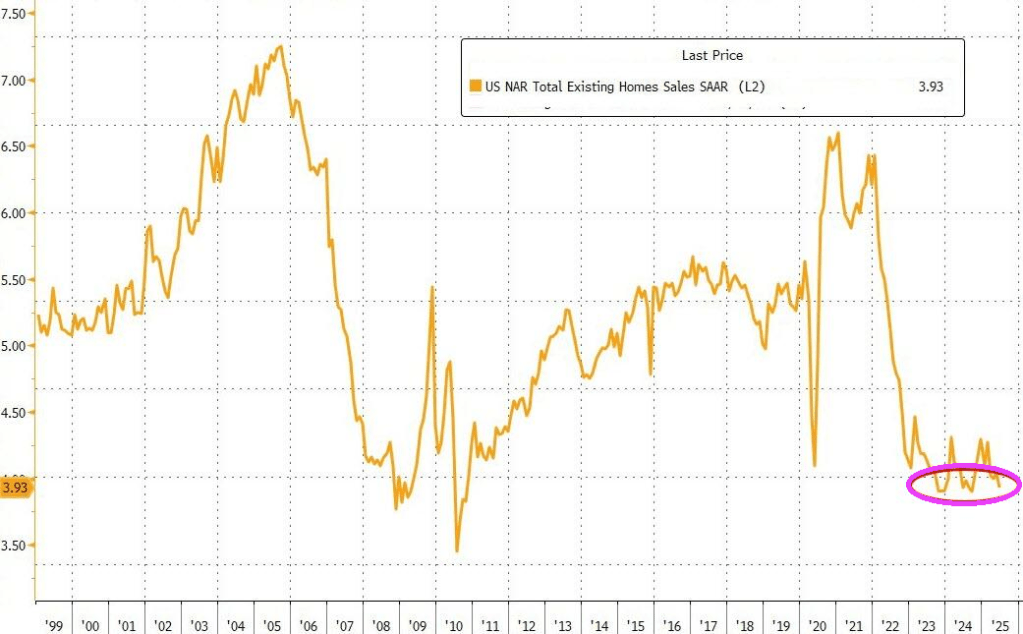

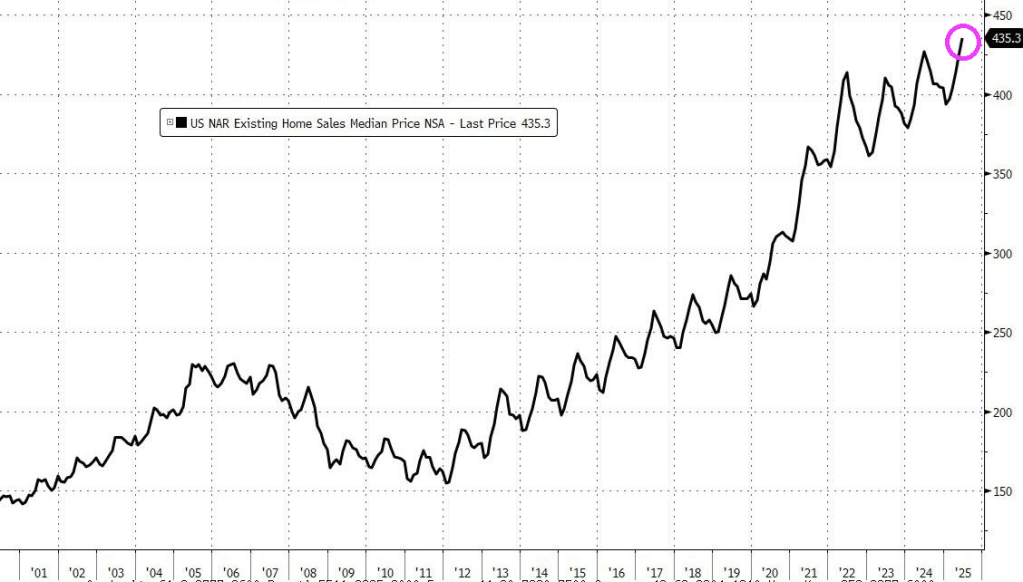

US existing home sales dropped 2.7% MoM (vs -0.7% MoM expected) in June leaving existing home sales unchanged year-over-year.

The median sales price increased 2% in June from a year ago to a record high of $435,300.

Meanwhile, The Fed keeps on printing money.

This is a new world for housing and mortgage finance. Outrageous, unafforable housing for millions.

You must be logged in to post a comment.