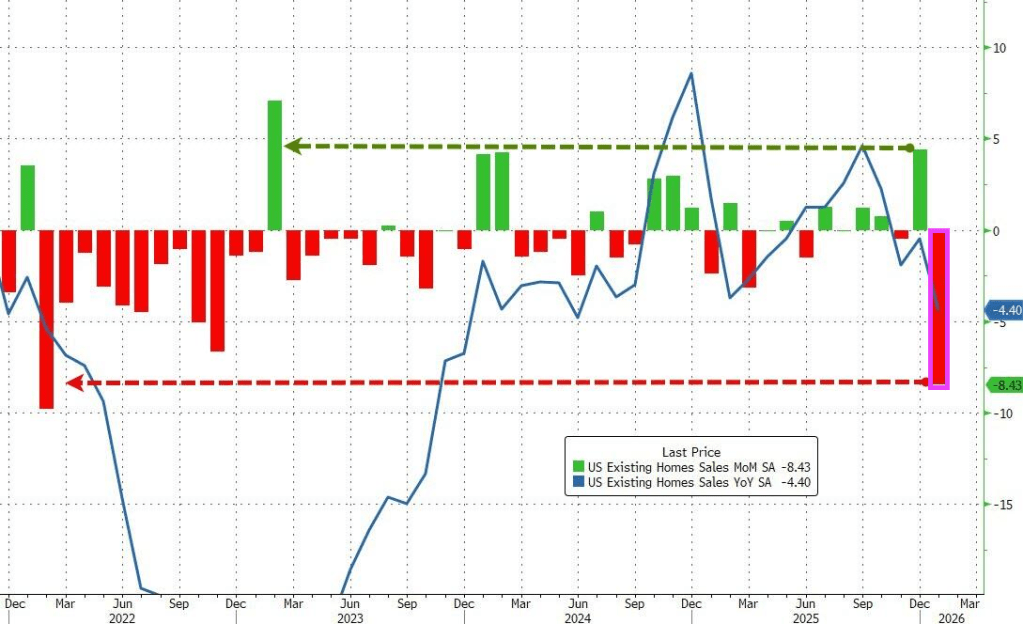

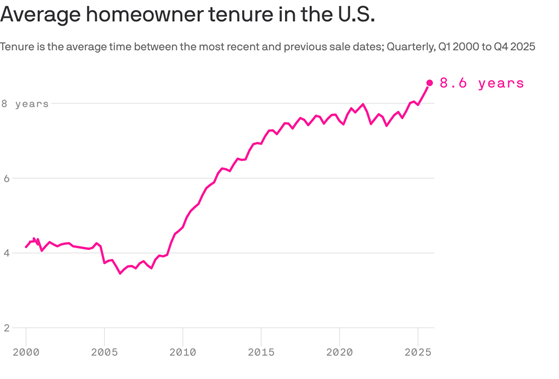

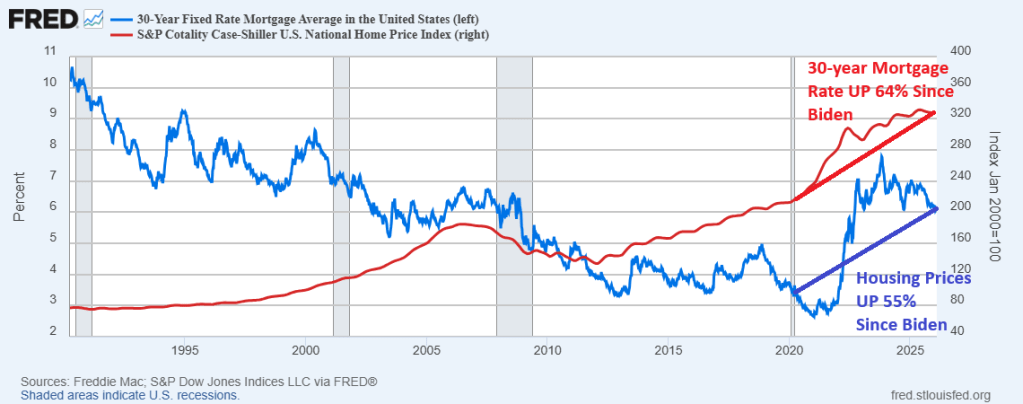

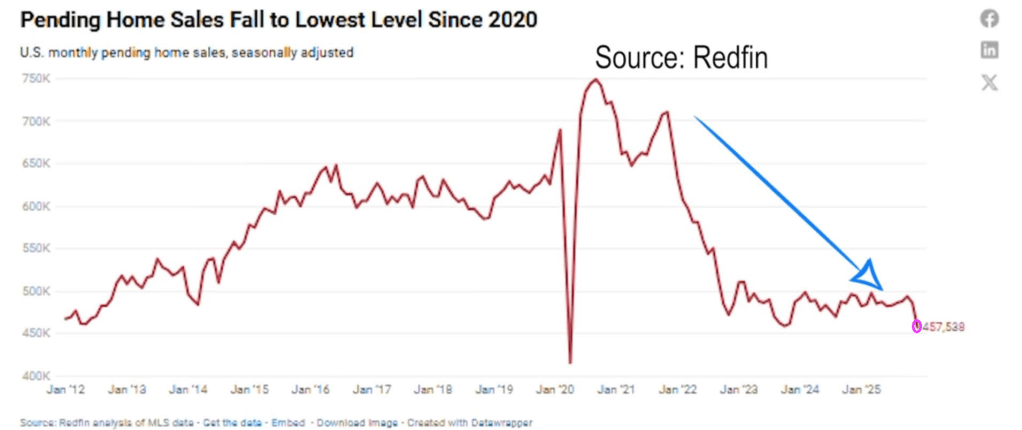

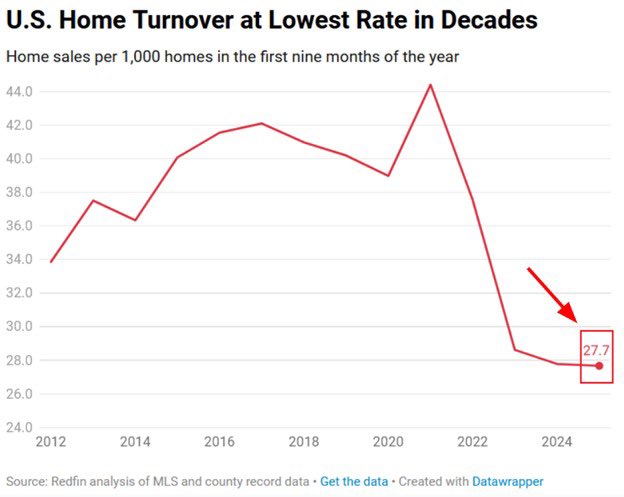

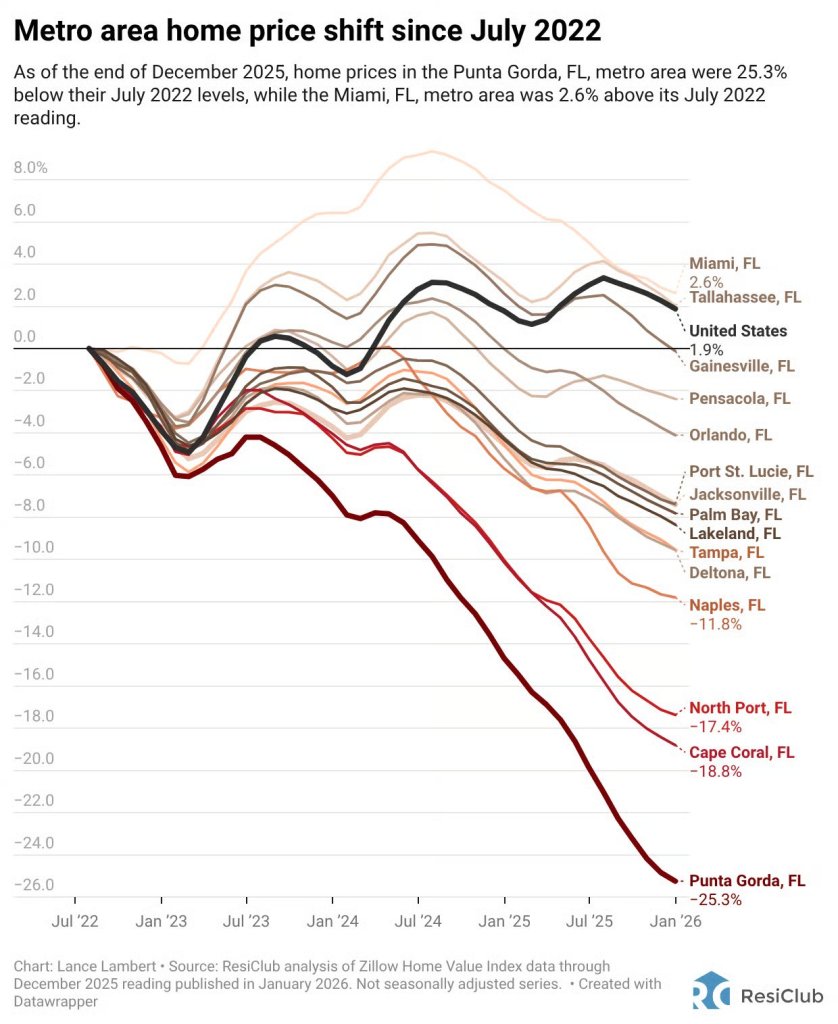

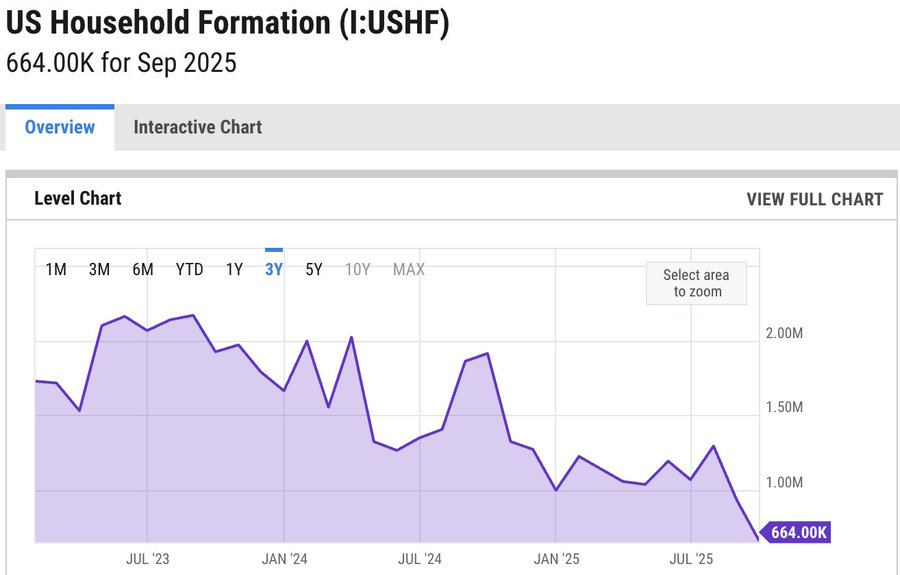

After managing a 1.4% YoY rise in 2025 (dramatically down from the 9.7% YoY rise in 2024, and 33% YoY collapse in 2023), US existing home sales were expected to drop 4.6% MoM in January (following December’s outsized 5.1% MoM surge), despite a tumble in mortgage rates.

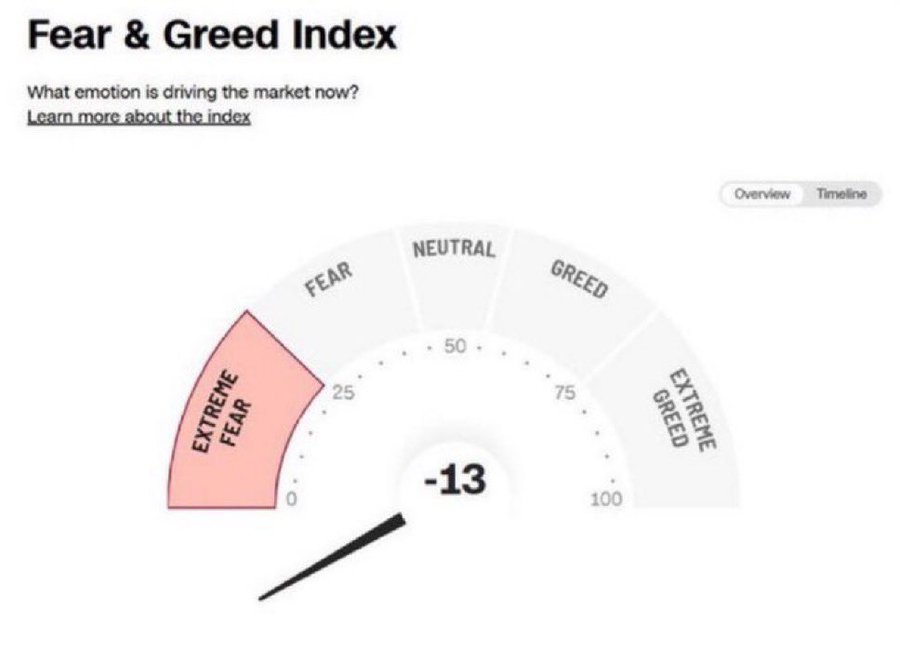

The analysts were correct on the direction but wrong on the scale as existing home sales plunged 8.4% MoM in January from a downwardly revised +4.4% MoM in December. That is the biggest MoM drop since February 2022.

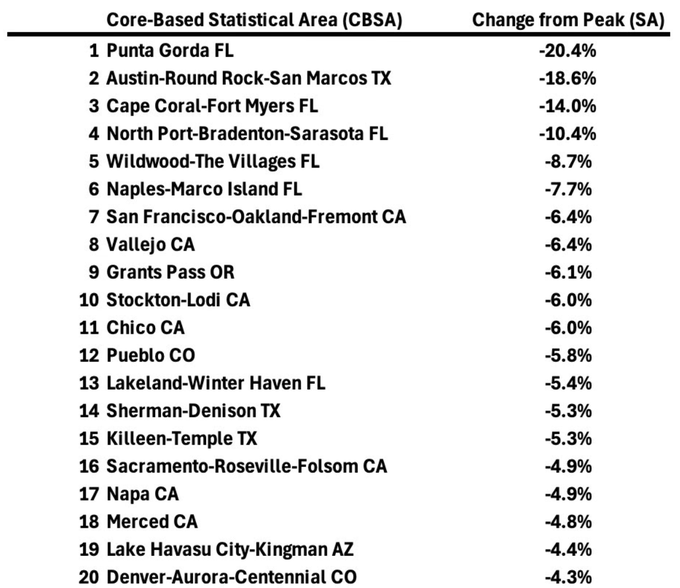

While some suggested this could be impacted by the Winter Storms, this is based on contracts signed in November/December… and the biggest decline was in The West (which had zero weather impact)

Nevertheless, realtors gonna realtor:

“The below-normal temperatures and above-normal precipitation this January make it harder than usual to assess the underlying driver of the decrease and determine if this month’s numbers are an aberration,” NAR Chief Economist Lawrence Yun said in a statement.

That MoM plunge pulled the total SAAR down near 15 year lows…

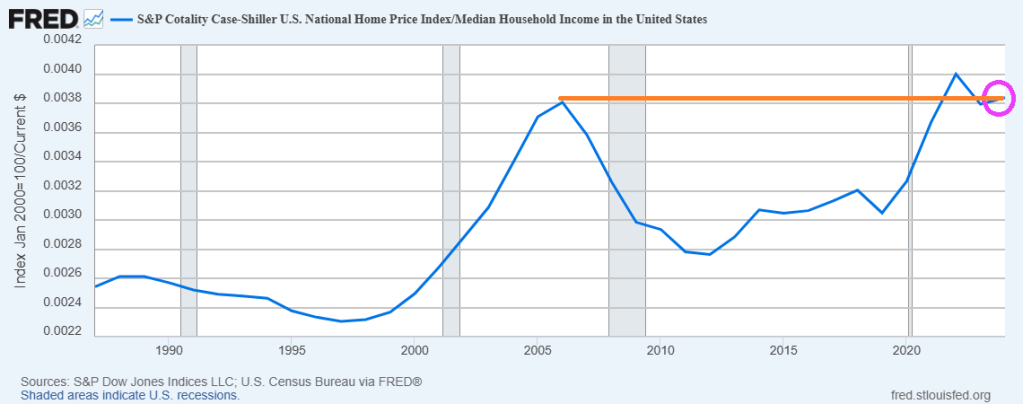

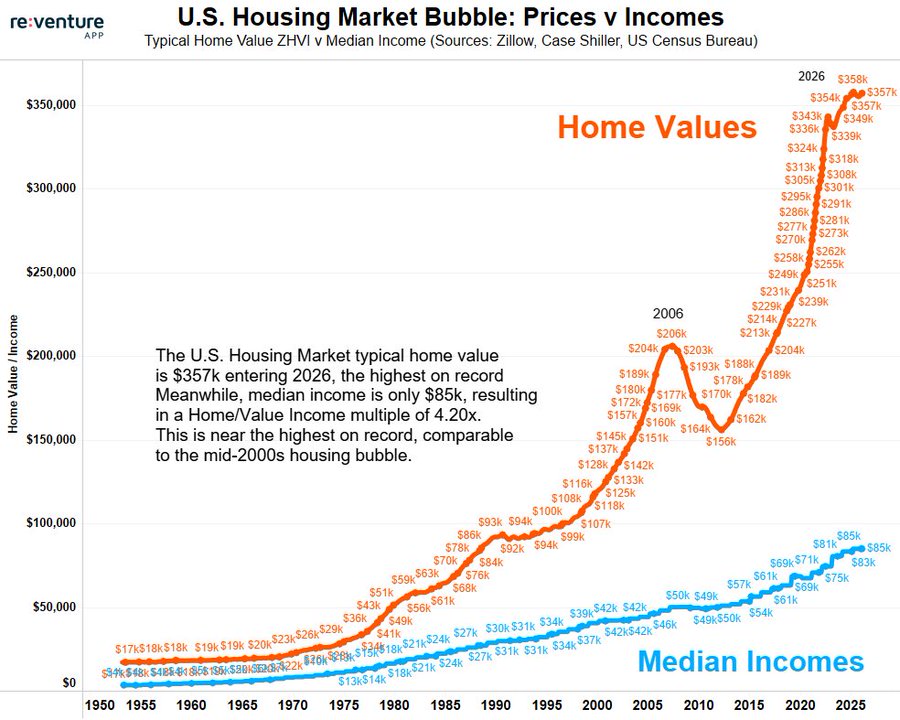

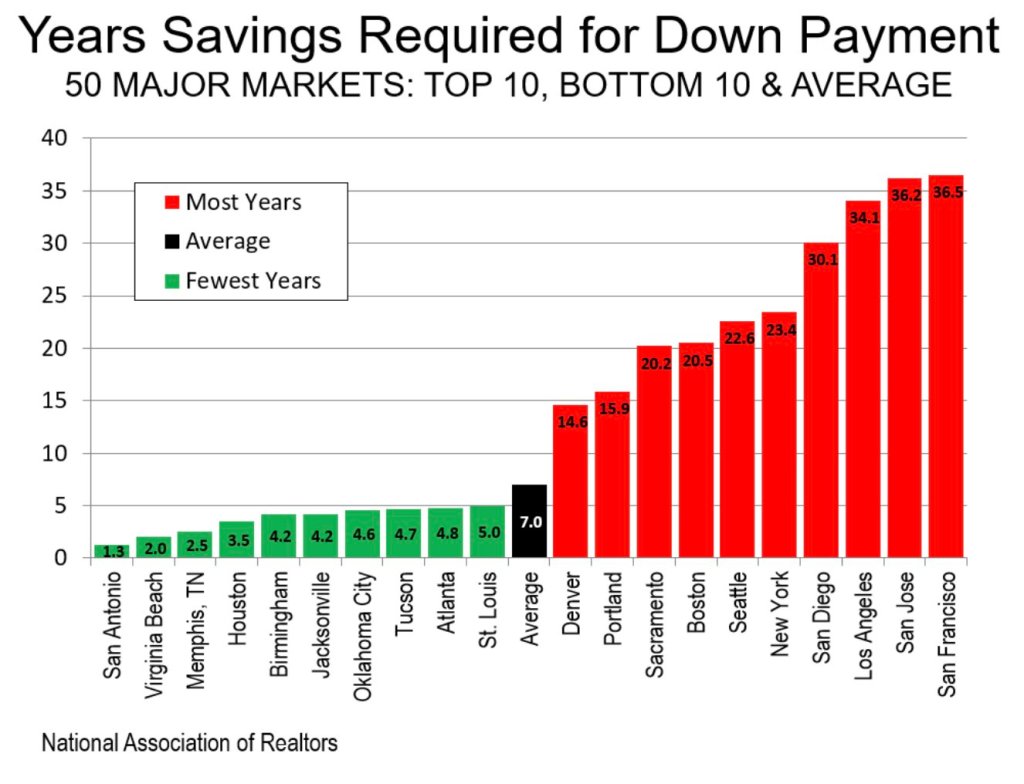

Without an extended period of improved affordability, the recovery in the housing market is likely to be prolonged.

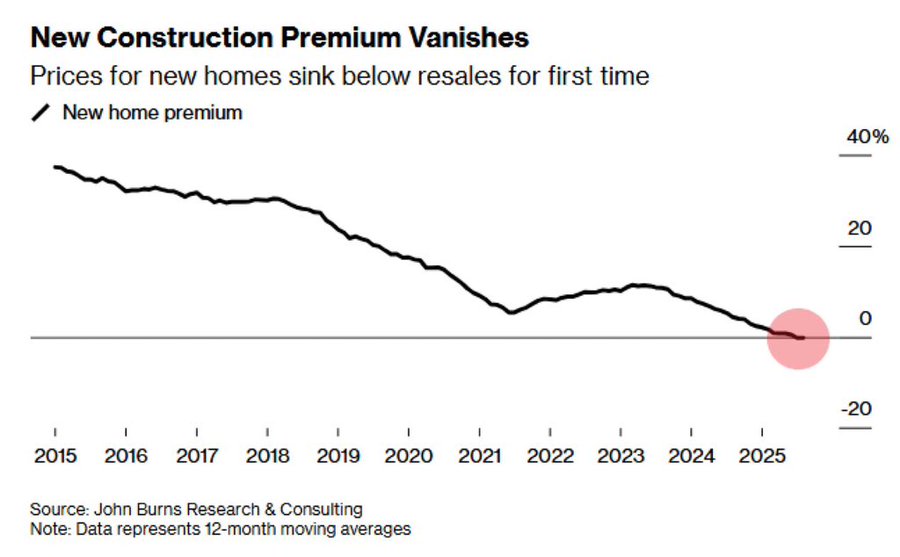

The NAR report showed the median selling price rose 0.9% from a year earlier to $396,800 last month.

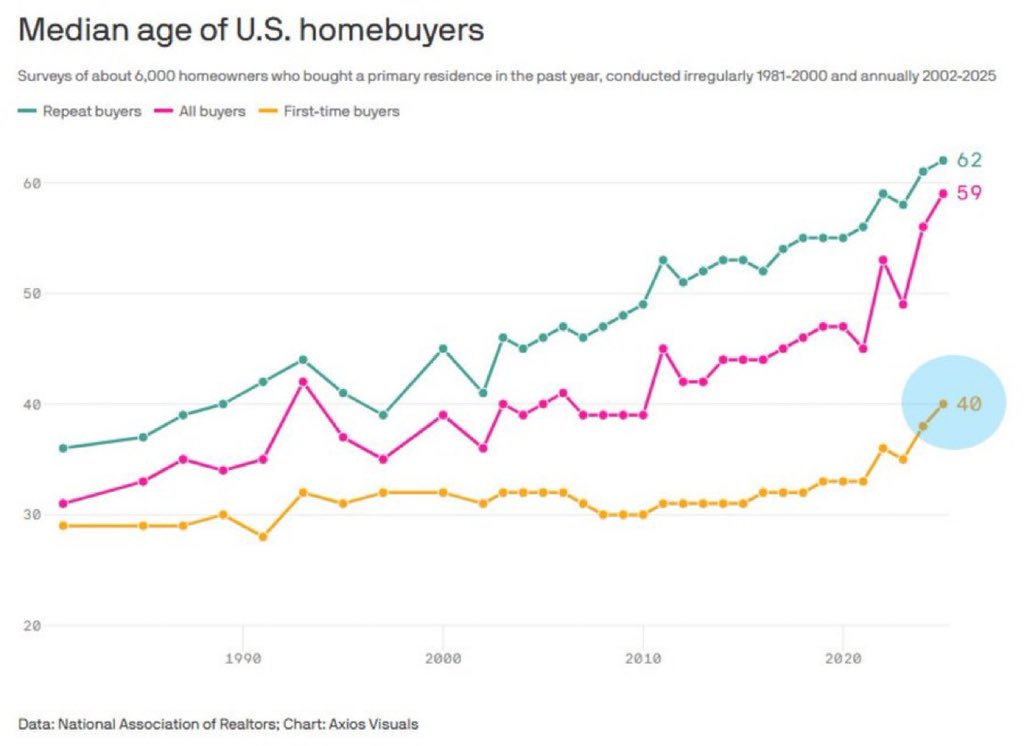

First-time buyers represented 31% of buyers of existing homes in January, up slightly from 29% in the prior month and higher than a year ago.

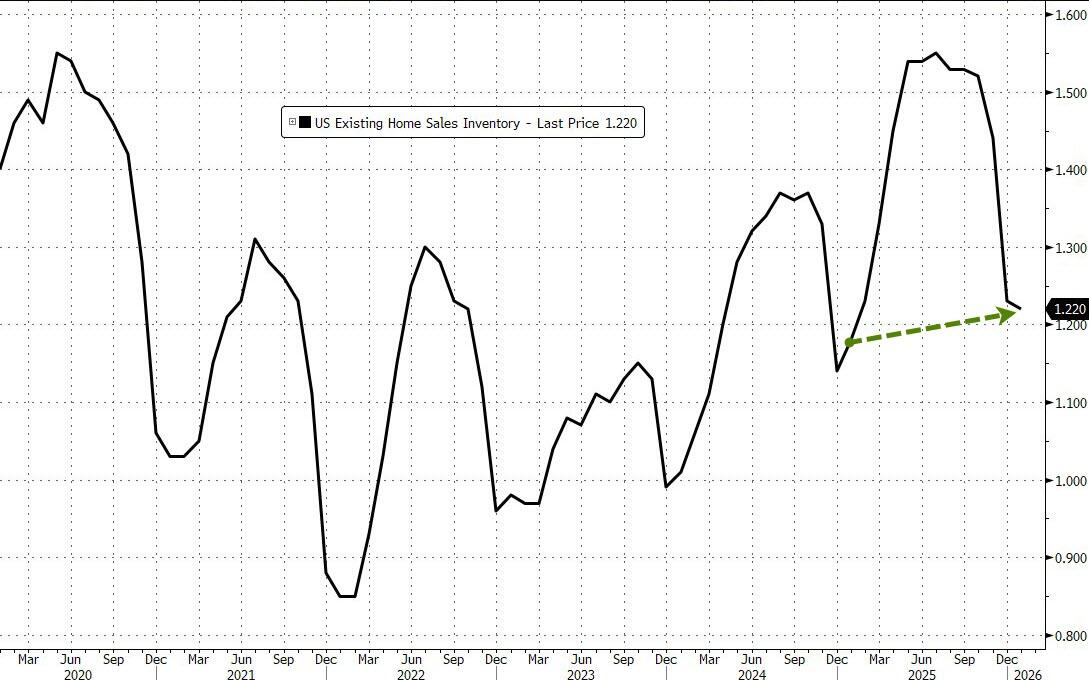

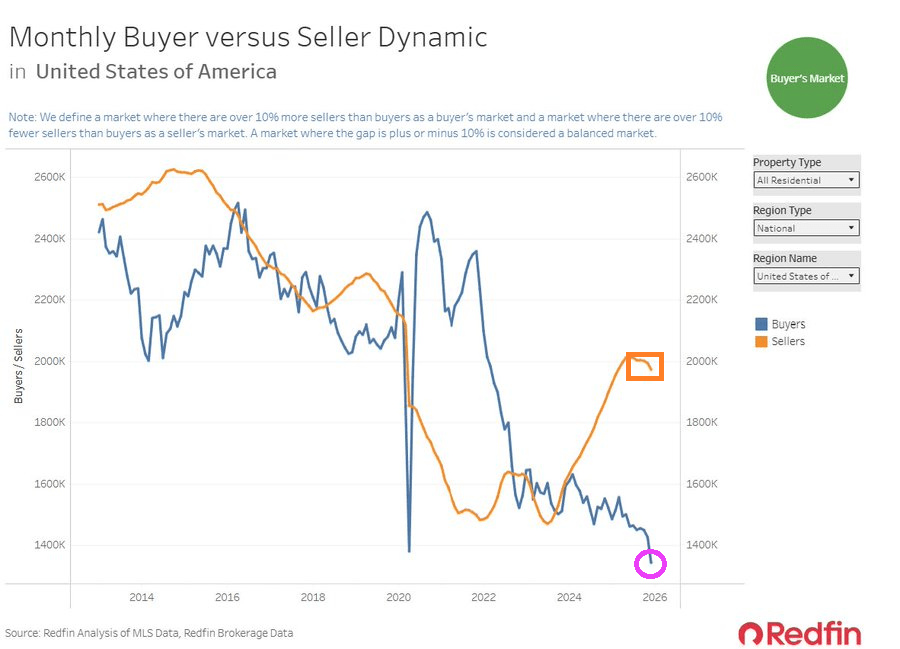

The inventory of previously owned homes increased 3.4% in January from a year ago to 1.22 million.

A pickup in supply through 2025 has helped to tame price growth, though Yun said on a call with reporters that listings need to increase much more to help improve sales.

On the bright side, it appears mortgage applications are rebounding as the year started with lower rates…

Arguably, existing home sales have much further to go to the upside as the lagged mortgage rate has continued to decline… so what triggered this collapse?

Finally, circling back to where we started, NAR expects home sales to rise a stunning 14% this year, higher than most other forecasts but a figure that NAR Chief Economist Lawrence Yun said he feels “confident” in. That assumes more inventory will come on the market, mortgage rates will hover around 6% and the Fed will cut interest rates another two times, compared to policymakers’ median projection for one.

You must be logged in to post a comment.