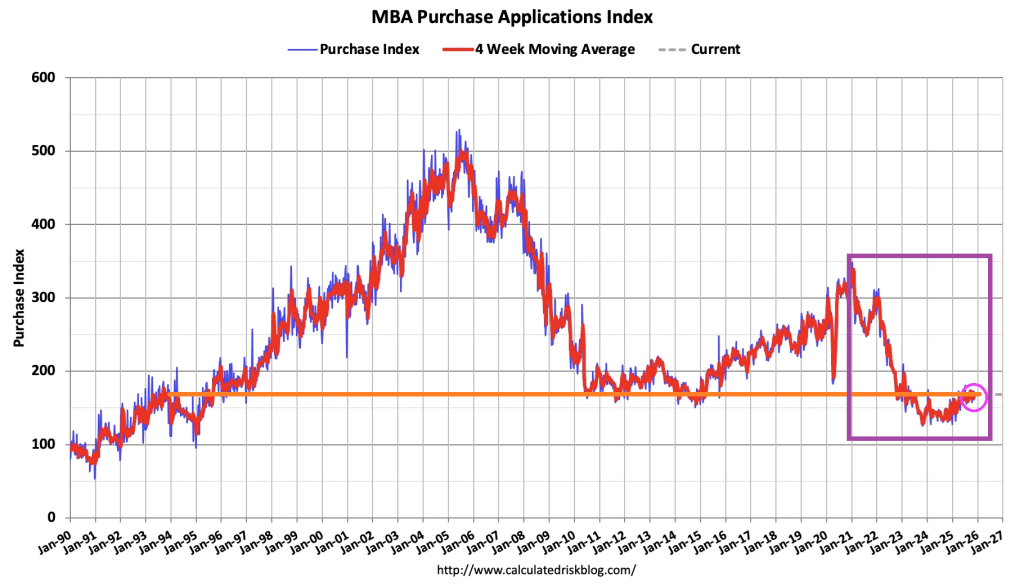

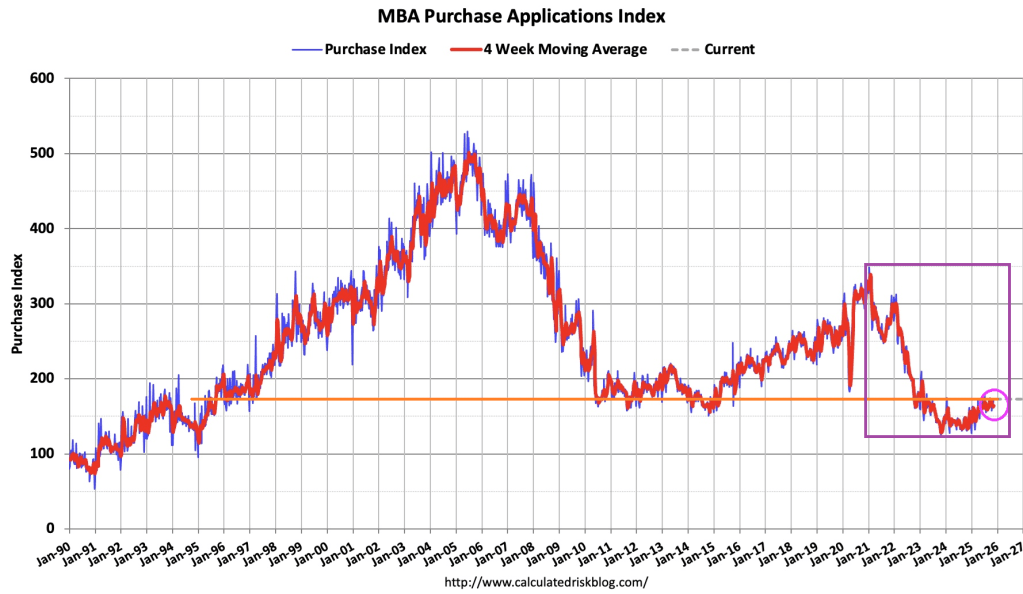

Mortgage demand is beginning to look a lot like Christmas. That is, mortgage demand will be listless in December (like the infamous Lake Erie snow effect), but leap upwards in January 202.

Mortgage applications decreased 1.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 28, 2025. This week’s results include an adjustment for the Thanksgiving holiday.

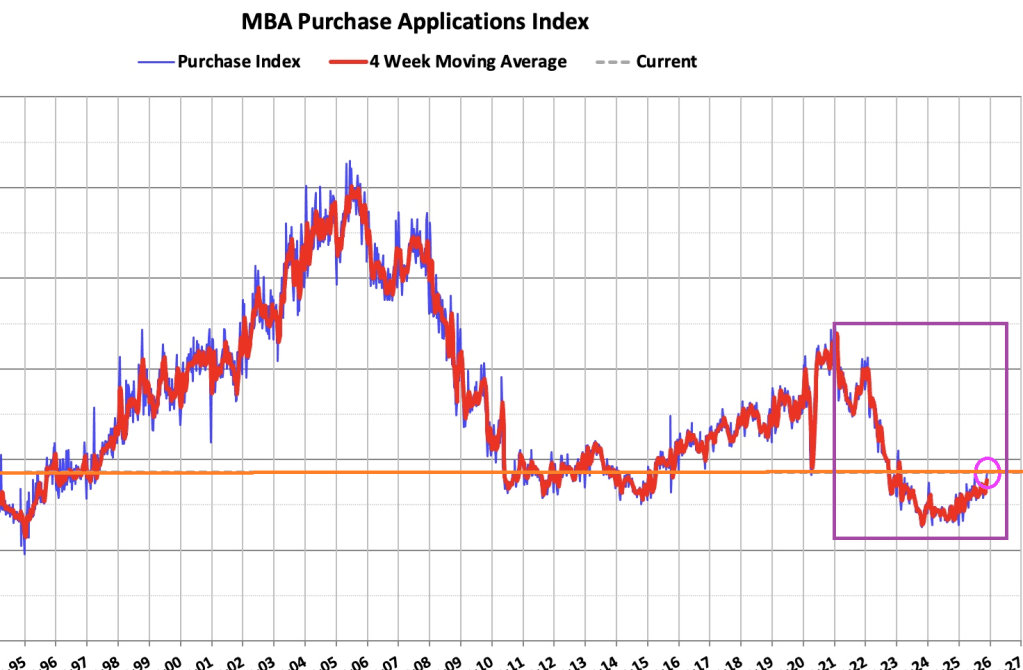

The Market Composite Index, a measure of mortgage loan application volume, decreased 1.4 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 33 percent compared with the previous week. The seasonally adjusted Purchase Index increased 3 percent from one week earlier. The unadjusted Purchase Index decreased 32 percent compared with the previous week and was 17 percent higher than the same week one year ago.

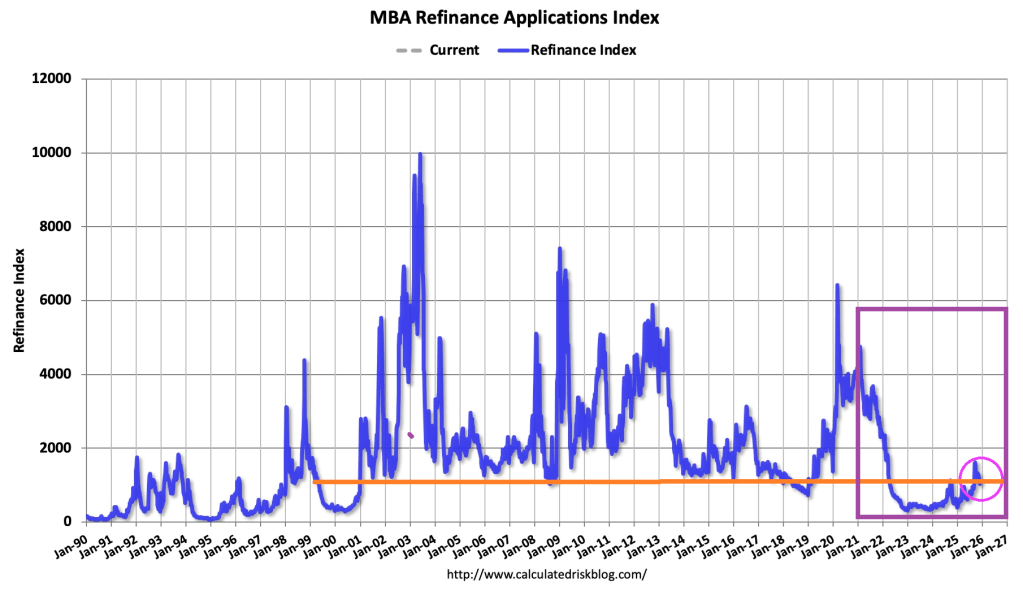

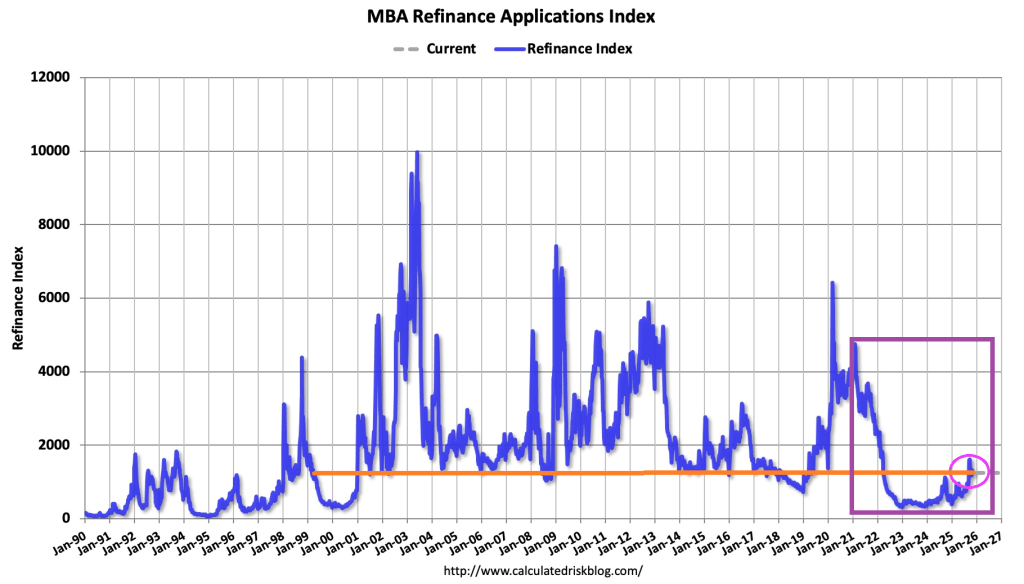

The Refinance Index decreased 4 percent from the previous week and was 109 percent higher than the same week one year ago.

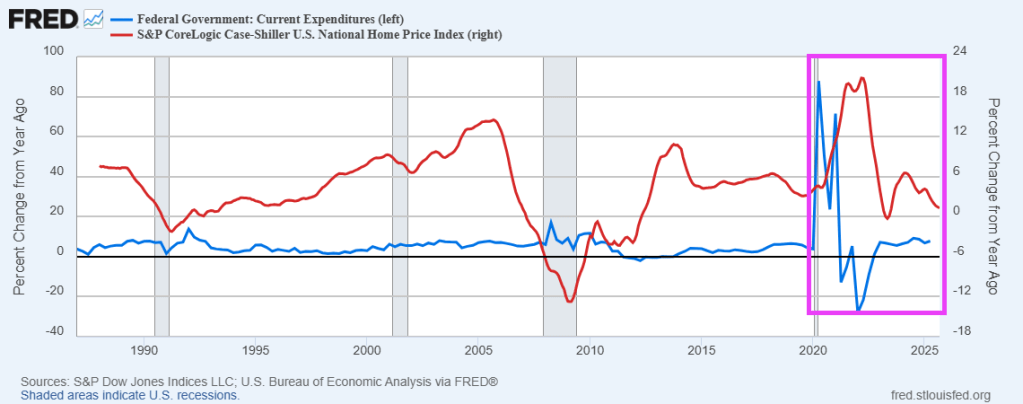

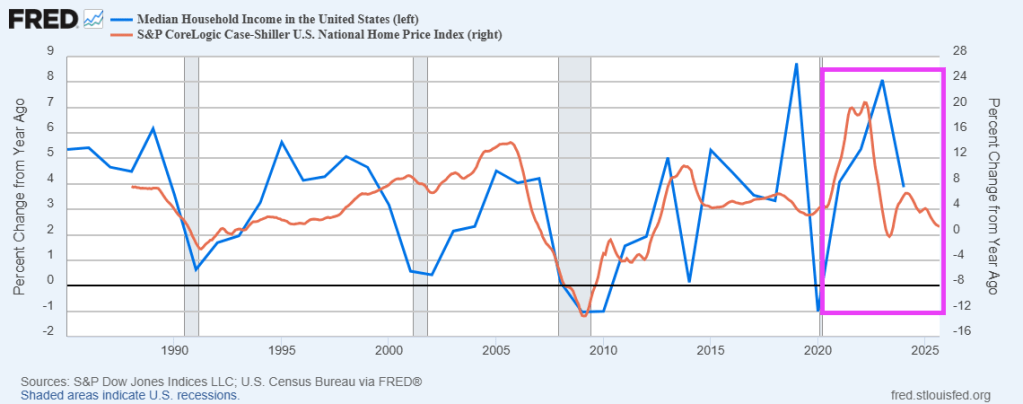

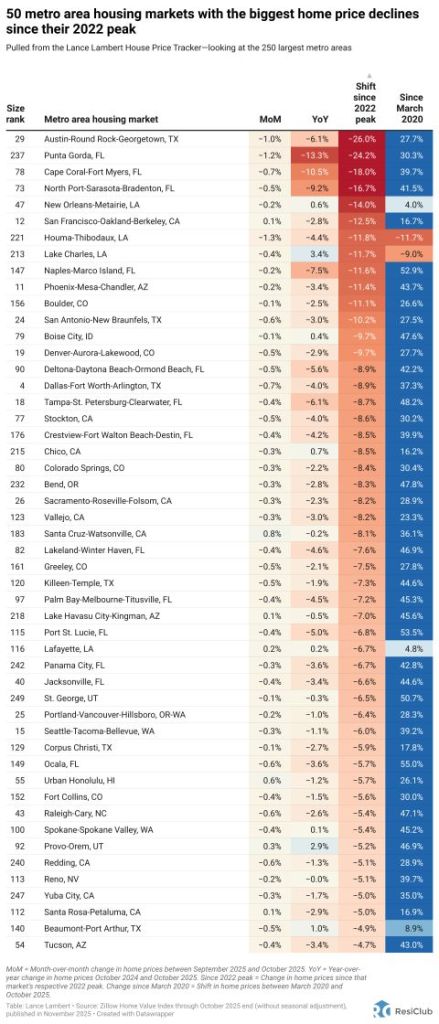

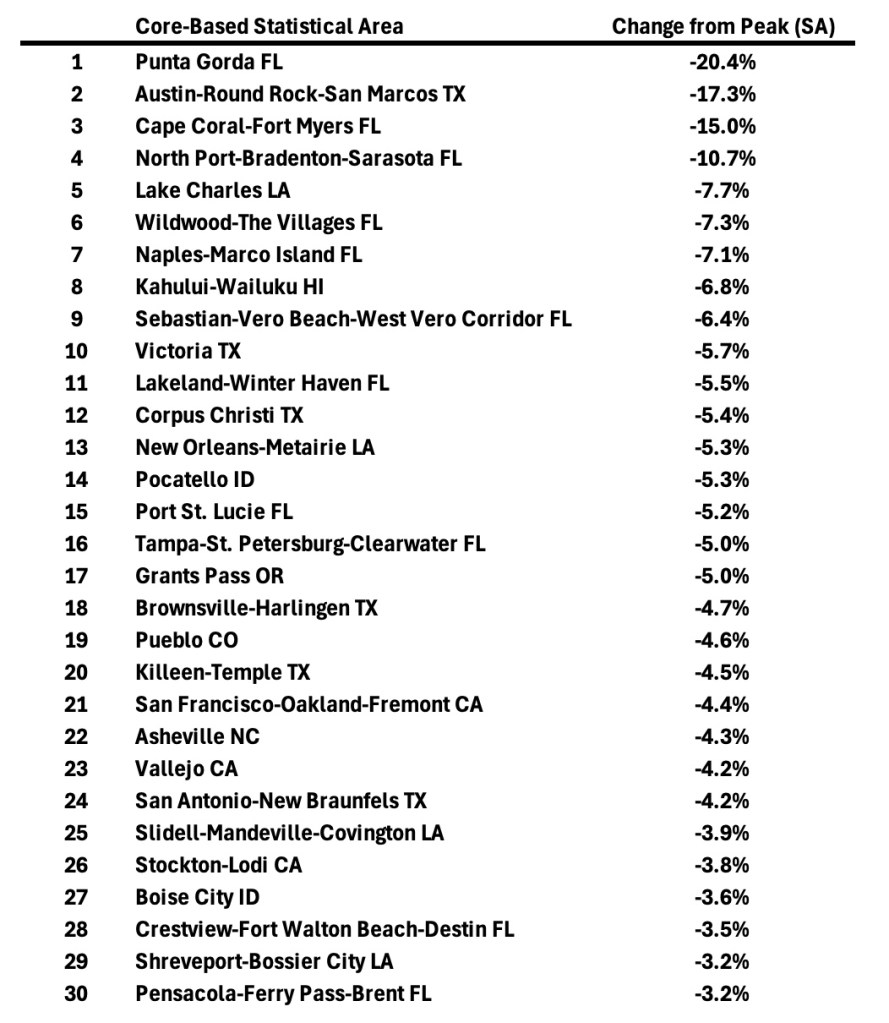

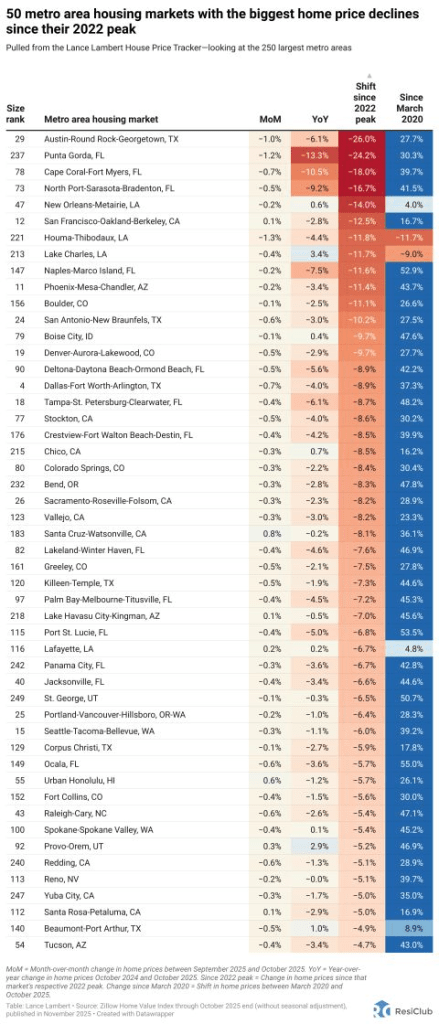

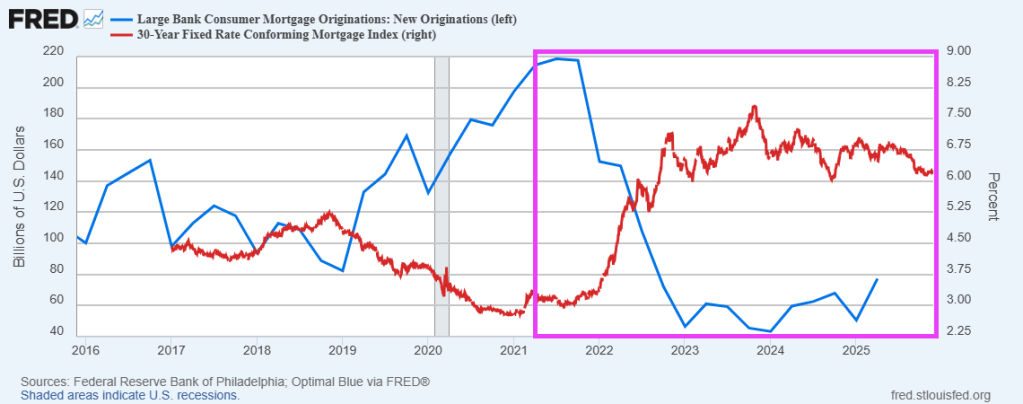

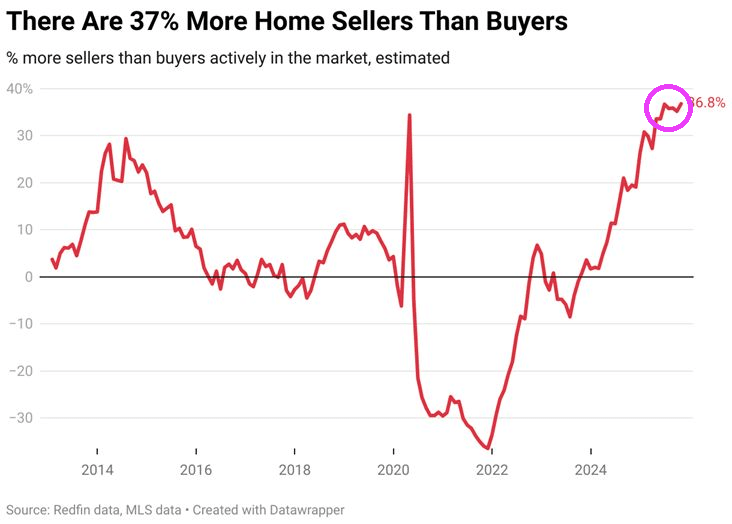

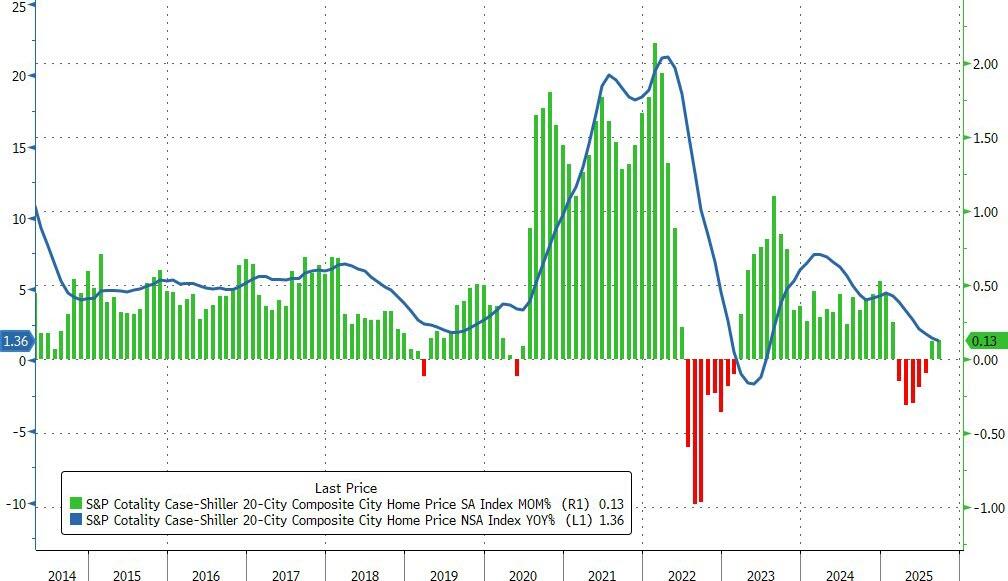

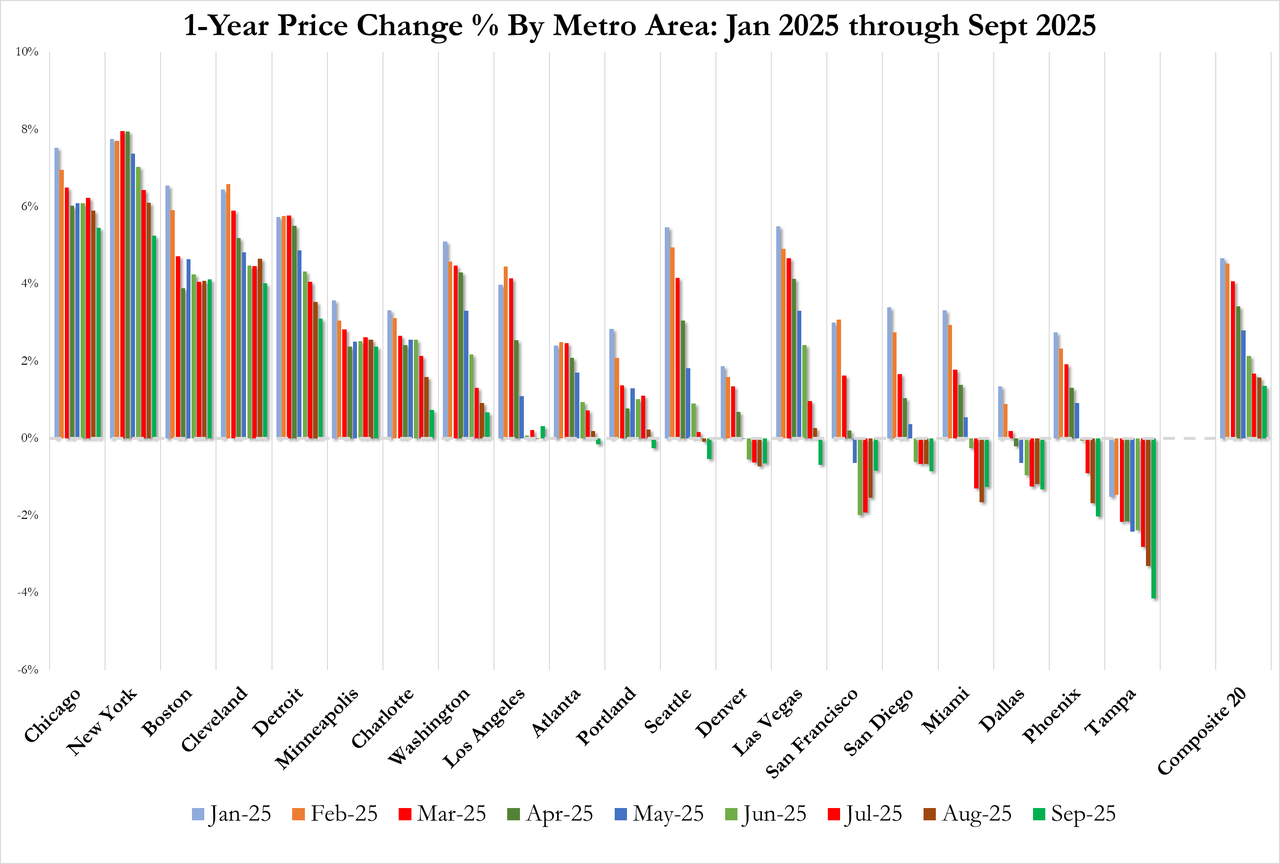

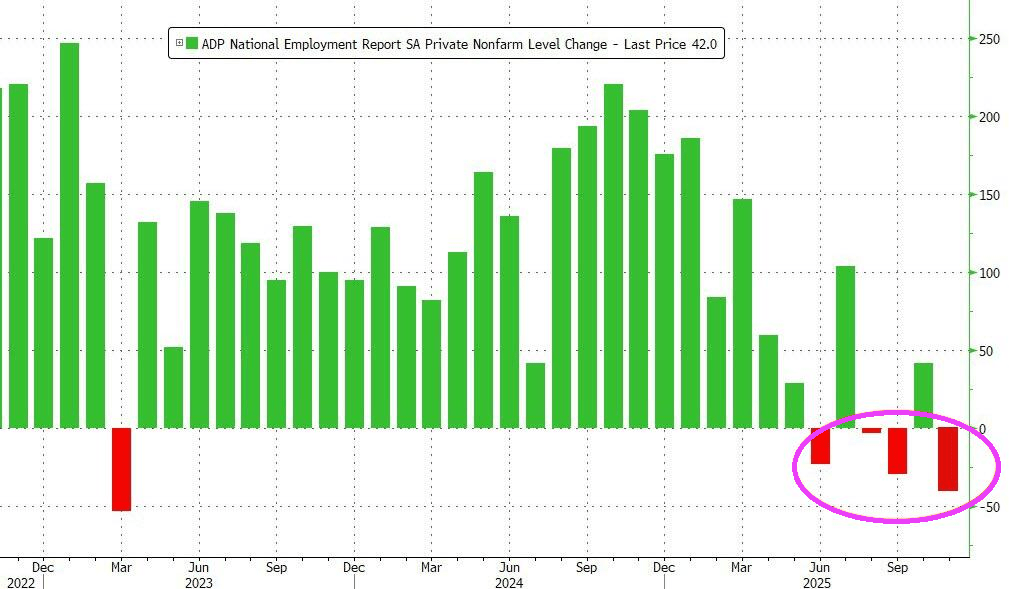

Mortgage rates moved lower in line with Treasury yields, which declined on data showing a weaker labor market and declining consumer confidence. The 30-year fixed mortgage rate declined to 6.32 percent after steadily increasing over the past month. After adjusting for the impact of the Thanksgiving holiday, refinance activity decreased across both conventional and government loans, as borrowers held out for lower rates. Purchase applications were up slightly, but we continue to see mixed results each week as the broader economic outlook remains cloudy, even as cooling home-price growth and increasing for-sale inventory bring some buyers back into the market.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($806,500 or less) decreased to 6.32 percent from 6.40 percent, with points decreasing to 0.58 from 0.60 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

You must be logged in to post a comment.