Its not a wonderful world for regional and small banks given the deterioration of office markets.

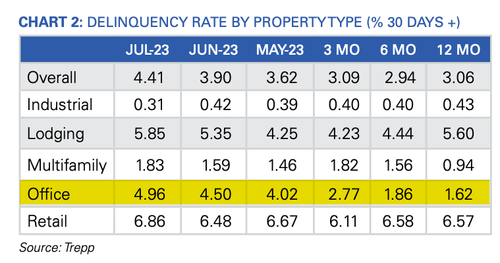

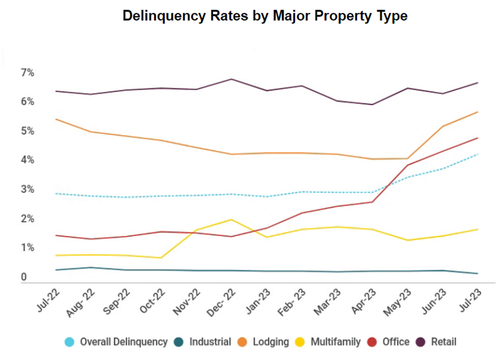

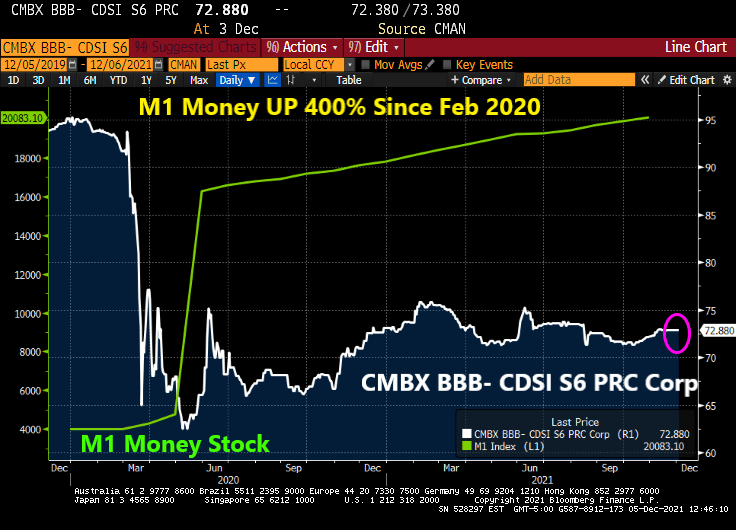

The latest data from Trepp, which tracks commercial mortgage-backed securities (CMBS) securities market data, shows the delinquency rate of commercial property loans packaged up by Wall Street jumped again in July, with four of the five major property segments posting increases.

“While the rest of the US economy has seen relief in terms of higher equity prices, better-than-expected corporate earnings, and falling inflation numbers, the commercial real estate (CRE) market continues to be left behind,” Trepp wrote in the report.

Trepp data found the delinquency rate rose 51 basis points to 4.41% last month — the highest level since December 2021. Office delinquencies increased by 46 basis points to 4.96% — up more than 350 basis points since the end of 2022. The deterioration in the office segment is intensifying at an alarmingly rapid pace.

A broad overview of the US CMBS market shows the delinquency rate increased to 4.41%, a 51bps rise compared to the previous month, but still significantly lower than the 10.34% rate recorded in July 2012. The rate peaked at 10.32% in June 2020 during the government-forced Covid lockdowns.

Here are more highlights from the report:

- Year over year, the overall US CMBS delinquency rate is up 135 basis points.

- Year to date, the rate is up 137 basis points.

- The percentage of loans that are seriously delinquent (60+ days delinquent, in foreclosure, REO, or non-performing balloons) is now 3.92%, up 20 basis points for the month.

- If defeased loans were taken out of the equation, the overall headline delinquency rate would be 4.64%, up 51 basis points from June.

- One year ago, the US CMBS delinquency rate was 3.06%.

- Six months ago, the US CMBS delinquency rate was 2.94%.

To better understand what might come next for the CRE market, Kiran Raichura, Capital Economics’ deputy chief property economist, recently warned in a note to clients that the office segment might experience a 35% plunge in values by the second half 2025 and “is unlikely to be recovered even by 2040.”

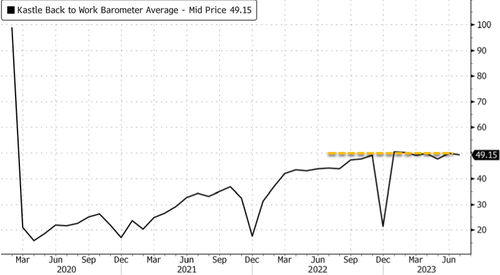

According to swipe data from Kastle Systems, the US office occupancy rate is less than 50%. The figure has plateaued since September, indicating a new reality of remote work.

One major hurdle for CRE space is that “more than 50% of the $2.9 trillion in commercial mortgages will need to be renegotiated in the next 24 months when new lending rates are likely to be up by 350 to 450 basis points,” Lisa Shalett, chief investment officer for Morgan Stanley Wealth Management, wrote in a note to clients.

Shalett expects a “peak-to-trough CRE price decline of as much as 40%, worse than in the Great Financial Crisis.”

Bank of America analysts expect challenges in the CRE space but noted, “They are manageable and do not represent a systemic risk to the US economy.”

Meanwhile, analysts at UBS warned:

“About $1.3 billion of office mortgage loans are currently slated to mature over the next three years.

“It’s possible that some of these loans will need to be restructured, but the scope of the issue pales in comparison to the more than $2 trillion of bank equity capital. Office exposure for banks represents less than 5% of total loans and just 1.9% on average for large banks.”

We’ve already seen major building owners returning their office towers and malls to lenders in California (here & here) and elsewhere (here). This will result in an uptick in CMBS delinquencies moving forward.

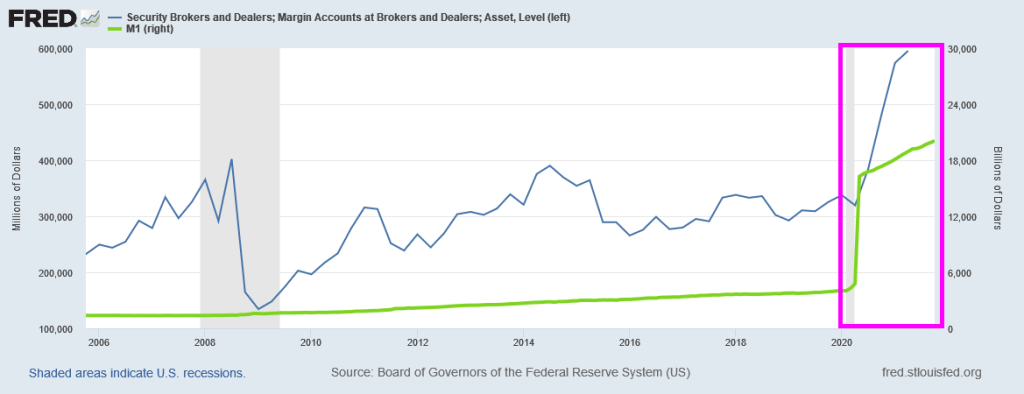

… and remember what we wrote during the regional bank crisis earlier this year — the note was titled “Nowhere To Hide In CMBS”: CRE Nuke Goes Off With Small Banks Accounting For 70% Of Commercial Real Estate Loans.

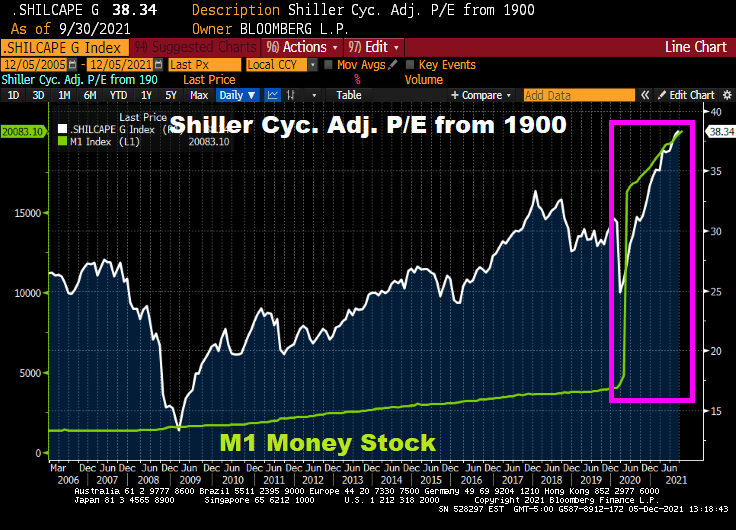

Meanwhile, The Federal Reserve is printing the night away.

Sam Cooke sang Joe Biden’s favorite song: “Only Sixteen.”

“So why did I give my heart so fast

It never will happen again

But I was a mere man of 80

I’ve aged a year since then.”

You must be logged in to post a comment.