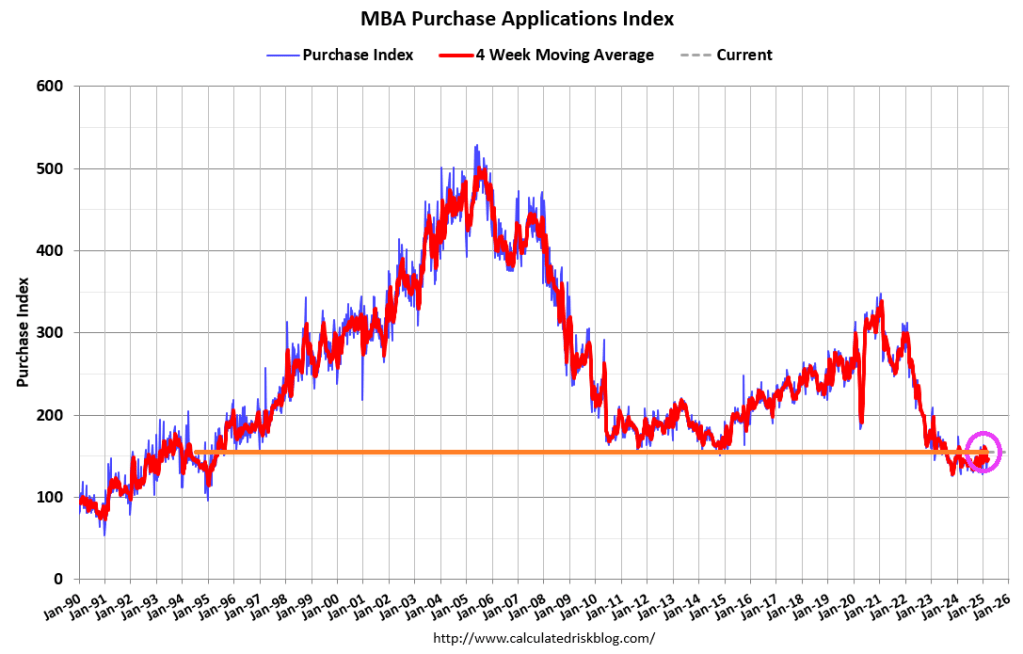

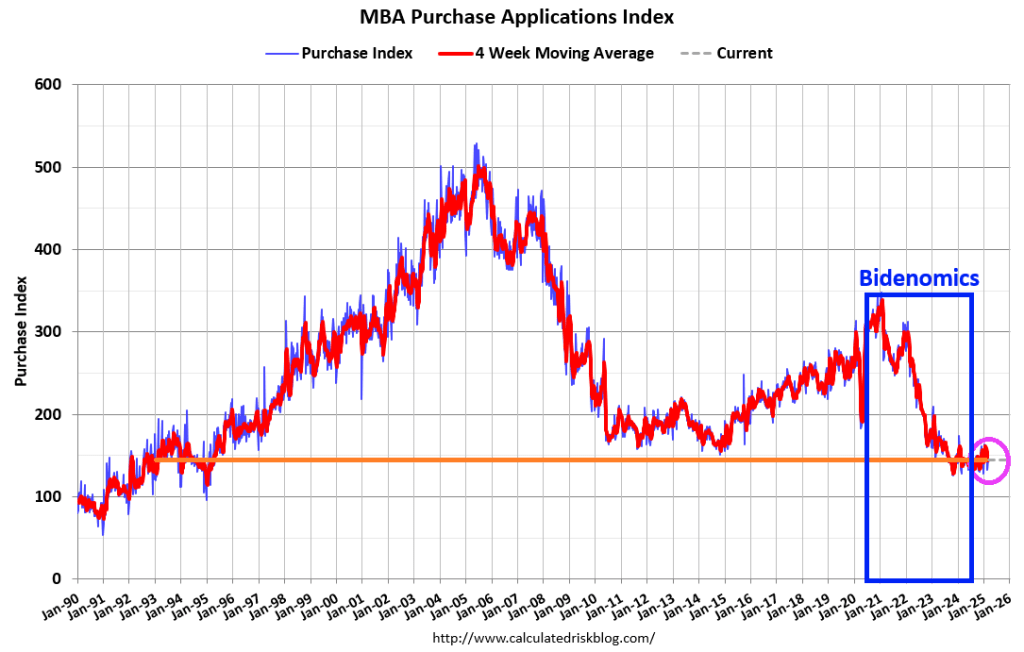

The mortgage market got its mind set on a recovery, but Biden’s mindless economic policies have jammed up the mortgage market. Example? Mortgage applications are down in a season where they typically increase.

Mortgage applications decreased 1.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 28, 2025.

The Market Composite Index, a measure of mortgage loan application volume, decreased 1.6 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 1 percent compared with the previous week. The seasonally adjusted Purchase Index increased 2 percent from one week earlier. The unadjusted Purchase Index increased 2 percent compared with the previous week and was 9 percent higher than the same week one year ago.

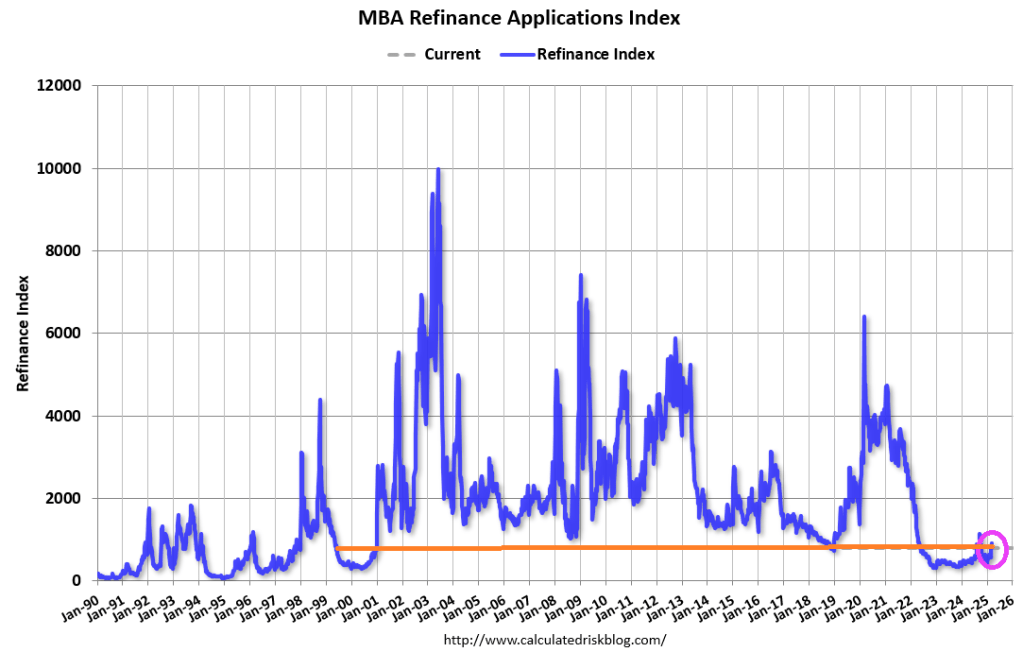

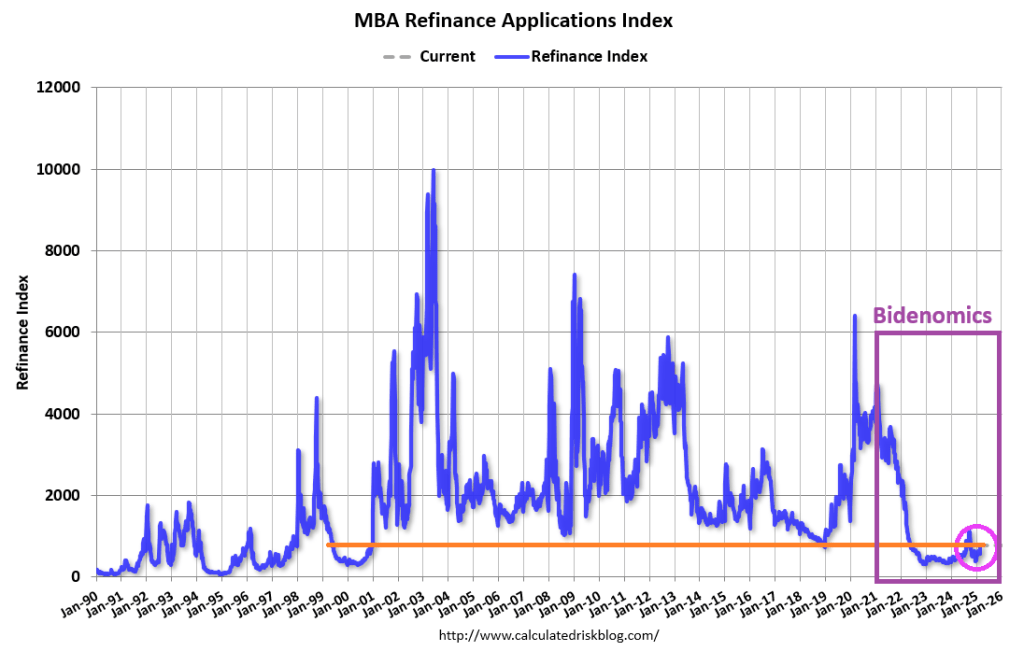

The Refinance Index decreased 6 percent from the previous week and was 57 percent higher than the same week one year ago.

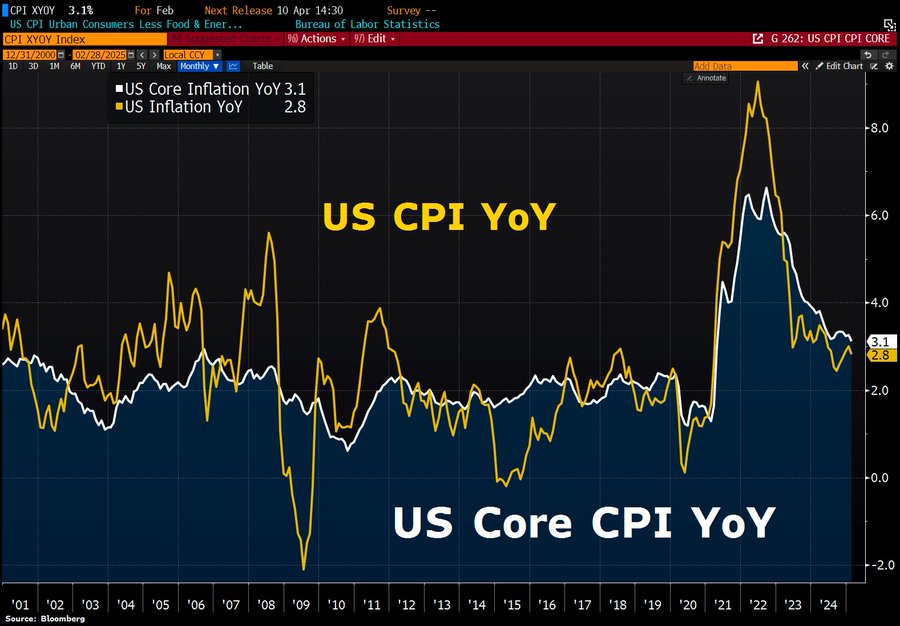

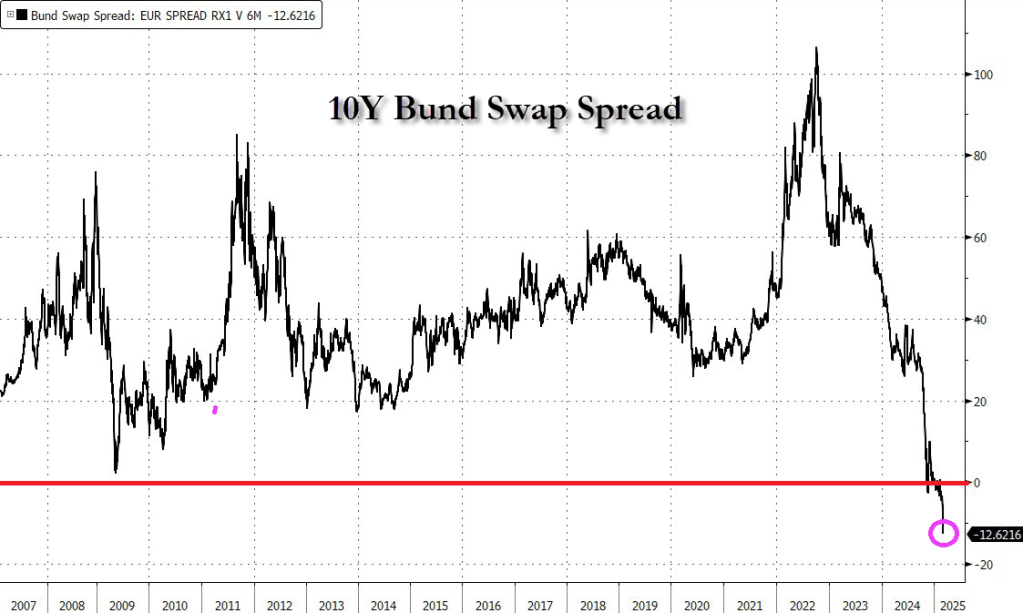

Treasury yields continue to be volatile as economic uncertainty dominates markets. Most mortgage rates finished last week lower, with the 30-year fixed essentially unchanged at 6.70 percent. Last week’s level of purchase applications was its highest since the end of January, driven by a 3 percent increase in conventional purchases, while government purchase applications were down 2 percent.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($806,500 or less) decreased to 6.70 percent from 6.71 percent, with points increasing to 0.62 from 0.60 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

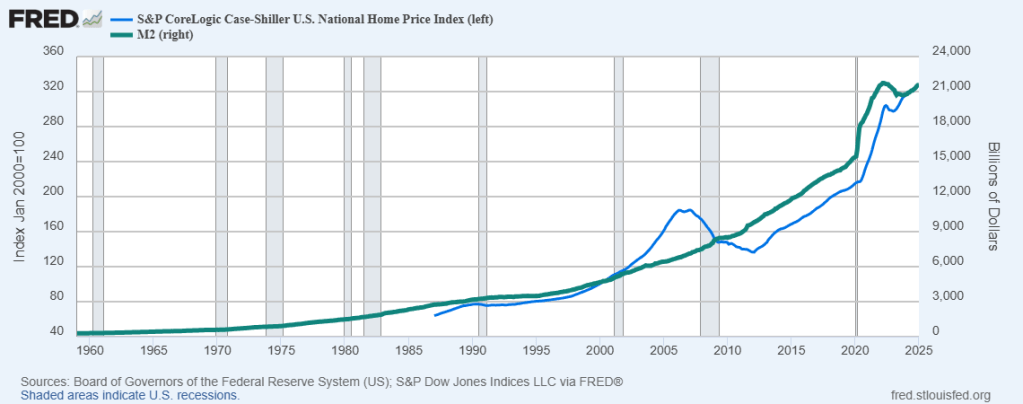

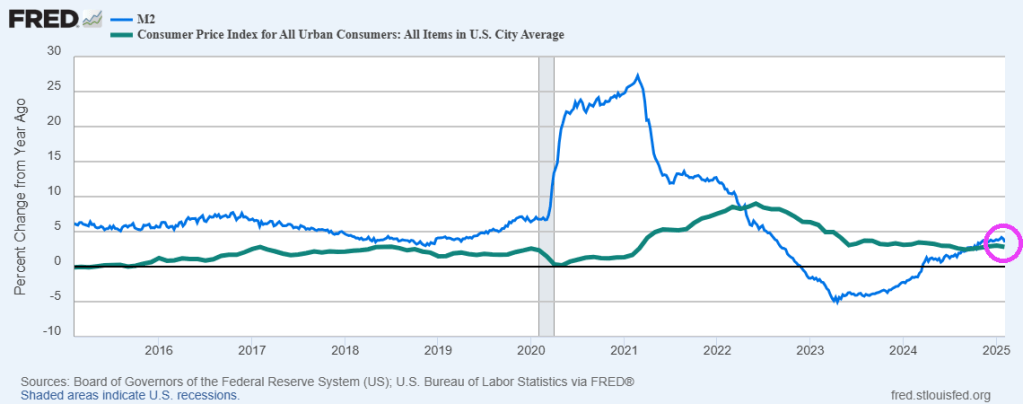

Conforming 30Y mortgage rates are up 137% since Biden was elected President.

Biden was the destroyer!

You must be logged in to post a comment.