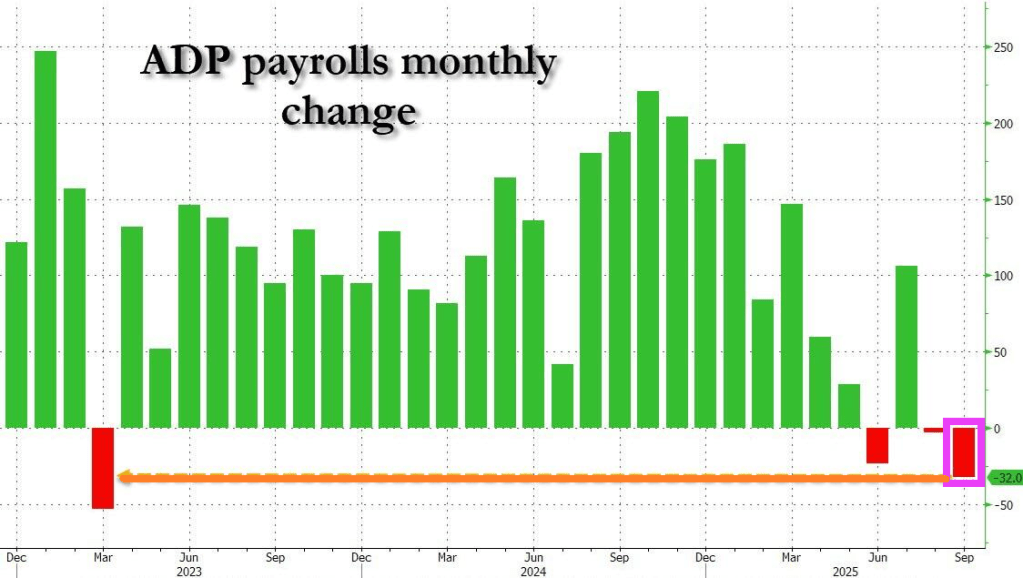

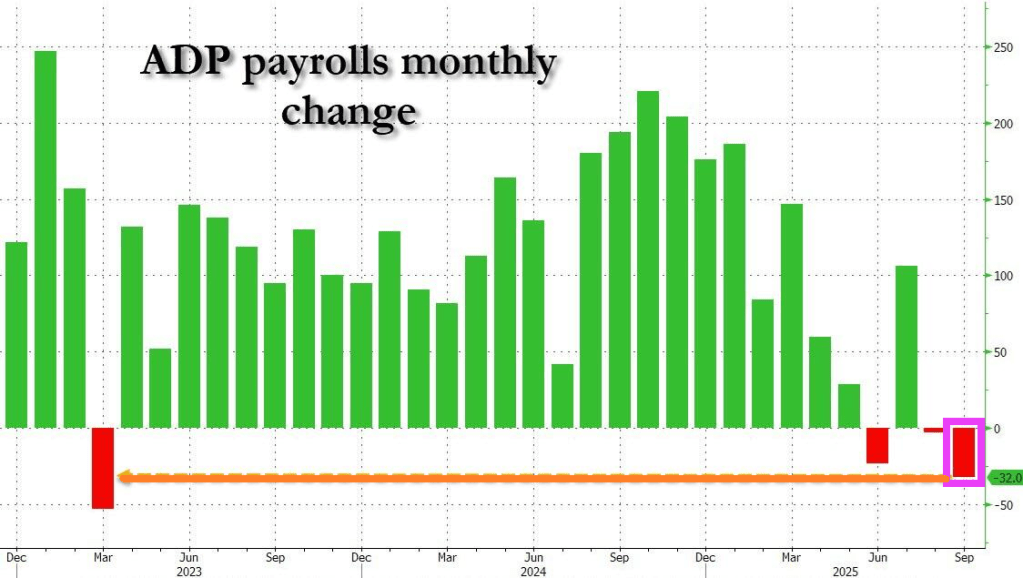

This should get The Fed to cut rates! ADP reported that in September, the US private sector shed 32,000 jobs, the worst print since March 2023.

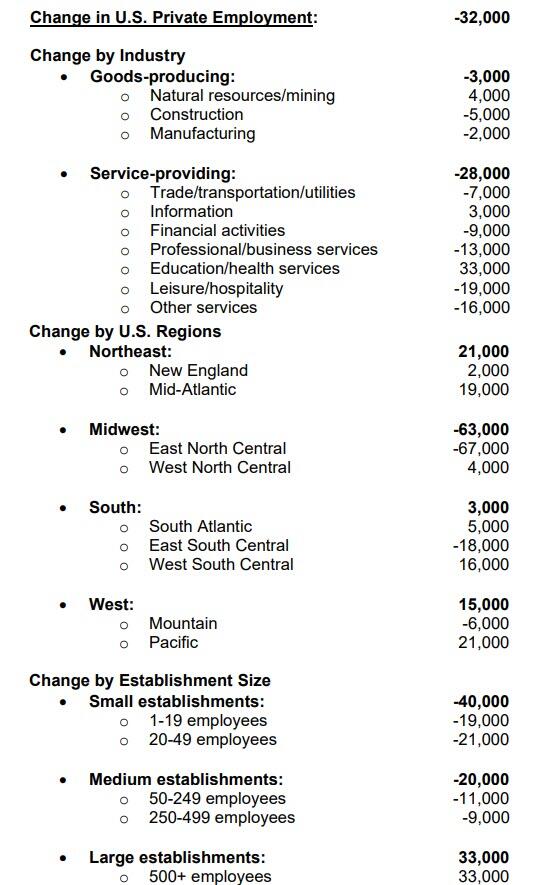

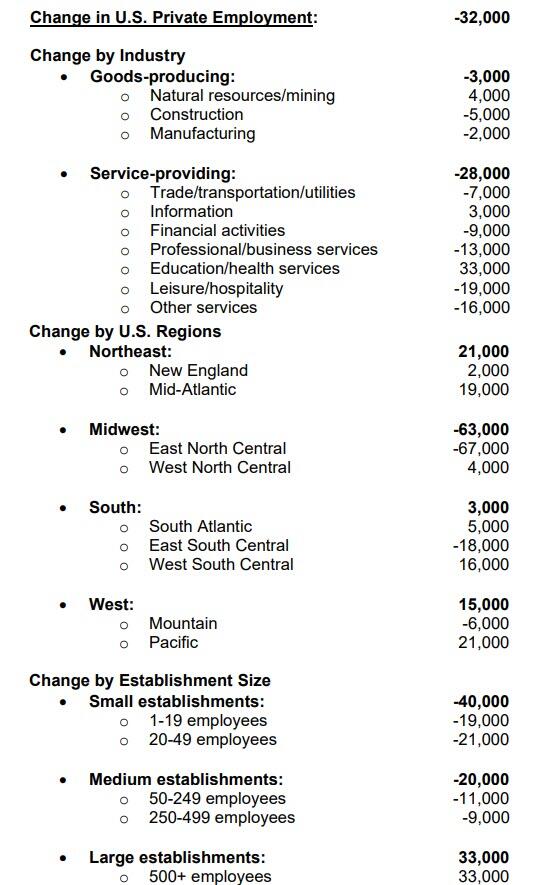

Here is the breakdown.

Confounded Interest – Anthony B. Sanders

Financial Markets And Real Estate

This should get The Fed to cut rates! ADP reported that in September, the US private sector shed 32,000 jobs, the worst print since March 2023.

Here is the breakdown.

Shutdown!

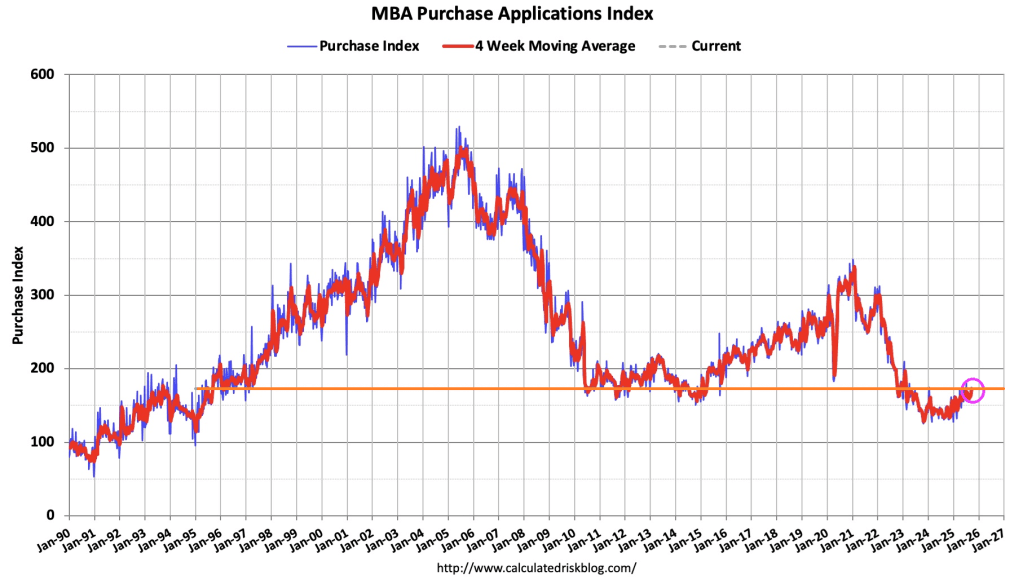

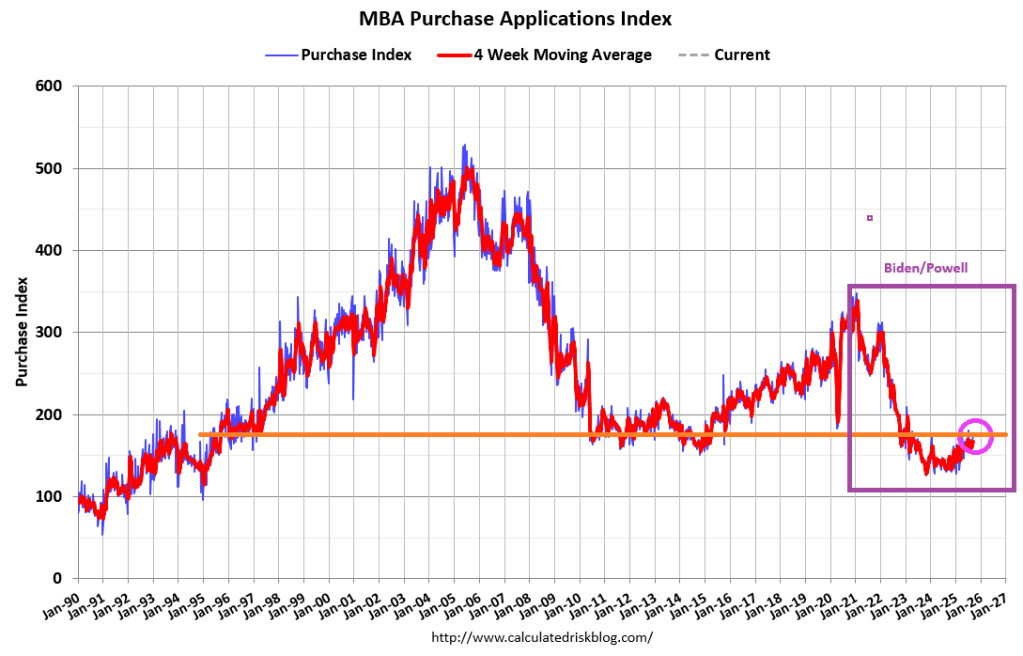

Mortgage applications decreased 12.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 26, 2025.

The Market Composite Index, a measure of mortgage loan application volume, decreased 12.7 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 13 percent compared with the previous week. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 16 percent higher than the same week one year ago.

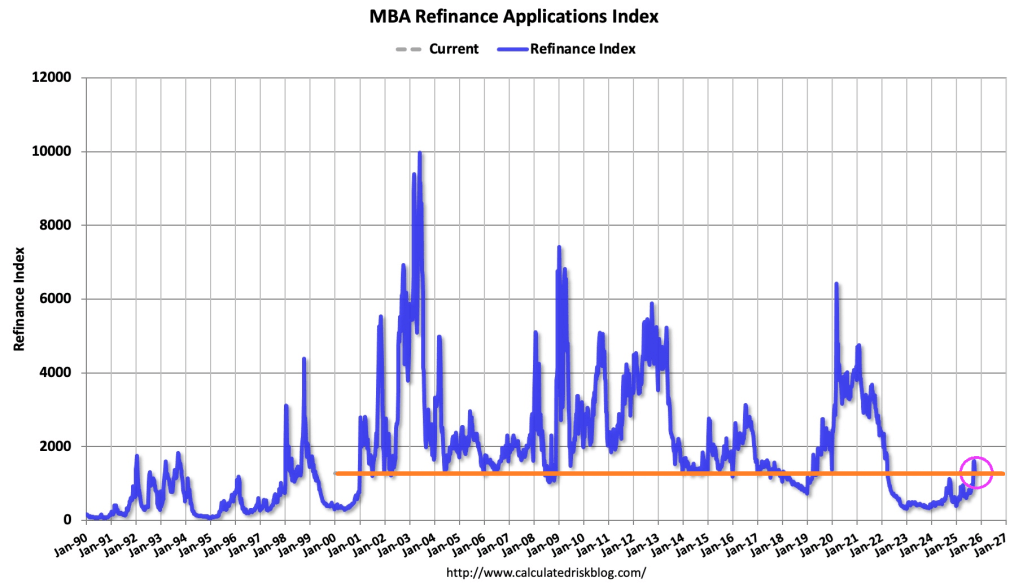

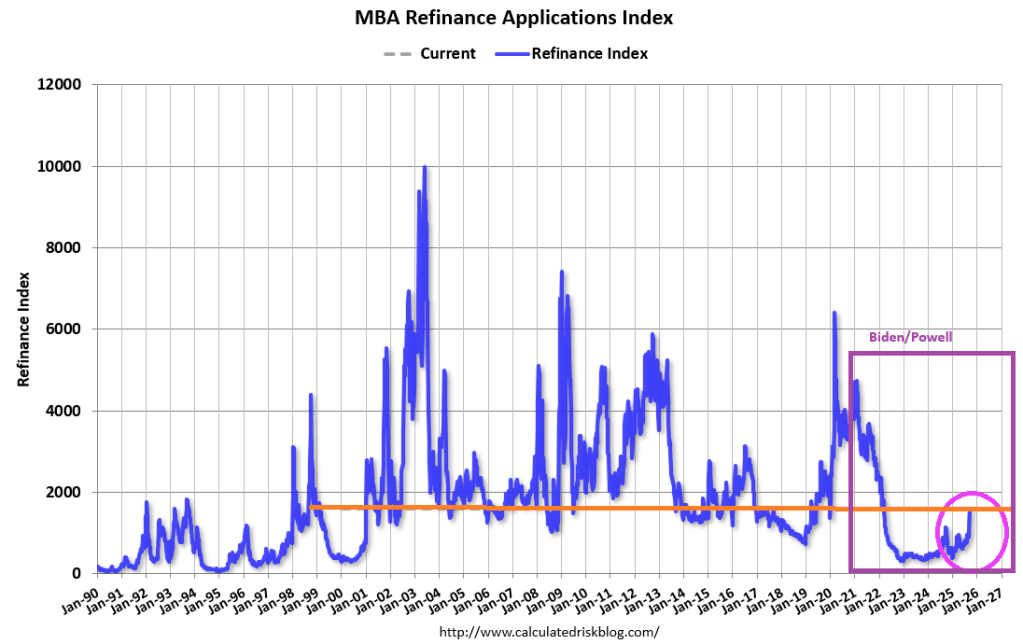

The Refinance Index decreased 21 percent from the previous week and was 16 percent higher than the same week one year ago.

Mortgage rates increased to its highest level in three weeks as Treasury yields pushed higher on recent, stronger than expected economic data. After the burst in refinancing activity over the past month, this reversal in mortgage rates led to a sizeable drop in refinance applications, consistent with the view that refinance opportunities this year will be short-lived.

Yes, the Federal government has shut down.

August data for the US housing market has been ‘mixed’ to say the least with a surge in new home sales (thanks to a massive rise in incentives from homebuilders) and a small decline (near multi-year lows), leaving this morning’s pending home sales data as the tie-breaker (with expectations of an ‘unch’ shift MoM).

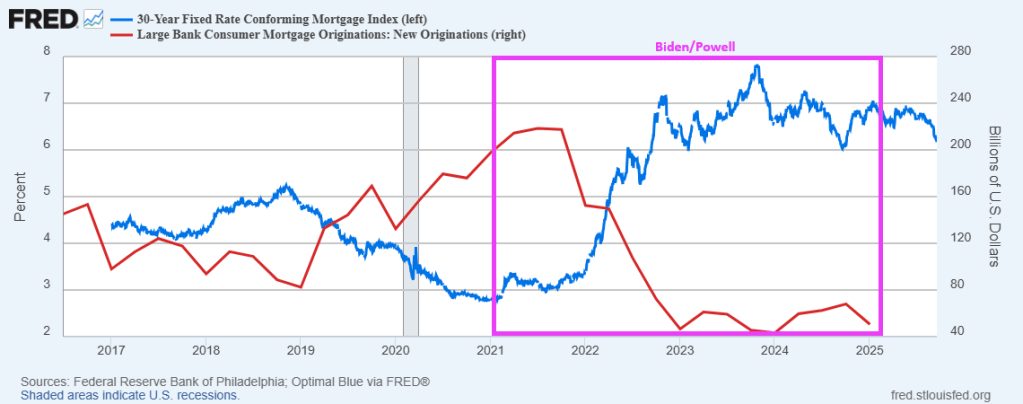

It appears the drop in mortgage rates is driving some purchase activity as pending home sales soared 4.0% MoM in August – the most since March – dragging sales up 0.5% YoY.

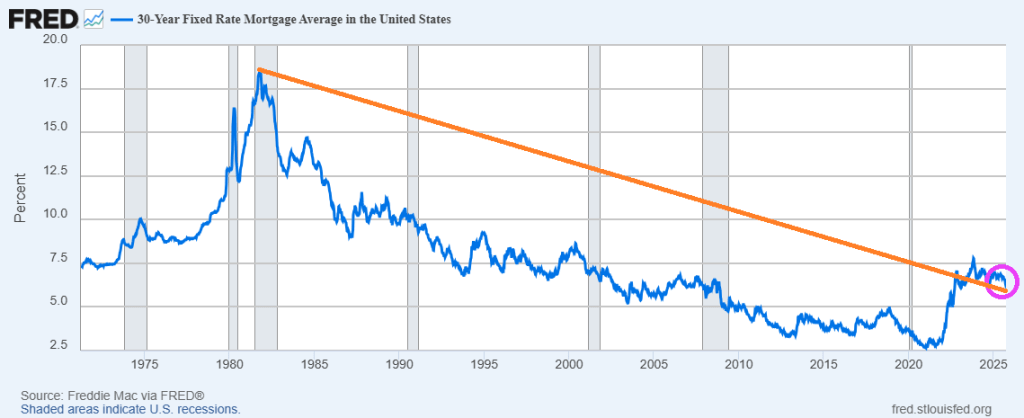

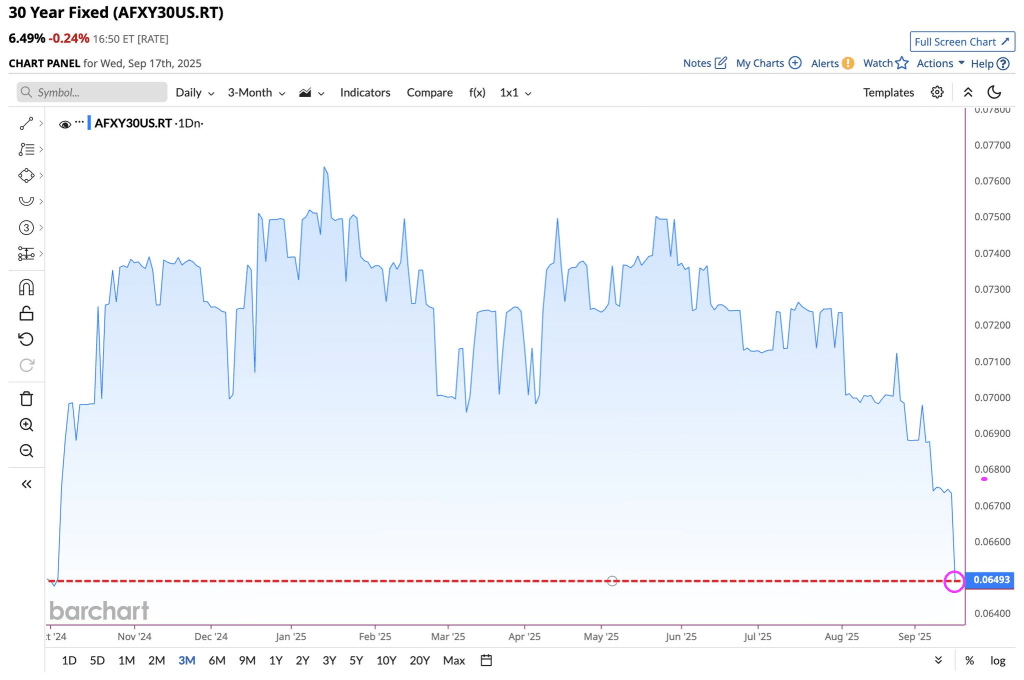

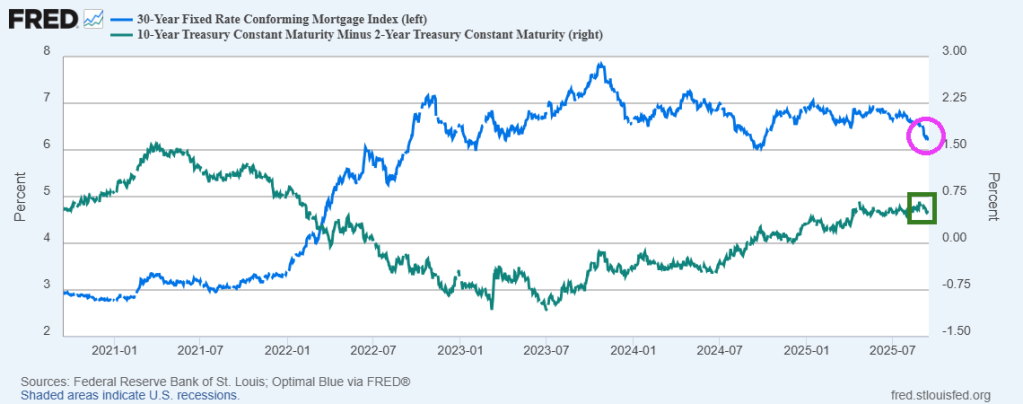

Mortgage rates are falling, helping existing home sales. Note that the 30-year mortgage rate peaked at 18.63% in 1981.

Zowie! The US economy is red hot!!

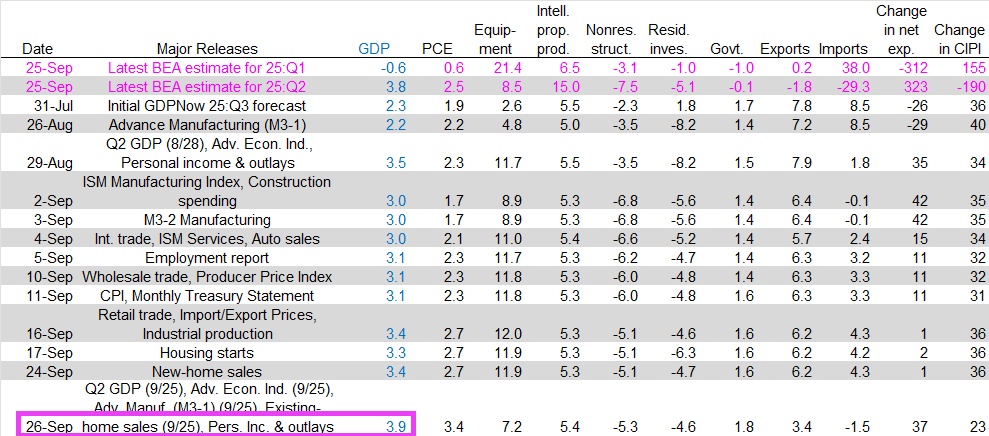

Latest estimate: 3.9 percent — September 26, 2025

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2025 is 3.9 percent on September 26, up from 3.3 percent on September 17. After recent releases from the US Census Bureau, the US Bureau of Economic Analysis, and the National Association of Realtors, a decrease in the nowcast of third-quarter real gross private domestic investment growth from 6.4 percent to 4.1 percent was more than offset by increases in the nowcast of third-quarter real personal consumption expenditures growth from 2.7 percent to 3.4 percent and the nowcast of the contribution of net exports to third-quarter real GDP growth from 0.08 percentage points to 0.58 percentage points.

Existing home sales helped drive higher GDP growth.

Zowie! The US economy is red hot!

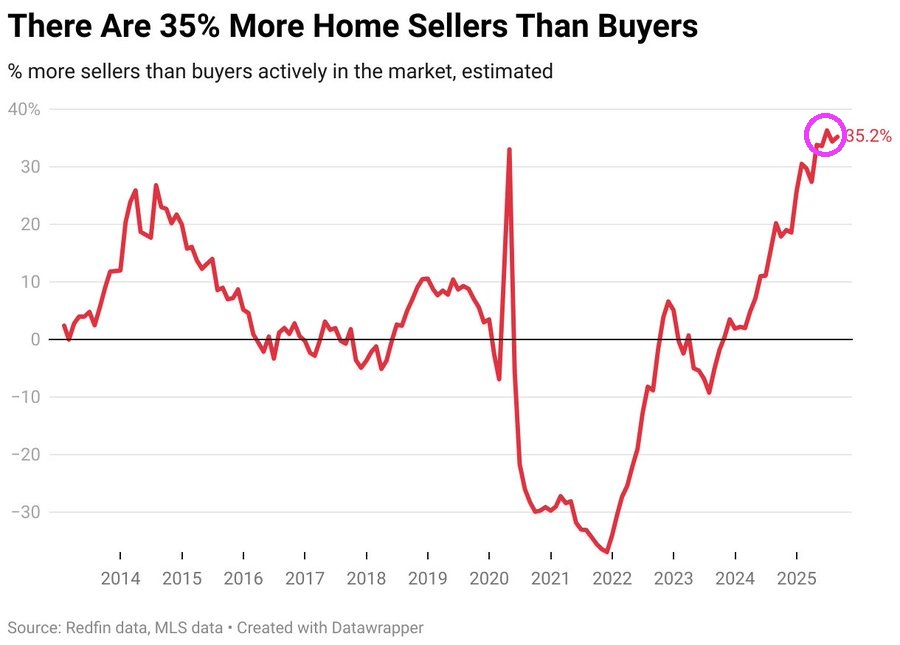

August represents a massive switch from 3 years ago when there were nearly 40% more home buyers and sellers in the US housing market. There are now 35.2% MORE home sellers than buyers!

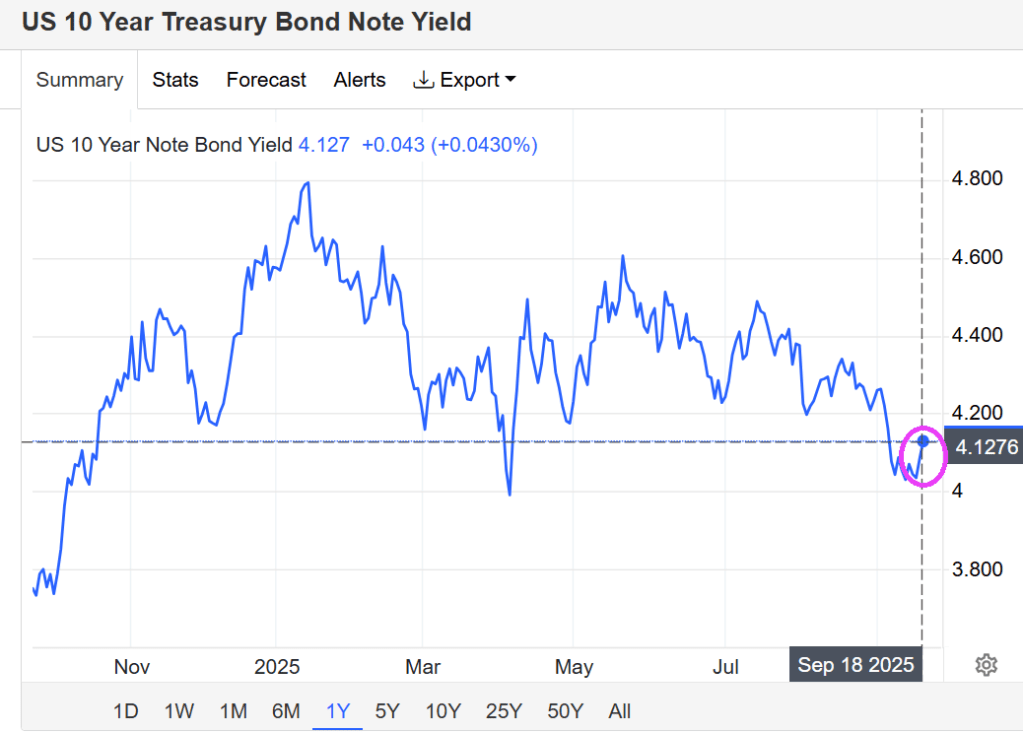

Fed Chair Jerome Powell is the God of Hellfire! We should always wait a day to digest Fed’s annoucements since they often make little sense. For example, yesterday the 10Y yield fell below 4% after The Fed’s announcement … then promplty rose above 4% again. And today, the US Treasury 10Y yield rose to 4.1276%

The 30Y US mortgage rate fell to 6.493%.

How about the US Dollar? Similar to the US 10Y yield, volatility reigned following Powell’s muddled message.

Powell rarely is straightforward and never puts cash on the barrelhead.

Zowie!

Mortgage applications increased 29.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 12, 2025. Last week’s results included an adjustment for the Labor Day holiday.

The Market Composite Index, a measure of mortgage loan application volume, increased 29.7 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 43 percent compared with the previous week. The seasonally adjusted Purchase Index increased 3 percent from one week earlier. The unadjusted Purchase Index increased 12 percent compared with the previous week and was 20 percent higher than the same week one year ago.

The Refinance Index increased 58 percent from the previous week and was 70 percent higher than the same week one year ago.

Indicative of the weakening job market, and in anticipation of a rate cut from the Federal Reserve, mortgage rates last week dropped to their lowest level since last October, with the 30-year fixed rate declining to 6.39 percent. Homeowners responded swiftly, with refinance application volume jumping almost 60 percent compared to the prior week. Homeowners with larger loans jumped first, as the average loan size on refinances reached its highest level in the 35-year history of our survey. Almost 60 percent of applications were for refinances, but there was also a pickup in purchase applications.

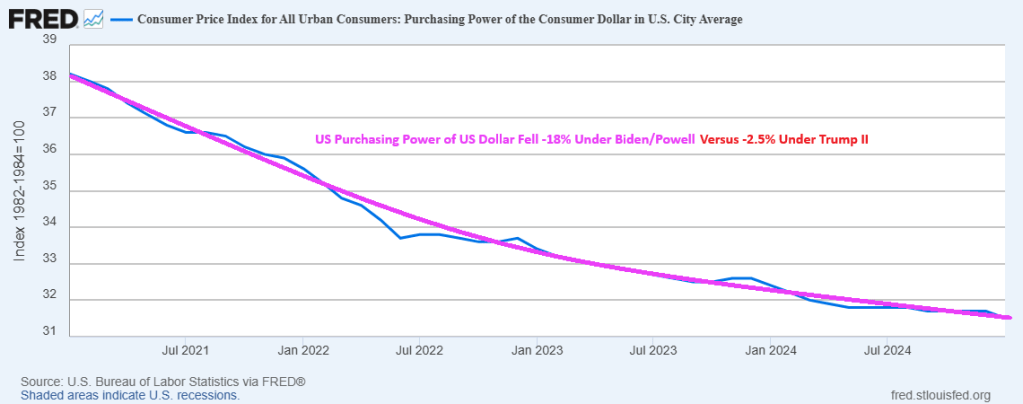

The Biden/Powell “reign of error” is ending.

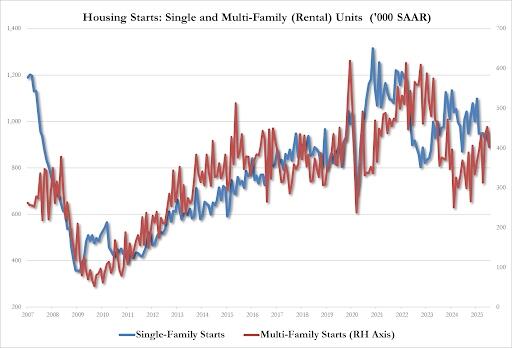

It will take a while to recover from Biden’s “Reign of Error.” According the US Census Bureau, housing starts are 6.0 percent below the August 2024 rate.

Housing starts:

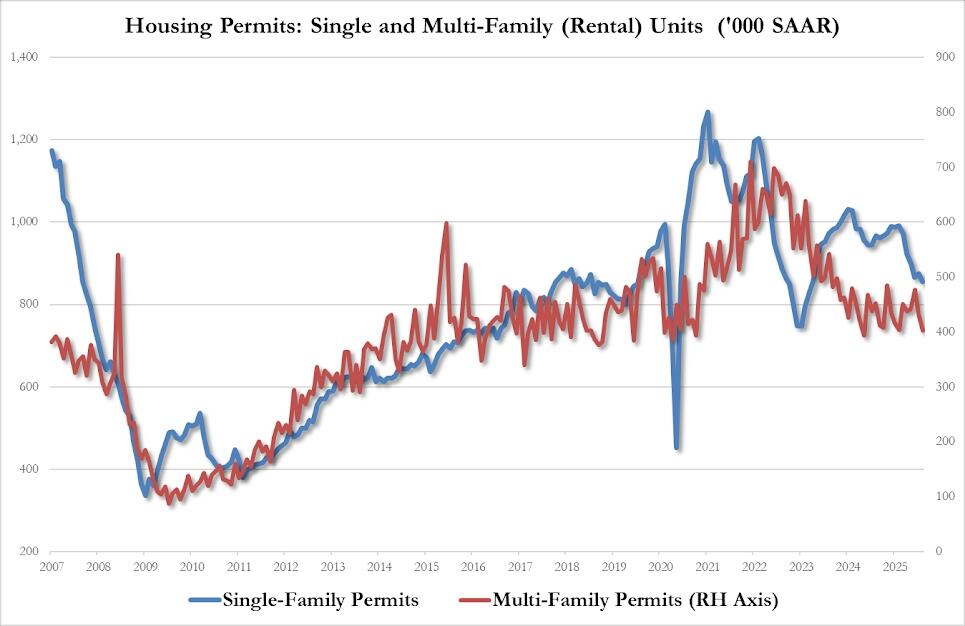

Housing permits?

Let’s see if Powell and The Gang drop rates 25 or 50 basis points at today’s FOMC meeting.

Between The Fed’s persistent policy errors and Biden’s centralized mismanagement of the economy, Biden’s Maladministration is the epitome of a “Reign of Error.”

Participants in the mortgage market are hoping for relief in the mortgage market when The Fed lowers rates tomorrow.

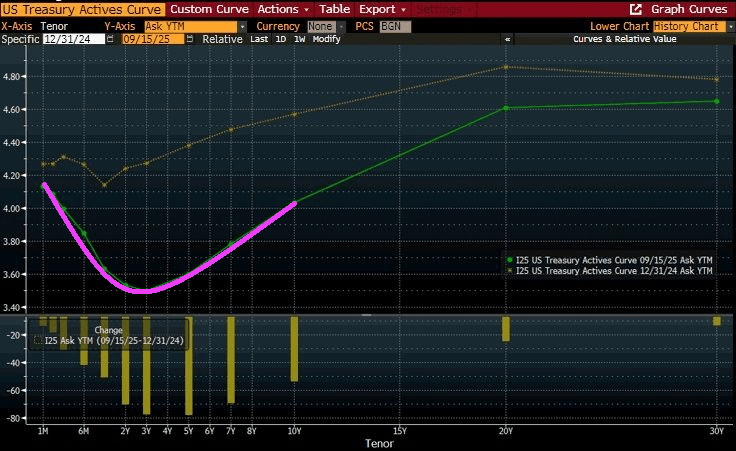

But the reality is the the bond market is expecting declining short-term rates, but not much change at the 10-year tenor.

Mortgage rates have fallen since October 23, 2023 as the yield curve has gradually steepened.

So don’t be surprised if The Fed cuts rates tomorrow and there is little or no reaction in mortgage rates.

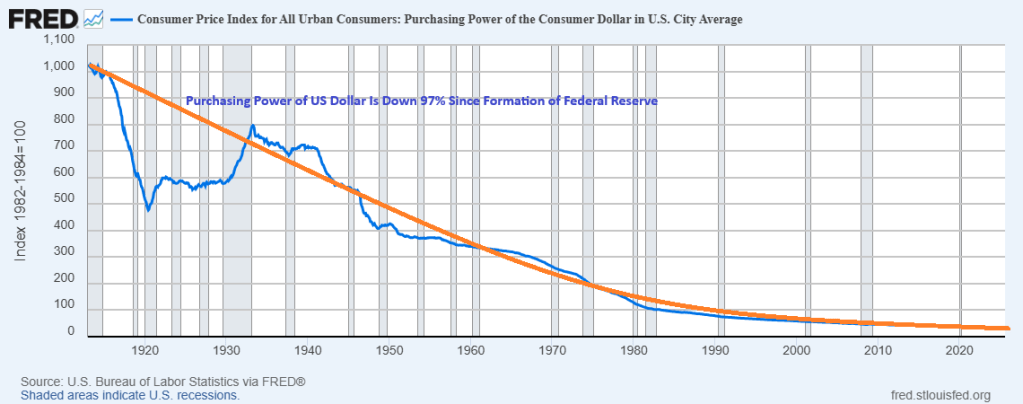

Under The Federal Reserve, the purchasing power of the US Dollar has declined -97% since the establishment of The Federal Reserve in 1913. It is the House of the Dying Dollar.

Under The Federal Reserve, the purchasing power of the US Dollar has declined -97% since the establishment of The Federal Reserve in 1913.

Of course, Trump II is only 9 months old and Biden had 4 long years to destroy the dollar.

You must be logged in to post a comment.