Let’s put this in black and white. There are 11 indications that the US economy is in a state of slow motion collapse.

The fact that economic conditions are getting worse is certainly not good news, but it is better to know in advance what is coming. After four years under Joe Biden, the U.S. economy is a giant mess. We have been witnessing a slow-motion collapse right in front of our eyes, and those at the bottom levels of the economic food chain have been experiencing more pain than anyone else. Of course this is one of the biggest reasons why Donald Trump won the election.

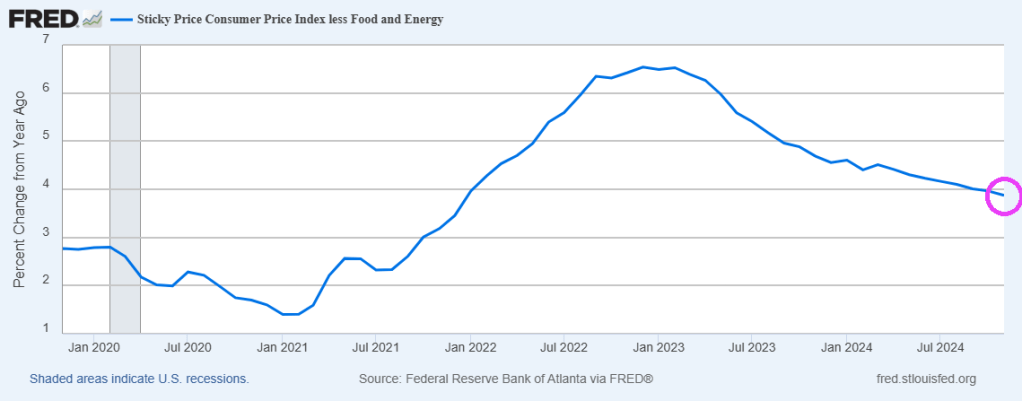

Example? Sticky inflation remains far higher under Biden/Harris than it did when Trump was President. Prices remain elevated as you will notice when Christmas shopping!

#1 When the economy is in good shape, holiday spending increases each year. In 2024, only 16 percent of Americans say that they are going to spend more than last year and 35 percent of Americans say that they are going to spend less…

Americans this holiday season say they are seeing a ghost of Christmas past: inflation.

The CNBC All-America Economic Survey finds inflation is still haunting the buying public, leading to what’s shaping up to be just an average season for retailers. Just 16% of respondents say they will spend more, down two points compared to last year. Forty-eight percent said that they’ll lay out the same amount for holiday gifts, up five points. At the same time, 35% say they’ll spend less, down two points as well.

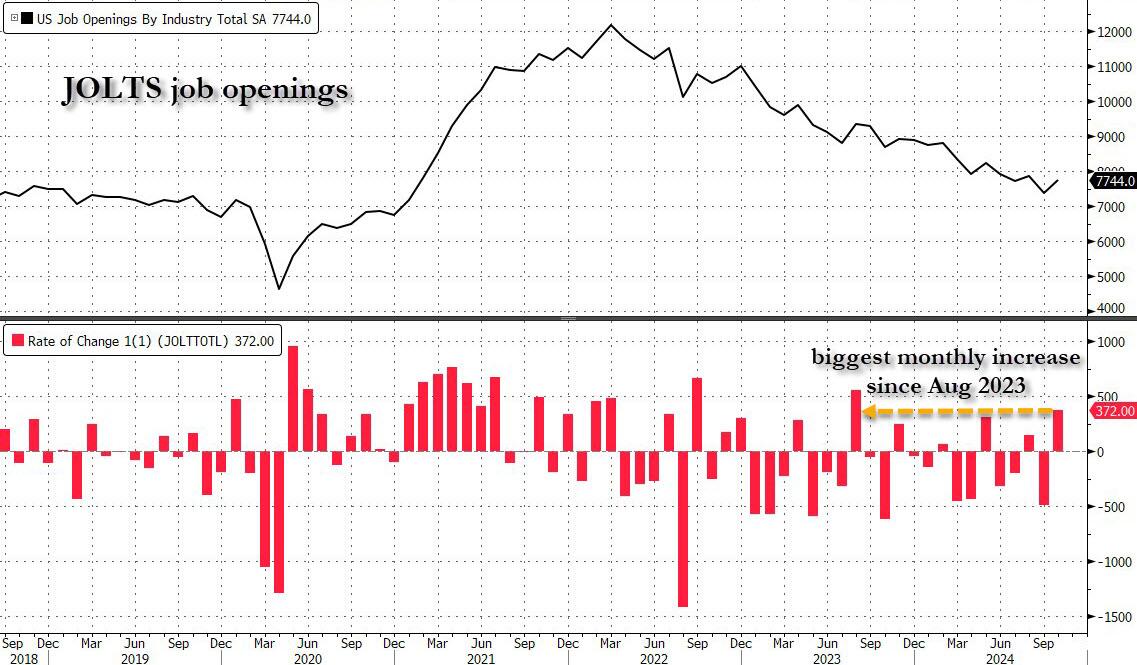

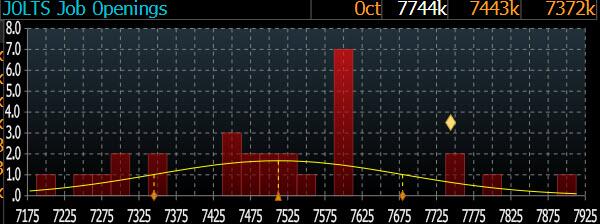

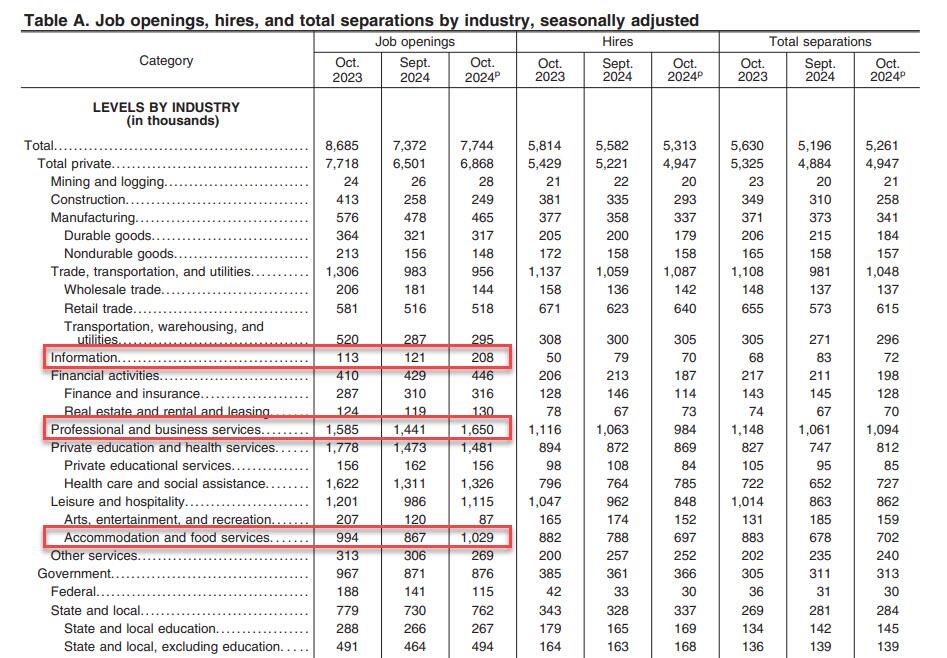

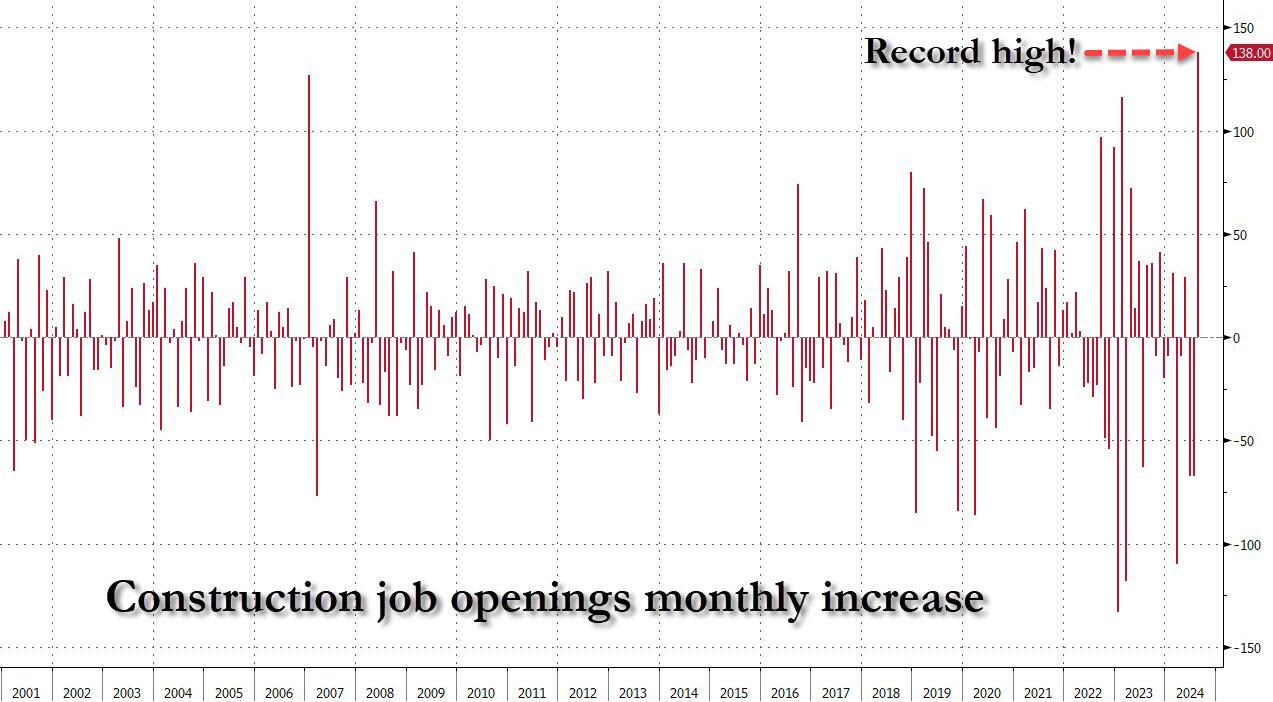

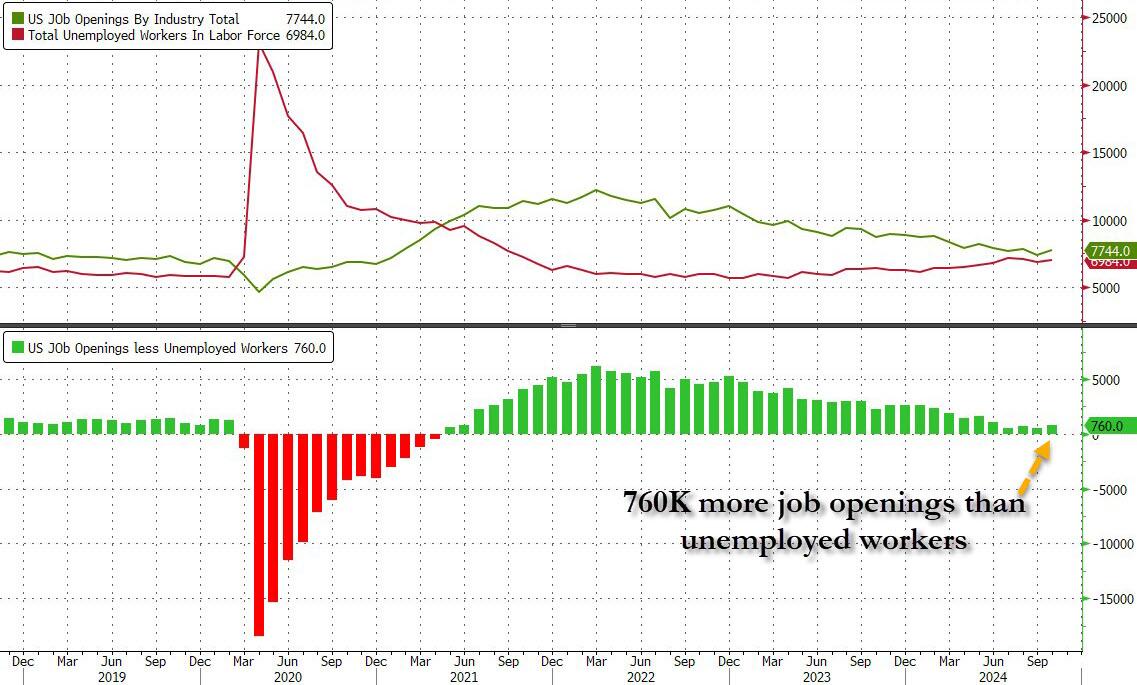

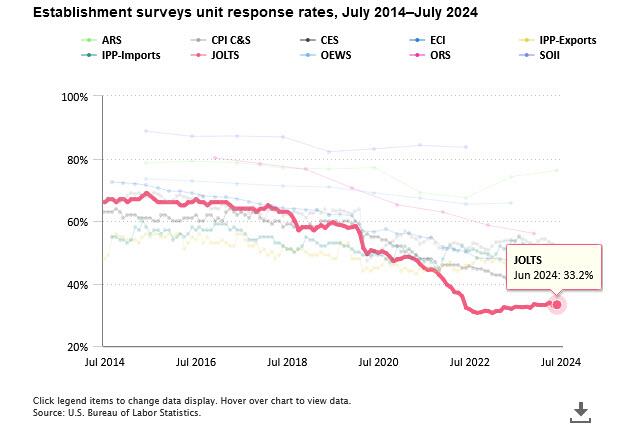

#2 The number of job openings in the U.S. is now the lowest it has been since January 2021, but unlike January 2021 we don’t have a pandemic to blame our poor performance on…

US job openings tumbled last month to their lowest level since January 2021, a sign that the labor market is losing some momentum. Still, posted vacancies remain well above pre-pandemic levels.

The Labor Department reported Tuesday that the number of job openings dropped to 7.4 million in September from 7.9 million in August.

Economists had expected the level of openings to be virtually unchanged. Job openings fell in particular at healthcare companies and at government agencies at the federal, state and local levels.

#3 The manufacturing numbers that we are getting are extremely dismal. For example, the Philadelphia Federal Reserve Manufacturing Index just experienced an extremely sharp decline…

The Philadelphia Federal Reserve Manufacturing Index, a critical gauge of the general business conditions in Philadelphia, has reported a significant drop. The actual figure stands at -16.4, a sharp decline that suggests worsening conditions for manufacturers in the region.

This figure starkly contrasts with the forecasted number of 2.9, highlighting a more severe downturn than initially predicted. Analysts had anticipated a positive shift, indicating improving conditions, but the actual data presents a different, more concerning situation.

Moreover, when compared to the previous index value of -5.5, the current reading of -16.4 further emphasizes the severity of the decline. This continuous drop indicates a concerning trend for manufacturers within the Philadelphia Federal Reserve district.

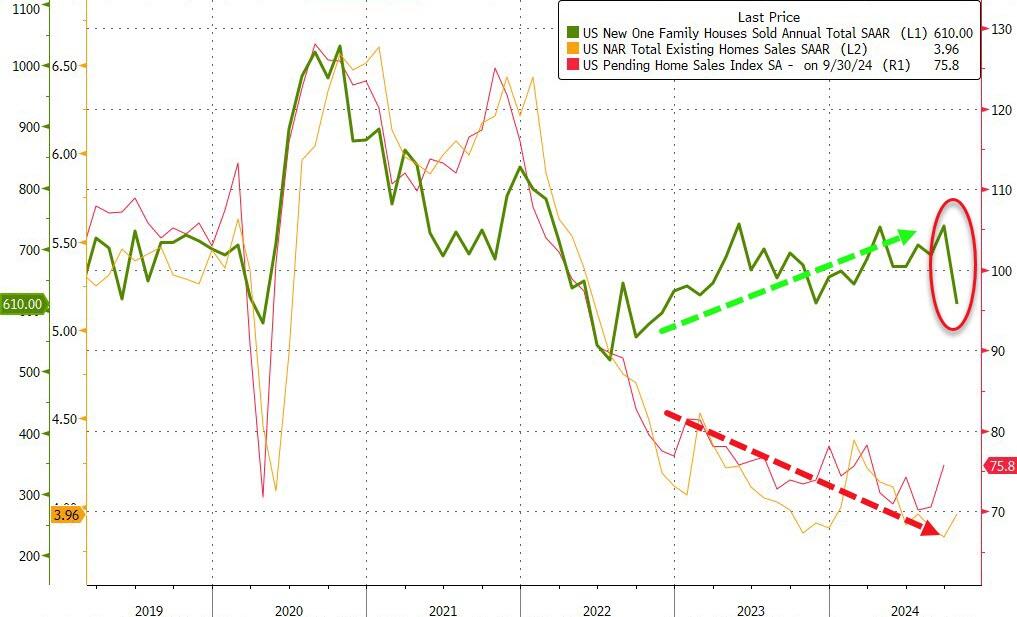

#4 Thanks to rapidly rising mortgage rates, the average U.S. homebuyer just lost $33,250 in purchasing power in just six weeks…

Mortgage rates hit 7% on October 28, the highest level since the start of summer and up nearly one percentage point from the 18-month low they dropped to in mid-September.

A homebuyer on a $3,000 monthly budget can afford a $442,500 home with a 7% mortgage rate, the daily average 30-year fixed rate on October 28. That buyer has lost $33,250 in purchasing power over the last six weeks; they could have purchased a $475,750 home with the 6.11% average rate on September 17. That was the lowest level since February 2023.

#5 Our cost of living crisis is officially out of control. According to Bank of America, almost a third of all households “spend more than 95% of their disposable income on necessities such as housing costs, groceries and utility bills”…

Many Americans are still in a tough spot: Nearly 30% of all US households this year said they spend more than 95% of their disposable income on necessities such as housing costs, groceries and utility bills, according to a Bank of America Institute report, up from 2019 levels.

#6 A recent Lending Tree survey discovered that nearly a quarter of all households couldn’t pay their entire power bill at some point within the past year…

LendingTree’s findings about electricity bill costs comes as it reported 23.4% of Americans experienced an inability to cover their entire energy bill or portions of it in the last year, based on Census Bureau Household Pulse Survey data.

#7 The same Lending Tree survey found that about a third of all households had to reduce spending “on necessary things” within the past year in order to pay utility costs…

Needing to cover utility bills prompted 34.3% of Americans to curb their spending on necessary things – or eliminate some altogether – in at least one instance in the prior year, LendingTree said.

#8 As I discussed last week, demand is at record levels at food banks all over the nation…

Why is demand at food banks all over the country higher than it has ever been before? The media keeps insisting that economic conditions are just fine, but it has become quite obvious to everyone that this is not true. In particular, the rising cost of living has been absolutely crushing households from coast to coast. In the old days, most of the people that would show up at food banks were unemployed. But now food banks are serving large numbers of people that actually do have jobs but that don’t make enough to pay for all of the basics. The ranks of the “working poor” are growing very rapidly, and this is creating an unprecedented crisis all over America.

#9 During normal times, troubled retailers would at least wait until after the holiday season to throw in the towel. But we haven’t even reached Christmas and Party City has already announced that it will be closing all stores…

Party City is closing down all of its stores, ending nearly 40 years in business, CNN has learned.

CEO Barry Litwin told corporate employees Friday in a meeting viewed by CNN that Party City is “winding down” operations immediately and that today will be their last day of employment. Staff were told they will not receive severance pay, and they were told their benefits would end as the company goes out of business.

#10 Not to be outdone, Big Lots has announced that all 936 of their remaining stores will be shutting down on a permanent basis…

Big Lots is beginning ‘going out of business’ sales at all its stores across the US, as it prepares to close its remaining locations.

The discount retail chain filed for Chapter 11 bankruptcy in September, and has already shut hundreds of stores nationwide.

In a press release Thursday, the company said it would begin the sales at its 963 remaining locations, after a sale to a private equity firm fell through.

#11 As of the end of November, more than 7,000 store closings had been announced in the United States. That is a 69 percent increase from last year…

According to a report from CoreSight Research, U.S. retailers had announced more than 7,100 store closures through the end of November 2024, which represents a 69% increase compared to the same time in 2023. These closures are spread across numerous different sectors of retail from auto parts to restaurants to pharmacies, leaving many consumers wondering which companies will survive. This brings us to GameStop, the beloved retail gaming store, which has not only been closing hundreds of retail store locations since 2020, but also appears to be on track to close hundreds more of its locations in the very near future.

This is what a failing economy looks like.

Last week, a prominent mall in downtown San Francisco was empty of shoppers in the middle of the afternoon…

Look at all of these beautiful Christmas decorations at the Crocker Galleria mall in San Francisco. It’s 4:47 PM and everybody should be shopping and buying Christmas presents for their family, but nobody is in this mall.

There are only three stores left that are open here. The escalators hum on inside this beautiful but empty decorated mall.

Outside on Market Street the fentanyl addicts lay folded over while a street performer sings Last Christmas to an empty Street.

Of course the lack of shoppers at that particular mall is just the tip of the iceberg.

Unfortunately, the truth is that downtown areas all over California “are crumbling under the weight of homelessness and drug addiction”…

California’s biggest downtown areas are crumbling under the weight of homelessness and drug addiction, causing a vital part of its economy to dry out.

Cities like Los Angeles and San Francisco have made countless headlines since the pandemic about their drug-infested streets where businesses are quickly pulling out due to high crime rates and low consumer passage.

The number of drug addicts in America is at the highest level ever.

The number of homeless people in America is at the highest level ever.

They are victims of our slow-motion economic collapse, and the holidays will not be very happy for them.

So if you still have food on the table and a warm home to sleep in, you should consider yourself to be incredibly blessed.

Sadly, more Americans are being forced out into the streets with each passing day as the slow-motion collapse of our economy accelerates.

Merry Christmas!

You must be logged in to post a comment.