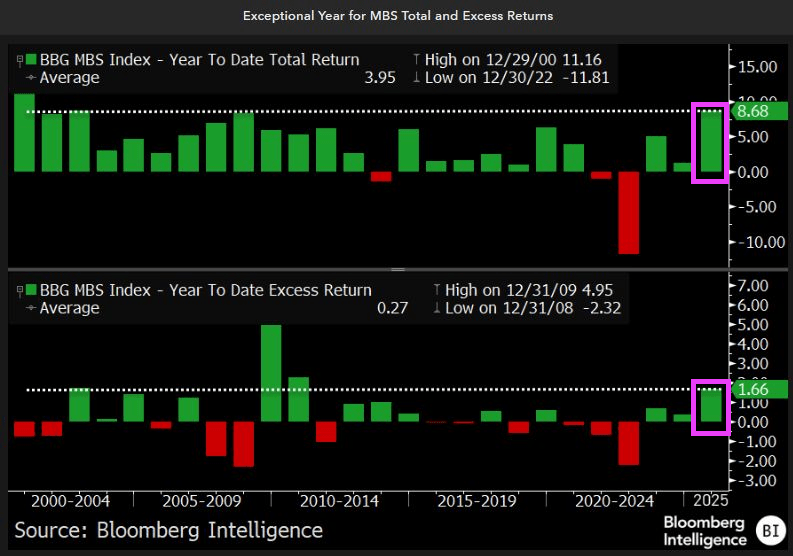

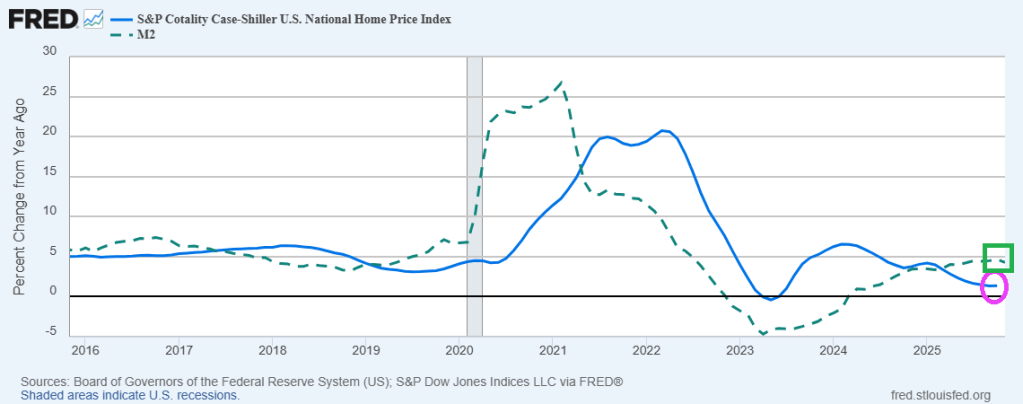

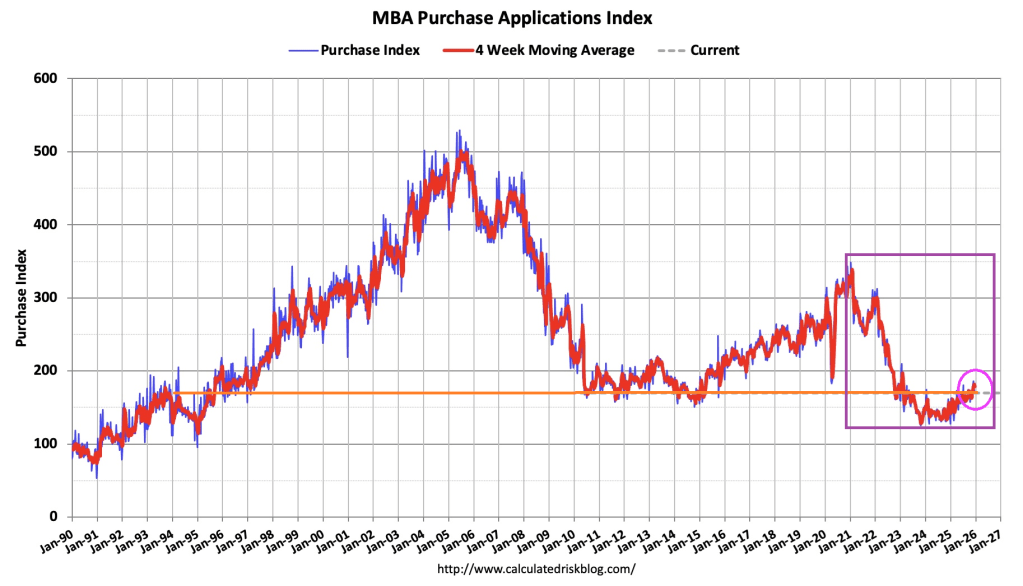

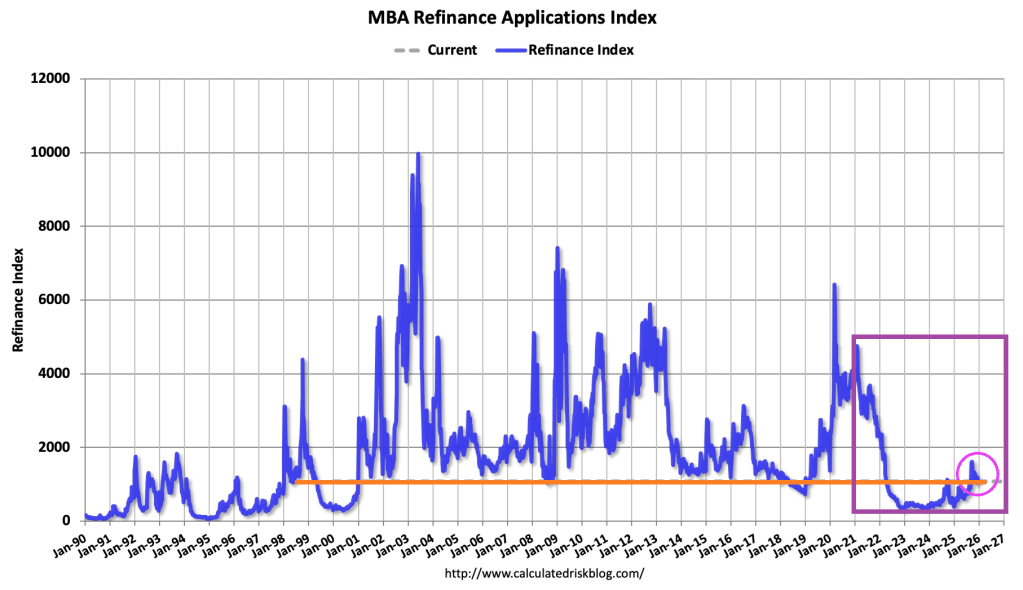

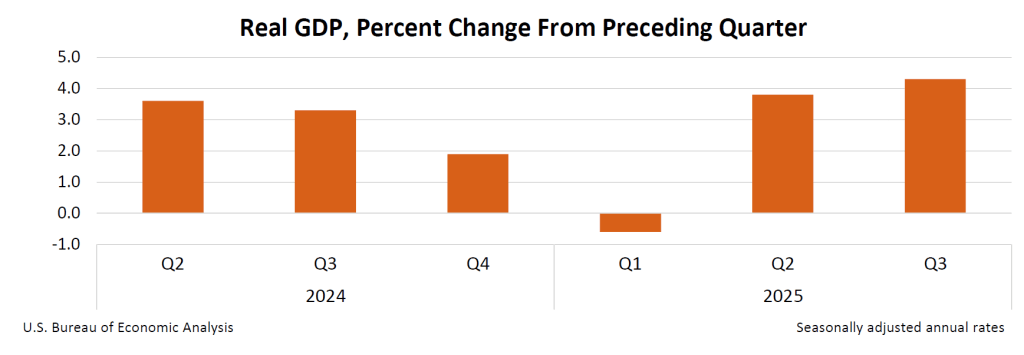

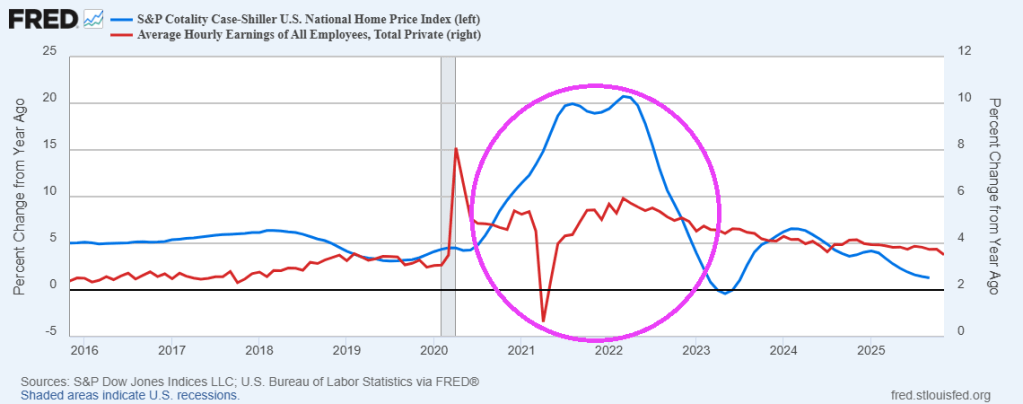

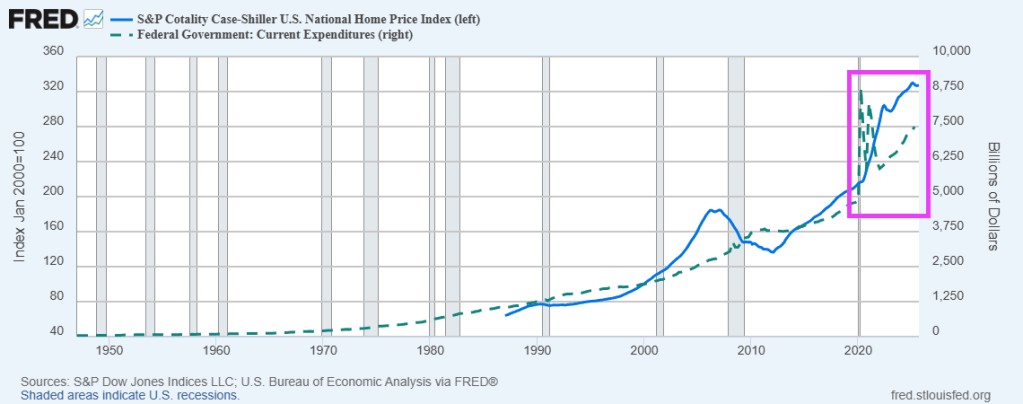

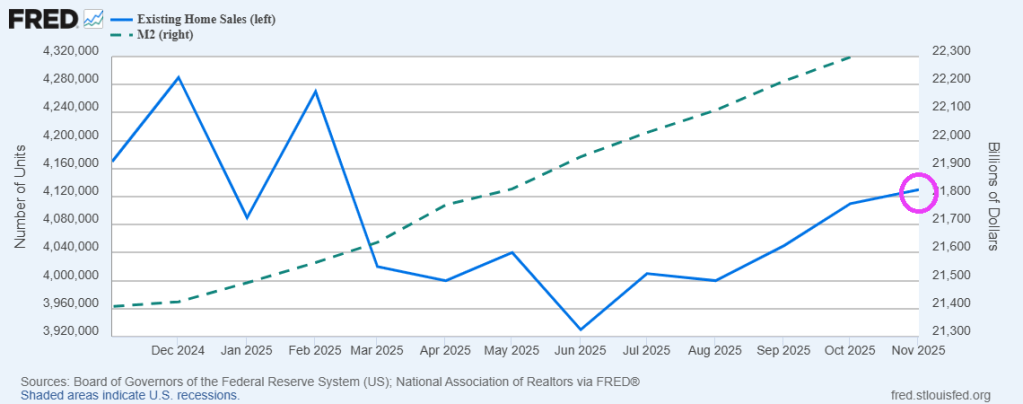

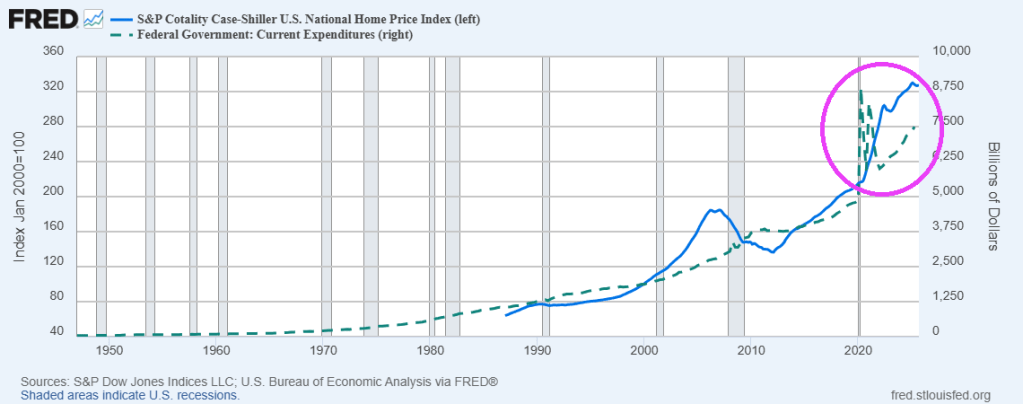

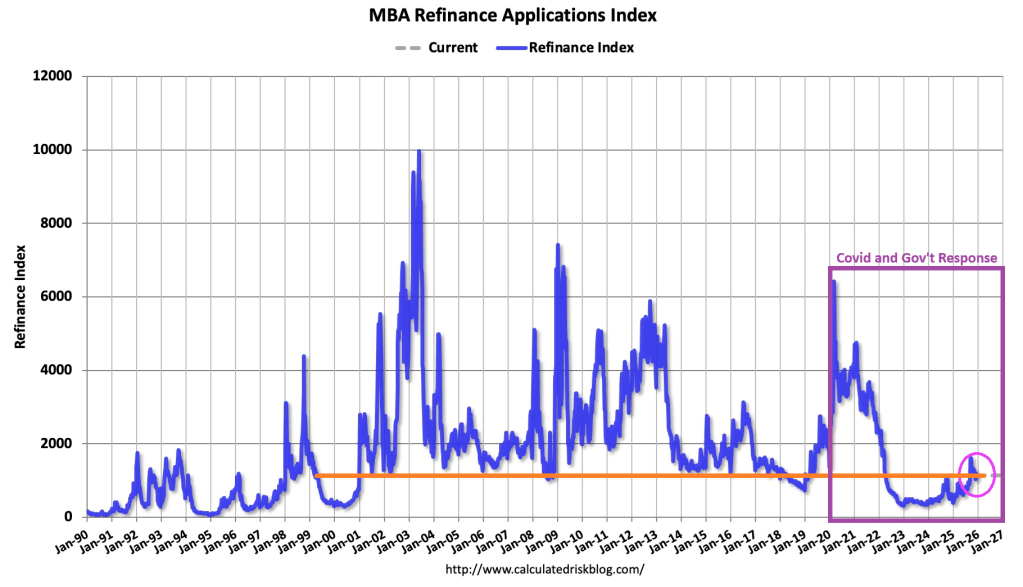

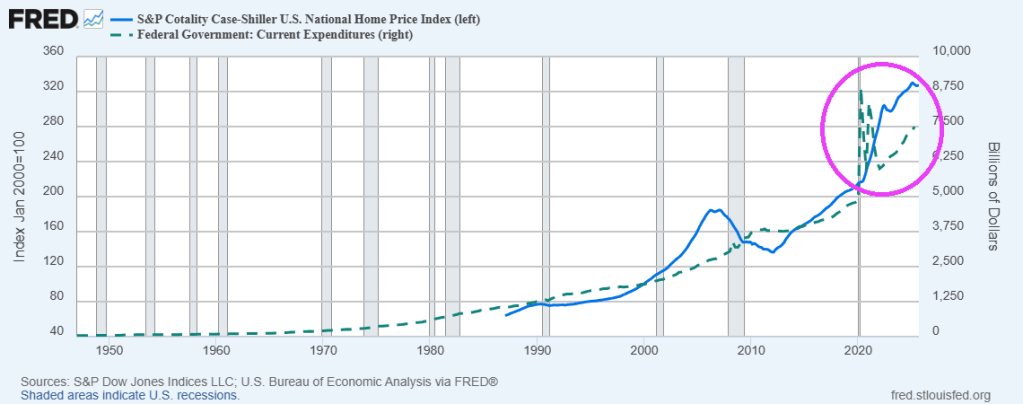

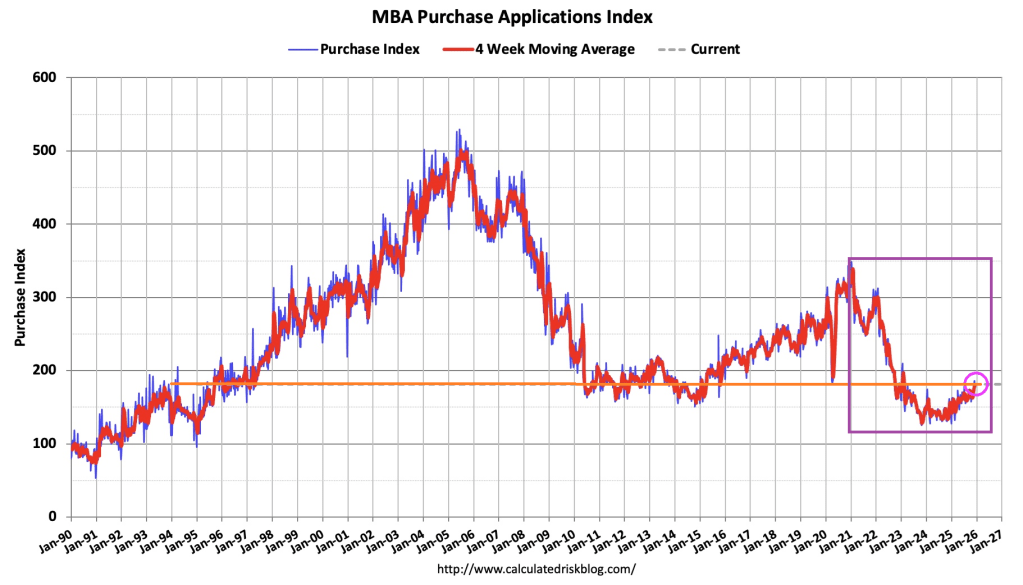

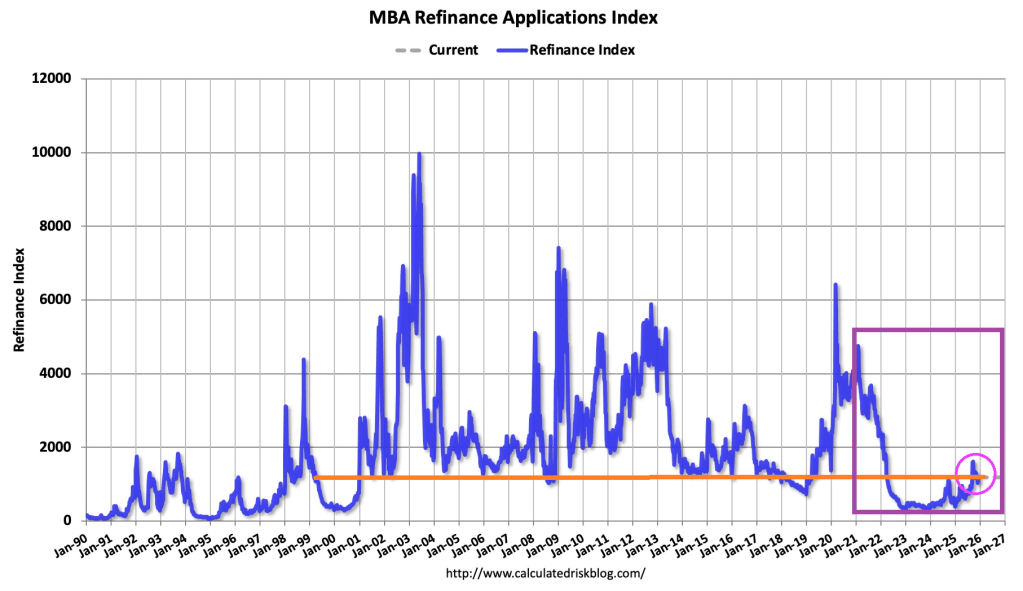

It looks like President Trump wants ANOTHER Federal Reserve. He has ordered the GSEs (Fannie Mae and Freddie Mac) to purchase $200 BILLION in mortgage bonds in an attempt to lower mortgage rates. Puzzling since real GDP growth is soaring.

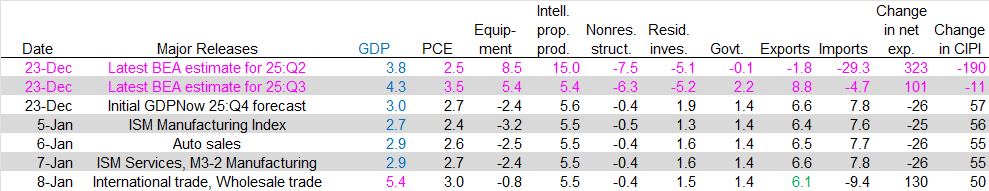

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2025 is 5.4 percent on January 8, up from 2.7 percent on January 5. After recent releases from the US Bureau of Economic Analysis, the US Census Bureau, and the Institute for Supply Management, the nowcast of fourth-quarter real personal consumption expenditures growth increased from 2.4 percent to 3.0 percent, while the nowcast of the contribution of net exports to fourth-quarter real GDP growth increased from -0.30 percentage points to 1.97 percentage points.

The 5.4% real GDP forecast is largely due to exports rising at 6.1% and imports falling -9.4%.

Looks like Trump’s tariffs are working.

You must be logged in to post a comment.