Feelin’ stronger for the most part.

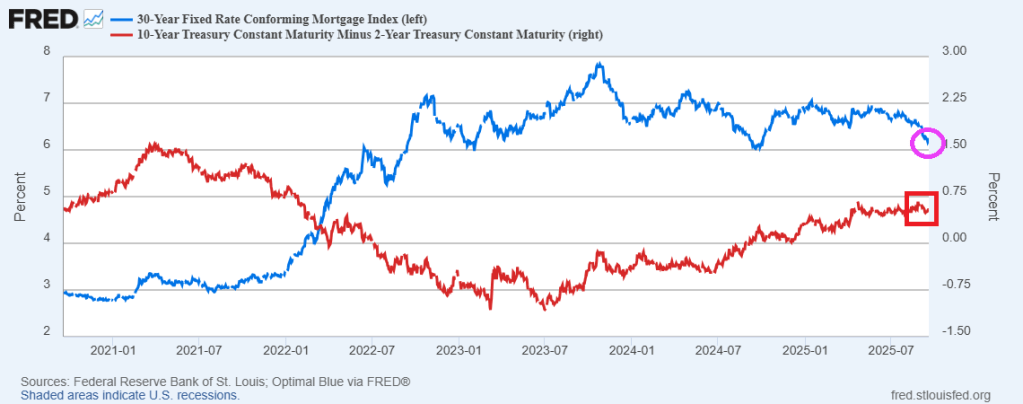

Mortgage applications decreased 4.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 3, 2025.

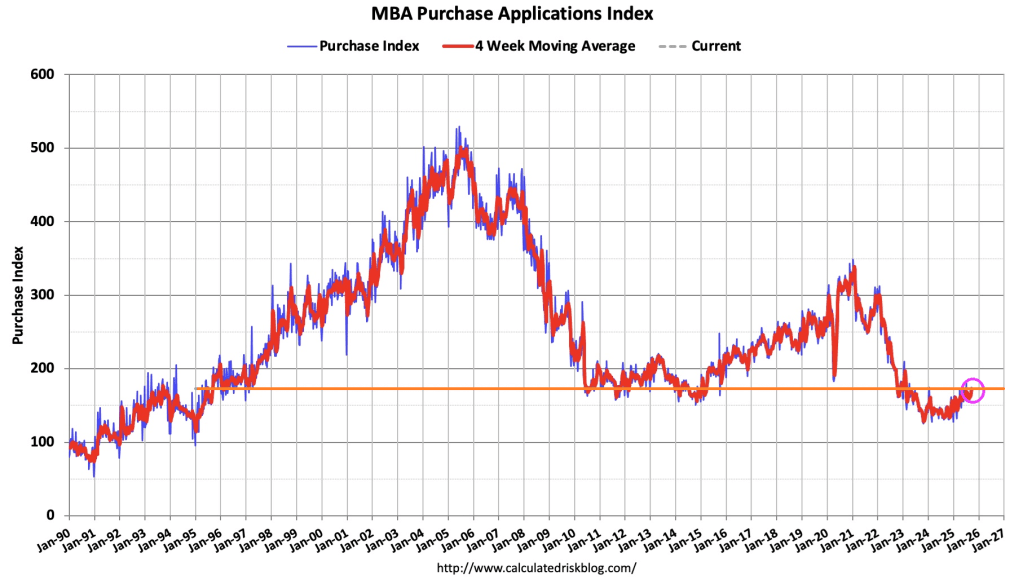

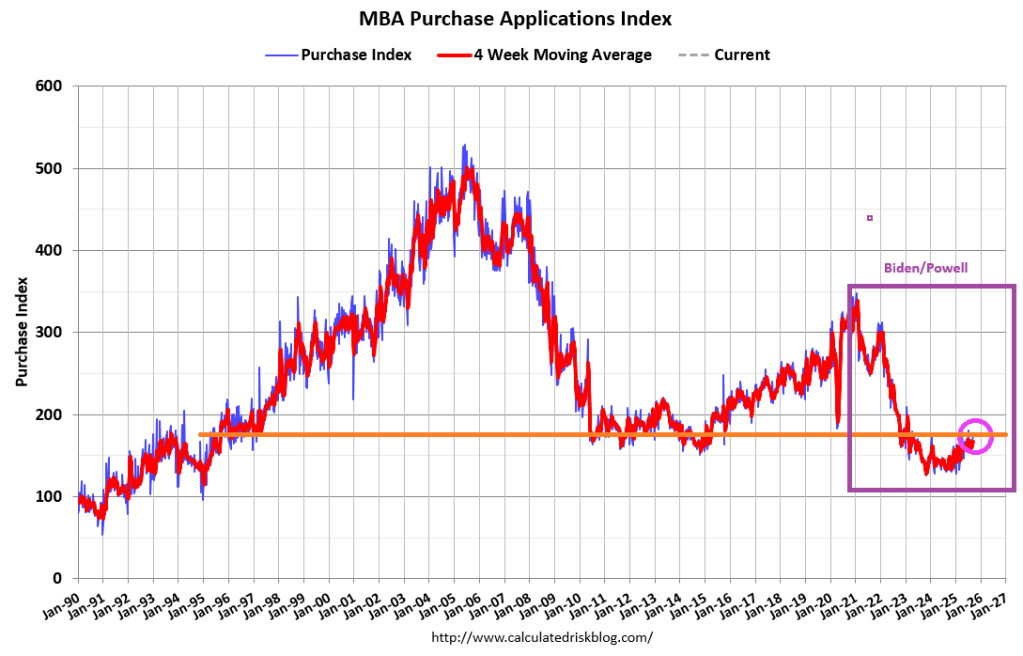

The Market Composite Index, a measure of mortgage loan application volume, decreased 4.7 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 5 percent compared with the previous week. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index decreased 1 percent compared with the previous week and was 14 percent higher than the same week one year ago.

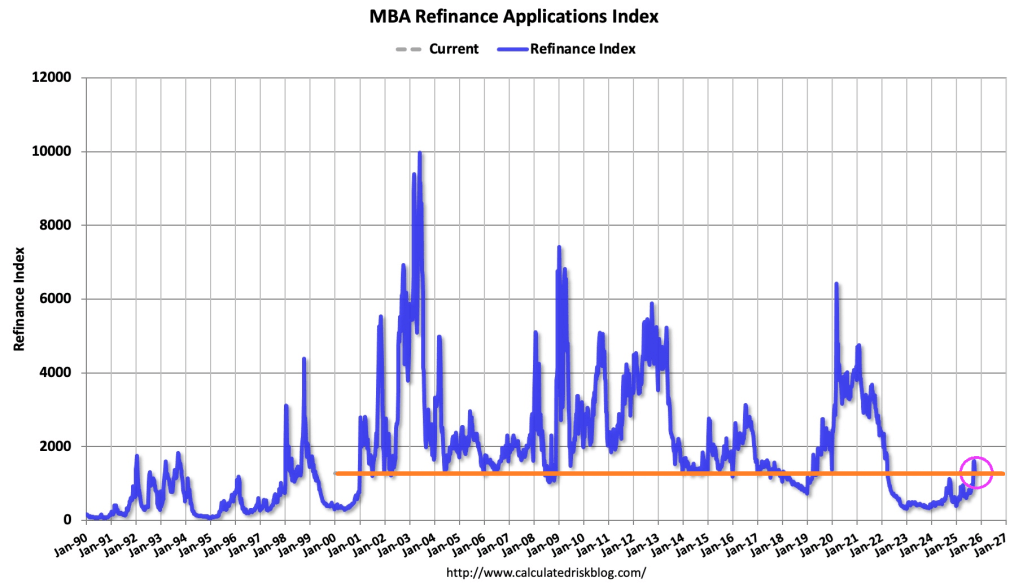

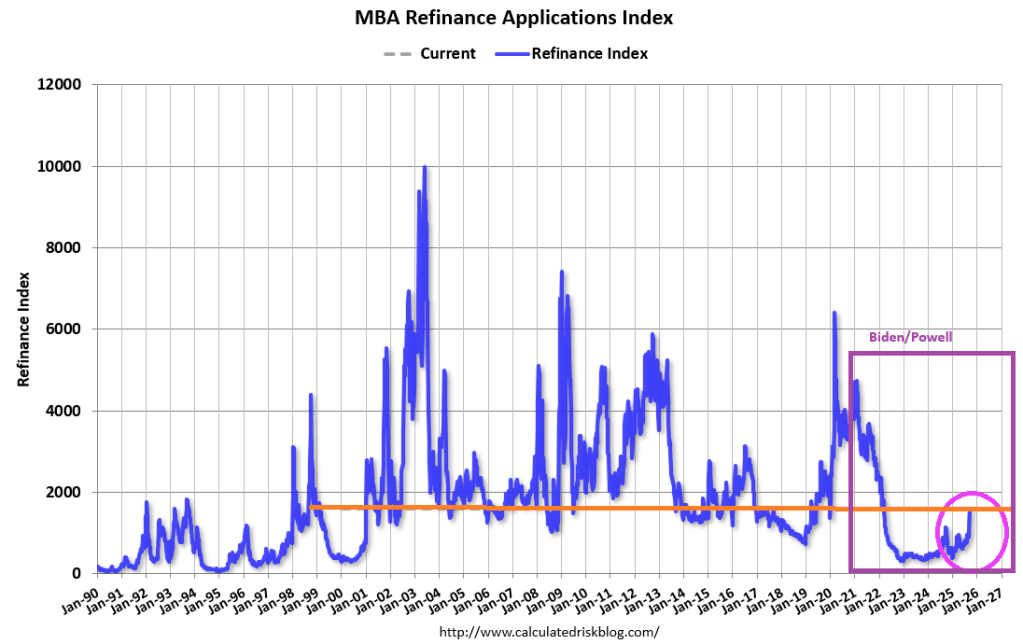

The Refinance Index decreased 8 percent from the previous week and was 18 percent higher than the same week one year ago.

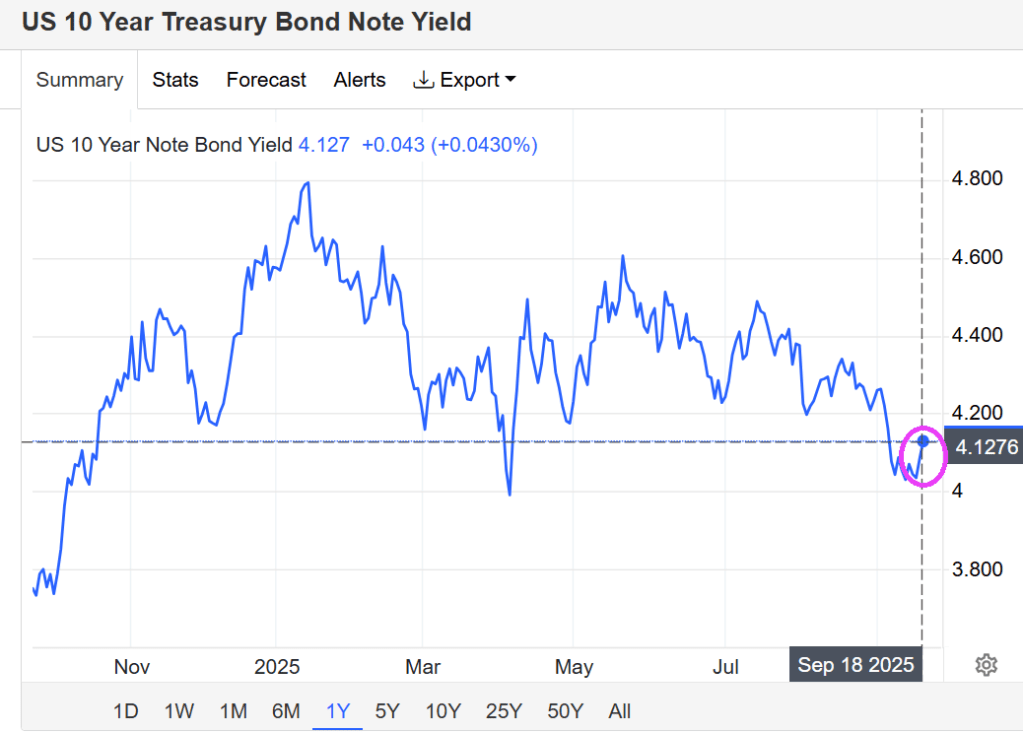

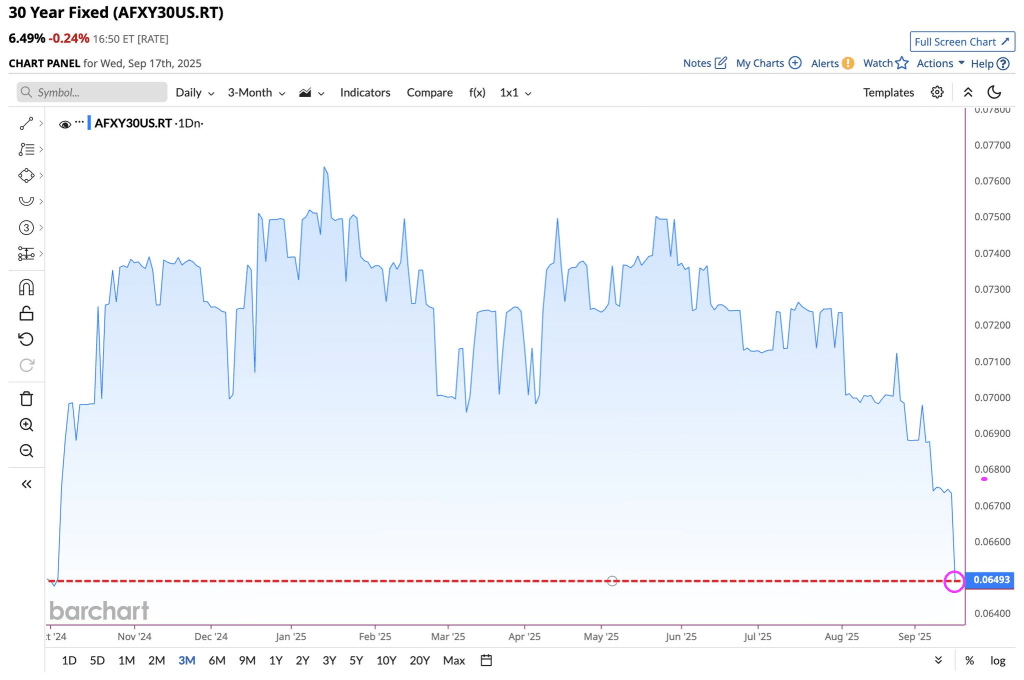

With mortgage rates on fixed-rate loans little changed last week, refinance application activity generally declined, with the exception of a modest increase for FHA refinance applications.

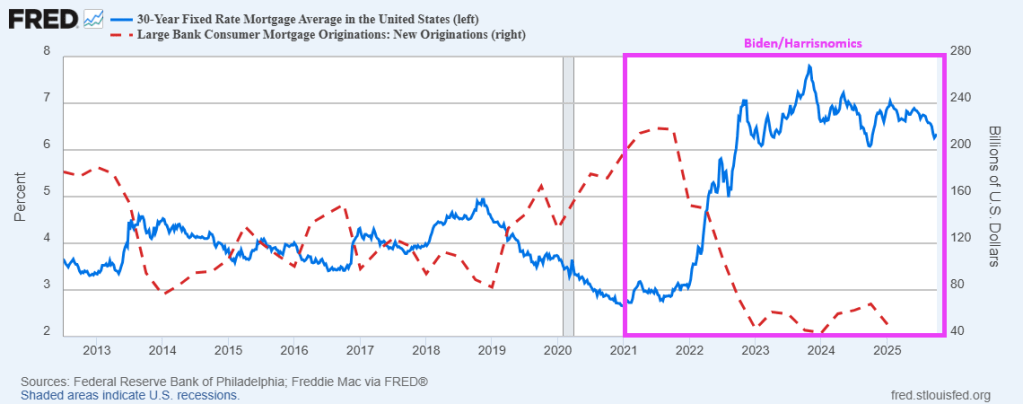

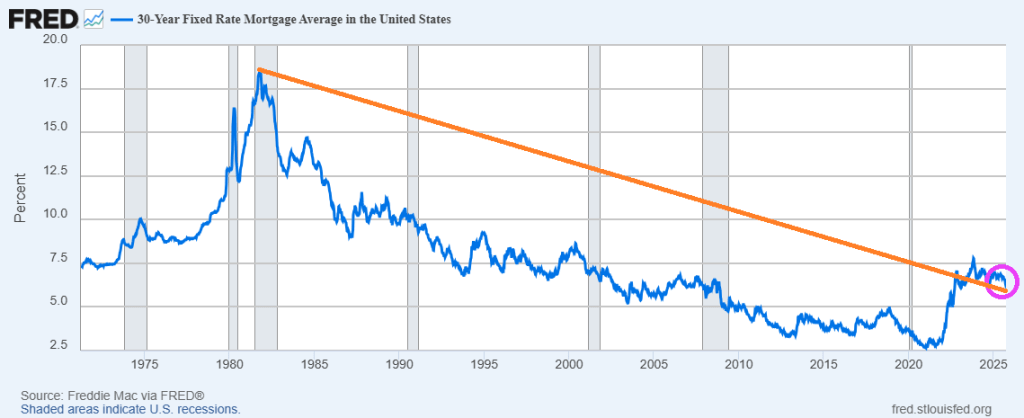

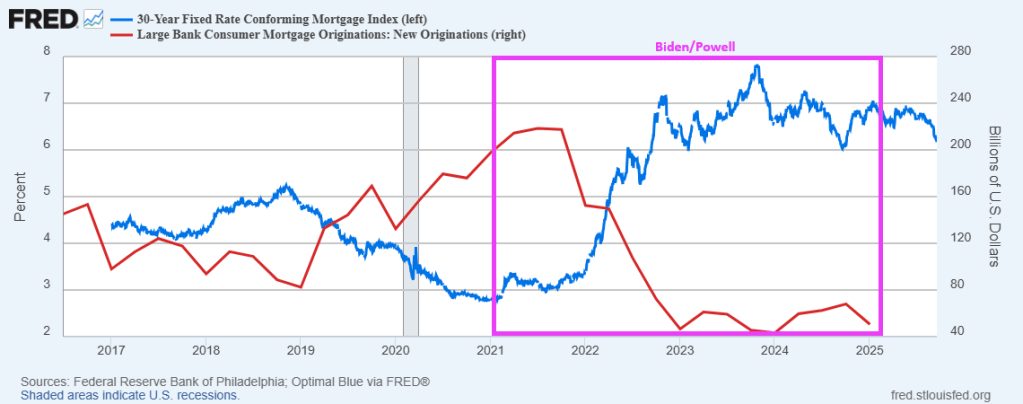

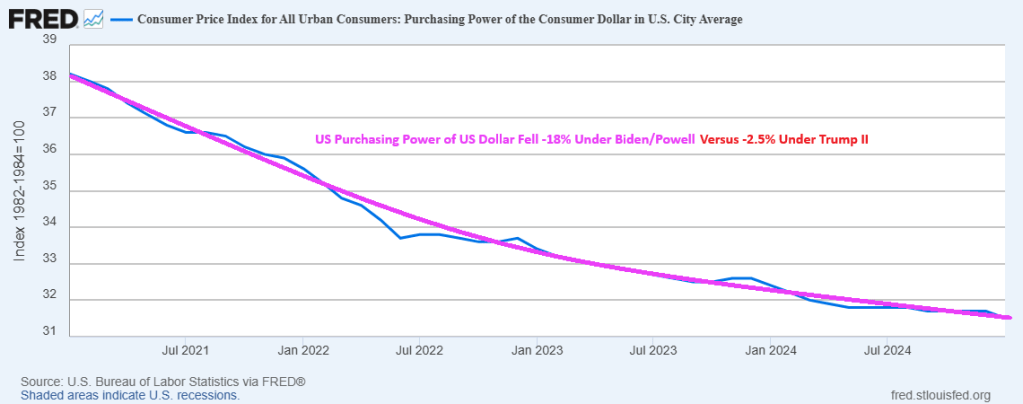

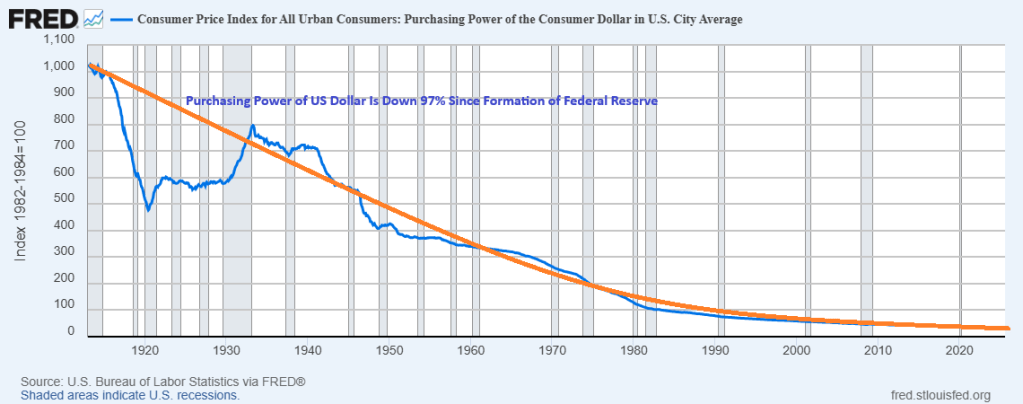

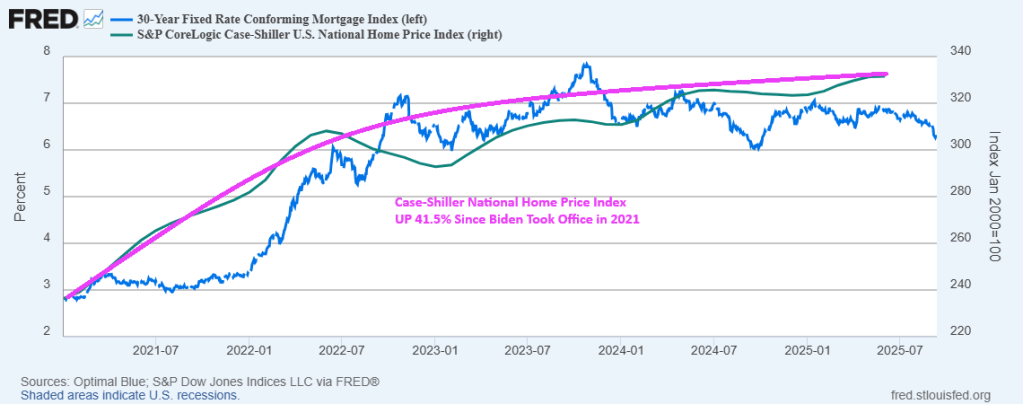

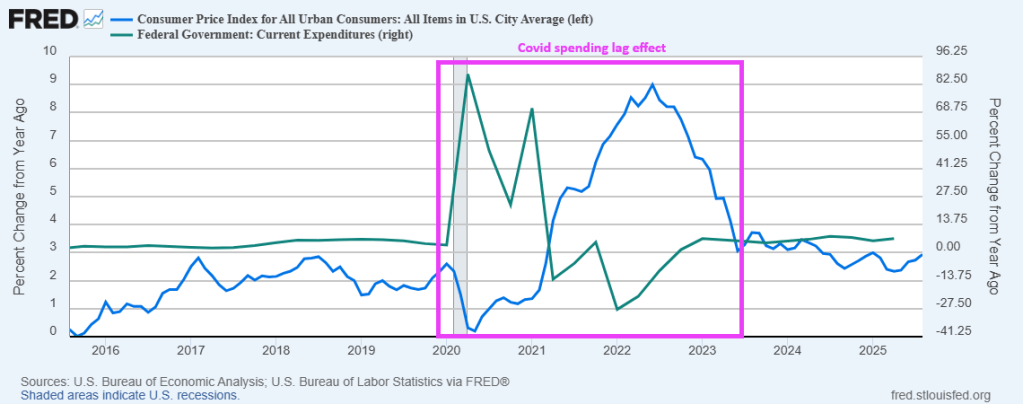

Mortgage demand dwindled since Covid and Biden/Powell and hasn’t recovered.

You must be logged in to post a comment.