The Fed didn’t try, but mortgage rates fell and mortgage applications rose 10.9% week-over-week.

Mortgage applications increased 10.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 8, 2025.

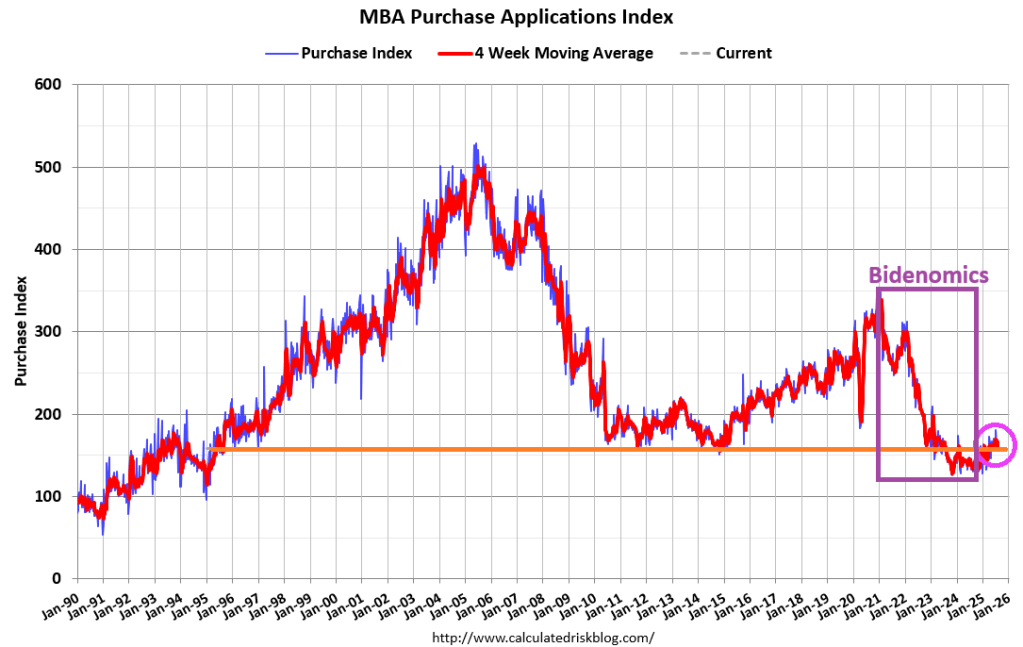

The Market Composite Index, a measure of mortgage loan application volume, increased 10.9 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 10 percent compared with the previous week. The seasonally adjusted Purchase Index increased 1 percent from one week earlier. The unadjusted Purchase Index increased 1 percent compared with the previous week and was 17 percent higher than the same week one year ago.

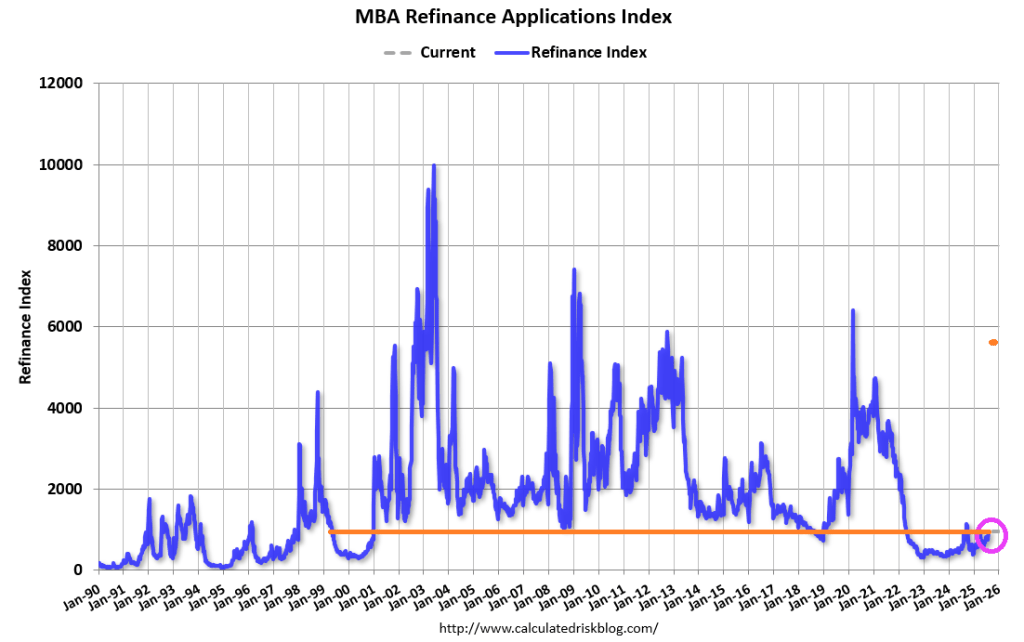

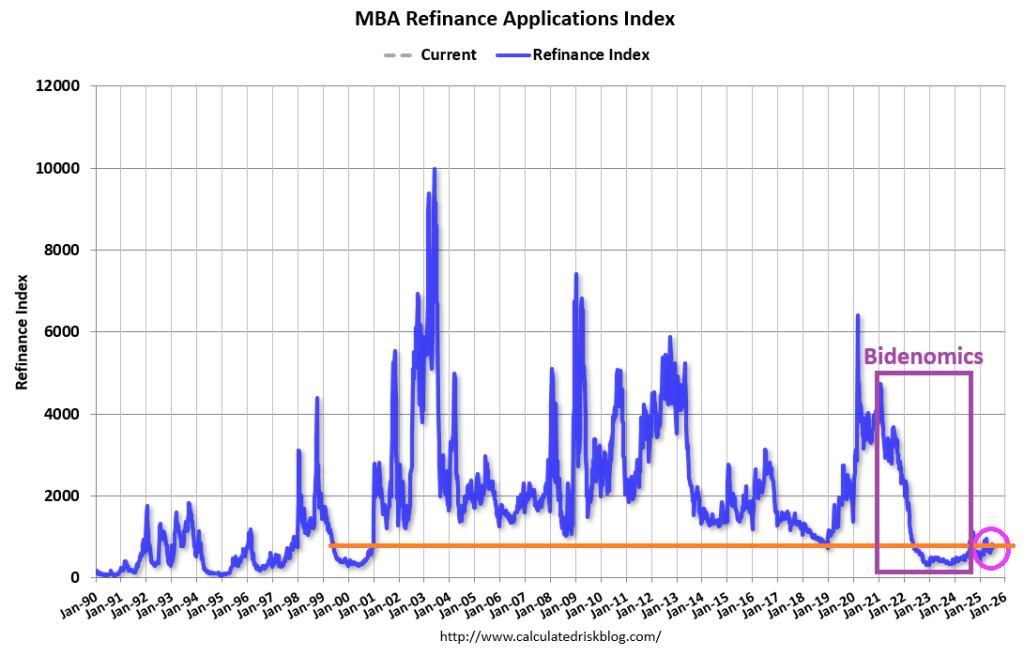

The Refinance Index increased 23 percent from the previous week and was 8 percent higher than the same week one year ago.

The 30-year fixed mortgage rate declined to 6.67 percent last week, which spurred the strongest week for refinance activity since April. Borrowers responded favorably, as refinance applications increased 23 percent, driven mostly by conventional and VA applications. Refinances accounted for 46.5 percent of applications and as seen in other recent refinance bursts, the average loan size grew significantly to $366,400. Borrowers with larger loan sizes continue to be more sensitive to rate movements.

You must be logged in to post a comment.