You might as well face it, markets are “addicted to gov.” Government monetary interference, that is. Government money printing and massive Federal spending.

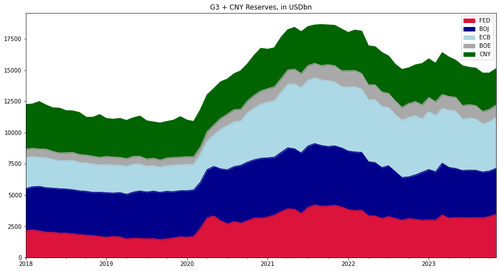

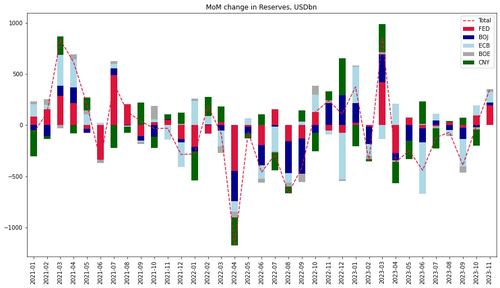

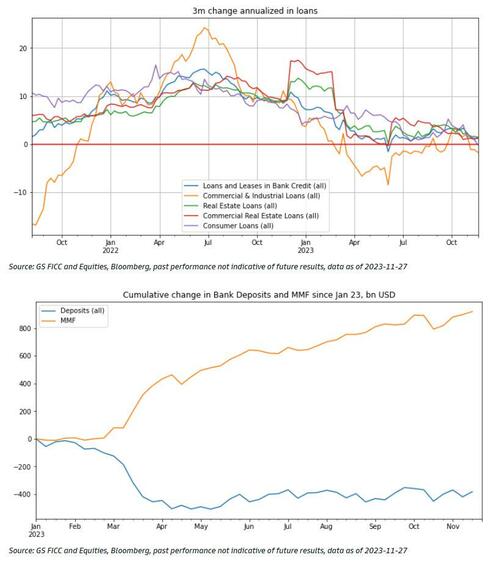

According to Goldman calculations, $350BN of liquidity (in USD terms) was added in November from the G4 central banks + the PBOC was nothing short of a fire hose.

In fact, this was the third largest monthly increase this year after January and March 2023.

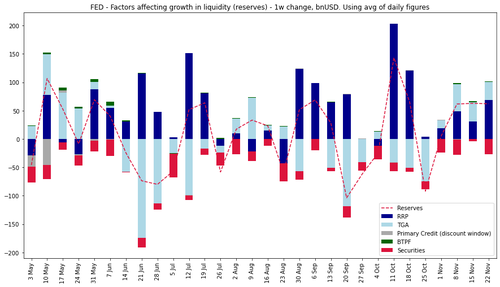

The US addition of $60bn for a third consecutive week plus weaker dollar are the main drivers.

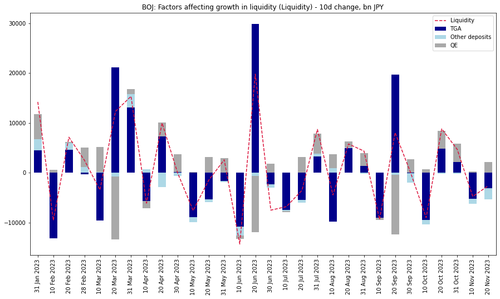

While the BoJ keeps adding liquidity via bond purchases, increases in the TGA balances in the past 20 days have net drained Yen liquidity.

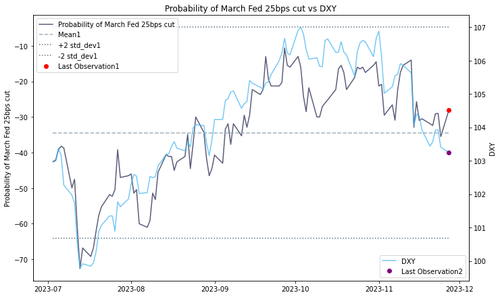

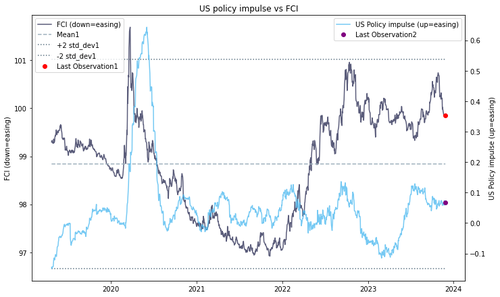

Looking forward over the year end and at the start of 2024, Goldman thinks that the US can keep adding liquidity via high bill issuance and RRP withdrawal over the next couple of months (something we discussed last month in “How Treasury Averted A Bond Market “Earthquake” In The Last Second: What Everyone Missed In The TBAC’s Remarkable Refunding Presentation“), while the dollar contribution to benign liquidity conditions could face some headwinds due to the risk of pricing out of some of the March Fed cuts as a result of the strong positive FCI impulse in November.

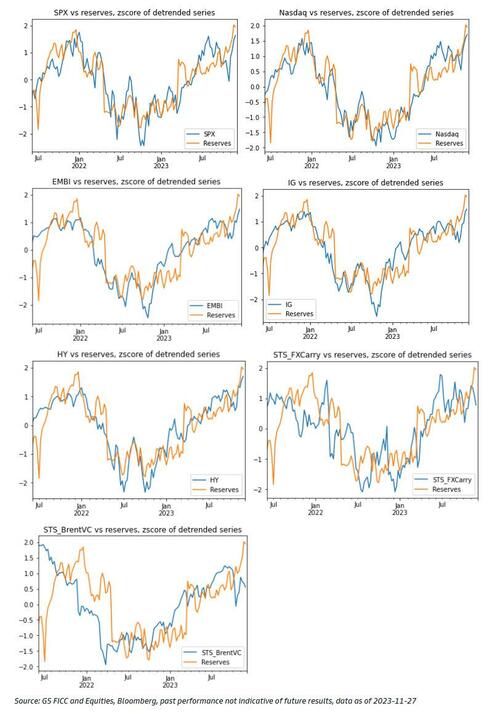

Goldman’s one-factor model for risky assets based on the liquidity cycle suggests that US IG and EM hard currency debt are cheap and the bank’s STS FX carry and Brent Vol Carry indices have under-performed the benign liquidity environment and may catch up the next two months.

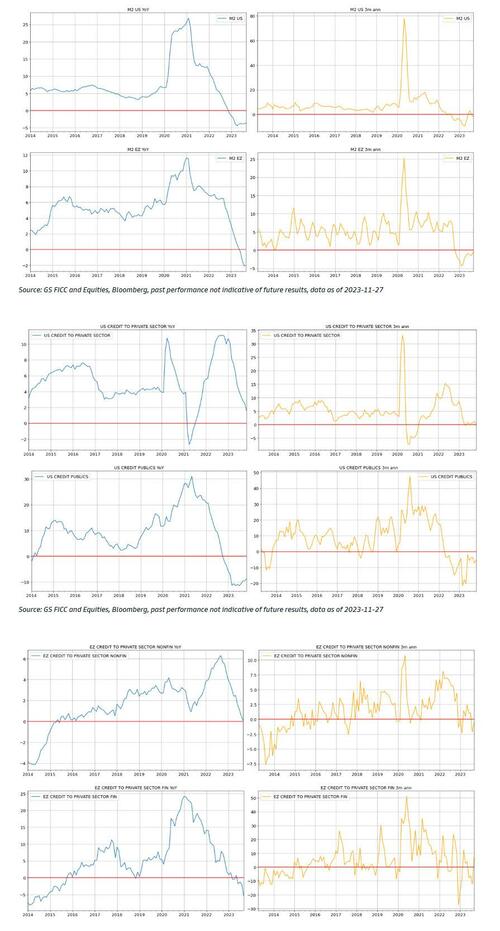

The US and Eurozone money supply and lending growth indicators remain weak, implying extended downside bias in domestic demand and inflation in H1-2024 (i.e., higher likelihood for easing absent a reflationary shock out of China or a supply-driven commodity price surge).

Finally, The US policy impulse (comprising of liquidity, fiscal stance, as well as nominal and real forward rates) has moved sideways in October and November after some renewed tightening in September. The GS FCI index eased nearly -100 basis points (-1.4z) in November.

Doctor, doctor (Yellen), we got a bad case of distortionomics (where the 1% wins and the 99% fall behind). After all, under Dr. Yellen as our Treasury Secretary, we are suffering from massive fiscal inferno with wild government spending. I would use “Government Gone Wild!” but the thought of Yellen … well, never mind.

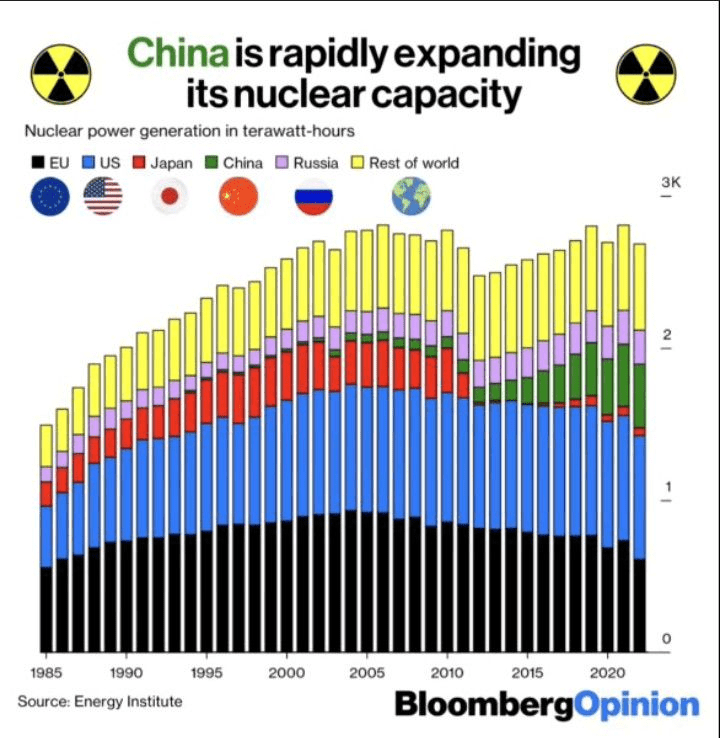

Meanwhile, while John Kerry pushes for ending ALL coal powered plants (good luck charging the thousands of EV charging stations on wind/solar power!), China is building NUCLEAR plants. While US green wimps (Kerry comes to mind) whine whenever nuclear plants are mentioned for the US.

You must be logged in to post a comment.