Markets are ranked by fear about tariffs. Particularly since China is acting like a child.

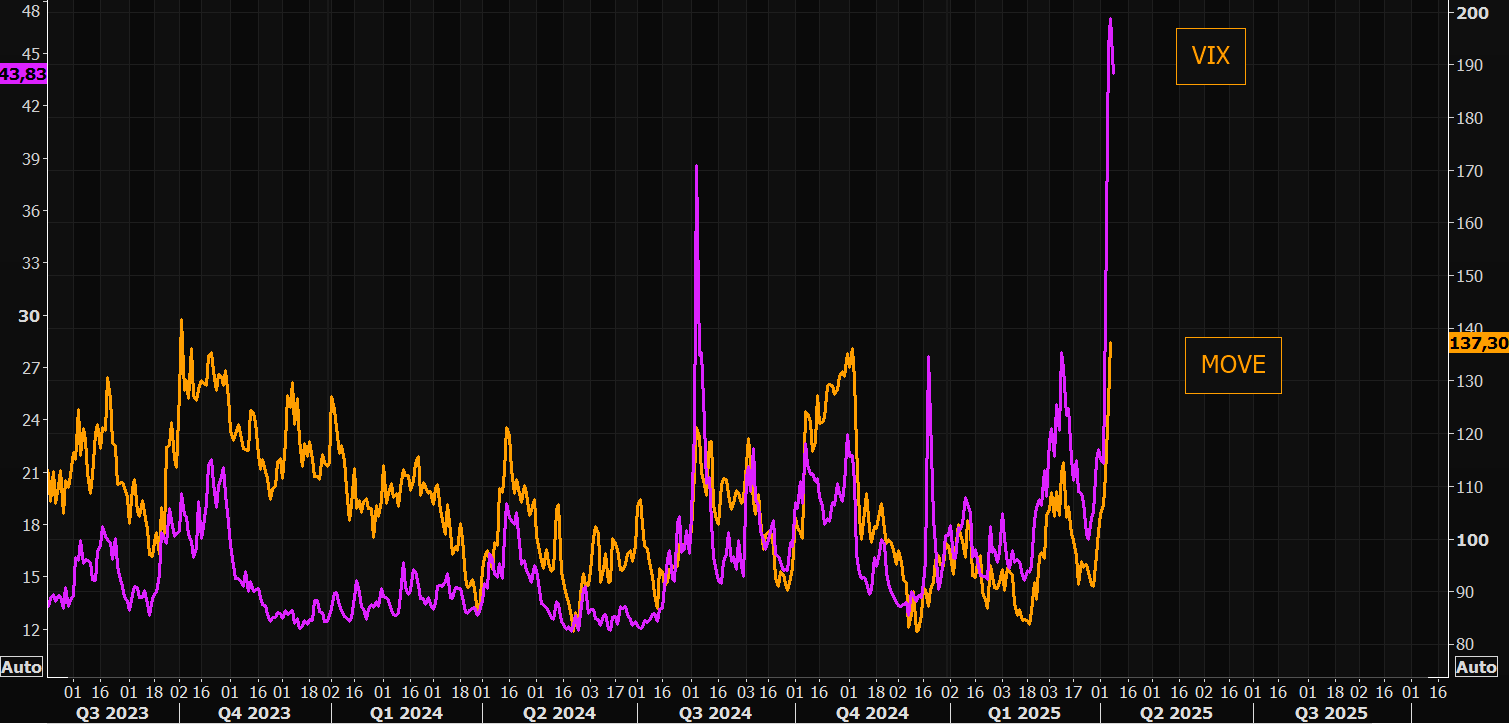

Bond vs equity fear

Bond volatility has shot up higher, but remains “muted” compared to the VIX move.

Source: Refinitiv

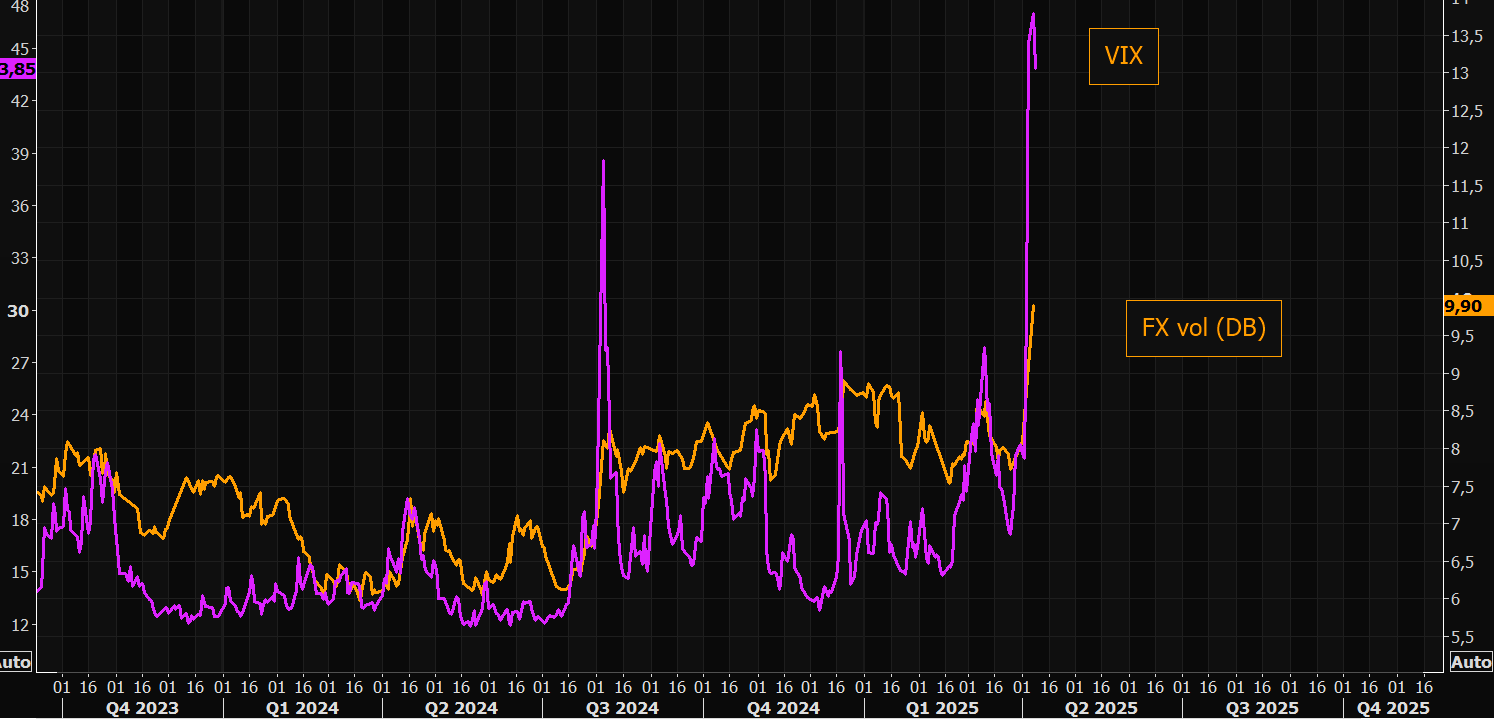

FX vs equity fear

FX volatility has shot up higher as well, but is pale in comparison to the VIX move.

Source: Refinitiv

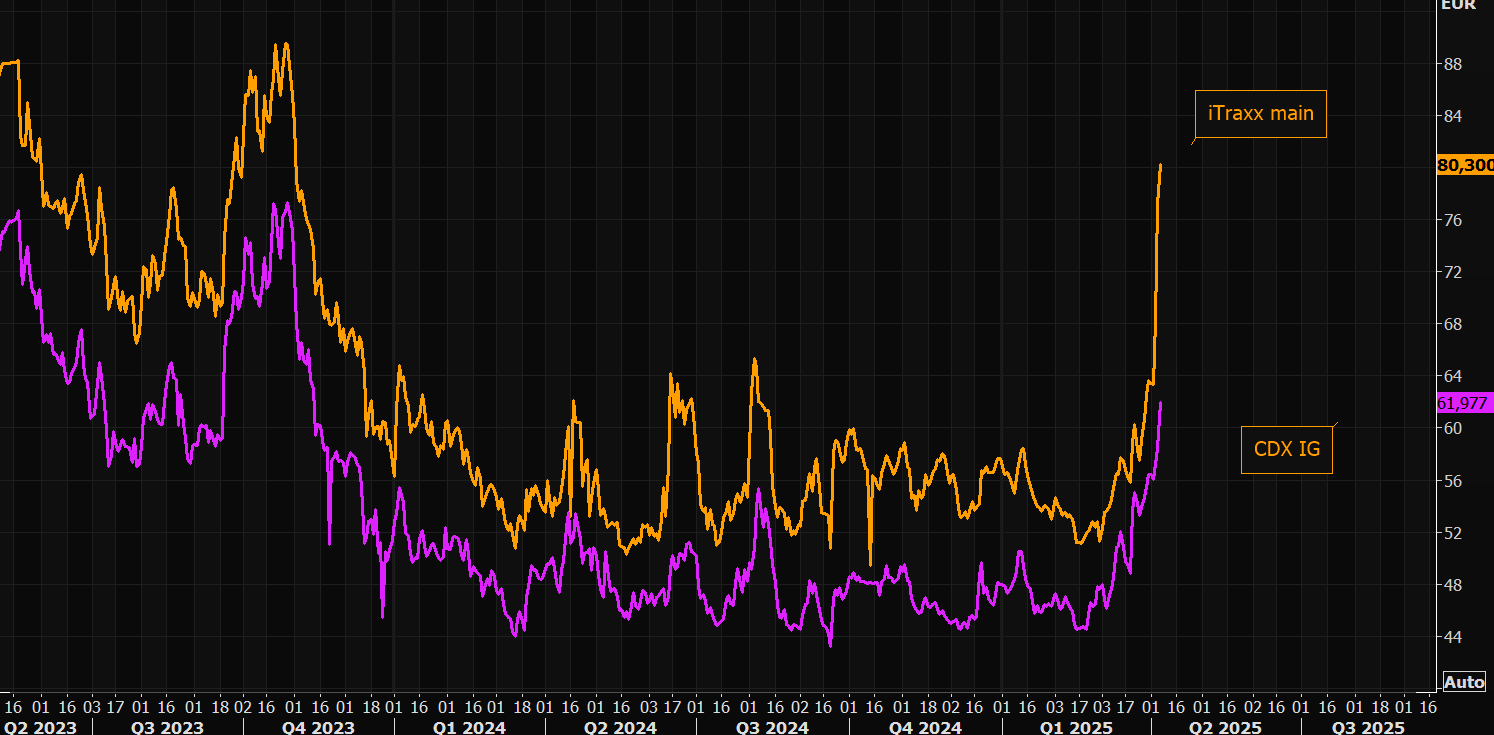

Credit “crunched”

Credit protection has surged during the “chaos”. Chart shows the US and the European versions.

Source: Refinitiv

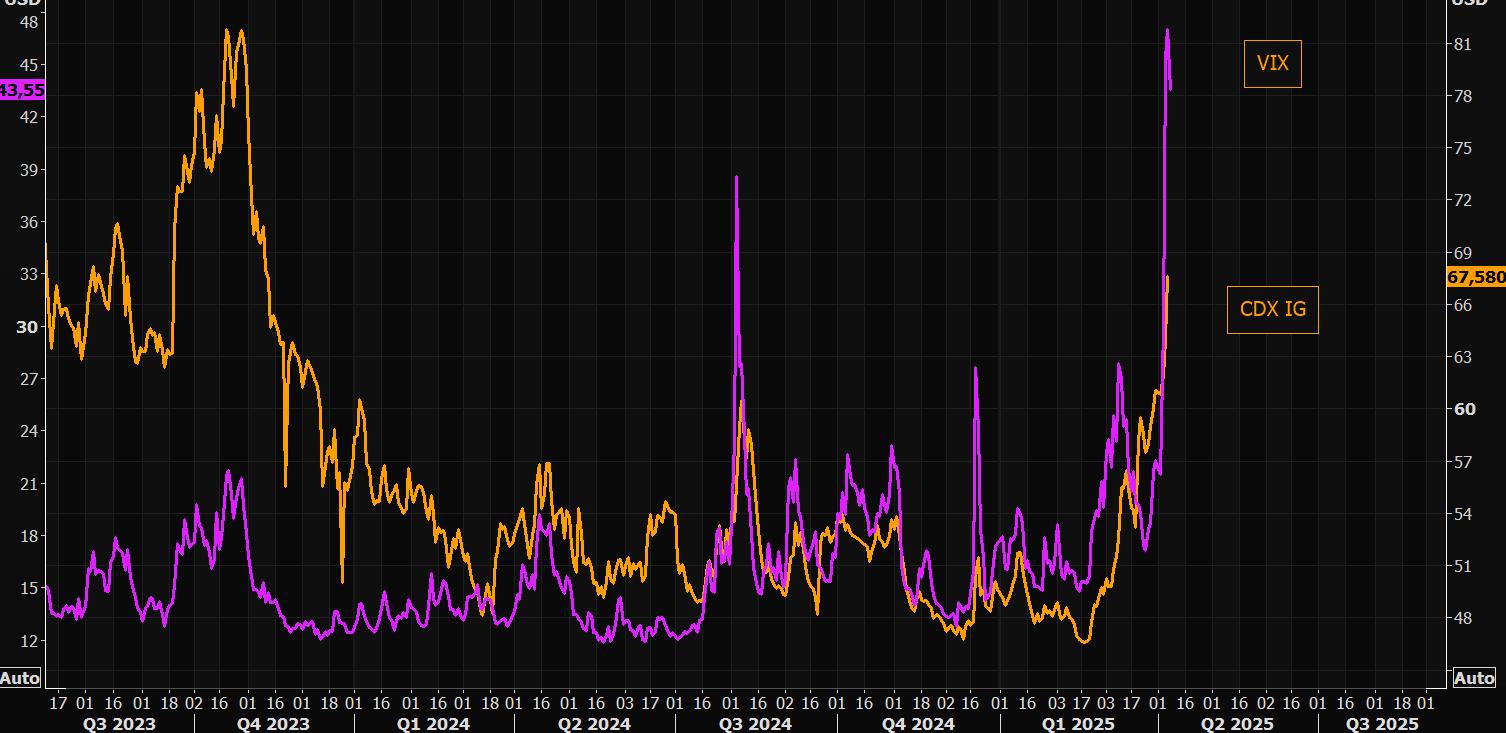

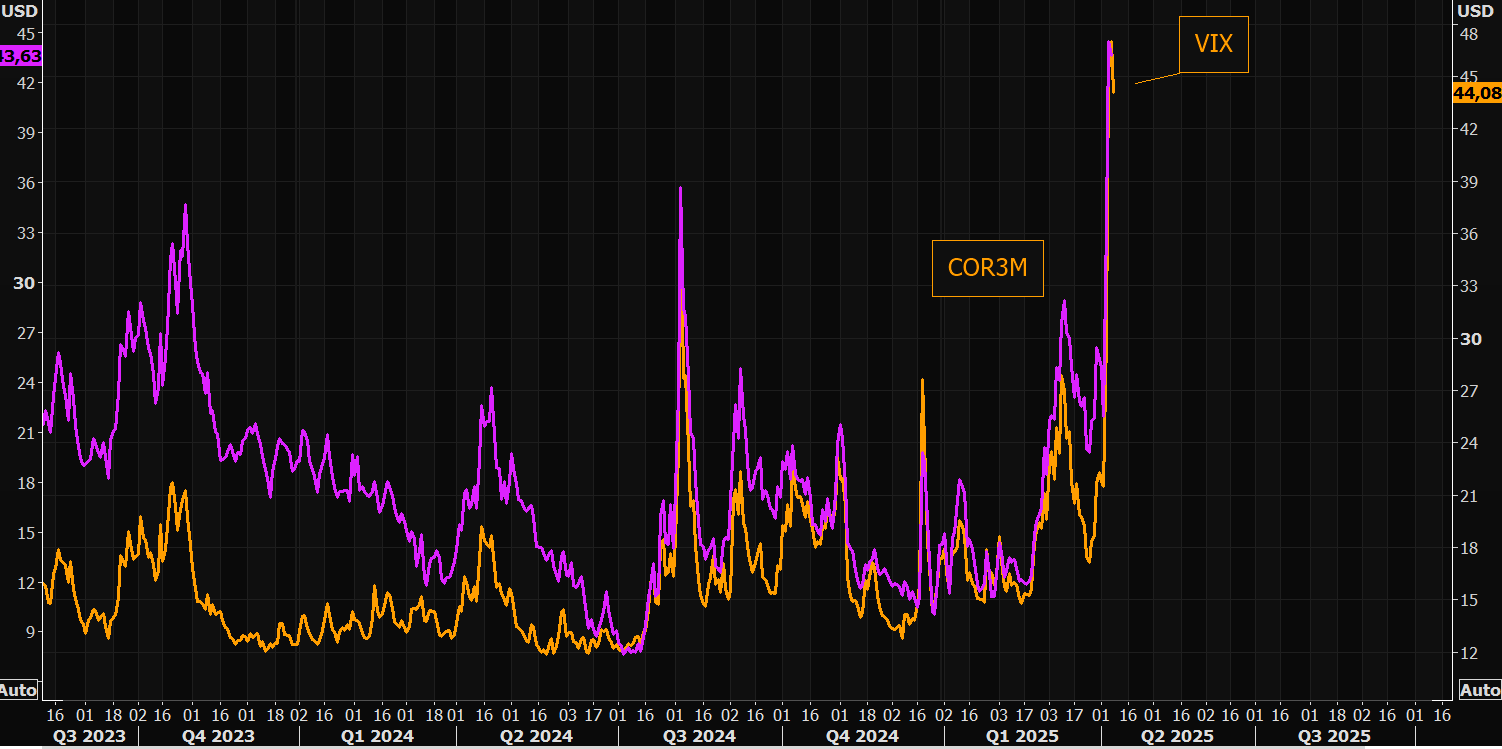

Equity vs credit protection

VIX vs CDX IG.

Source: Refinitiv

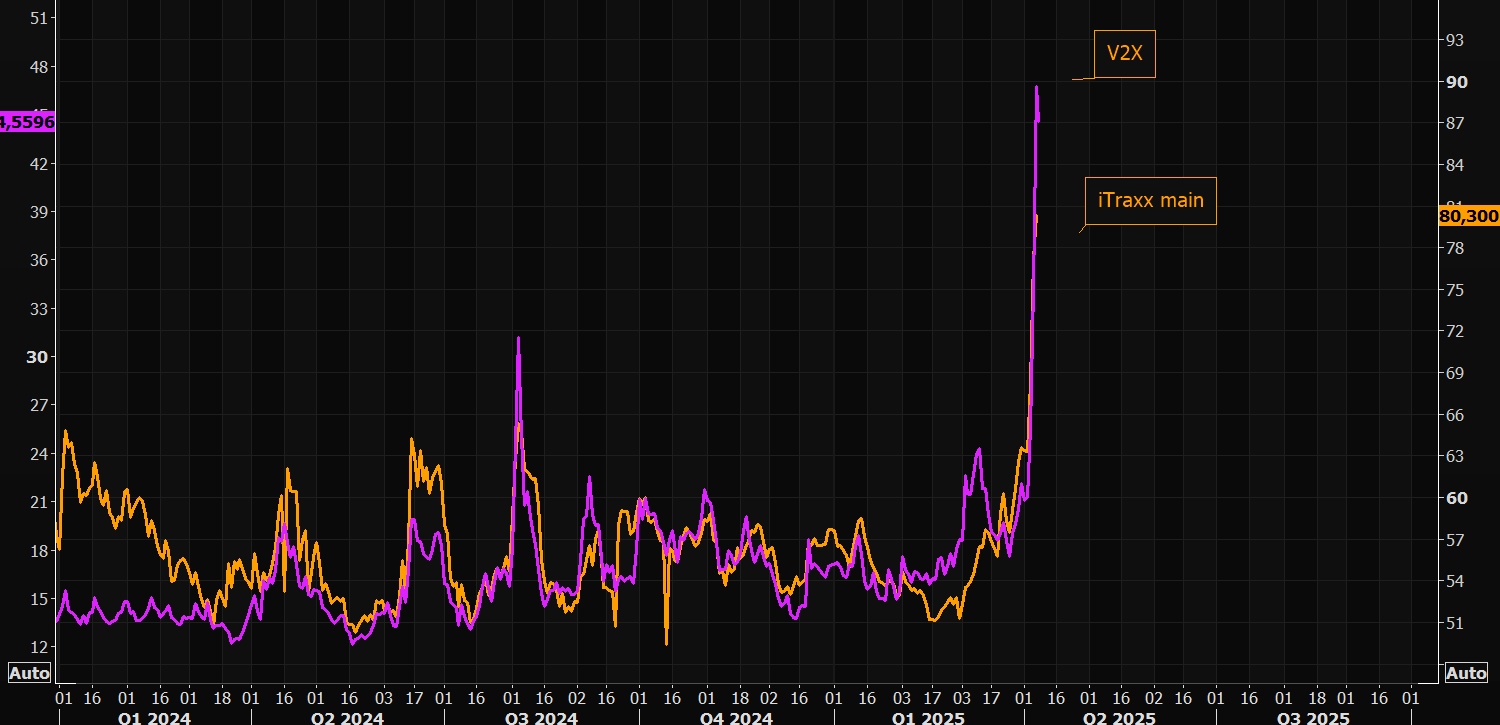

Europe as well

V2X vs iTraxx main.

Source: Refinitiv

Correlation – the upside crash

Implied correlations showing a lot of “fear” as pretty much everything has been treated as if it were the “same” during the crash.

Source: Refinitiv

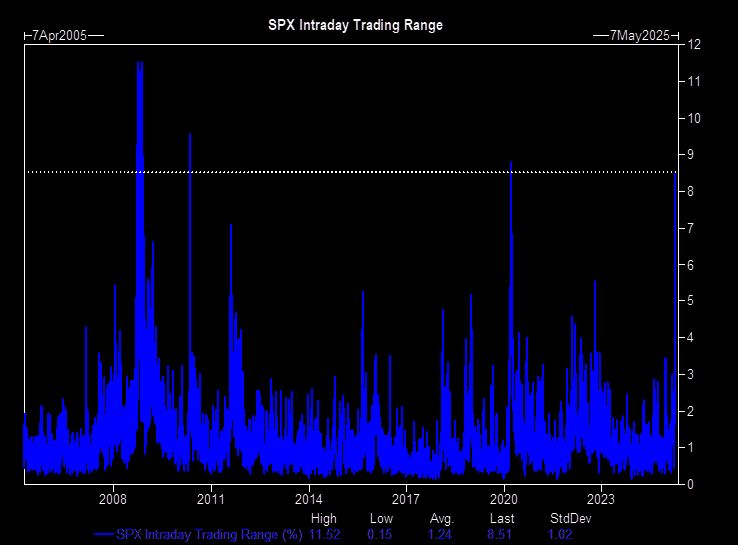

Massive

Intraday range was huge during yesterday’s session, but close to close very modest. Imagine trading short gamma….and hedging the extremes.

Source: GS

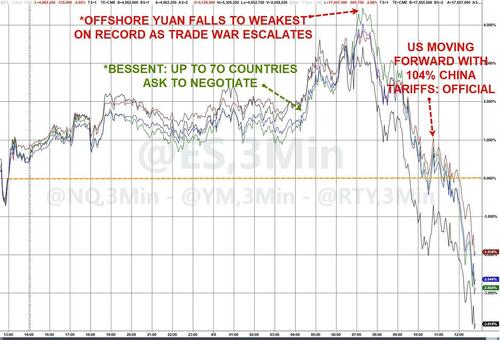

The Yuan is having a volatile day.

You must be logged in to post a comment.