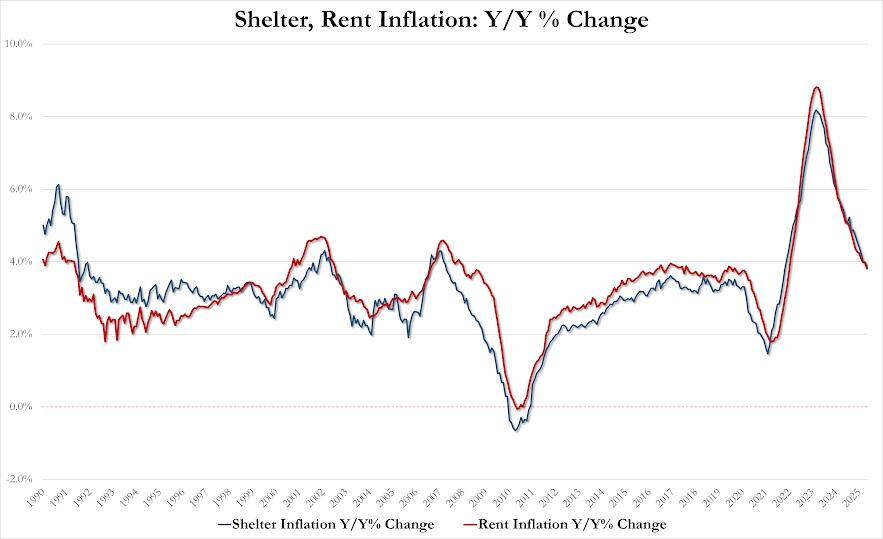

May Rent inflation 3.81% YoY, down from 3.98% in April, lowest since Jan 2022.

May Shelter inflation 3.86% YoY, down from 3.99% in April, lowest since Nov 2021

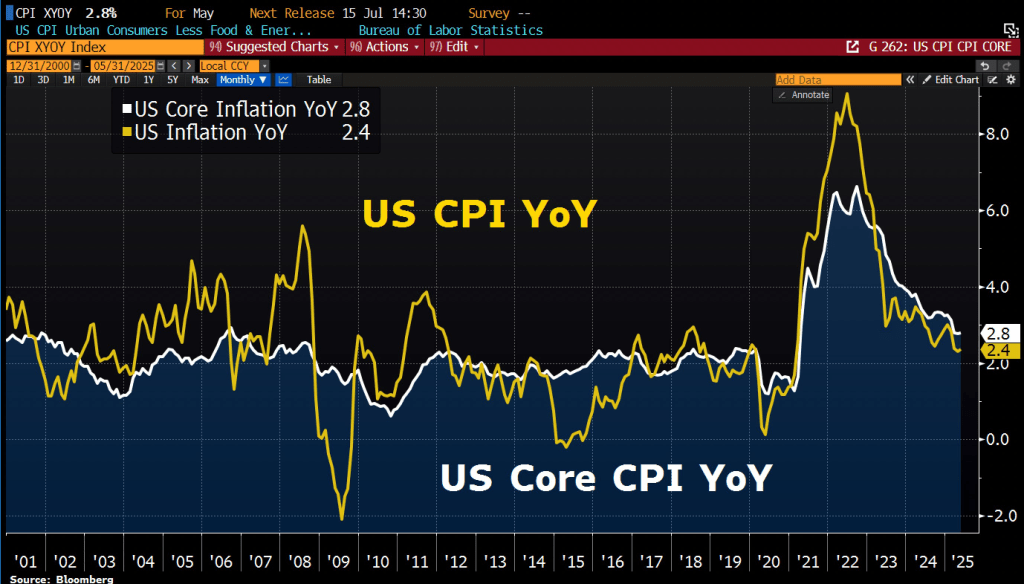

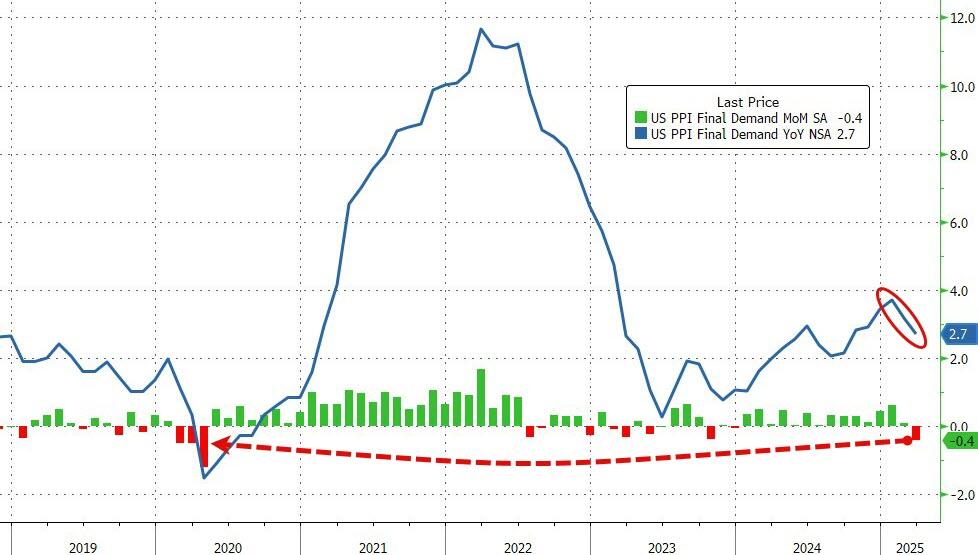

In general, CPI increased 0.1% MoM after rising 0.2 percent in April; Over the last 12 months, the all items index increased 2.4 percent before seasonal adjustment. The index for all items less food and energy rose 0.1% in May, following a 0.2% increase in April.

The index for shelter rose 0.3% in May and was the primary factor in the all items monthly increase. The food index increased 0.3% as both of its major components, the index for food at home and the index for food away from home also rose 0.3% in May.

In contrast, the energy index declined 1.0% in May as the gasoline index fell over the month.

Indexes that increased over the month include medical care, motor vehicle insurance, household furnishings and operations, personal care, and education.

The indexes for airline fares, used cars and trucks, new vehicles, and apparel were among the major indexes that decreased in May.

Core inflation is up 2.787% YoY, considerably lower than under Autopen Biden.

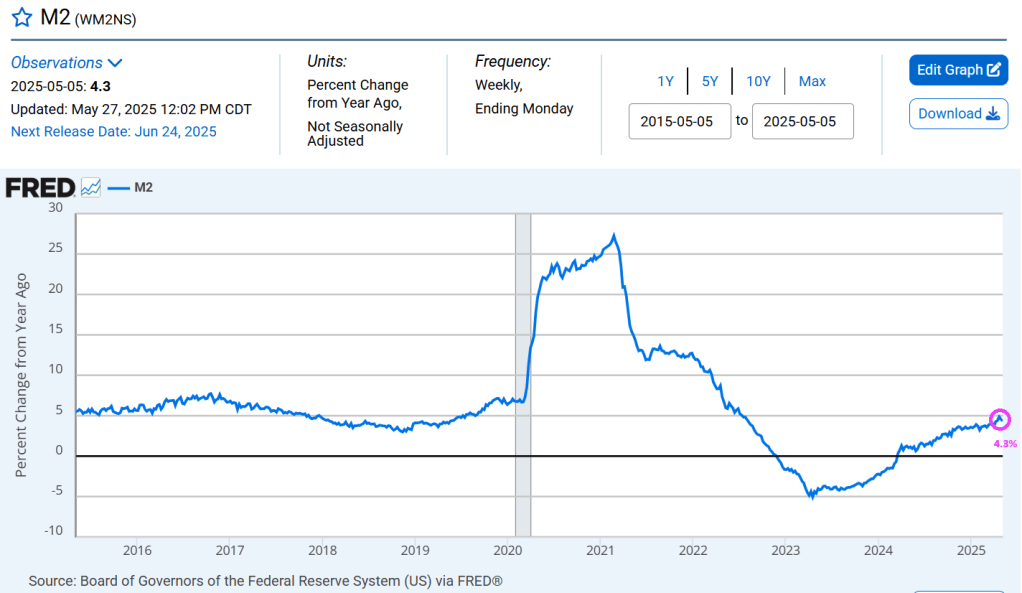

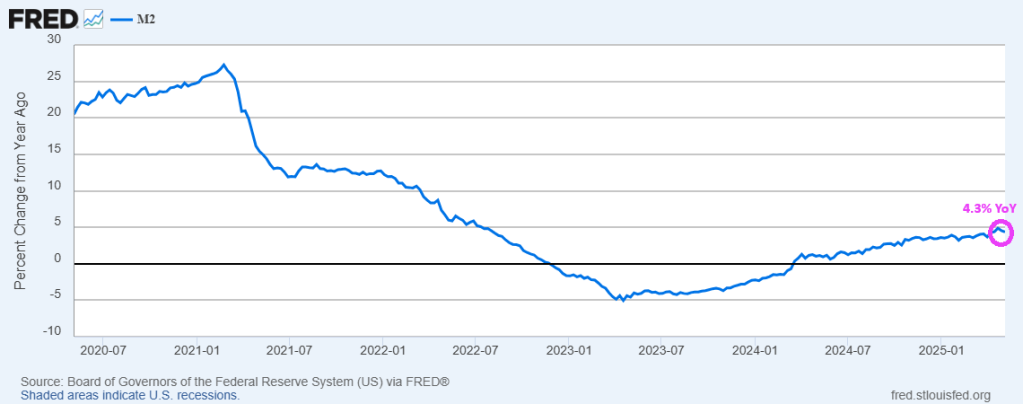

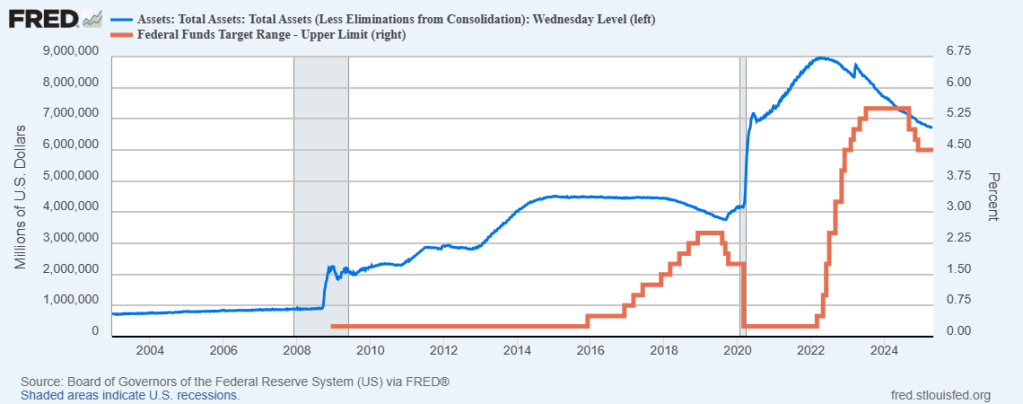

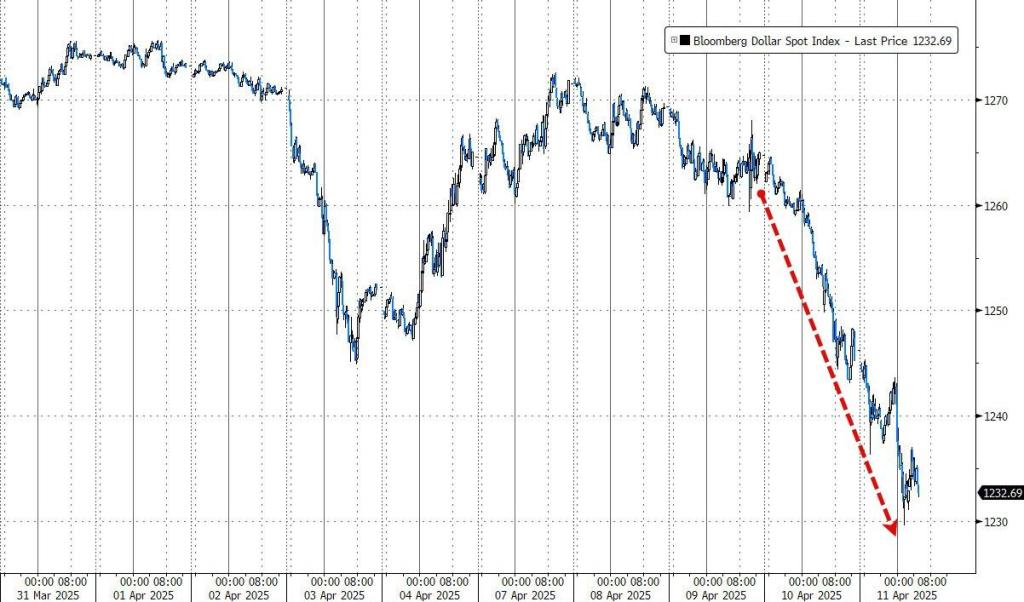

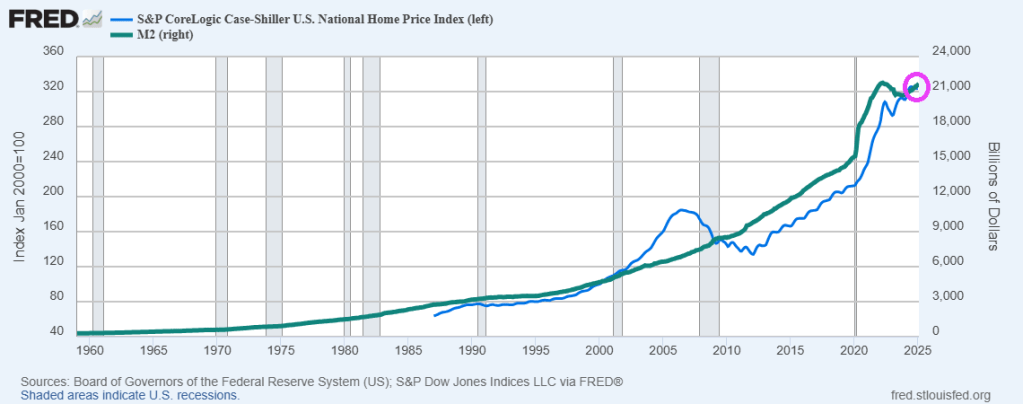

M2 Money is currently growing at 4.3%.

You must be logged in to post a comment.