Janet Yelllen, the former Federal Reserve Chair and Treasury Secretary under clueless Joe Biden was a disaster in every respect. As Fed Chair, she was noteworthy for her clinging to low rates for too long. And as Treasury Secretary, she is noteworthy for her gross fiscal mismanagement (look at the deficit and debt crisis!). Now Zero Hedge has this disastrous report of $4.7 TRILLION in virtuallly untraceable Treasury payments.

The Elon Musk-led Department of Government Efficiency (DOGE) on Monday revealed its finding that $4.7 trillion in disbursements by the US Treasury are “almost impossible” to trace, thanks to a rampant disregard for the basic accounting practice of using of tracking codes when dishing out money.

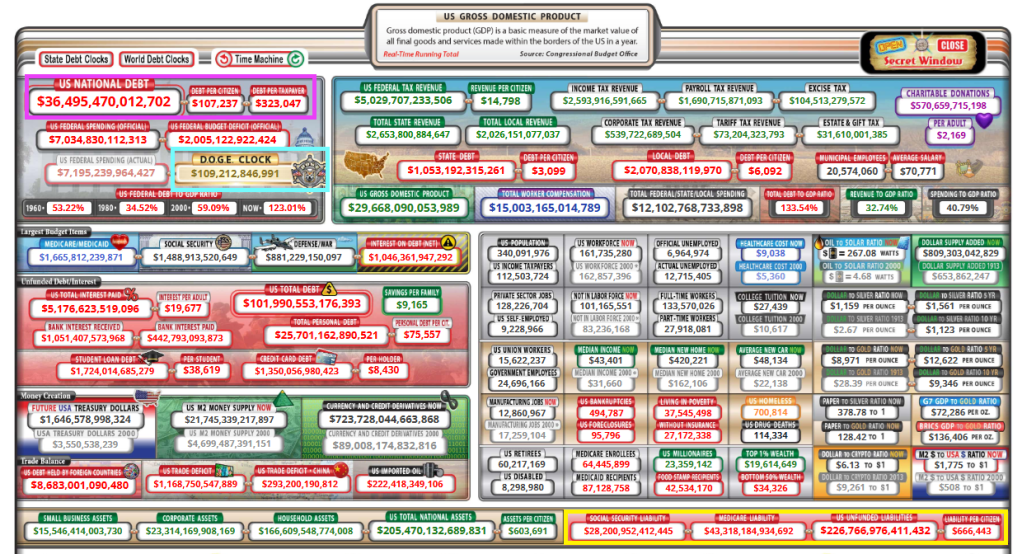

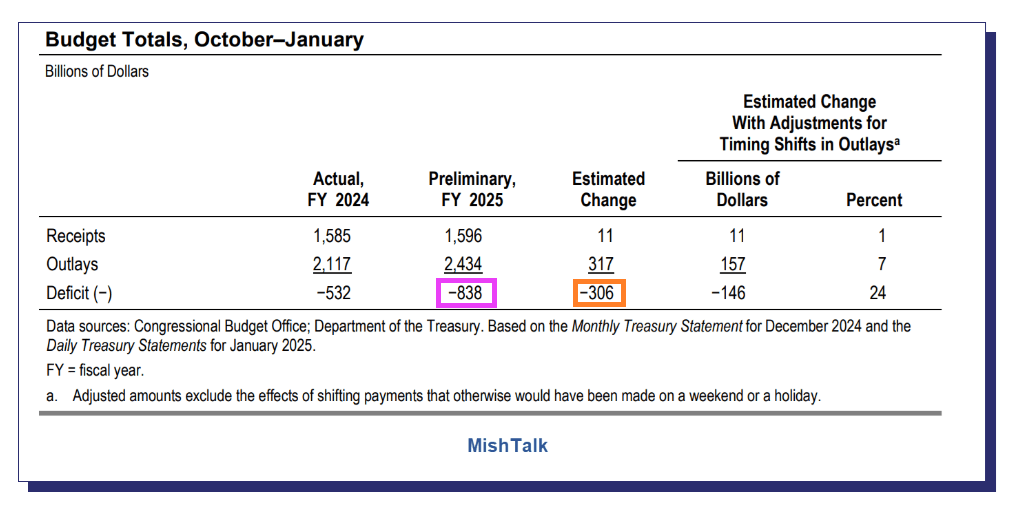

With a debt load of $36.5 trillion and D.O.G.E. clock at $109 million and growing. Not to mention the $227 trillion in unfunded liabilities.

Mind you, it’s not as if such a federal tracking system wasn’t already in place — it simply went casually unused for all sorts of payouts adding up to an almost unfathomable $4.7 trillion. Without Treasury Access Symbol (TAS) identification codes associated with those payouts, there’s little hope in figuring out where all that money went.

“In the Federal Government, the TAS field was optional for ~$4.7 Trillion in payments and was often left blank, making traceability almost impossible,” DOGE announced via its X account. Thanks to DOGE, those “optional” days are over. “As of Saturday, this is now a required field, increasing insight into where money is actually going,” DOGE added.

Musk celebrated the move. “Major improvement in Treasury payment integrity going live!” he tweeted. “This was a combined effort of DOGE, USTreasury and FederalReserve. Nice work by all.”

DOGE’s scrutiny of various government agencies is eliciting high-pitched shrieks from nearly every leftist in America, from establishment politicians who don’t want the curtain that hides their hijinks and grifting torn down, to your liberal sister-in-law who thinks the government has an endless supply of money and that it spends it all virtuously.

Earlier this month, Treasury Secretary Scott Bessent pushed back on portrayals of DOGE employees as reckless rogues. “These are highly trained professionals,” he told Bloomberg. “This is not some roving band going around doing things. This is methodical and it is going to yield big savings.”

In the wake of the latest revelation that makes normal people glad that DOGE teams are scouring the federal government, Democrats desperately tried to find a way to make it sound bad that DOGE exposed trillions in untraceable payouts and promptly instituted tighter accounting discipline.

Meanwhile, leftists have also been foaming at the mouth over news that DOGE staffers are looking into the Social Security Administration’s (SSA) books, as if they were going to start rerouting funds to Tesla. Considering Social Security is careening toward mandatory benefit cuts as soon as 2033, everyone should welcome a team of financial professionals making sure the system isn’t being drained by improper payments.

Of course, that appears to be exactly what’s been happening. On Sunday night, Musk said DOGE might be on the trail of “the biggest fraud in history,” as SSA data appears to show that 20.789 million Americans over the age of 100 are collecting Social Security retirement benefits. That includes 12 million who are purportedly over 120 years old.

Bent on derailing DOGE, Democrats have sued to prevent the organization from accessing federal data associated with the Office of Personnel Management, and the Health and Human Services, Education, Energy, Transportation, Labor and Commerce departments. On Monday, the federal judge handling the request for a restraining order expressed skepticism over Democrats’ challenge, noting that their “evidence” was largely media speculation about potential harms springing from DOGE’s activities: “The courts can’t act based on media reports. We can’t do that.“

A ruling is expected Tuesday. Here’s looking forward to DOGE proceeding to uncover a relentless string of scandals for months and months to come.

You must be logged in to post a comment.