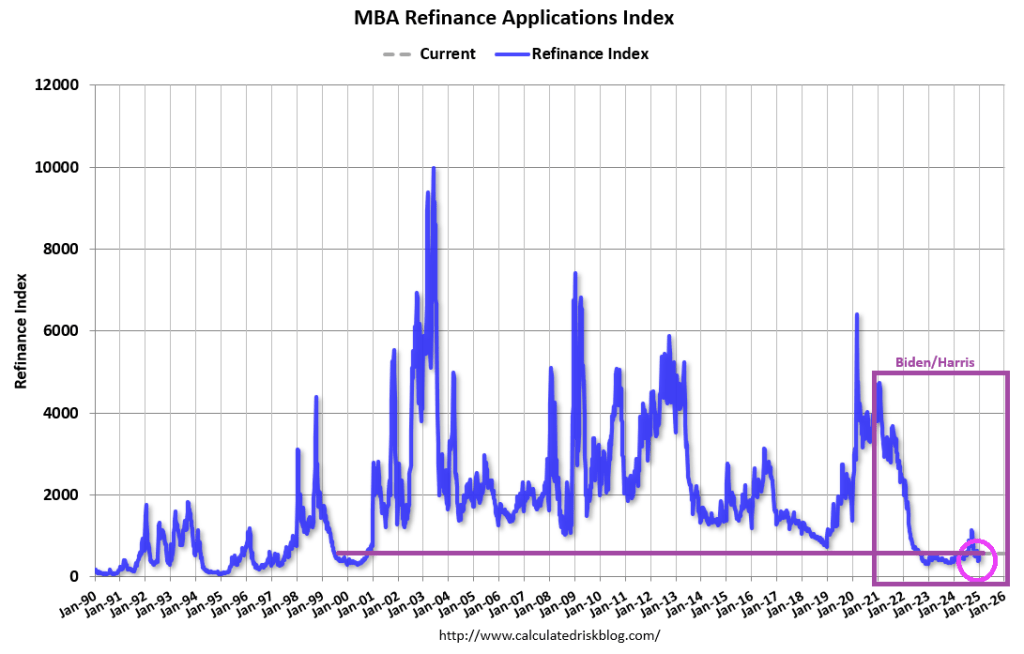

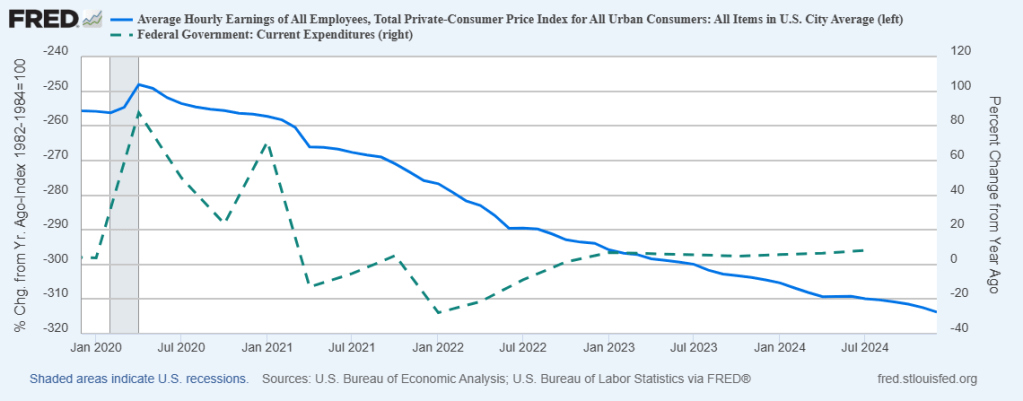

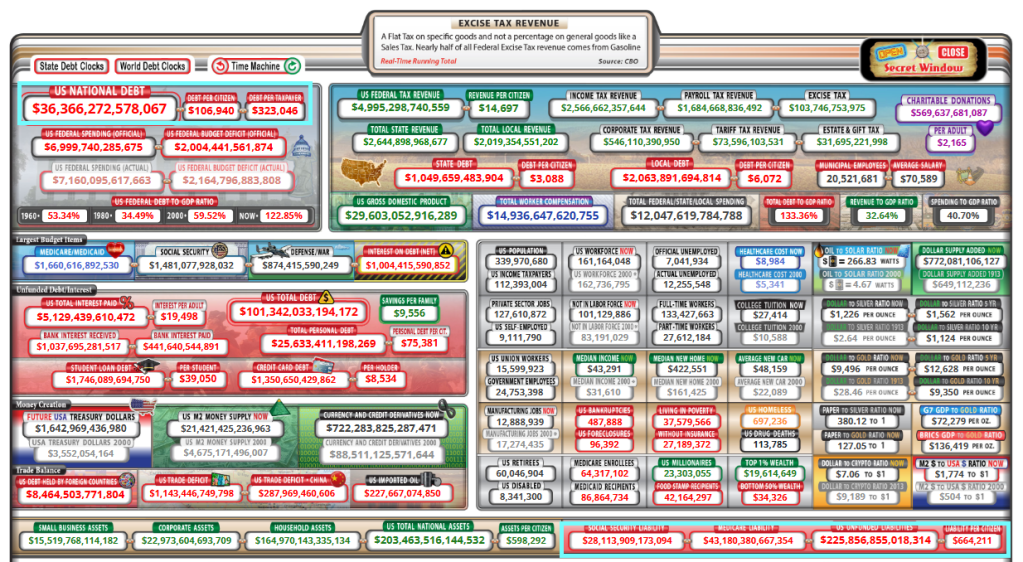

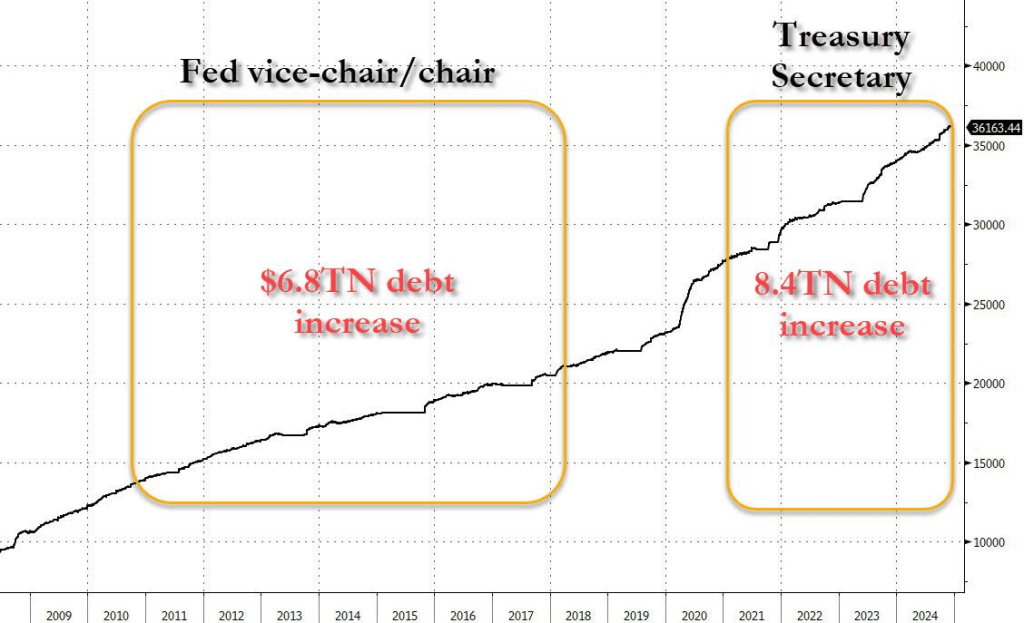

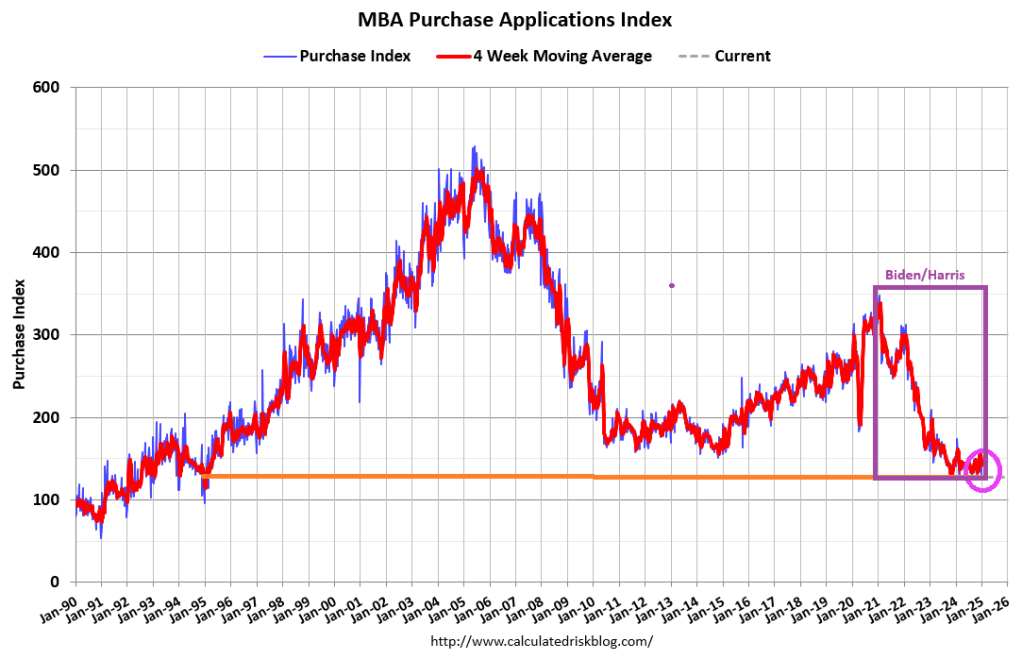

Wow. Money printing by The Federal Reserve went will after the Covid outbreak in early 2020. So did Federal spending. Unfortunately, politicians are addicted to Federal spending. And Senators like Chuck Schumer (D-NY) and Adam Schiff (D-CA) are trying to obstruct any spending cuts by Trump and his DOGE.

Well, M1 Money printing is UP 365% since Covid while M2 Money printing is UP 40%.

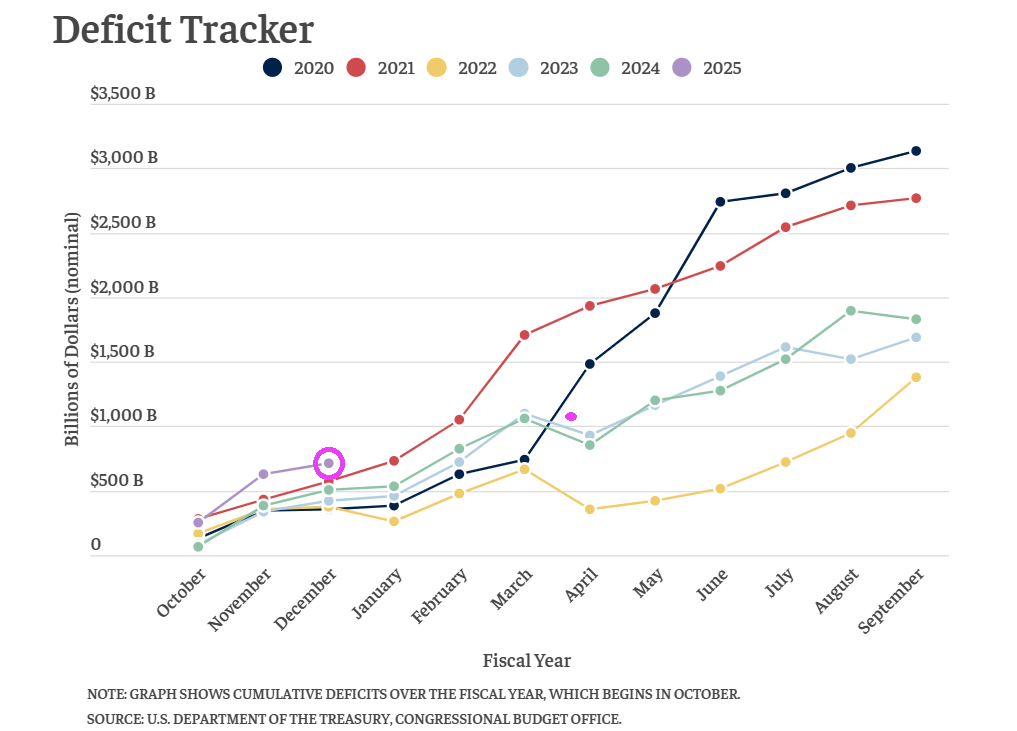

Federal current expenditures are up 45% since the Covid outbreak. But were never returned to normal spending levels.

New York senator Chuck Schumer is opposed to Trump’s efforts to cut Federal spending. Is Senator Schumer REALLY the political boss of Tammany Hall, the Democratic Party’s political machine that played a major role in the politics of 19th-century New York City and State?

You must be logged in to post a comment.