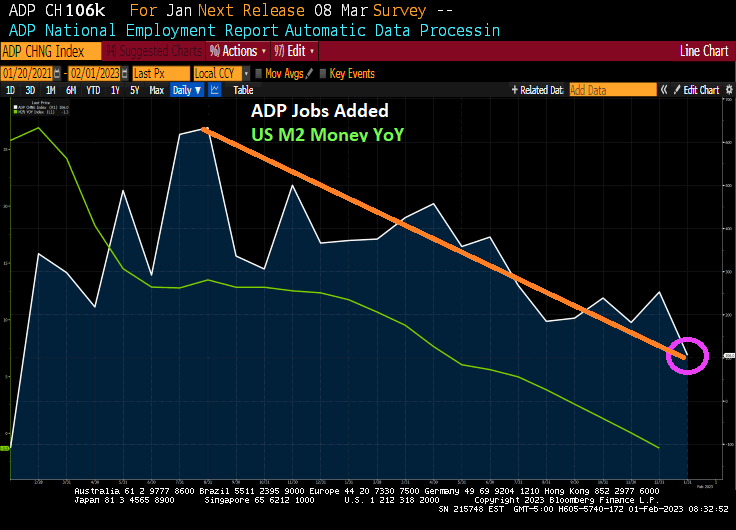

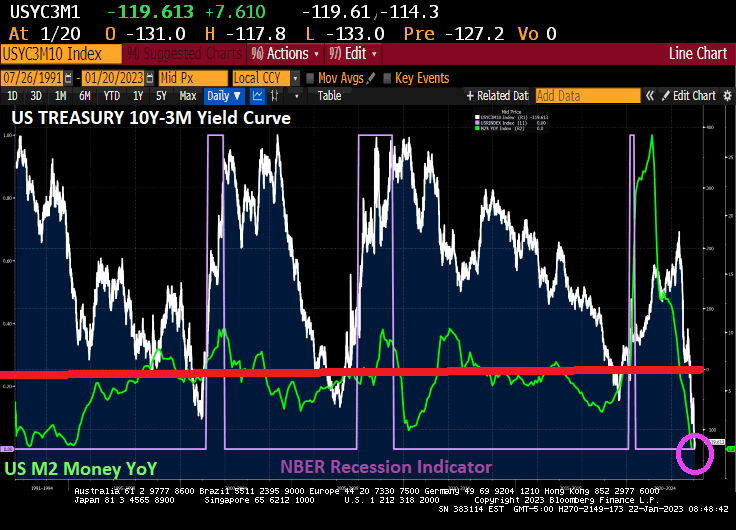

The US economy is slowing down. In fact, ADP jobs added just printed at 106k in January, the lowest reading since August 2021. ADP jobs added follows the slow down of M2 Money growth YoY as The Fed tightens its monetary policy.

Do I detect a trend (orange line)?

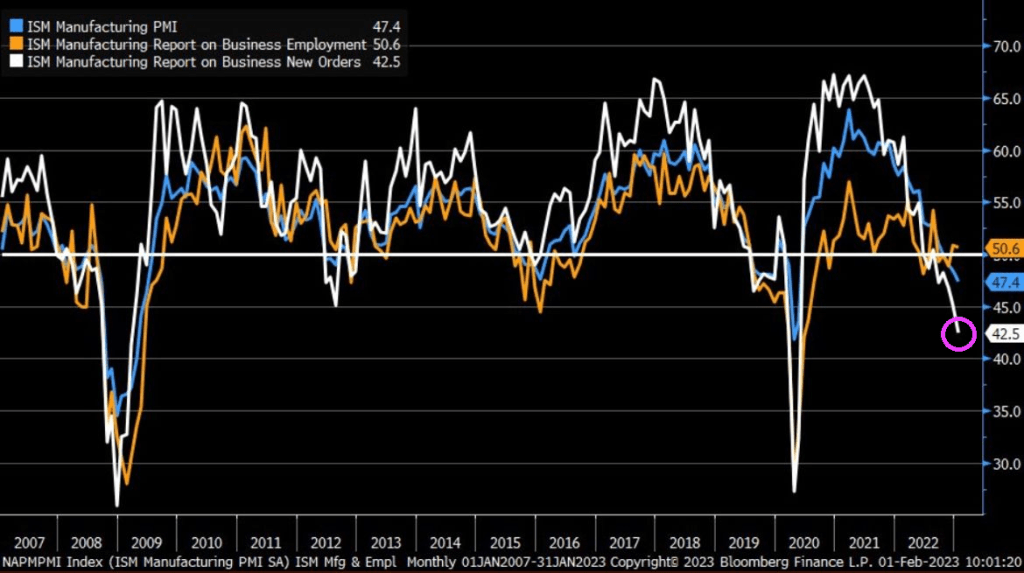

Speaking of trends, check out ISM Manufacturing New Orders. Lowest since Great Recession of 2008 (if I exclude the government economic shutdown Covid recession).

I doubt that January’s ADP report or the ISM Manufacturing report will be mentioned in Biden’s State of the Union address.

You must be logged in to post a comment.