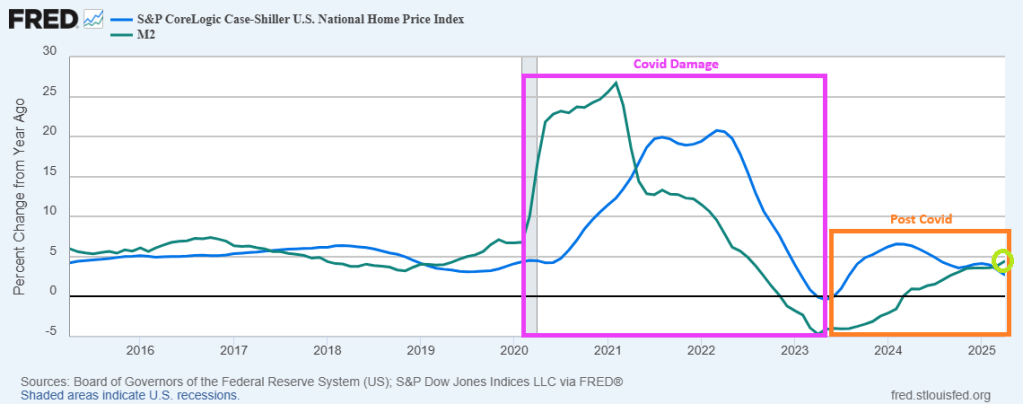

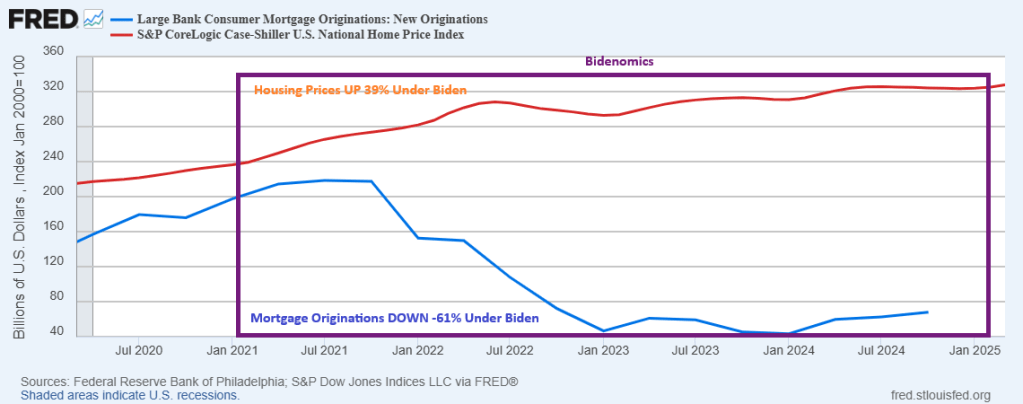

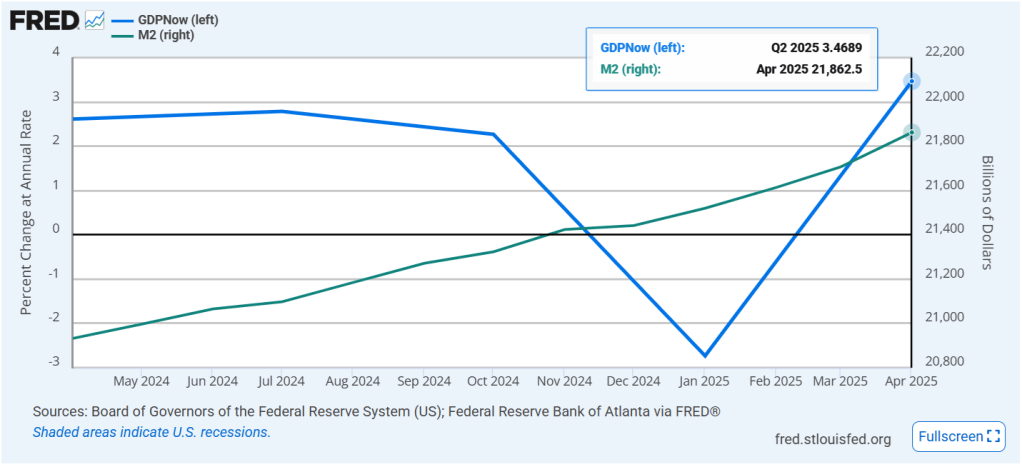

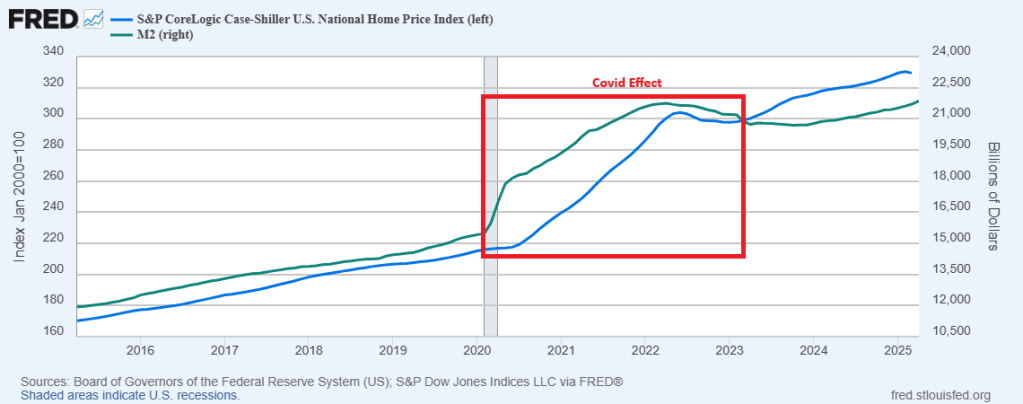

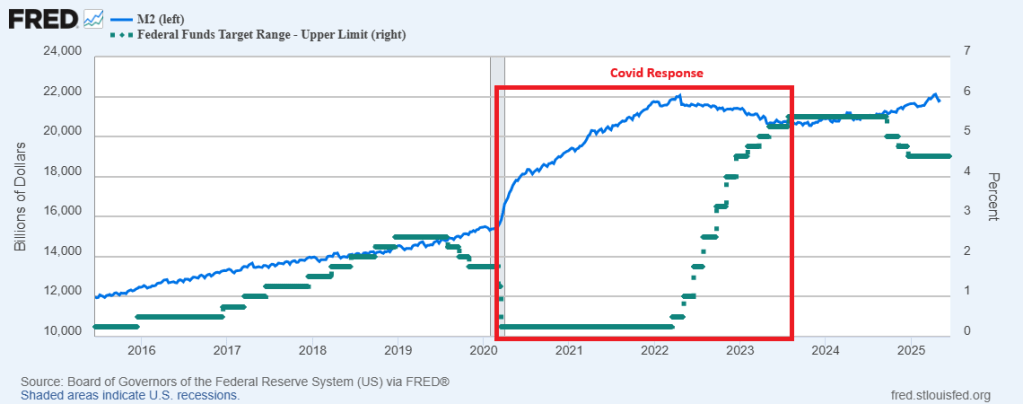

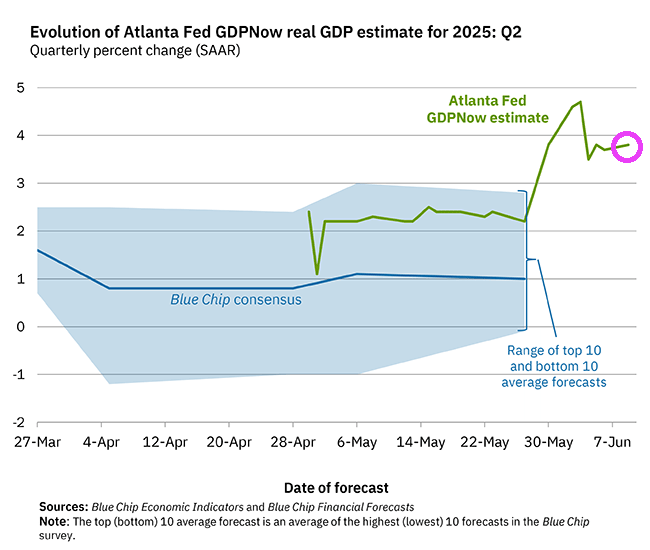

The Fed continues printing money! And home prices continue to rise on year-over-year basis, but falling on a month-over-month basis.

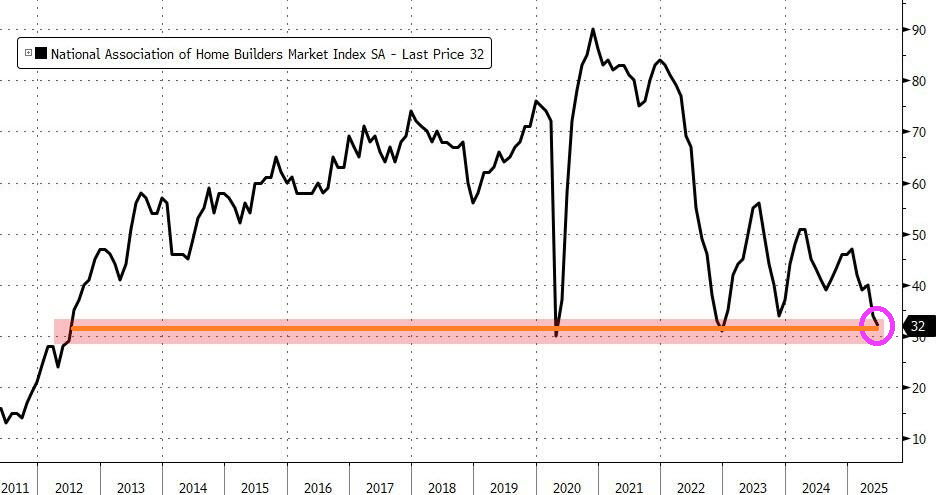

Home prices in April tumbled 0.31% MoM (-0.02% exp) – the biggest MoM drop since Dec 2022.

But if we look at the national home prices via S&P Case-Shiller and YoY rather than MoM, home prices ROSE 2.64% YoY.

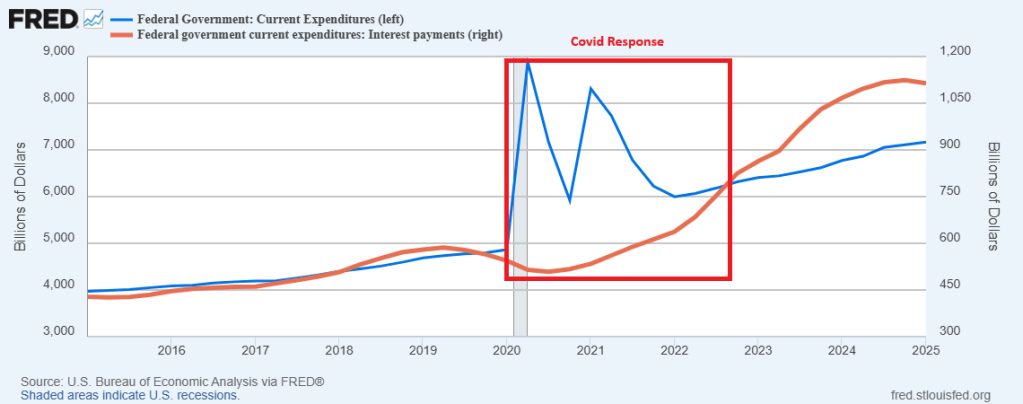

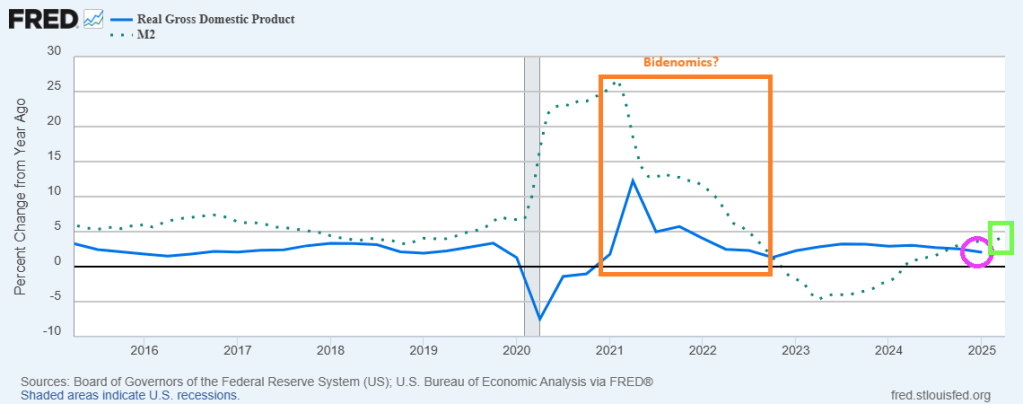

You can see the damage to homeownership caused by Covid and The Fed. The massive expansion of M2 Money in 2020 was followed shortly by rapid increases in home prices. This was followed by a normalization in Fed M2 Money printing. Consequently, home price growth has slowed.

You must be logged in to post a comment.