This isn’t the Sahm’s Club that is good fpr consumers. This is the club which crushes consumers. Better to be called Joe’s Club after our demented President Joe Biden.

In this morning’s US Bureau of Labor Statistics data release, the U-3 unemployment rate increased 4.1 percent in June 2024, rising by one-tenth of a percentage point above the forecast rate. The U-3 rate measures the percentage of the civilian labor force that is jobless, actively seeking work, and available to work, excluding discouraged workers and the underemployed.

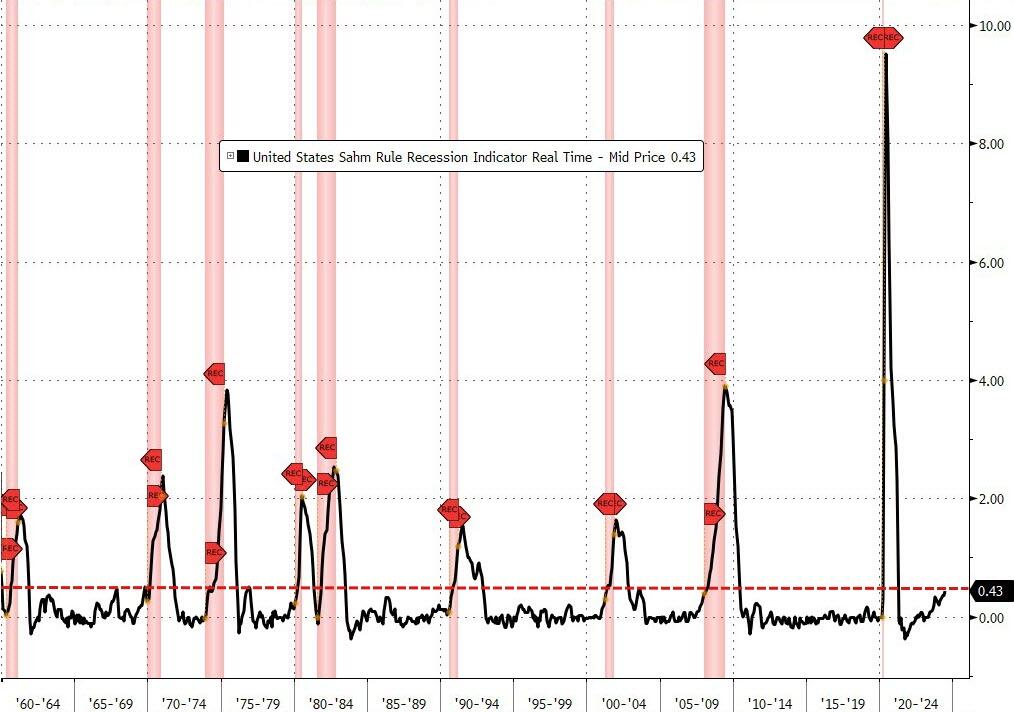

This uptick triggers the Sahm Rule, a real-time recession indicator, suggesting that the US economy is in, or is nearing, a recession. The Sahm Rule, developed by former Fed economist Claudia Sahm, is designed to identify the start of a recession using changes in the total unemployment rate.

According to the rule, a recession is underway if the three-month moving average of the national unemployment rate rises by 0.50 percentage points or more, relative to its low during the previous 12 months. With the June 2024 U-3 rate of 4.1 percent, the average of the last three months being 4.0 and the lowest 12-month rate of 3.5 percent in July 2023, this criterion has been met.

Sahm Rule indications (1960 – 2024)

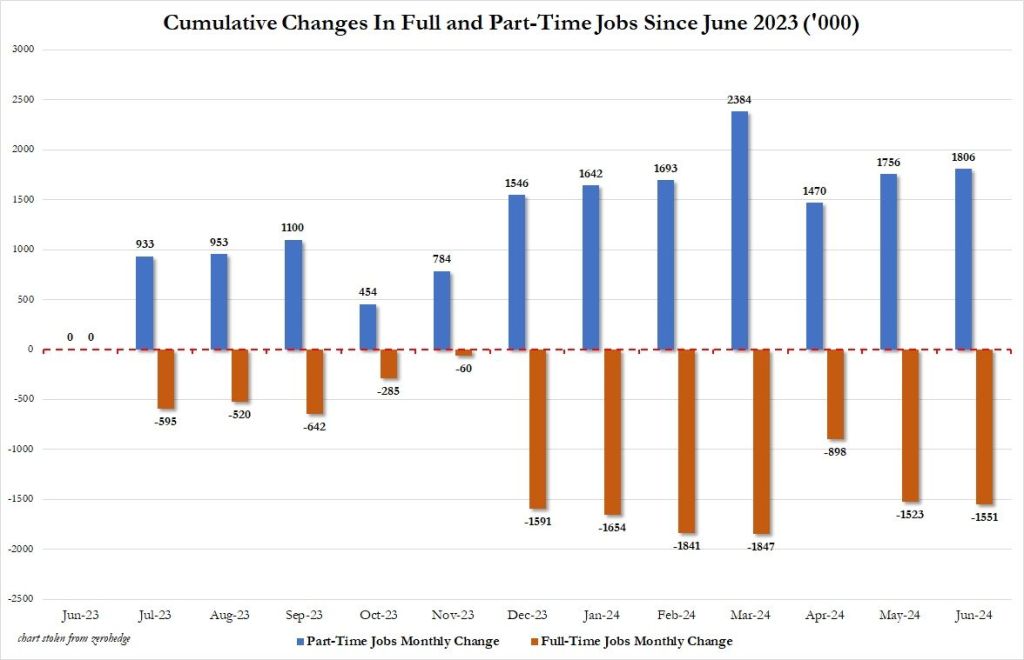

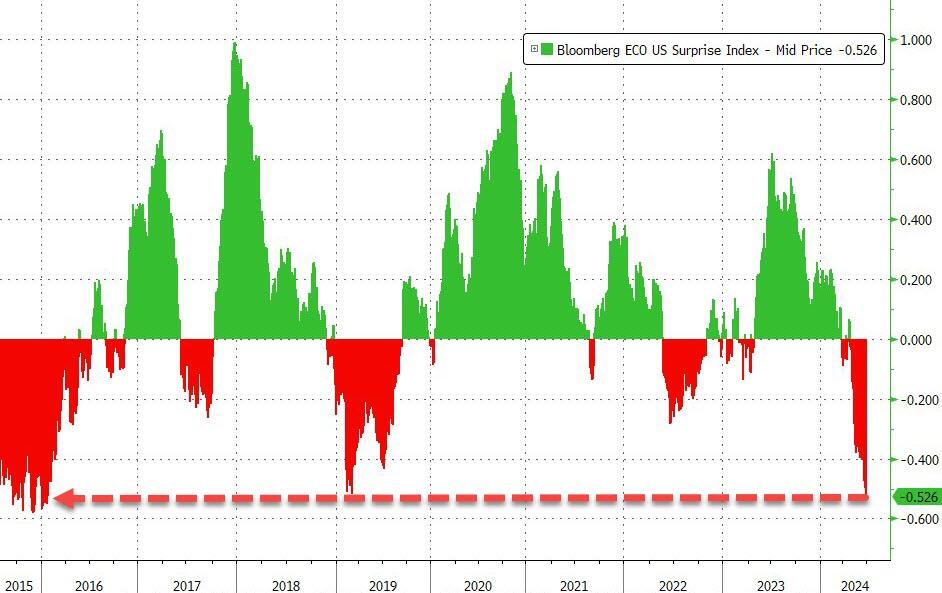

Surveys had forecast the U-3 rate to hold steady at 4.0 percent in June, unchanged from May 2024. The seemingly small 0.1 percent uptick, however, carries substantial implications for the broader economy. One possible confounding effect of the signal is growth in the labor force: If the labor force grows rapidly and the economy does not generate enough jobs to match the increase, the unemployment rate might rise and the Sahm Rule may be triggered, even if overall employment is increasing.

The rise of initial claims over the past few weeks, and nine consecutive increases in continuing claims, support the June 2024 Sahm indication.

Equity futures were flat just after the release, while Treasuries rallied across all maturities.

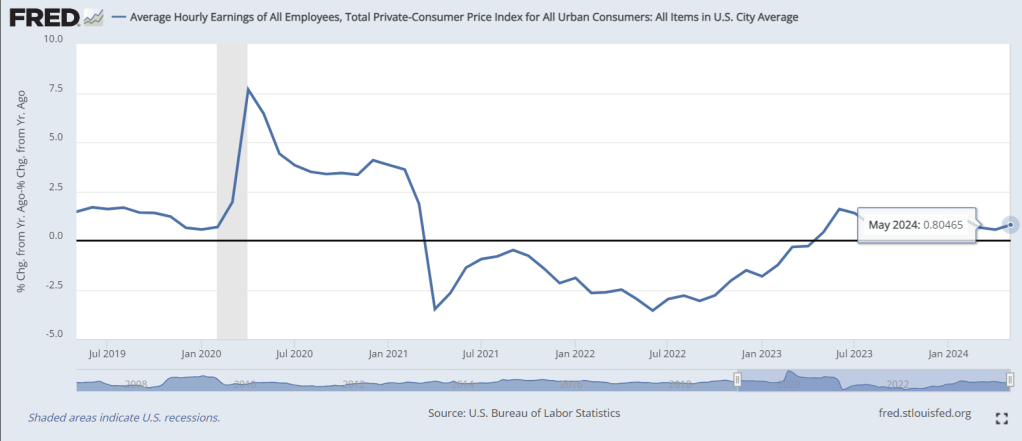

In recent months, Fed Chairman Jerome Powell has indicated that “unexpected weakness” may prompt a start to an accommodative policy stance without the additional data sought regarding the pace of disinflation. Historically, an increase in unemployment rates and the onset of a recession have led to policy adjustments aimed at stimulating economic growth and mitigating job losses, and the reversal of the rate hikes which began in 2022 to mitigate the highest inflation in four decades has been widely anticipated.

While more data will be required to confirm the Sahm Rule indication, the impact of accelerating prices, interest rates at their highest levels since 2007, and commercially suppressive pandemic policies have probably caught up with US producers and consumers.

Biden’s version of Sahm’s Club. Where the economy tanks and all he and his wife Jill care about is staying in Power. Perhaps we should call the sagging US economy “Joe’s Club.”

You must be logged in to post a comment.