Hello Hello pre-Biden inflation levels!

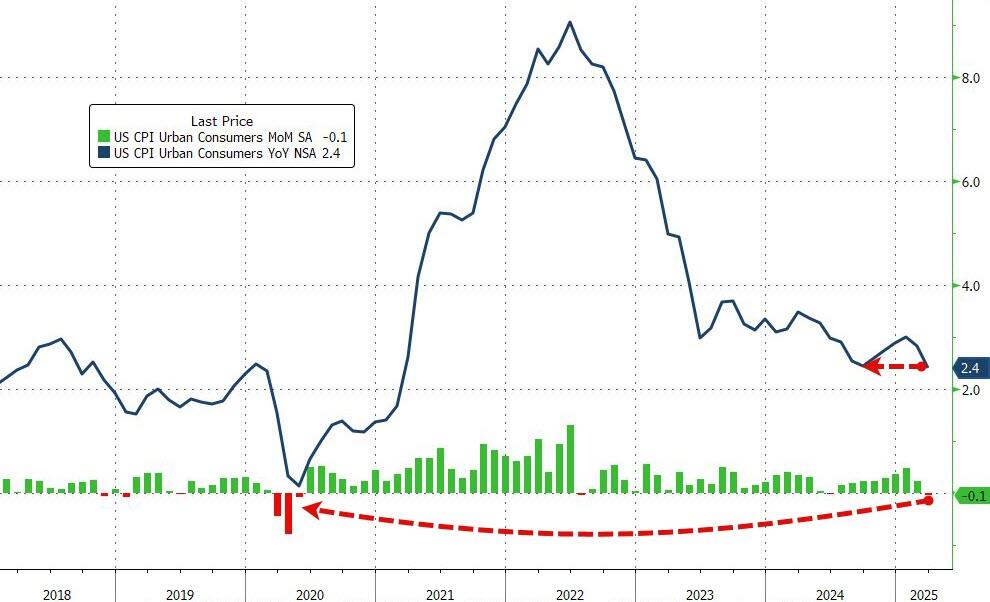

Having dipped lower in the previous month (following a few straight months of re-acceleration), expectations were for both headline and core measures to continue trending lower on a YoY basis… and they were.

Headline CPI FELL 0.1% MoM (vs +0.1% exp), which dragged the YoY CPI to +2.4%, matching the September lows…

That is the weakest MoM print since May 2020.

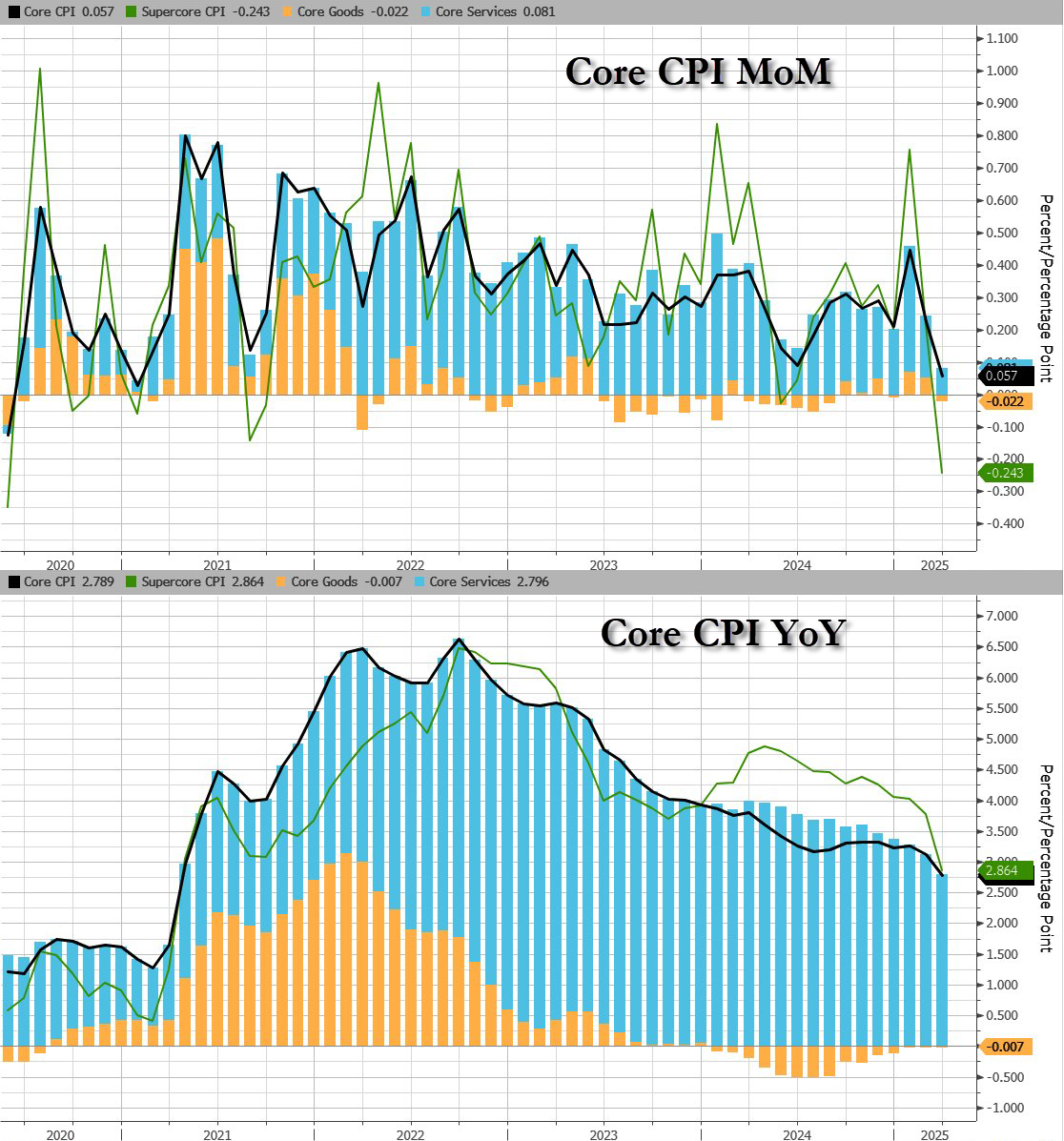

Core CPI also printed cooler than expected (+0.1% MoM vs +0.3% MoM exp), pulling the YoY print down t0 +2.8% YoY – the lowest since March 2021…

Services inflation tumbled…

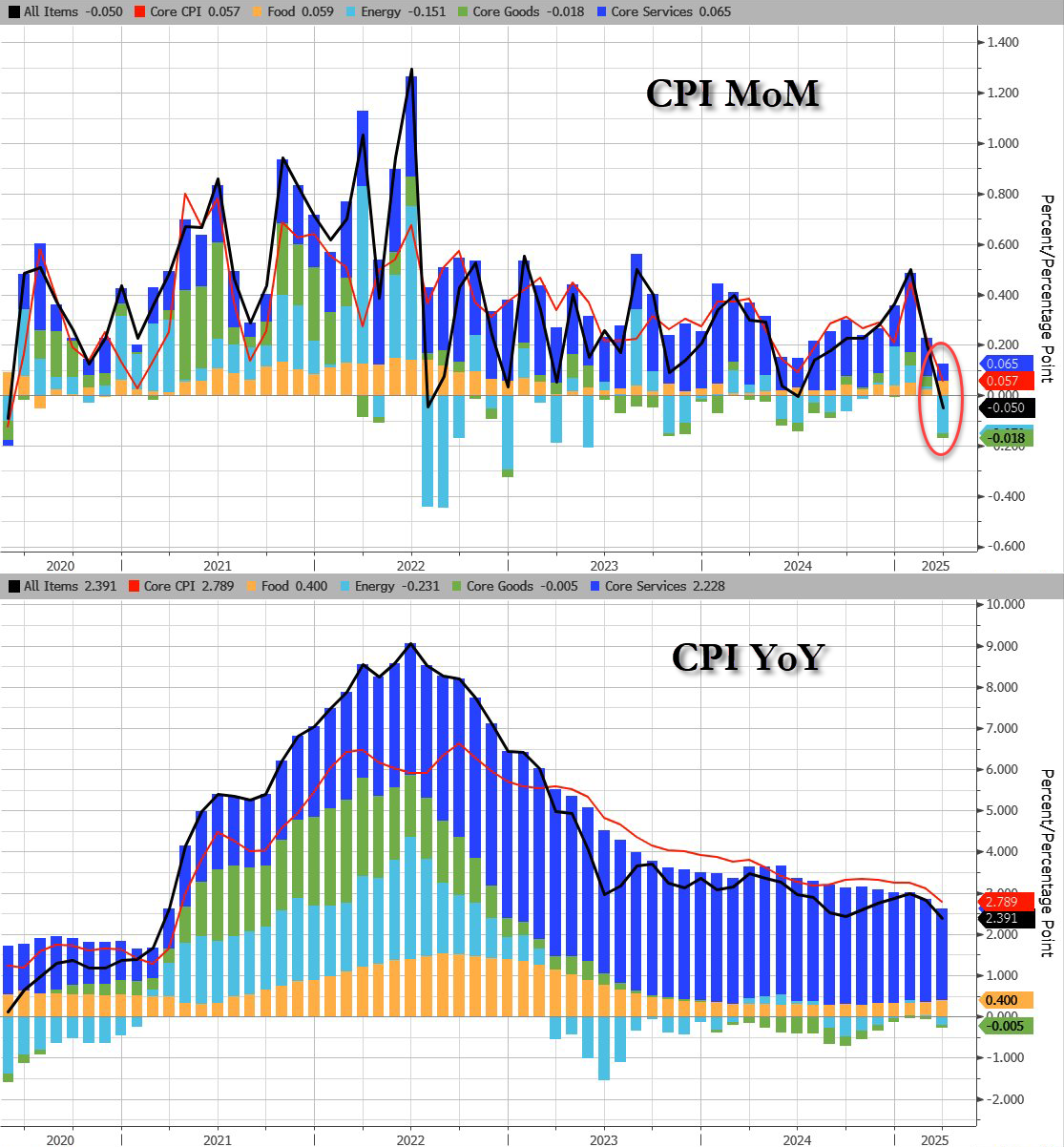

CPI breakdown:

Headline:

- CPI decreased 0.1% after rising 0.2% in February, and below the +0.1% estimate. Over the last 12 months, CPI rose 2.4%, below the 2.5% estimate.

- Energy CPI fell 2.4% in March, as a 6.3% decline in the index for gasoline more than offset increases in the indexes for electricity and natural gas.

- Food CPI rose 0.4% in March as the food at home index increased 0.5% and the food away from home index rose 0.4 percent over the month.

Core CPI:

- The index for all items less food and energy rose 0.1% in March, following a 0.2% increase in February.

- Indexes that increased over the month include personal care, medical care, education, apparel, and new vehicles.

- The indexes for airline fares, motor vehicle insurance, used cars and trucks, and recreation were among the major indexes that decreased in March.

Core CPI details (MoM increase):

- The shelter index increased 0.2% over the month.

- The index for owners’ equivalent rent rose 0.% in March and the index for rent increased 0.3%.

- The lodging away from home index fell 3.5 percent in March.

- The personal care index rose 1.0%in March.

- The index for education rose 0.4% over the month, as did the index for apparel.

- The new vehicles index also increased over the month, rising 0.1%.

- The index for airline fares fell 5.3% in March, after declining 4.0% in February.

- The indexes for motor vehicle insurance, used cars and trucks, and recreation also fell over the month.

- The household furnishings and operations index was unchanged in March.

- The medical care index increased 0.2% over the month.

- The index for hospital services increased 1.1% in March and the index for physicians’ services rose 0.3% over the month. In contrast, the prescription drugs index fell 2.0% in March.

Core CPI details (YoY increase):

- The index for all items less food and energy rose 2.8 percent over the past 12 months.

- The shelter index increased 4.0 percent over the last year, the smallest 12-month increase since November 2021.

- Other indexes with notable increases over the last year include motor vehicle insurance (+7.5 percent), medical care (+2.6 percent), recreation (+1.9 percent), and education (+3.9 percent).

While goods inflation is flat (zero-ish), services cost inflation is fading fast…

Shelter and Rent inflation is slowing fast:

- Shelter inflation +0.3% MoM, +3.99% YoY, down from 4.25% in February (lowest since Nov 2021)

- Rent inflation +0.3% MoM, +3.99% YoY, down from 4.09% in February (lowest since Jan 2022)

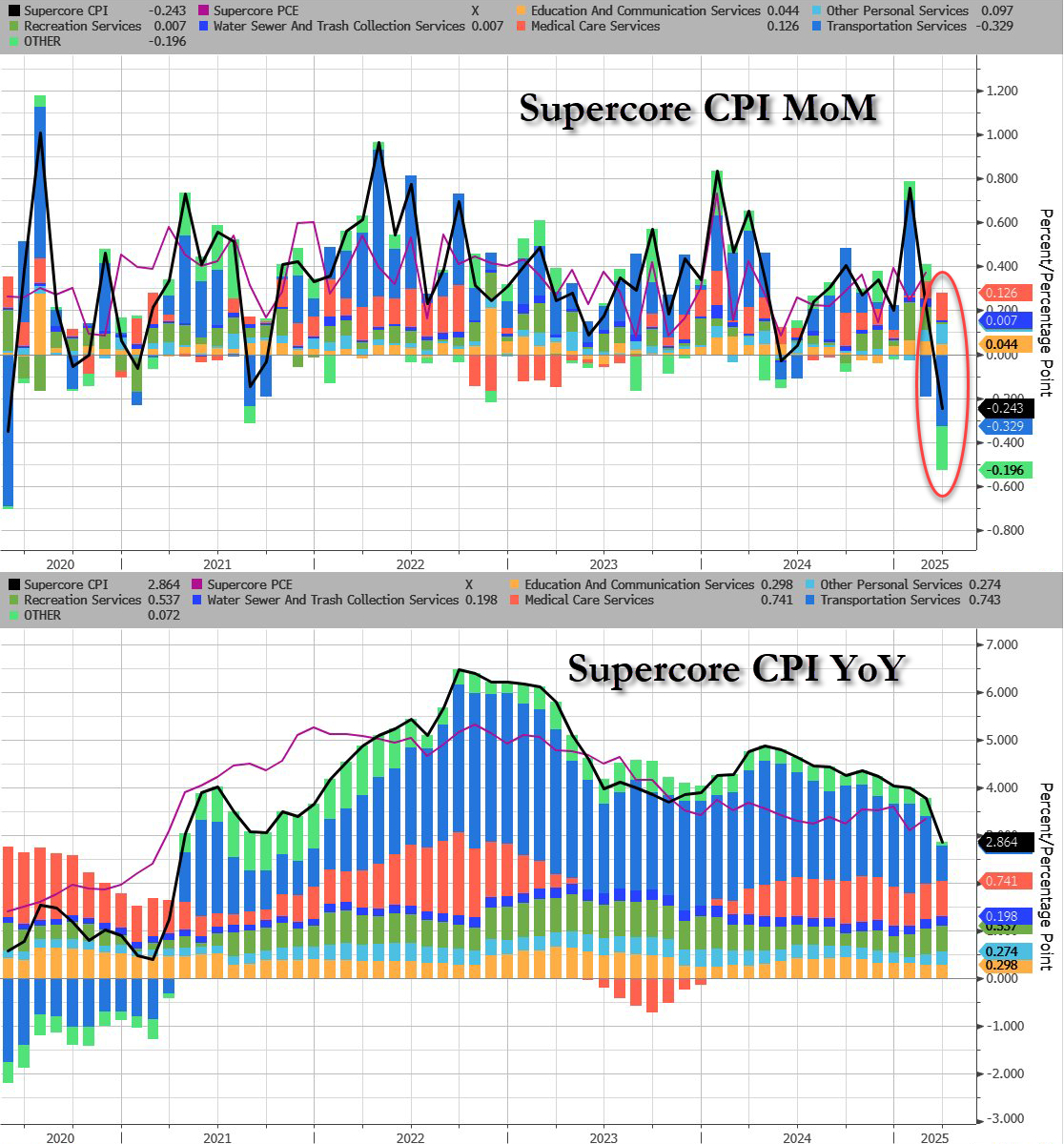

The so-called SuperCore CPI – Services Ex-Shelter – dropped 0.1% MoM dragging it down to +3.22% YoY – the lowest since Dec 2021…

Drill Baby Drill (and tariffs recession fears) have dragged energy prices lower and pulled CPI lower with it…

You must be logged in to post a comment.