The mortgage market is back! Time to polka!!

Mortgage applications increased 20.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending February 28, 2025.

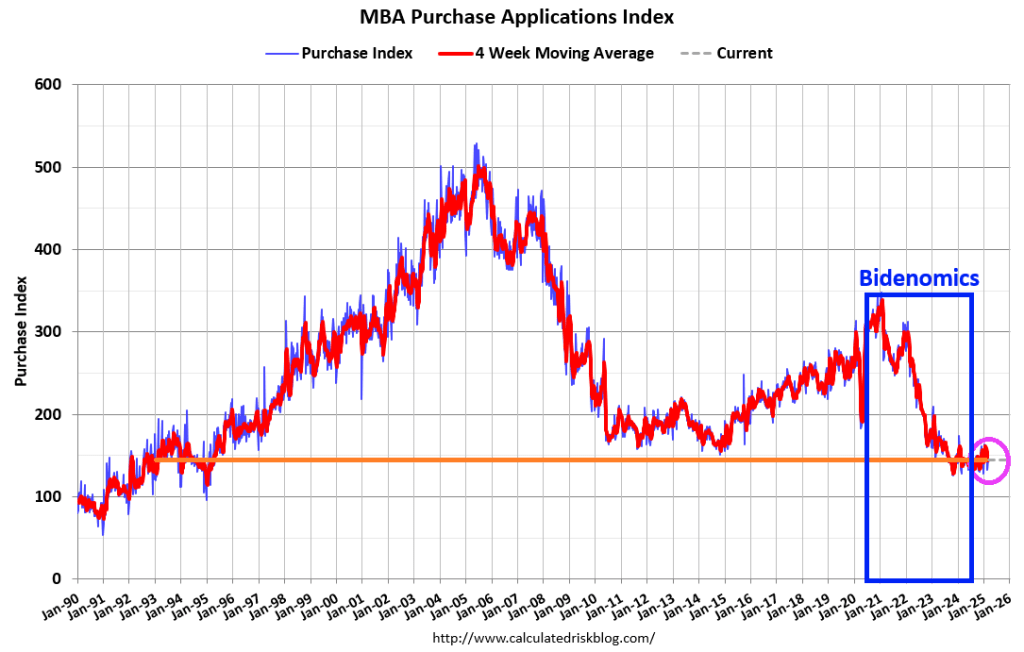

The Market Composite Index, a measure of mortgage loan application volume, increased 20.4 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 22 percent compared with the previous week. The seasonally adjusted Purchase Index increased 9 percent from one week earlier. The unadjusted Purchase Index increased 12 percent compared with the previous week and was 2 percent higher than the same week one year ago.

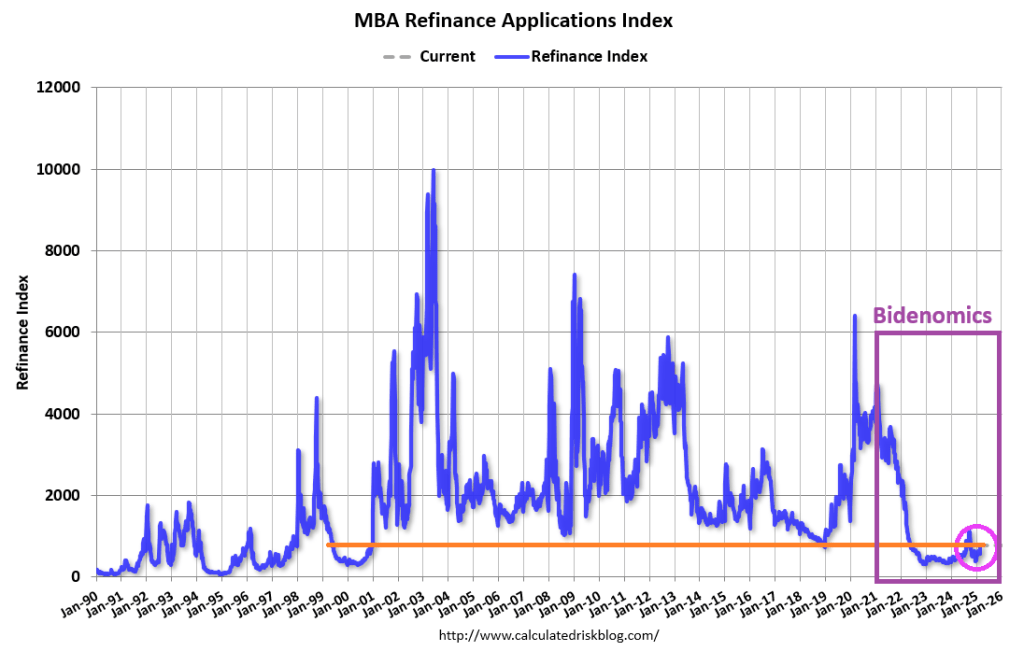

The Refinance Index increased 37 percent from the previous week and was 83 percent higher than the same week one year ago.

Thank God the adults are in charge in DC instead of the children we saw at Trump’s speech last night.

You must be logged in to post a comment.