From Zero Hedge: Yellen’s Bald-Faced Lies Exposed

Authored by MN Gordon via EconomicPrism.com,

Did you see the recent government propaganda from the U.S. Bureau of Labor Statistics?

Not the latest faulty claim that consumer prices increased at an annual rate of just 3.4 percent in December. But rather the claim that 216,000 jobs were added in December.

Upon release, and right on cue, Treasury Secretary Janet Yellen declared that the U.S. economy had achieved a soft landing. She also said that her “hope is that it will continue.”

What Yellen neglected to mention was that October employment was revised down by 45,000 jobs and November was revised down by 26,000 jobs. That’s 71,000 jobs the government recently reported which didn’t exist.

How many of the 216,000 jobs reported for December will wind up being pure fantasy?

Yellen also didn’t mention that 52,000 of the reported jobs are in government, 59,000 are in health care and social assistance, and 22,000 are in food services.

These aren’t the kind of jobs that create and spread new wealth and abundance to the economy.

In addition, there are 4.2 million workers that are employed part time for economic reasons.

This represents individuals who prefer full-time employment but are working part-time because their hours have been cut or they cannot find full-time work.

There are also 8.5 million multiple job holders. These are people who work more than one job because a single job doesn’t pay the bills.

Yellen, obviously, isn’t interested in these pesky details. What she is interested in is that when the data is massaged and contrived, and then summed up, the government can report an unemployment rate of 3.7 percent.

Hence, she can point to this number and crow about how through her expert navigation skills she has piloted a soft landing.

What’s really going on?

Here we’ll offer an anecdote followed by some thoughts…

Burning Ambition

Your editor’s son, a junior in high school, works at a pizza joint in the mall. There he makes and sells pizzas to hungry customers for $12.50 per hour – pre-tax. The minimum wage in Tennessee is $7.25 per hour.

Of note, he’s the only highschooler working there. His coworkers are all well into their dirty-30s. Some have kids. Some have multiple jobs. We haven’t asked any of them. But we suppose none would claim to be living the dream.

Reviews on Google are unflattering. They warn of pizzas and customer service that are of dubious quality. They tell a story of a shortage of good help. Here are several recent examples:

“Walked up to ask when they open. Some jerk behind the counter with a ponytail and big ear piercings goes, ‘Lights out not open!’ With a ton of attitude. We said, ‘You don’t have to be rude, we just wanted to know what time you opened.’ And his response was, ‘Welcome to the mall.’ What an absolute jerk. Don’t go here!”

“Ever had stale crackers with cheap ketchup and paper-thin burnt pepperoni on top of a thin layer of what was once cheap cheese before? If you’re on a quest to find the worst pizza in Knoxville, then come to the west town mall.”

“Got a slice of cheese pizza, sat down and the bottom of it was burnt. I tried to go get a different slice and he told me that all the other pizzas would be like that too and that it was normal for them to serve burnt pizza. He was a bit sarcastic about the situation.”

There are over one hundred reviews posted which share various tales of customer dissatisfaction. You’ve likely had similar experiences at your own local establishments. Burning pizzas and serving them with heapings of attitude is normal these days. Though having a burning ambition is rare.

What’s the point…

Cherry Picking Data Durations

These low-level service jobs, filled by people with low-level skill sets, are the jobs that Yellen is so excited about.

Absolutely, these jobs are important.

If they didn’t exist there would be no option to get cheap mall pizza while simultaneously getting insulted.

Life would be less abundant.

Nonetheless, these are not the type of jobs that drive the economy forward.

They certainly don’t offer opportunities for American workers to get ahead.

They don’t provide the cutting-edge skills, or the higher wages needed to propel the American economy above its foreign competitors.

One of Yellen’s key talking points is that wage growth is outpacing inflation. She can even point to the December jobs report for justification.

Based on the government propaganda, hourly earnings rose 4.1 percent in the year through December while consumer price inflation, as measured by the consumer price index (CPI), came in at 3.4 percent for the year. Here’s Yellen:

“Wage increases are running over price increases now. American workers are getting ahead and the progress for the middle-income families is very noticeable.”

Cherry picking data durations to support a false narrative is a longstanding tactic of big government statists. The reality is that on Yellen’s watch American workers have steadily fallen behind.

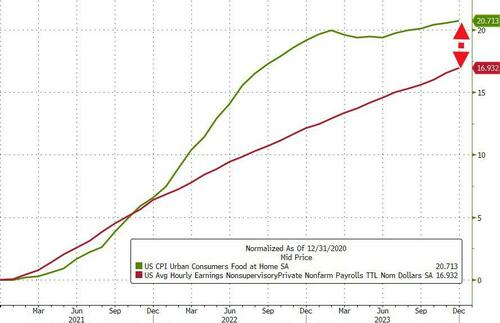

When you zoom out to show from December 2020 to the present, average hourly wages and CPI tell a much different story.

As David Stockman, the former Director of the Office of Management and Budget recently detailed, “the cost of living has risen 25 percent more than the average hourly wage.”

In other words, American workers have taken a significant pay cut over the last three years.

Yellen’s Bald-Faced Lies

If you didn’t know, Yellen has held various positions with the Federal Reserve and later the Treasury over the last 30 years. She’s participated in and advanced an era of unprecedented economic activism.

Moreover, Yellen and her colleagues at the Fed have their fingerprints all over the wage debasement that has taken place over the last several years.

As Stockman elaborated:

“A few years ago when the shortest inflation ruler available—the core PCE deflator—was running significantly below the Fed’s sacred 2.00% target, the Eccles Building was all for a catch-up of the level. The Fed even announced a policy of targeting inflation to average 2.0% over time, which ukase did not include, conveniently, the exact span of time to be measured.

“‘The Federal Reserve now intends to implement a strategy called flexible average inflation targeting (FAIT). Under this new strategy, the Federal Reserve will seek inflation that averages 2% over a time frame that is not formally defined. This means that after long periods of low inflation, the Federal Reserve will not enact tighter monetary policy to prevent rates higher than 2%. One benefit of this flexible strategy to managing the mandate of price stability is that it will impose fewer restrictions on the mandate of full employment.’

“Wouldn’t you know it? The Fed switched to ‘averaging’ in August 2020—just months before inflation went soaring to levels not seen since the 1970s.”

The gap between reality – consumer price increases vs wage increases – and what government bureaucrats want you to believe to be true takes frequent bald-faced lies to fill.

Yellen, for her part, excels at selectively using contrived data to make assertions that are visibly false.

We don’t know if she believes the propaganda she spews or if her intent is to deceive people. Regardless, the whole act is exceedingly wearisome.

You must be logged in to post a comment.