Newly-minted US House Speaker Kevin McCarthy faces a daunting task: trying to avoid a US debt default. As I have discussed many times before, nothing has been the same since the US housing bubble and near-collapse of the banking system that produced an expensive bailout of seemingly all financial institutions. After 2008, Federal spending has gone out of control. The budgetary hawks (or pigeons) in the US House of Representatives (with Pelosi, Boehner, Ryan then Pelosi again) went on Federal spending sprees of epic proportions.

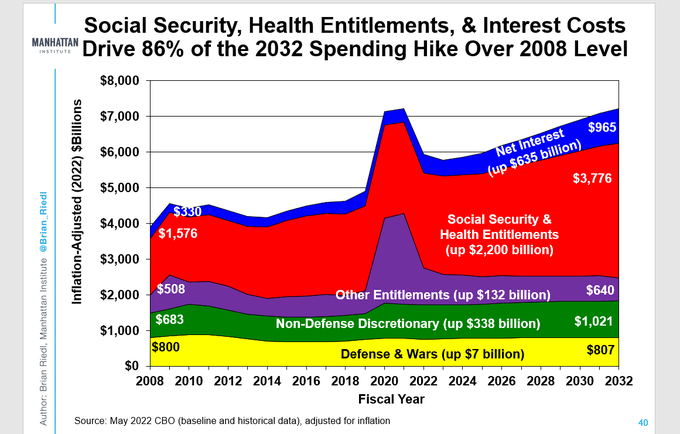

The Manhattan Institute has a nice chart showing the explosion in the Federal budget since 2008. Of particular note, interest payments on the Federal debt has increased by a staggering 192%. On the non-interest spending front, Social Security and Health Entitlements have increased by 140% while Nondefense Discretionary Spending has increased 76%.

The massive increase in Federal debt interest is due to both increased Federal spending and rising interest rates thanks to The Federal Reserve raising rates to fight inflation.

But what will McCarthy and House Republicans recommend cuts in? Tighter restrictions on who qualifies for Social Security and particularly Social Security Disability payments?

The odd factoid is that Defense and Wars budget is up less than 1% from 2008 to 2032. So, Ukraine military aid is coming from somewhere, but not from the Defense budget. Is Ukraine another entitlement program?

Rest assured that after debate, the House will pass a budget and, provided that virtually nothing was cut, the Senate will gleefully agree to more spending and “Top Secret Documents” Biden will sign it.

After he parks his gorgeous Corvette Sting Ray, that is.

You must be logged in to post a comment.