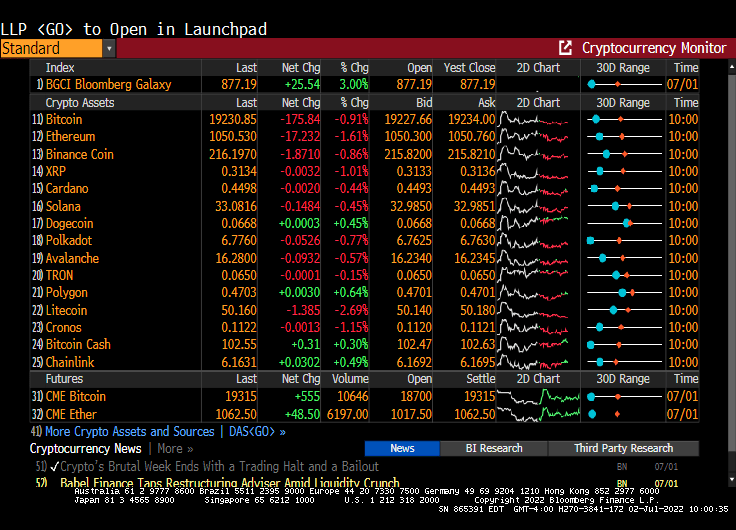

Crypto markets have slumped, adding to a decline that has wiped away some $2 trillion of market value and left market participants uneasy heading into the long Fourth of July weekend.

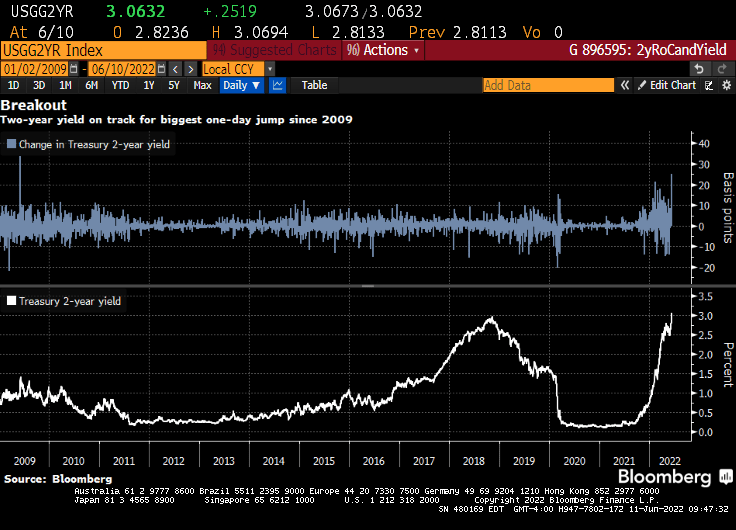

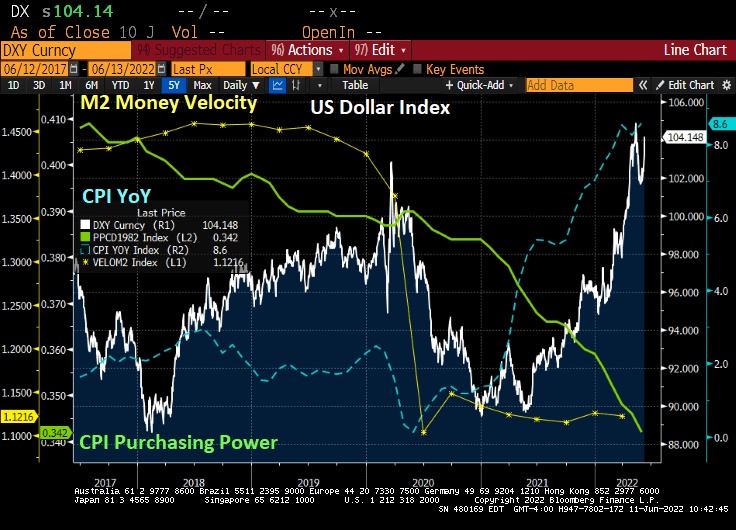

Bitcoin has fallen below $20,000 as the US Dollar strengthens.

At least Dogecoin is up today.

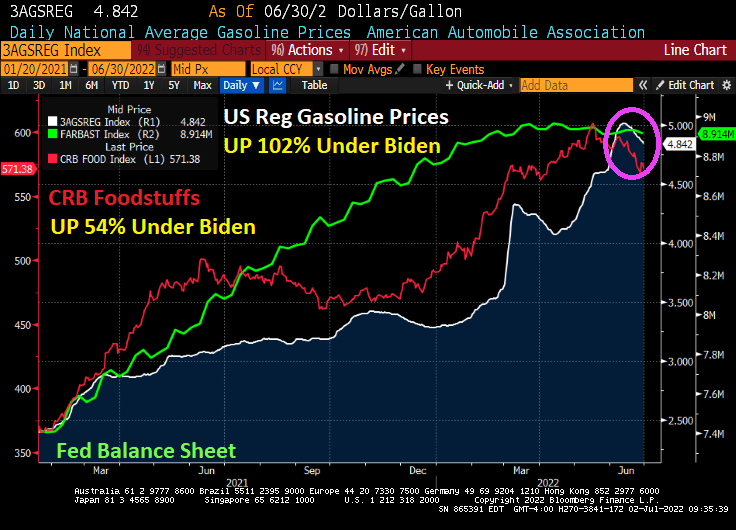

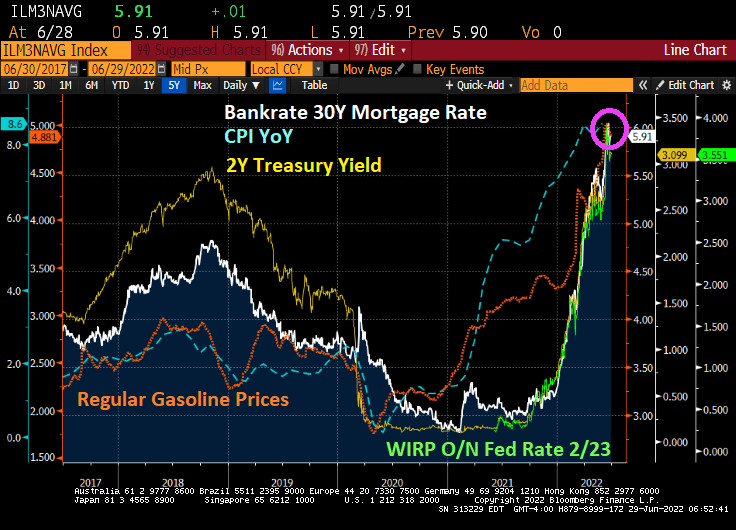

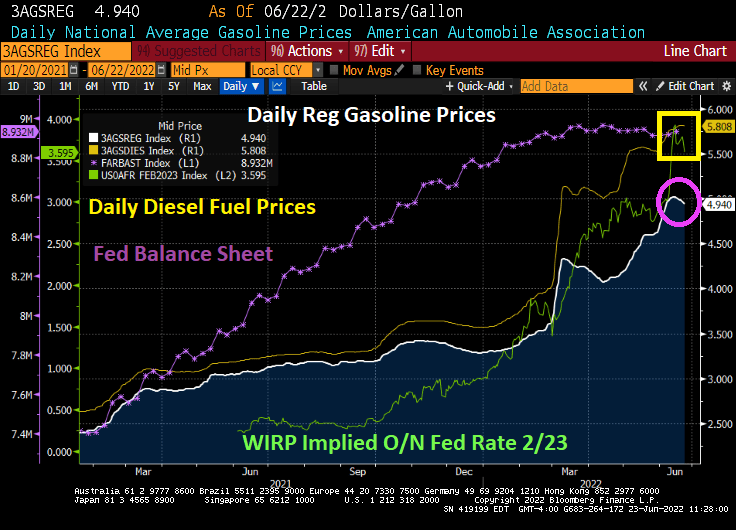

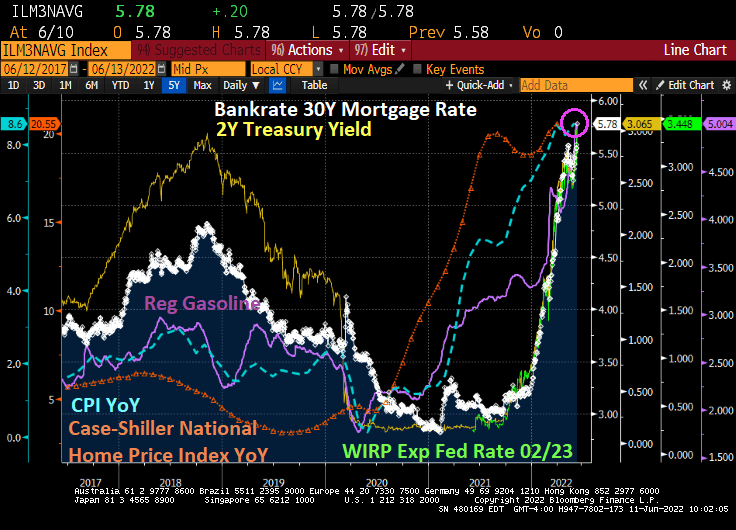

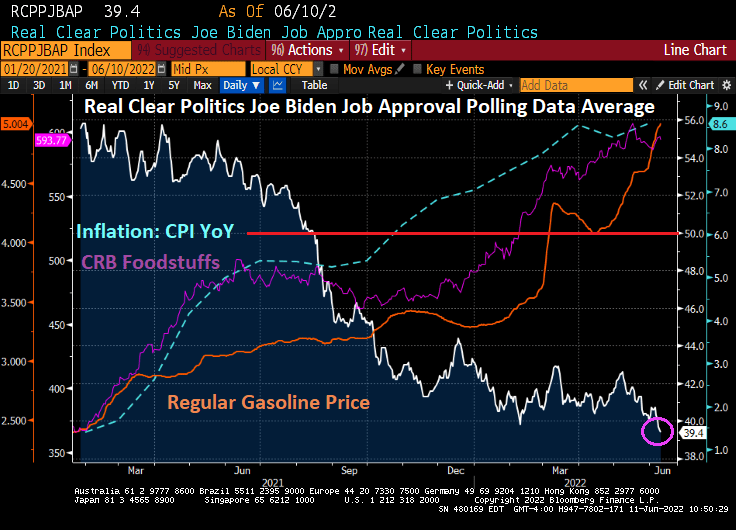

Enjoy your expensive 4th of July weekend! As long as you don’t eat much due to expensive food prices or drive anywhere due to high gasoline prices.

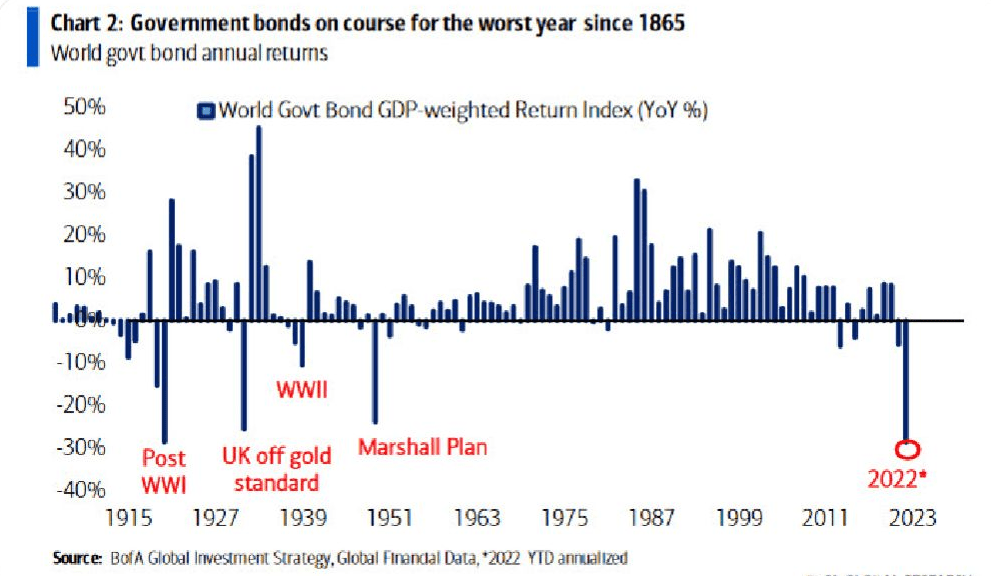

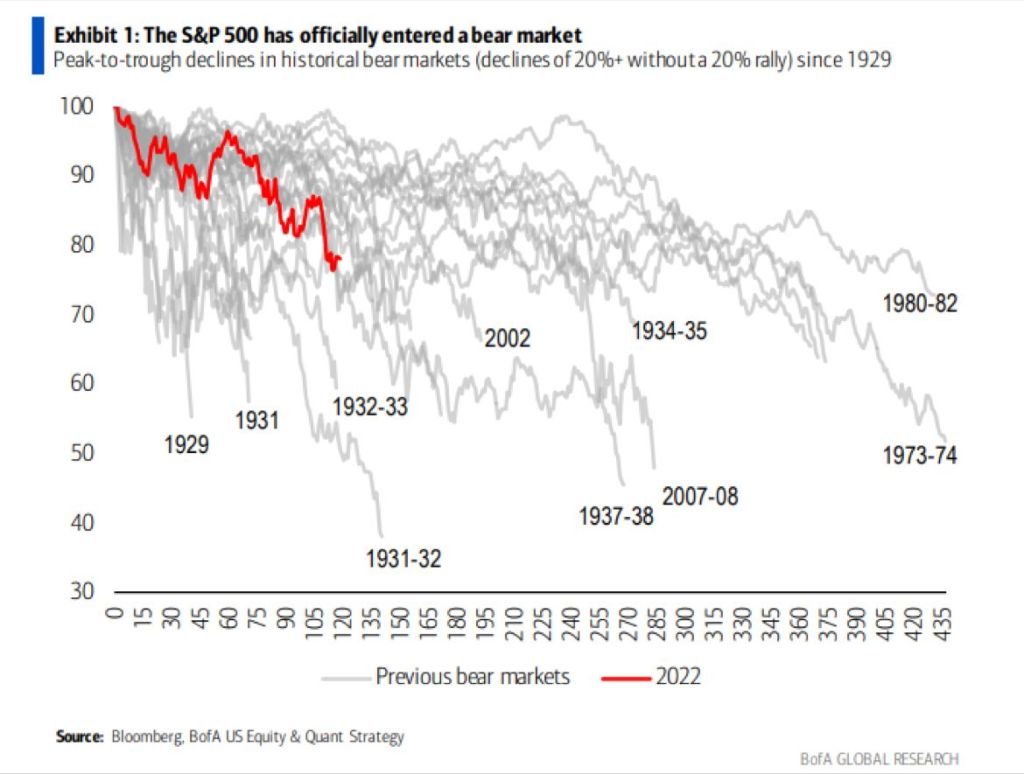

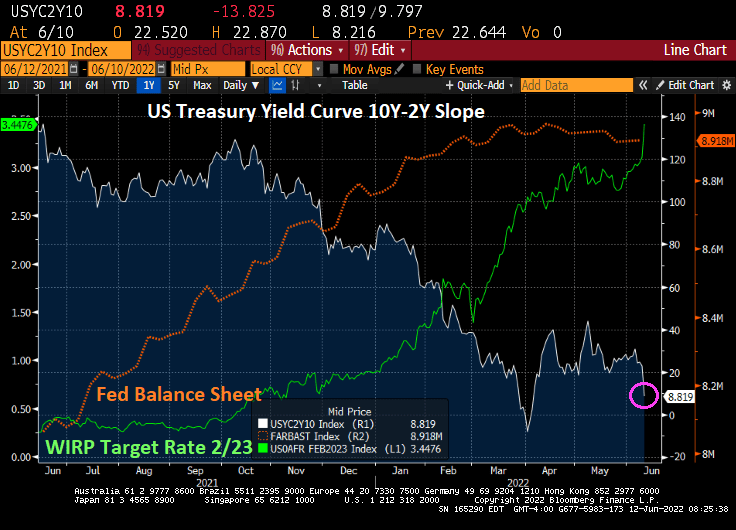

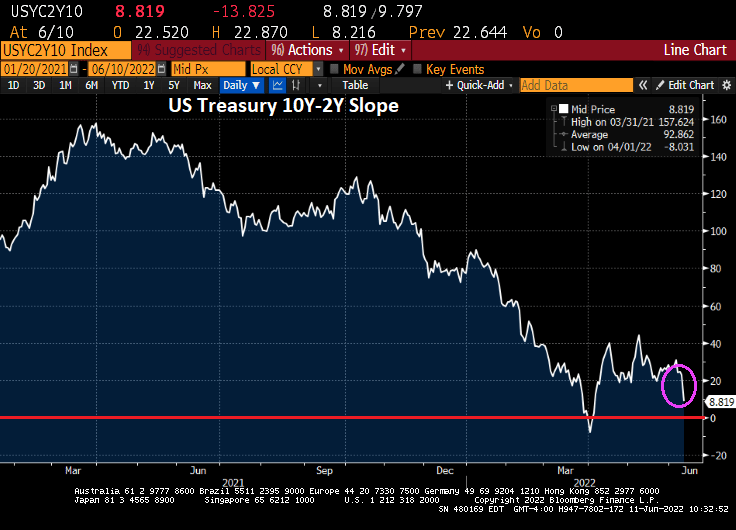

And government bonds on course for worst year since 1865 and President Abraham Lincoln (then President Andrew Johnson).

At least the Biden Administration is doing what The New World Order is making them do. Or The Liberal World Order.

Biden looks like he is saying “Kiss me you Statist fool!”

You must be logged in to post a comment.