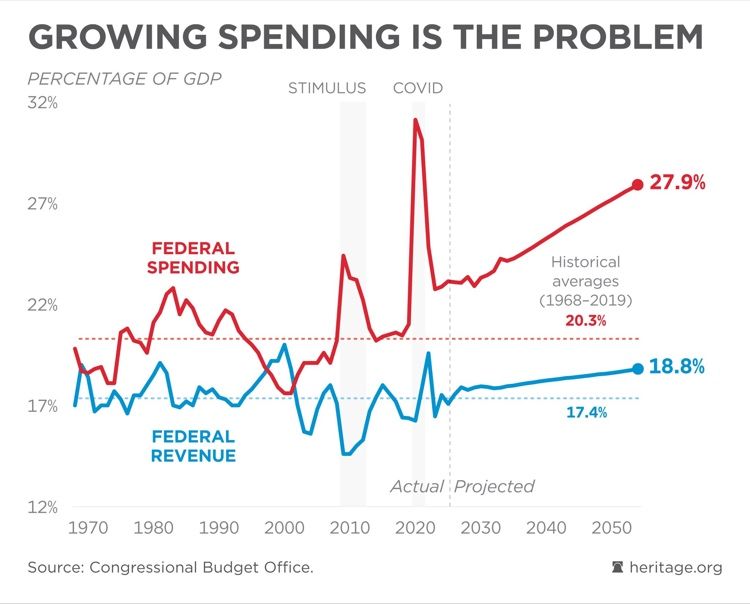

Face it. The Federal government is broken. Congress and the Biden Administration are addicted to spending money and running up massive debts. There is no attempt at fiscal restraint because they will always argue that “More money must be spent!” On what exactly? Usually pet projects (aka, pork) like the LGBTQ retirement home in Boston for $850 thousand and $15 million for Egyptian college tuition.

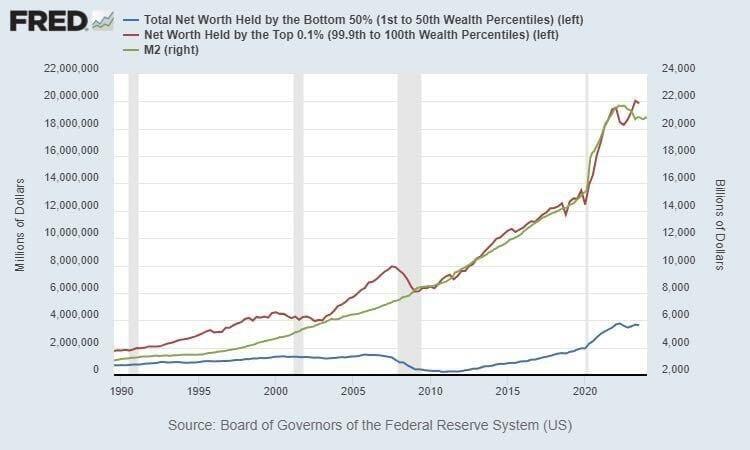

How does “broken money” work? Badly. Without any fiscal restraint, politicians can just give away thousands/millions of dollars to the donor class (donate $1, get $1,000 in return). As you can see, the net worth of the top 0.1% has exploded with each ensuing “crisis.” There was the 2008/2009 financial crisis and the 2008 Covid crisis. With each crisis, the top 0.1% get richer and richer. You will note that net worth for the top 0.1% is closely related to M2 Money printing. Like, who gets the money printed by Uncle Spam? The 0.1%, of course!

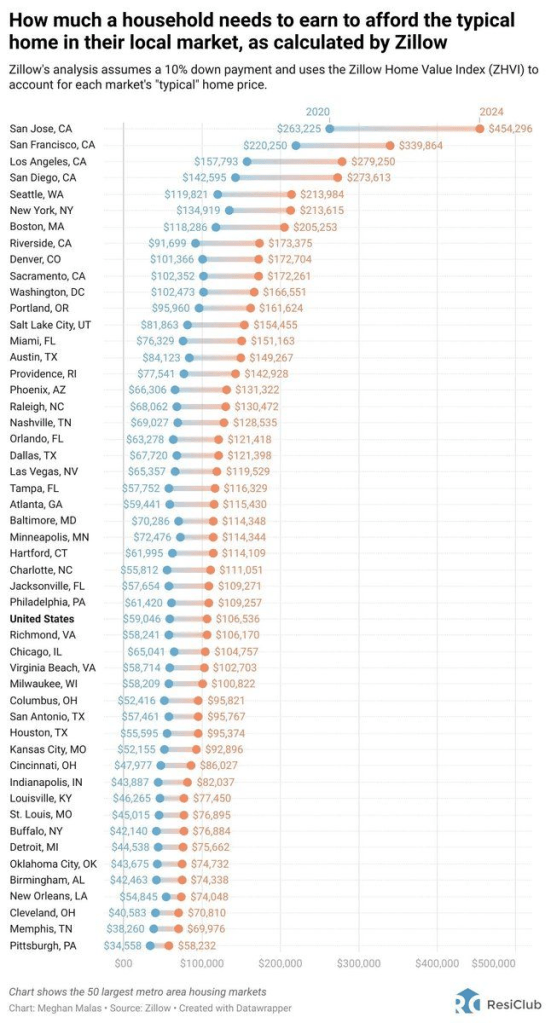

Broken money leads people to store their value in sub optimal vehicles like housing. This drives the cost of real estate up unnaturally and increases the gap between the “haves” and the “have nots”. Sowing seeds of animosity. Seeds that, when left to germinate and grow via the further degradation of the money people use, blossom into ugly flowers of Anarcho Tyranny.

This has manifested in the trend of people claiming other’s houses by squatting in them when they are left unattended for an extended period of time. The preferential treatment that has been given to squatters over homeowners in recent years can be seen as the regime which controls the money printers throwing the plebs a bone as they struggle to get by, an attempt to push the productive class to violence against a state unwilling to respect private property rights, or a combination of the two.

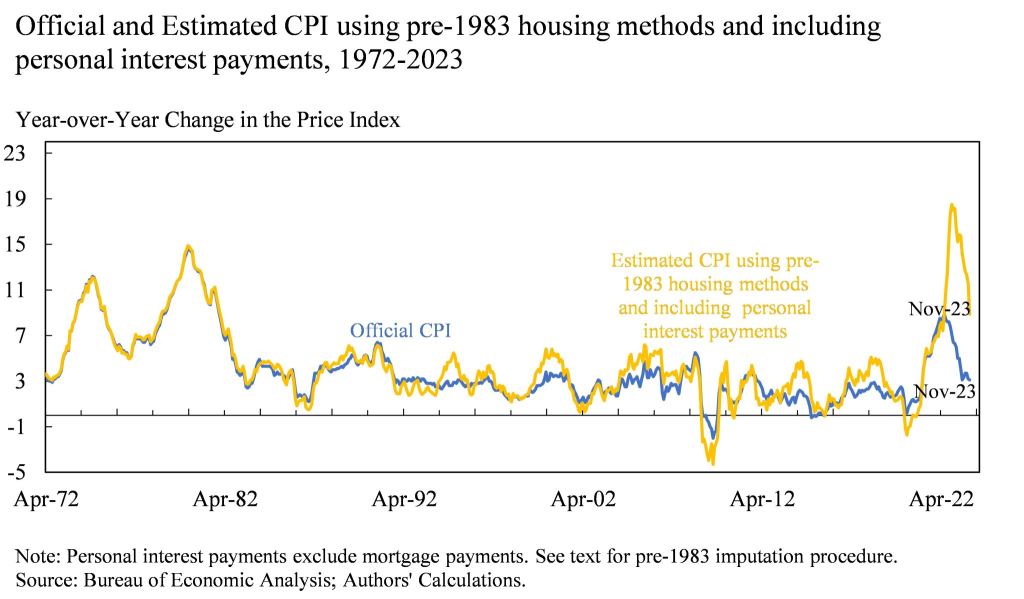

Look at inflation if we use pre-1983 methods. Inflation is still roaring at 18%!

Broken money incentivizes governments to allow their borders to be bum rushed by cheap laborers who will take low paying jobs that enable the systemically fragile economy to keep chugging along while simultaneously increasing the chaos that already exists and diluting the values that the natives of this country believe in.

The excess and decadence enabled by a world run on broken easy money allows people to live in a detached reality that leads them to push objectively false narratives. This is why there are running debates about gender and a retreat from merit based compensation.

All of this stems from broken money.

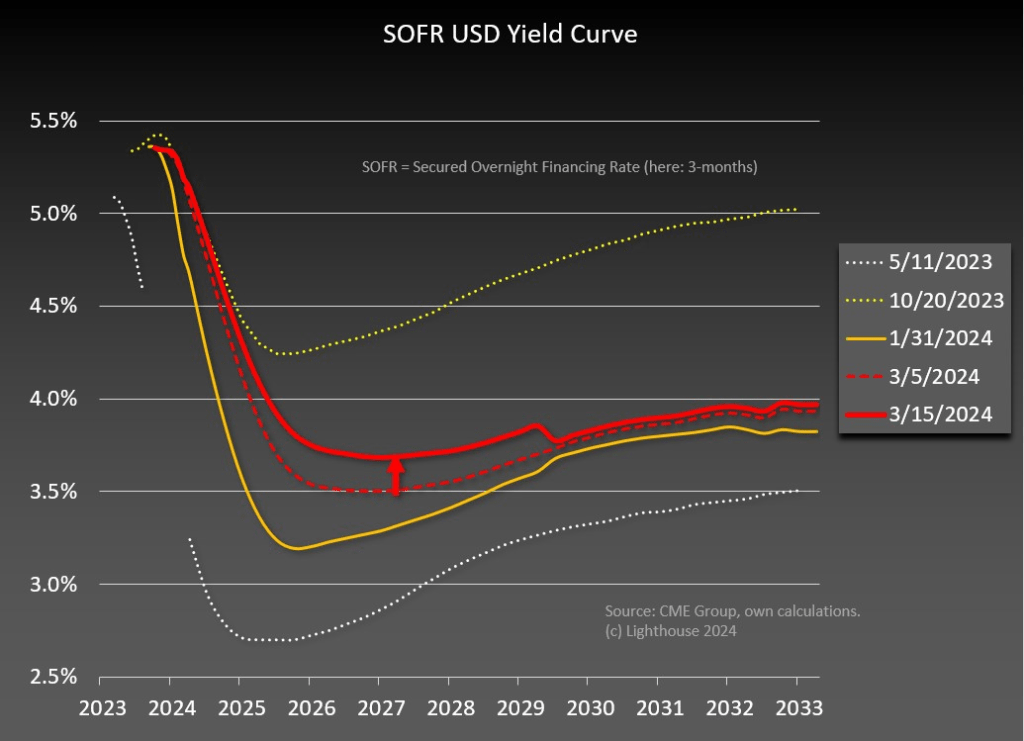

The chart above should act as a reminder to you all that the biggest problem in the world right now is the money. The chart above should also prove to you that the most powerful people throughout the economy are going to fight tooth and nail to protect the broken money because they benefit massively from the fact that it is broken.

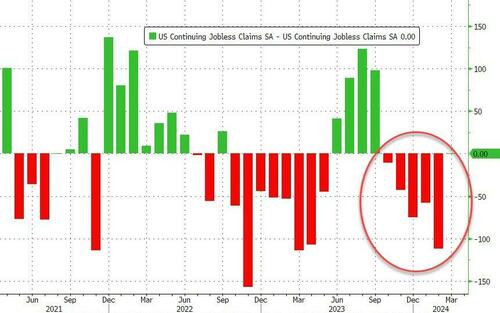

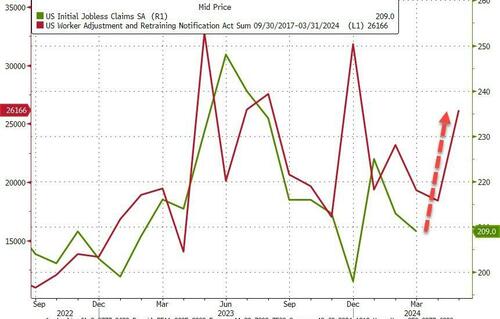

Keep this in mind as the chaos increases and narratives begin to form around using bitcoin as money. But we will never see inflation “normalizing” as long as Congress and Biden keep spending money.

Here are 3 of the BIG SPENDERS, Obama, Biden and Insider trader pro Pelosi. Do any of them look like the care about the bottom 50% of net worth or inflation??

You must be logged in to post a comment.