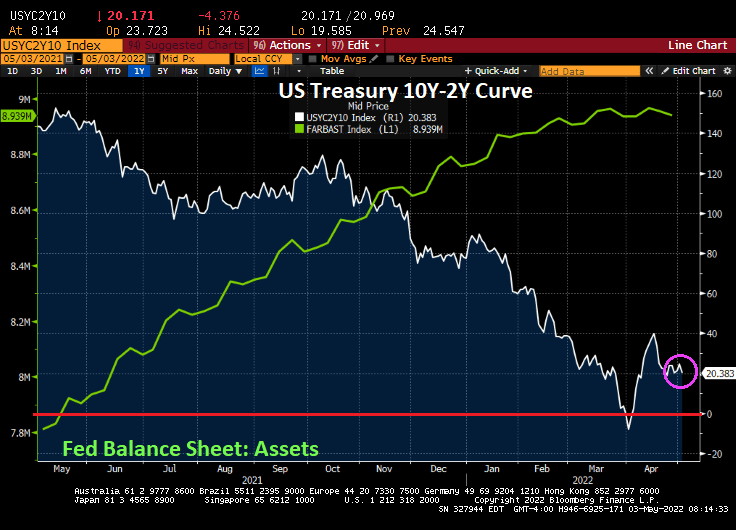

US pension funds seem to have no where to run, and no where to hide. They just need to keep on running as The Federal Reserve tightens.

(Bloomberg) Investors who might be looking for the world’s biggest bond market to rally back soon from its worst losses in decades appear doomed to disappointment.

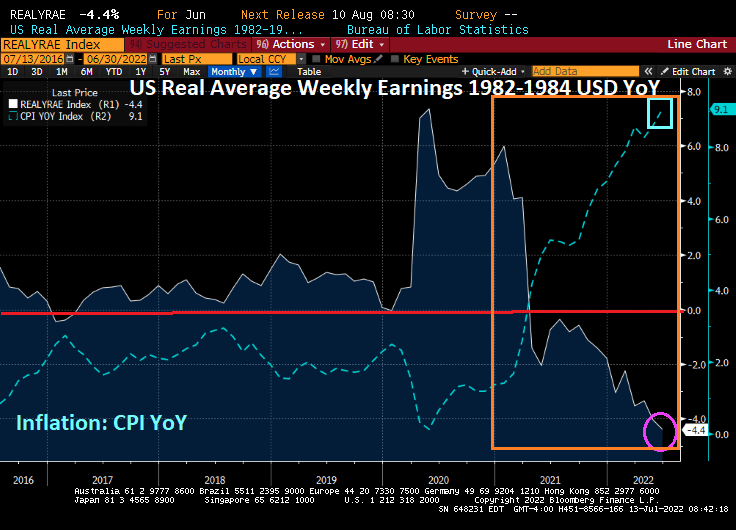

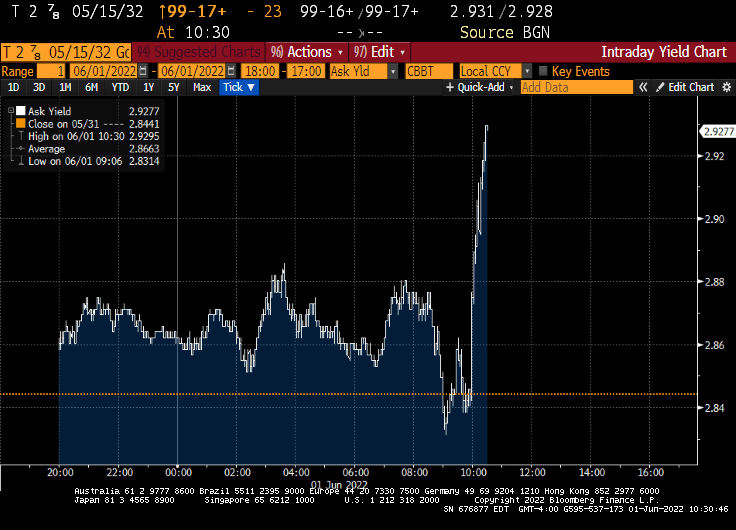

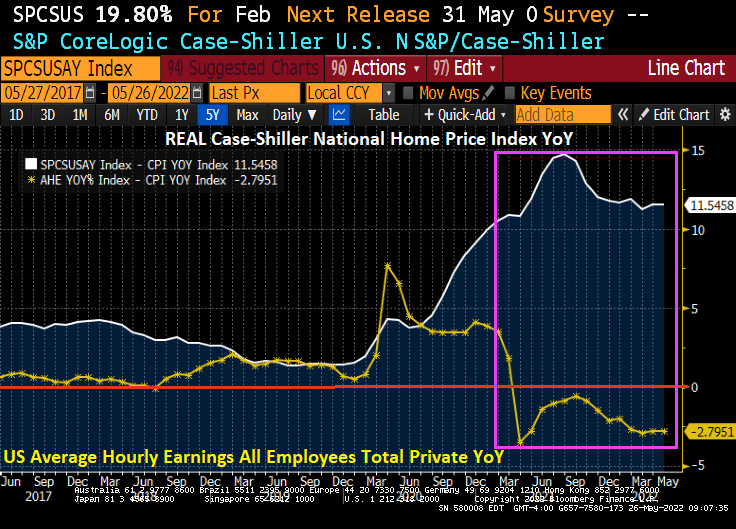

The US employment report on Friday illustrated the momentum of the economy in face of the Federal Reserve’s escalating effort to cool it down, with businesses rapidly adding jobs, pay rising and more Americans entering the workforce. While Treasury yields slipped as the figures showed a slight easing of wage pressures and an uptick in the jobless rate, the overall picture reinforced speculation the Fed is poised to keep raising interest rates — and hold them there — until the inflation surge recedes.

Swaps traders are pricing in a slightly better-than-even chance that the central bank will continue lifting its benchmark rate by three-quarters of a percentage point on Sept. 21 and tighten policy until it hits about 3.8%. That suggests more downside potential for bond prices because the 10-year Treasury yield has topped out at or above the Fed’s peak rate during previous monetary-policy tightening cycles. That yield is at about 3.19% now.

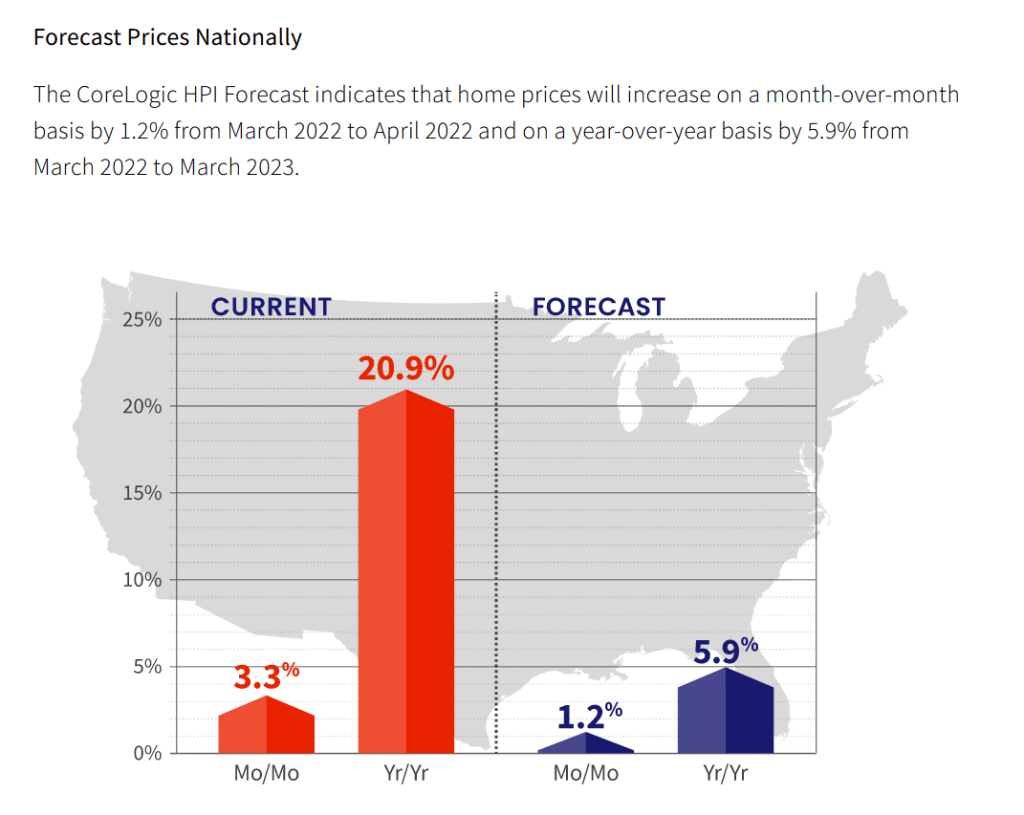

Then we have Bankrate’s 30-year mortgage rate soaring on Fed intervention expectations.

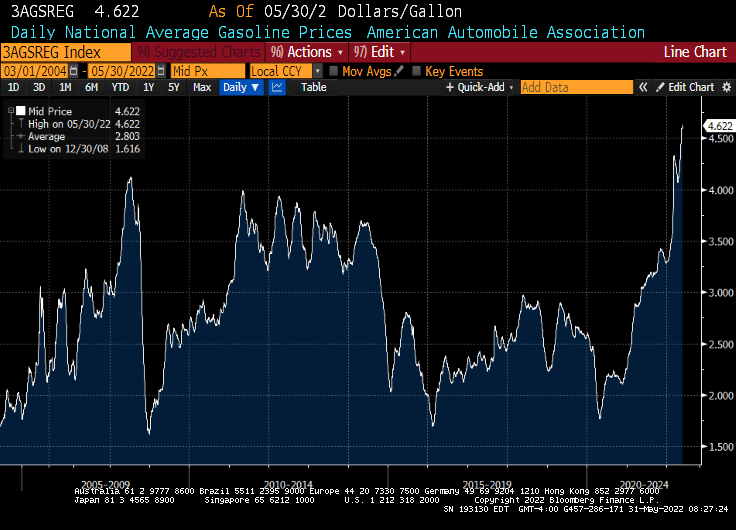

Inflation? US inflation is near its highest in 40 years and the USDollar Plain Vanilla Swap was at 0.50 when Biden first took office as President and is now 3.371 (quite an increase!).

Here is an interesting chart of FNCL 2% Agency MBS.

You must be logged in to post a comment.