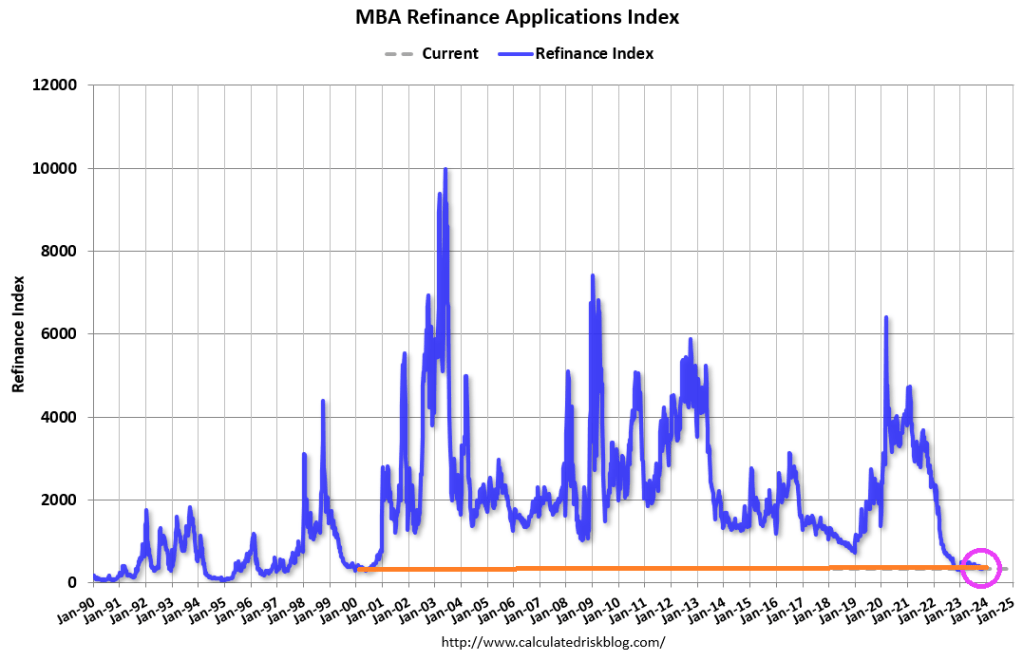

US inflation is lower than it was a year ago (cheers from The View CNN and MSNBC cheerleaders), but inflation remains stubborning above The Fed’s 2% target rate and will likely remain above 2% for the nexf few years. So mortgage demand is much like inflation … mortgage demand increased in the latest week but generally is very low compared to last year.

Mortgage applications increased 2.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 3, 2023.

The Market Composite Index, a measure of mortgage loan application volume, increased 2.5 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 1 percent compared with the previous week. The Refinance Index increased 2 percent from the previous week and was 7 percent lower than the same week one year ago.

The seasonally adjusted Purchase Index increased 3 percent from one week earlier. The unadjusted Purchase Index increased 1 percent compared with the previous week and was 20 percent lower than the same week one year ago.

The 30-year fixed mortgage rate dropped by 25 basis points to 7.61 percent, the largest single week decline since July 2022. But, mortgage rates are up 169% under Biden and Bidenomics.

Bideomics is over, under, sideways, down. Mostly down.

You must be logged in to post a comment.