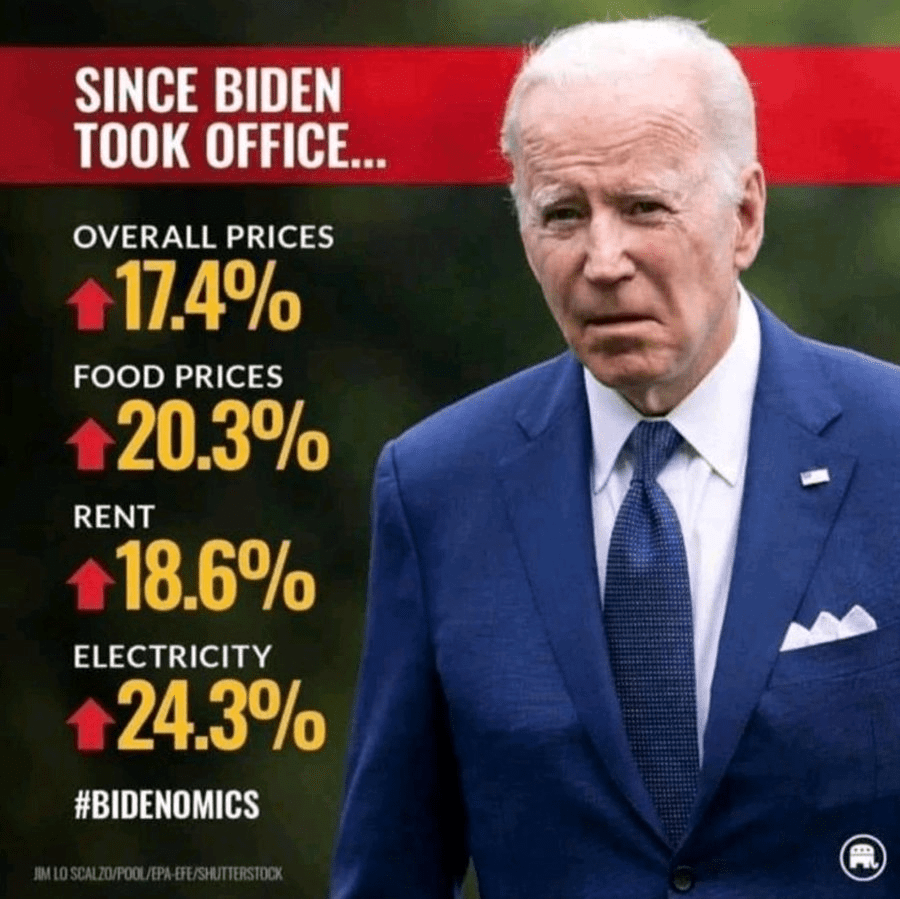

Joe Biden (aka, BeelzeBiden) is really a piece of … work. His policies are helping drive prices through the roof, he seeks to protect deepstate employees against removal by Trump, had a disastrous withdrawal from Afghanistan and is getting the US engaged in possible hot wars in Ukraine (against Russia), open borders allowing US crime to spike, seems to be suppoporting Hamas over our long-time ally Israel, the list goes on. Biden’s big push for electric cars is a Socialist fantasty and simply unrealistick, drives up energy costs and is EXPENSIVE. It is like Biden is the demon Beelzebub from the TV show “Supernatural.” I once referred to Washington DC as “Mordor on The Potomac.”

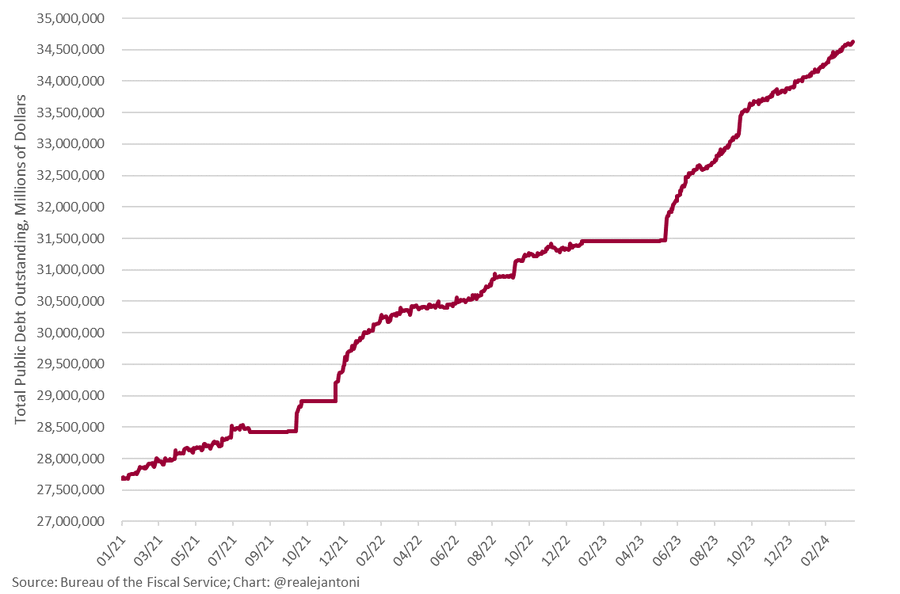

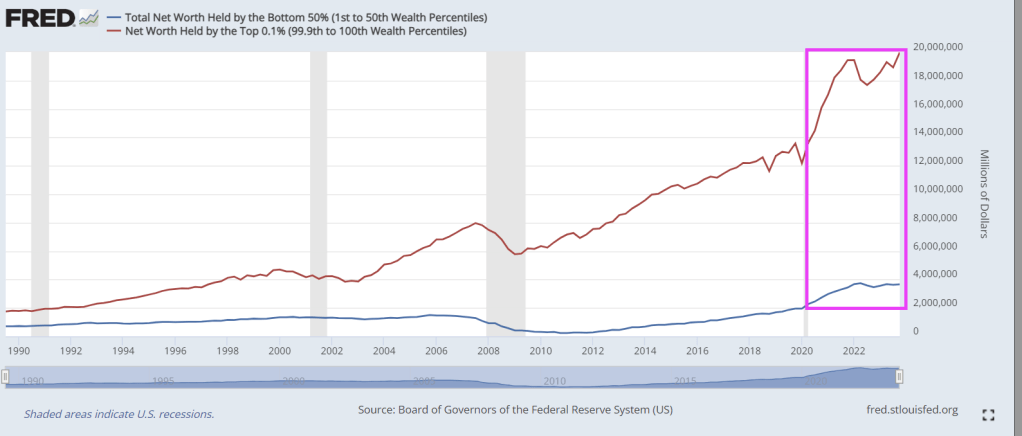

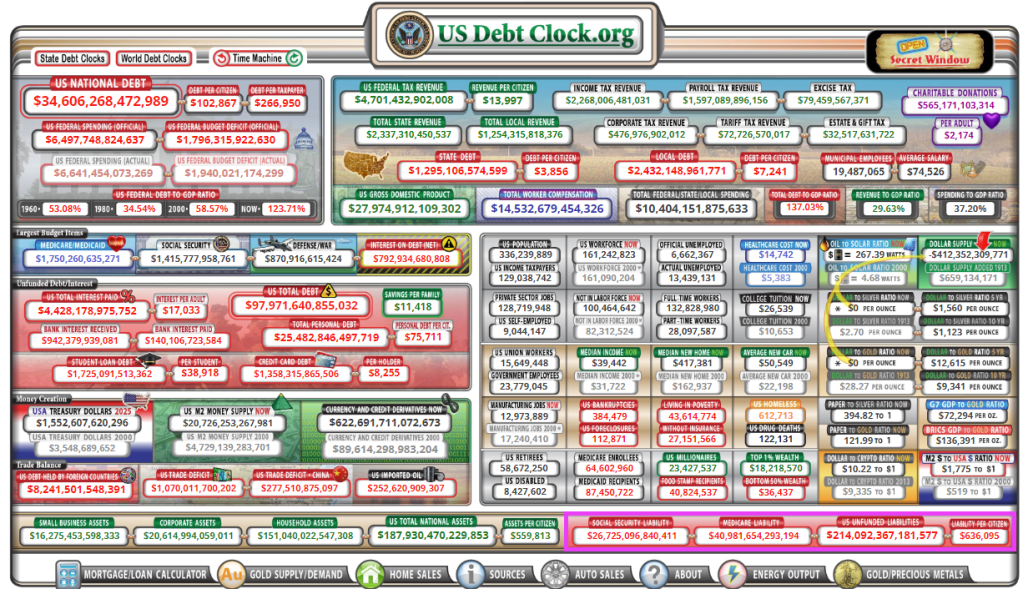

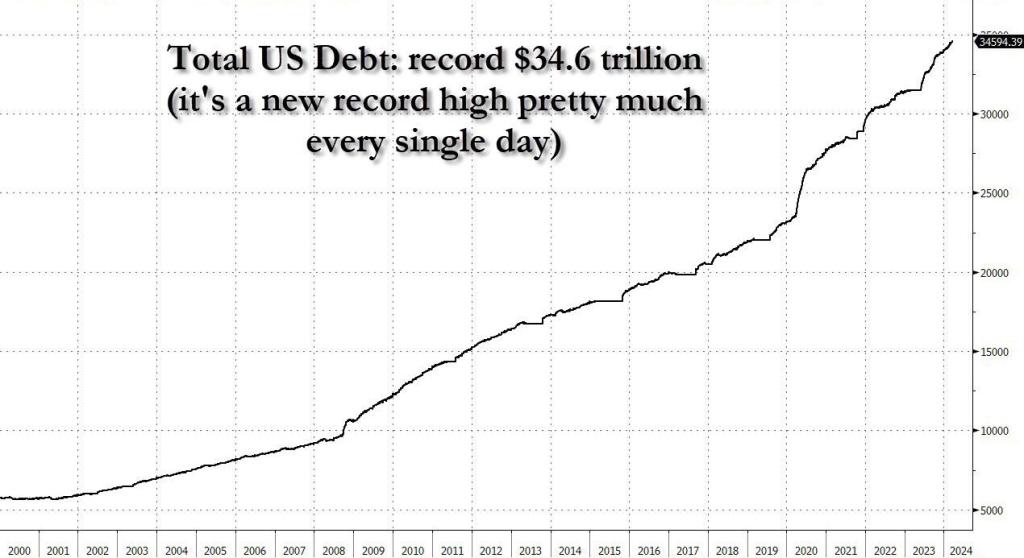

Throw in the Federal Reserve operating outside their mandate (excessive interference in the financial crisis of 2008, the excessive interfernce after the Covid outbreak in 2020) and the two together are destroying the US.

Look at housing prices (up 32.5% under Biden) against the purcchasing power of the US dollar (down -16.1% under Biden).

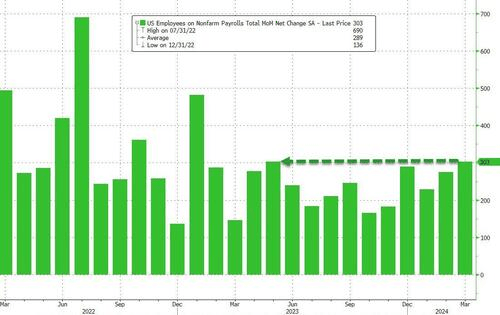

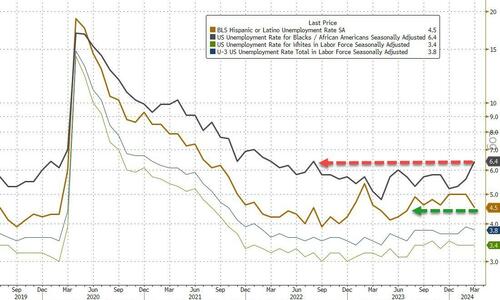

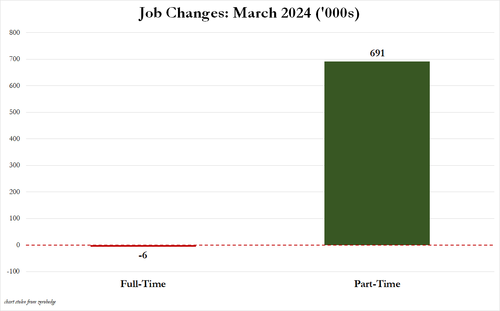

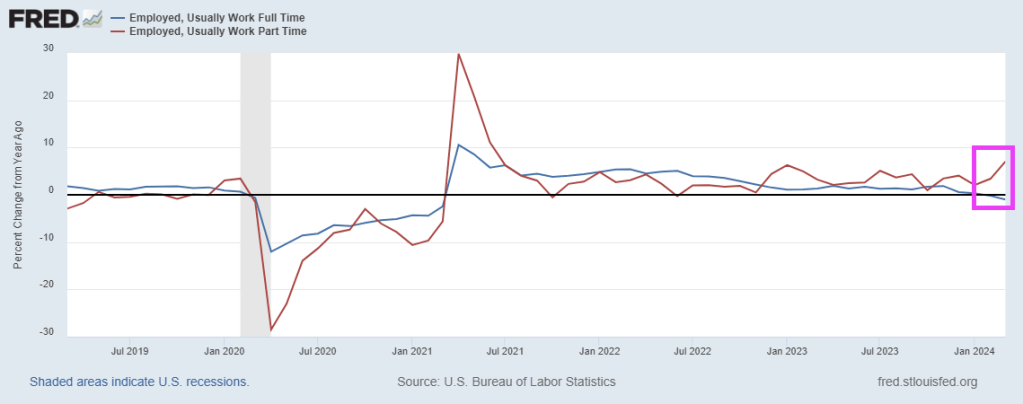

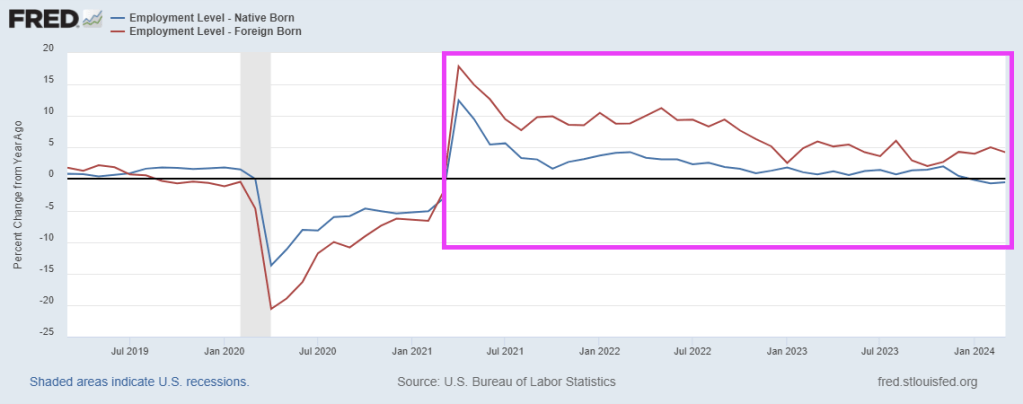

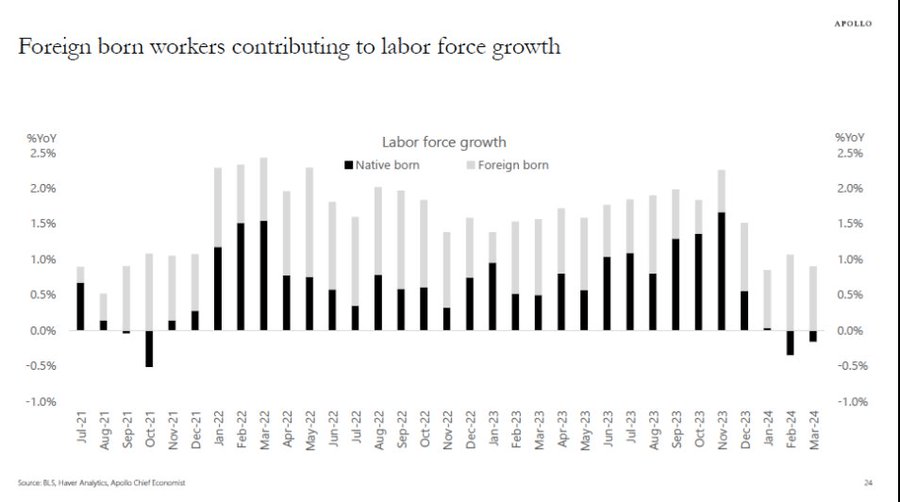

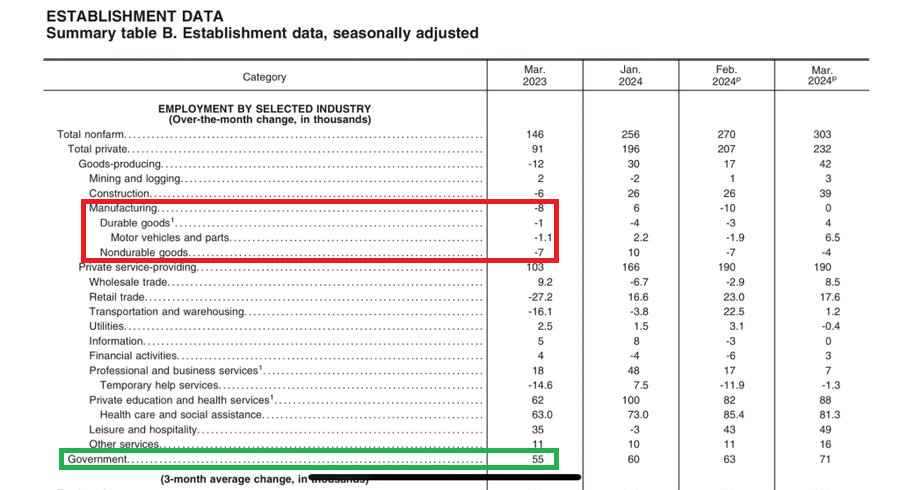

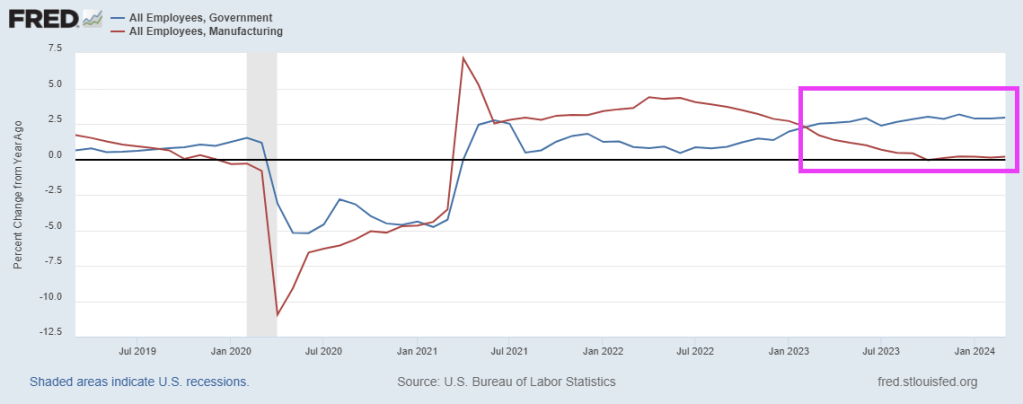

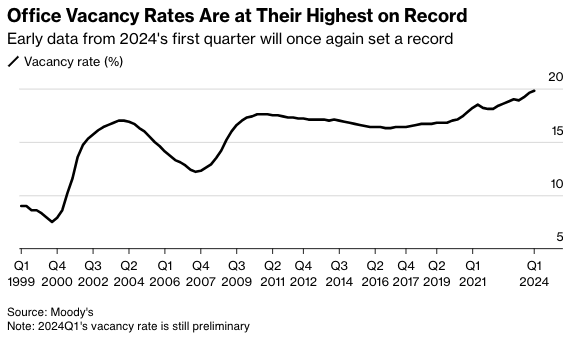

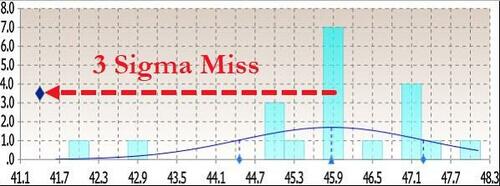

And with mortgage rates up 156% under Biden and housing prices up 32.5% (not to mention the last two jobs reports showed US firms are only hiring part-time workers (and illegal immigrants), the US is experiencing a serious housing affordability crisis.

When people couldn’t afford housing during the Great Depression, they built shantytowns from scrap construction supplies and named them “Hoovervilles,” after President Herbert Hoover. Today, Americans increasingly live out of their cars because they can’t afford housing. If history is any guide, will parking lots full of Americans soon be known as “Bidenvilles”?

The problem has gotten so bad that Sedona, Arizona, recently set aside a parking lot exclusively for these homeless workers. The city is even installing toilets and showers for the new occupants.

Apparently, the City Council thought installing temporary utilities was cheaper than solving the area’s cost-of-living crisis.

And what a crisis it is.

The average home in the city sells for $930,000, while most of the housing available for rent is not apartments, but luxury homes targeted at wealthy people on vacation.

With such a shortage of middle-class housing and with starter homes essentially nonexistent, low- and even middle-income blue-collar workers have nowhere to go at night but their back seat.

Much like America’s Great Depression in the 1930s, this marks a serious regression in our national standard of living. But shantytowns were not prevalent in the 1920s (a decade that began with a depression) or the 1910s. Nor were they ubiquitous following the Panic of 1907, which set off one of the worst recessions in American history.

Indeed, Americans in the Great Depression faced such a cost-of-living crisis that many were forced to accept a standard of living below what their parents and even their grandparents had.

Fast-forward about 90 years, and countless families are in the same boat. Many young people today don’t think they’ll ever be able to achieve the American dream of homeownership that their parents and grandparents achieved. The worst inflation in 40 years, rising interest rates, and a collapse of real (inflation-adjusted) earnings mean a huge step backward financially.

That inflation has pushed up rents so much that young Americans are moving back in with their parents at rates not seen since the Great Depression because they can’t make it on their own. Sometimes, they can’t even make it with multiple roommates.

But many people cannot move back in with family, so the car it is.

The housing problem is not limited to wealthy towns in Arizona, however. It is systemic. The monthly mortgage payment on a median-price home has doubled since January 2021, and rents are at record highs. Like the Great Depression, this disaster stems from impolitic public policy.

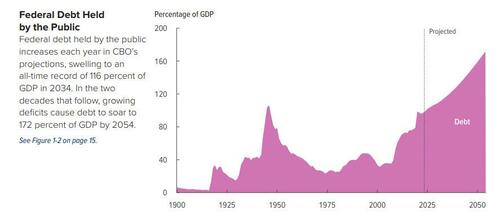

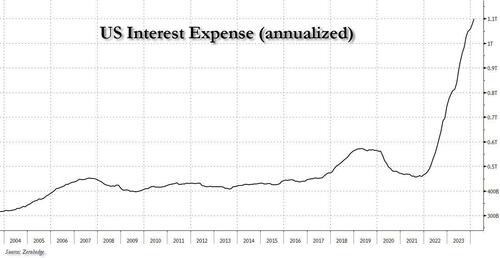

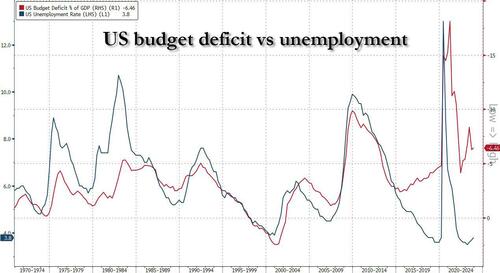

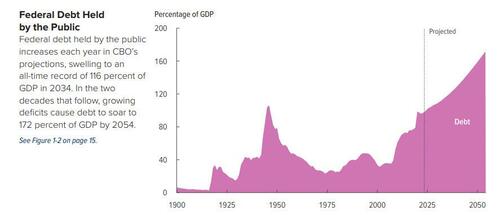

For the past several years, the government has spent, borrowed, and created trillions of dollars it didn’t have. The predictable result of this profligacy was runaway inflation, followed by equally foreseeable interest rate increases.

The deadly combination of high prices and high interest rates has frozen the housing market and reduced homeownership affordability metrics to near-record lows. In several major metropolitan areas, it takes more than 100 percent of the median household after-tax income to afford a median-price home.

Since rents and virtually all other prices have risen so much faster than incomes over the past three years, even renting is unaffordable today, so many people have to go into debt to keep a roof over their heads. And for some, that’s a car roof.

This is the kind of story you might expect from a Third World country or somewhere behind the Iron Curtain during the Cold War, not the largest economy in the world—at least not outside of a depression like the one in the 1930s.

Hoover certainly deserved some blame for the Great Depression, but so did the progressives in Congress, who came from both parties and repeatedly voted to meddle in the economy instead of allowing it to recover from the initial downturn.

Similarly, President Joe Biden deserves blame for constantly advocating runaway government spending. (Runaway Joe??)

But today’s multitrillion-dollar deficits are also made possible by the big spenders in Congress, who come from both parties.

If this bipartisan prodigality of Washington continues, Bidenvilles will only become more widespread as the housing affordability crisis worsens.

Biden’s official White House portrait.

Washington DC under Biden and Schumer, Pelosi, etc.

You must be logged in to post a comment.