California is in the clutches of a fiscal inferno!

California’s budget crisis is projected to expand more than previously thought and could hit a record deficit of $73 billion, according to a new report from the state’s nonpartisan Legislative Analyst’s Office (LAO). The LAO laid out the grim forecast in a Tuesday report that cautions that a $24 billion “erosion in revenues” corresponds to a $15 billion increase in the state’s budget problem. Due to this, the budget deficit, which last month was estimated to hit $58 billion, could now go as high as $73 billion.

Well, if a $73 billion dollar deficit isn’t bad enough, the California State Assembly took a giant step towards bankruptcy by … seriously … A controversial bill that would let illegal immigrants receive the same kind of homebuyer assistance as U.S. citizens has advanced in the California state legislature, drawing criticism from those who object to granting perks to people who break the law by entering the country illegally.

The measure, Assembly Bill 1840, was first introduced in mid-January, and after several amendments, it advanced last week to the Committee on Housing and Community Development, where it awaits further action.

Assembly Bill 1840 would change existing law to allow illegal immigrants to be eligible for the California Dream for All Fund, which provides interest-free loans for a down payment on a home for first-time buyers.

The bill was introduced by California Assemblyman Joaquin Arambula, a Democrat, who last month told GV Wire, a Fresno-based news outlet, that he “wanted to ensure that qualified first-time homebuyers include undocumented applicants.” (Note to Arambula: According to Redfin, there are no homes for $150,000 or less.

Last week, as the bill advanced to committee after amendments, Mr. Arambula told the Los Angeles Times that, historically, homeownership has been the main way people accumulate generational wealth in the United States.

“The social and economic benefits of homeownership should be available to everyone,” he said, arguing that it’s wrong to exclude people from the benefits of the California Dream for All Fund program just because they’re illegal immigrants.

Some lawmakers expressed opposition to the measure as it moves closer to becoming law.

“Assembly Bill 1840 is an insult to California citizens who are being left behind and priced out of homeownership. I’m all for helping first-time homebuyers, but give priority to those who are here in our state legally,” California Sen. Brian Dahle, a Republican, said in a post on X, formerly Twitter.

More Details

The California Dream for All Fund program, administered by the state’s Housing Finance Agency, provides loans for 20 percent of a home’s value but no greater than $150,000. (Good luck finding a house in Los Angeles for under $150,000!) Here is a home in Chico California for $55,000!

Qualifying homebuyers repay the loans when selling or transferring the property plus 20 percent of any appreciation in its value. Applicants who earn less than their county’s area median income get a slight break, having to pay 15 percent of the appreciation. If a home doesn’t appreciate in value, only the principal will be paid back, meaning the loan is technically interest-free.

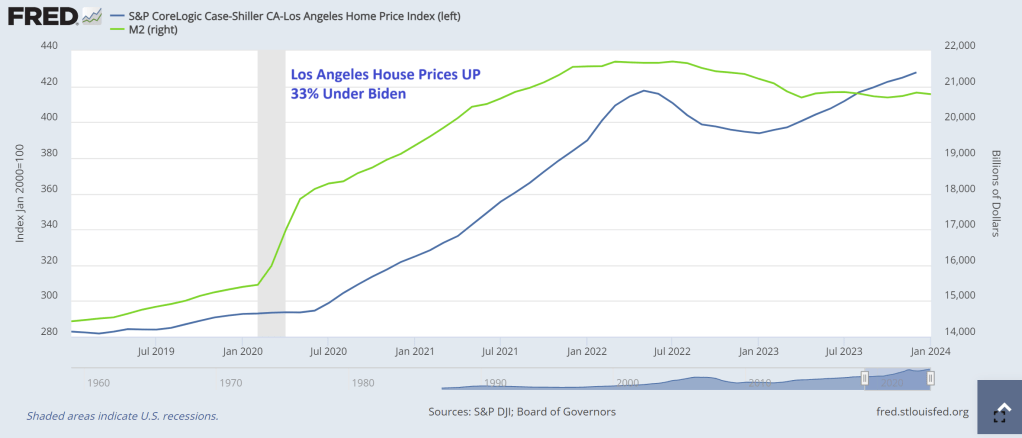

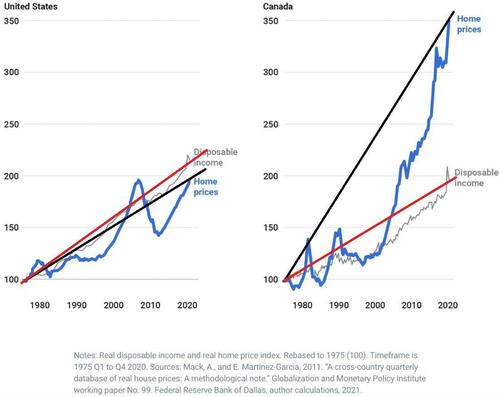

To make matters worse, Los Angeles housing prices are up 33% under China Joe Biden and California Governor Gavin Newsom. NOW they want to drive housing into even more unaffordable territory with allowing illegal immigrants to buy a home with 100% loan-to-value (100% LTV and NO INTEREST!).

I did find a few homes in Los Angeles for under $150,000 on Redfin. Here is a $125,000 home in Van Nuys.

The proposed bill seeks to amend Section 51523 of the California Health and Safety Code to include a subsection that reads: “An applicant under the program shall not be disqualified solely based on the applicant’s immigration status.”

Mr. Arambula has defended the program, arguing in the interview with GV Wire last month that it won’t affect the state budget because the loans are supposed to be paid back with an appreciation fee.

Even though the net impact of the program on the state budget is technically neutral-to-positive, some critics argue that it sends the wrong message and effectively rewards illegal immigration.

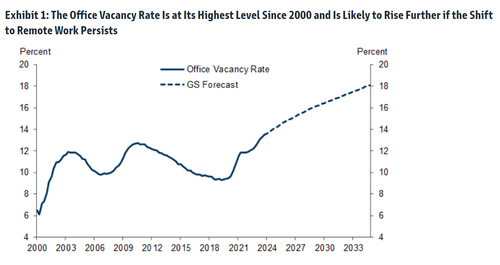

“We have a huge housing crisis in California and anything we can do to get people into housing we should do. However, we should help our own first. This next generation of people growing up can’t afford a house. I’ve got two kids in their early 30s and most of their friends do not own houses,” San Diego County Supervisor Jim Desmond, a Republican, told NBC 7 San Diego.

Mr. Desmond has been a vocal critic of policies that he says create incentives for people to enter the country illegally.

“You incentivize illegal immigration by providing free healthcare, free unemployment benefits and tons of other freebies,” he wrote in a recent post on X, reacting to a post by California Gov. Gavin Newsom, a Democrat, who called on Congressional Republicans to back President Joe Biden’s border deal.

“It’s no wonder we are getting thousands of people by the day. This is on you as much as the Federal Government,” Mr. Desmond added.

Mr. Desmond said on March 3 that over 5,000 illegal immigrants had been released in San Diego County over the past 10 days.

“What’s striking about the people being dropped here by the Border Patrol is about 70 percent of them are single males,” he told Fox News.

While many of the new arrivals are being taken to the airport by local nongovernmental organizations to fly out to someplace else in the country, Mr. Desmond lamented that “in the meantime, our airport is now the new migrant shelter.”

His remarks come as the United States remains in the throes of an illegal immigration crisis of historic proportions, with some border patrol officials and others warning of a national security risk.

Military-Aged Men Crossing Border

The head of the Border Patrol union recently warned about the sharp rise in the number of military-aged Chinese men crossing the U.S.–Mexico border illegally.

National Border Patrol Council President Brandon Judd said in a recent interview on “Just the News, No Noise” TV program that he believes some of them may be spies working on behalf of China’s communist regime to infiltrate the United States.

“At best, they’re here for a better life,” Mr. Judd said. “At worst, they’re here to be part of the Chinese government to infiltrate our own country.”

His remarks came as U.S. Customs and Border Protection (CBP) released its latest data for January encounters with illegal immigrants who crossed the border into the United States.

Aside from showing that Border Patrol agents encountered a record number of illegal immigrants (242,587) in January 2024 compared to any previous January, the CPB numbers show an alarming trend in the number of military-aged Chinese nationals entering the country illegally.

Border Patrol agents encountered 5,717 single Chinese adults in January, more than twice the number of any other January on record, CBP data shows. In December 2023, that figure rose to a record of 7,581, while the total since January 2023 stands at 64,979.

Some analysts say that deteriorating economic conditions in China, along with human rights abuses and policies such as strict COVID-19 lockdowns, are likely driving the increase.

The San Diego Sector has seen a more than 500 percent jump in the number of Chinese nationals entering the country illegally, according to Jason Owens, the chief of the U.S. Border Patrol.

You must be logged in to post a comment.