Joe Biden, his Administration, and The Federal Reserve are really “The Alligator People.” Despite what they tell you, they have small brains (particularly Biden) and are hyperfocused on spending.

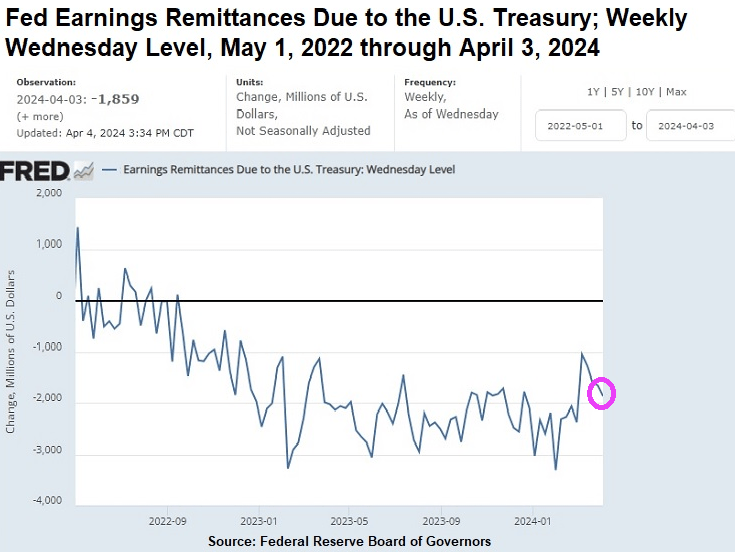

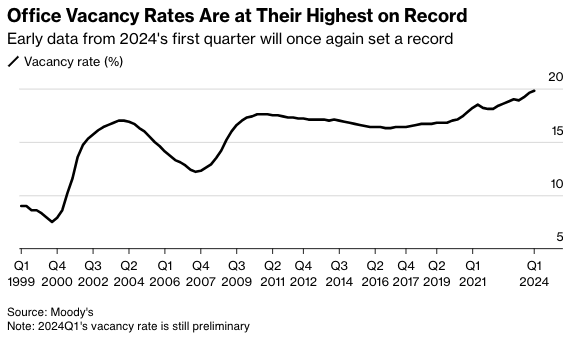

A good example comes from “Wall Street On Parade” where they show that The Federal Reserve is still paying BILLIONS to US Treasury in the form of remittances (losses). While at the same time, paying the mega banks on Wall Street high interest loans.

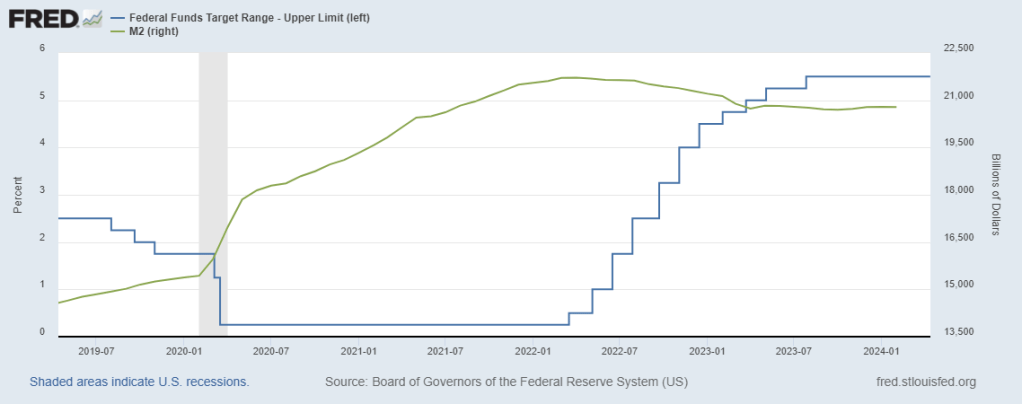

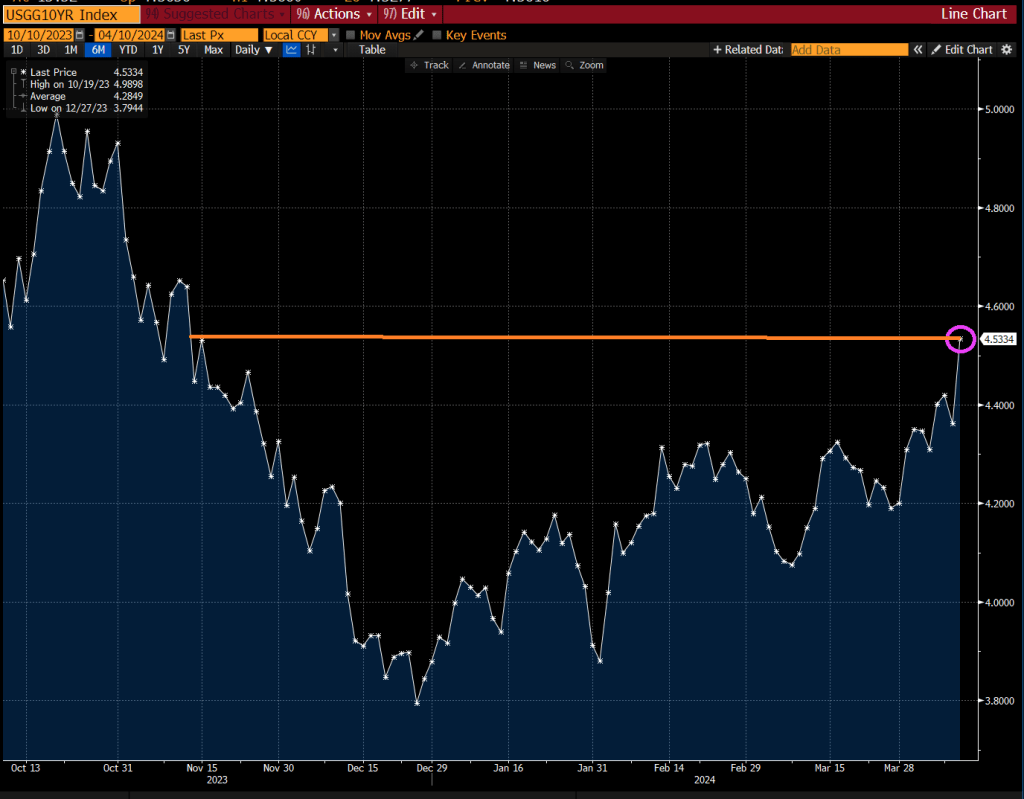

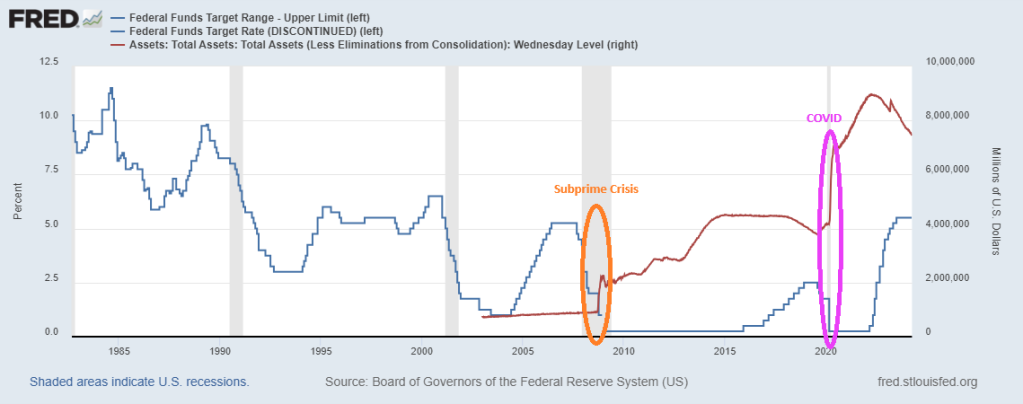

As of April 3 of this year, the Federal Reserve (Fed) has racked up $161 billion in accumulated losses. We’re not talking about unrealized losses on the underwater debt securities the Fed holds on its balance sheet, which it does not mark to market. We’re talking about real cash losses it is experiencing from earning approximately 2 percent interest on the $6.97 trillion of debt securities it holds on its balance sheet from its Quantitative Easing (QE) operations while it continues to pay out 5.4 percent interest to the mega banks on Wall Street (and other Fed member banks) for the reserves they hold with the Fed; 5.3 percent interest it pays on reverse repo operations with the Fed; and a whopping 6 percent dividend to member shareholder banks with assets of $10 billion or less and the lesser of 6 percent or the yield on the 10-year Treasury note at the most recent auction prior to the dividend payment to banks with assets larger than $10 billion. (This morning the 10-year Treasury is yielding 4.41 percent.)

Operating losses of this magnitude are unprecedented at the of Fed, which was created in 1913. In a press release dated March 26, the Fed stated this: “The Reserve Banks’ 2023 sum total of expenses exceeded earnings by $114.3 billion.”

As of March 13 of this year, the Fed’s accumulated losses stood at $156.24 billion and yet on March 20 the Federal Reserve voted to sustain those high 5+ percent interest rates to its member banks – making it look like the captured regulator it is considered to be by millions of Americans.

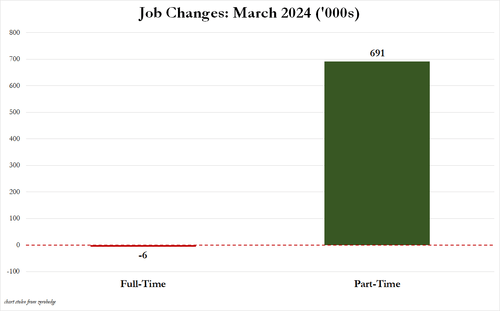

As the chart above indicates, the Fed’s ongoing weekly losses have ranged from a high of $3.3 billion for the week ending Wednesday, January 31, 2024, to $1.86 billion for the most recent week ending Wednesday, April 3, 2024.

American taxpayers have good reason to sit up and pay attention to the Fed’s giant and ongoing losses. That’s because when the Fed is operating in the green, as it was on an annual basis for 106 years from 1916 through 2022, the Fed, by law, turns over excess earnings to the U.S. Treasury – thus reducing the amount the U.S. government has to borrow by issuing Treasury debt securities. According to Fed data, between 2011 and 2021, the Fed’s excess earnings paid to the U.S. Treasury totaled more than $920 billion.

The loss of remittances from the Fed means the U.S. government will go deeper into debt, putting a heavier tax burden on the U.S. taxpayer and raising the risk of another credit rating agency downgrade of U.S. sovereign debt.

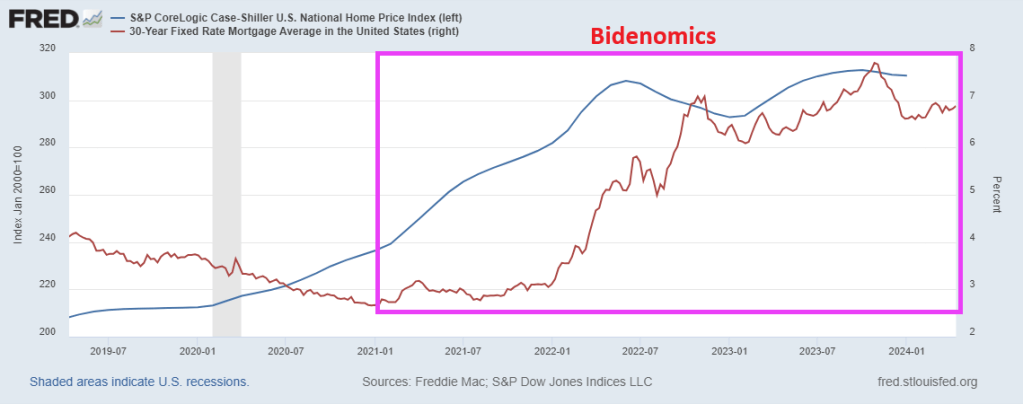

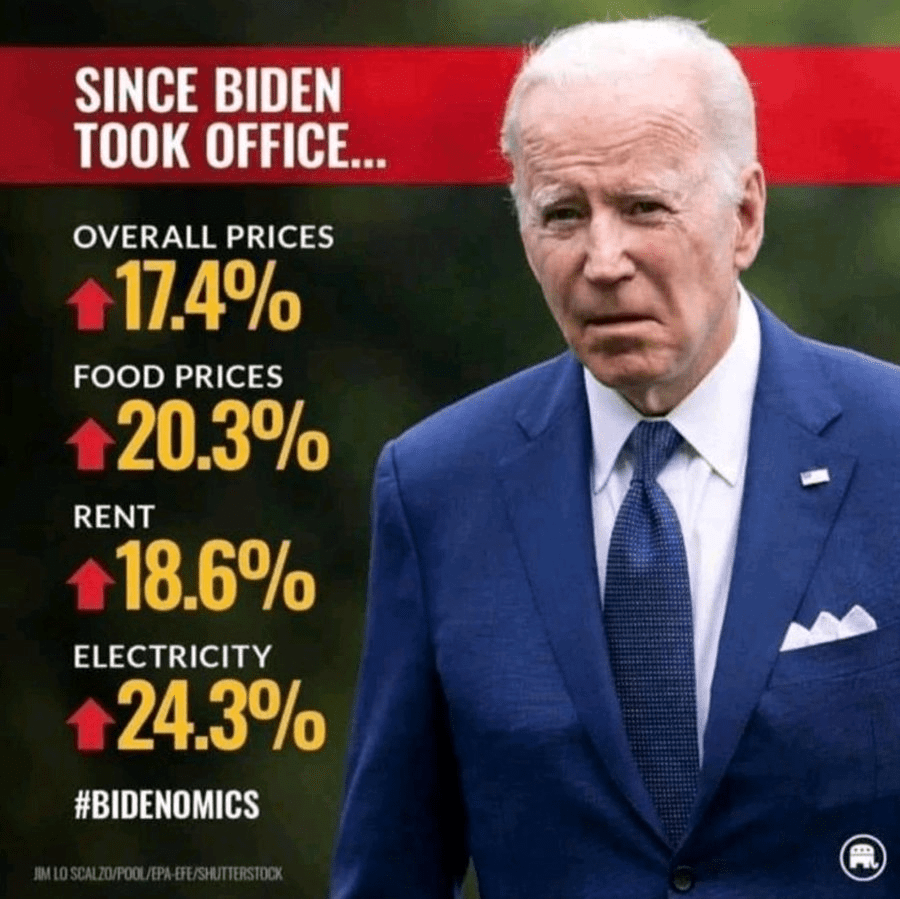

Of course, The Allgator People like Joe Biden, Treasury Secretary Janet Yellen and Fed Chair Jerome Powell, will Treasury remittances as “free money” to spend. And its an election year, so Joe Biden (aka, King Gator) is canceling $7.4 billion in student debt for 277,000 borrowers. Only alligators in Washington DC considered this action to have no consequences.

WHO pays for the student loan forgiveness? It just doesn’t vanish, it is transferred to taxpayers. Alligators like Alexandria Ocasio Cortez going on talk shows to argue the benefits of being free from financial obligations that student voluntarily agreed to. Say, can AOC get my mortgage forgiven?? Just kidding. Now those same students can borrow additional money to get MBA degrees with the expectation that the student loan is “free money.”

Yes, Biden is acting recklessly (no surprise). Here is a picture of King Gator, Joe Biden.

The Biden Administration and The Federal Reserve ARE the alligator people. Except these gators are hungry for your money and votes constantly.

You must be logged in to post a comment.