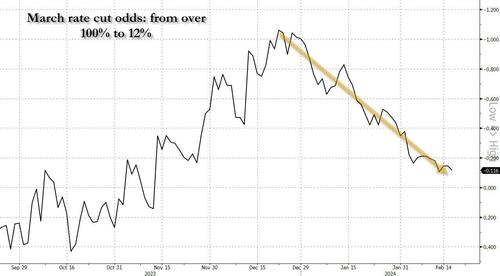

Back in mid-December, after the Fed’s first, and very shocking, dovish pivot when just two weeks after Powell said it had been “premature” to speculate on rate cuts the Fed suddenly changed its mind (despite very strong economic reports in the interim) and unexpectedly revealed it had been “discussing a timeline to start rate cuts”…

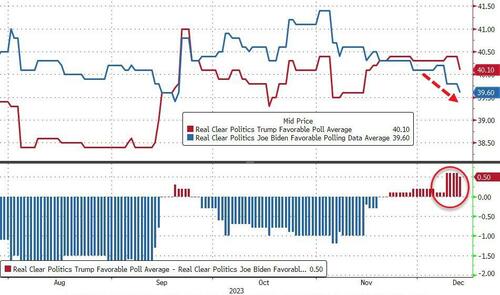

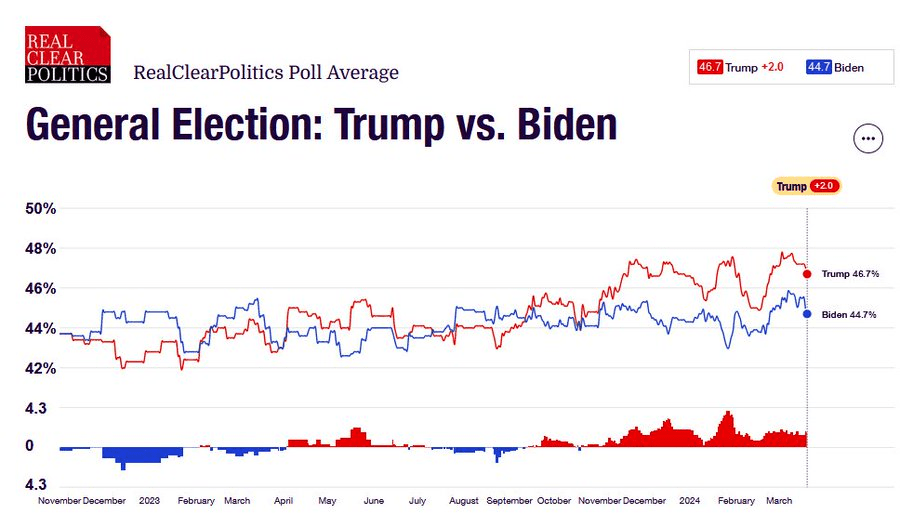

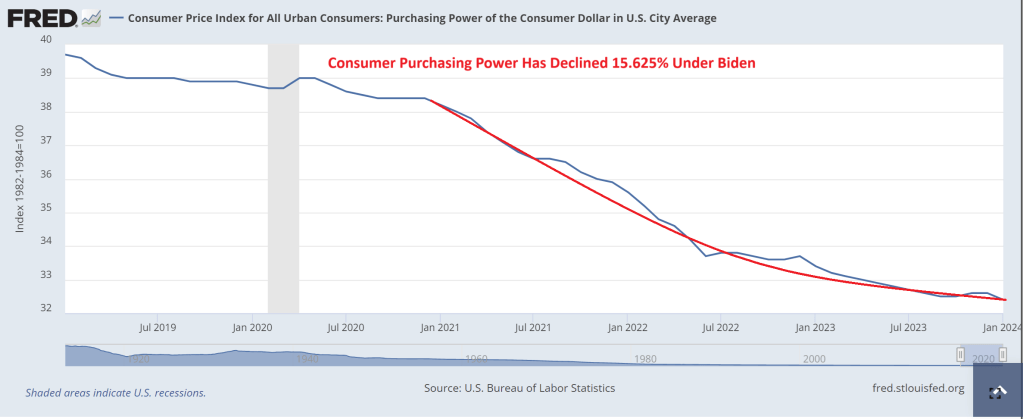

… in the process, sparking the biggest market meltup in a decade, we explained that there was no mystery behind the Fed’s sudden change of heart: it had everything to do with Biden’s woeful performance in the polls.

… maybe what that happened in the past two weeks had nothing to do with economic data, the state of the US consumer, or how hot inflation is running and everything to do with… phone calls from the increasingly angry White House, the same White House which after seeing the latest polling data putting Biden at the biggest disadvantage behind Trump despite the miracle of “Bidenomics” decided to pull its last political level, and had a back room conversation with the Fed Chair, making it very clear that it is in everyone’s best interest if the Fed ends its tightening campaign and informs the market that rate cuts are coming. It certainly would explain why despite keeping the 2026 projected fed funds rate unchanged at 2.875%, the Fed just as unexpectedly decided to pull one full rate cut out of the non-election year 2025 and push it into the pre-election 2024.

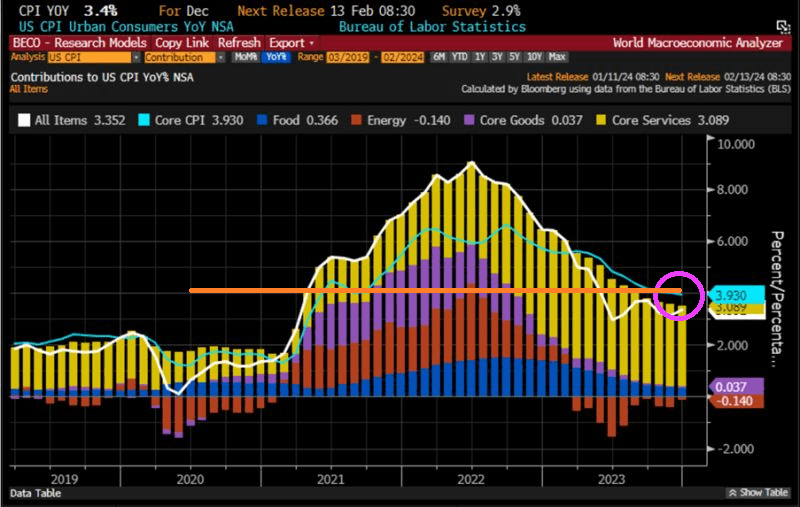

Three months later, when Powell again shocked the world with yet another exceedingly dovish press conference, this time pushing the S&P to all time highs as it became increasingly clear the Fed has raised its inflation target to 3% or more, as we first discussed in “There Goes The Fed’s Inflation Target: Terminal Rate To Rise 100bps To 3.5% And More” and as Bloomberg confirmed today in “Powell Ready to Support Job Market Even If Inflation Lingers“, there was again some confusion, most notably from the likes of Jeff Epstein BFF Larry Summers who tweeted:

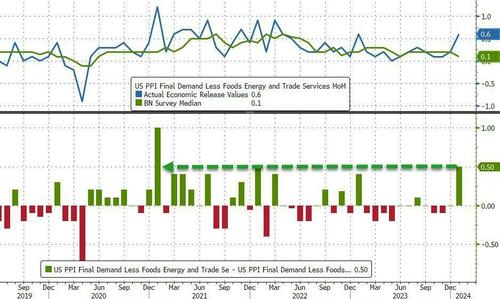

I don’t know why @federalreserve is in such a hurry to be talking about moving towards the accelerator. We’ve got unemployment, if anything, below what they think is full capacity. We’ve got inflation, even in their forecast, for the next two years above target. We’ve got GDP growth rising if anything faster than potential. We have financial conditions, the holistic measure of monetary policy, at a very loose level.

… to which we again replied that there is a very simple reason why the Fed is “moving toward the accelerator” and it again had to do with the fact that Biden approval rating is now imploding, so much so that even Time magazine has stepped in with an intervention.

But while once upon a time such a cynical, hyperbolic, and apocryphal view would have been relegated to the deep, dark corners of the financial blogosphere (duly shadowbanned and deboosted by the likes of such Democratic party stalwarts as Google, of course), that is no longer the case and in his latest note, SocGen’s in-house permaskeptic, Albert Edwards confirmed our view that the biggest driver behind the Fed’s decision making in recent months is neither the economy, nor the market, but rather the November presidential election, to wit:

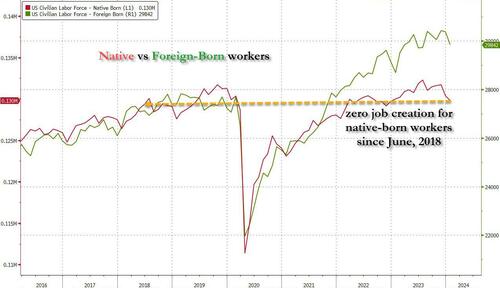

The widening inequality chasm in this US election year will be a real issue for policy makers. What will the Fed do? Traditionally, the Fed would not pivot rates policy to cushion inequality, which is usually addressed by fiscal policy. But growing inequality has been a key issue ever since the 2008 Global Financial Crisis triggered a backlash against ‘The Establishment’ – most evident in the rise in popularism (although many, including myself, believe that the loose money/tight fiscal policy mix was primarily responsible).

Might the unfolding inequality crisis force the Fed to bow to intense political pressure to cut rates faster and deeper? I think that is entirely plausible. Indeed we on these pages have previously observed, somewhat cynically, that Powell’s recent ‘surprise’ December 2023 dovish pivot came exactly at a time when Donald Trump was pulling ahead in the polls – link. But it would be a diehard cynic who could contemplate that the Fed, as part of ‘The Establishment’, would balk at the thought of Trump winning in November and juice up the economy to try and lower the odds of such an outcome. (I am that cynic.)

To be fair, we find it remarkable that Edwards – a long-tenured and respected veteran of the SocGen macro commentariat – would confirm our own observations. We doubt he is the only one, of course, but the others are far more afraid of losing their jobs, at least for now.

What we find less remarkable is that Edwards – whose job is to track down gruesome and painful ways for the market to die a miserable death – has done just that again and this time, in the aftermath of the BOJ’s long overdue exit from NIRP, ETF buying and Yield Curve Control, predicts that it is now only a matter of time before the YCC that was spawned in Japan will soon shift to the west.

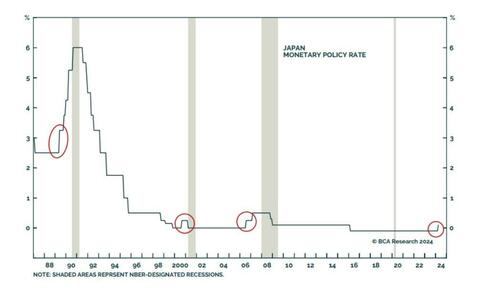

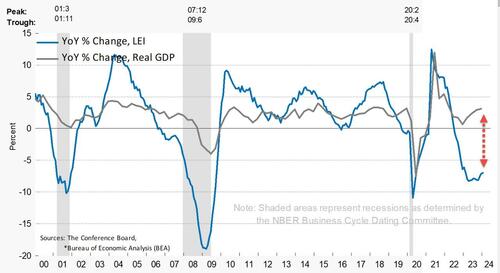

Edwards starts off by observing what has long been a “foolproof” signal of imminent recession: BOJ tightenging:

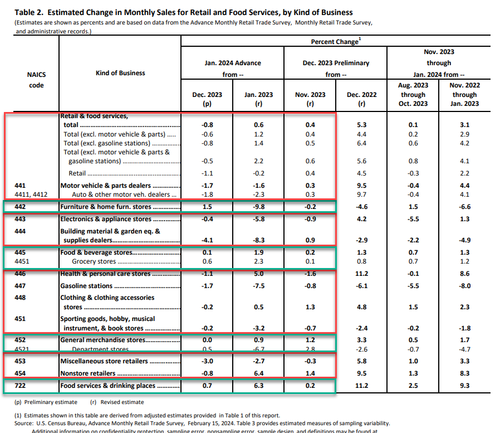

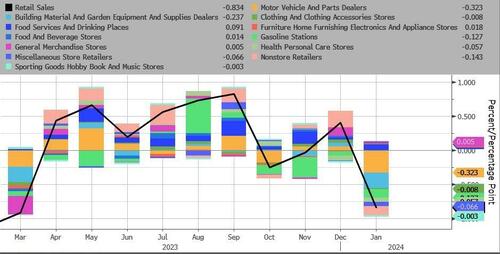

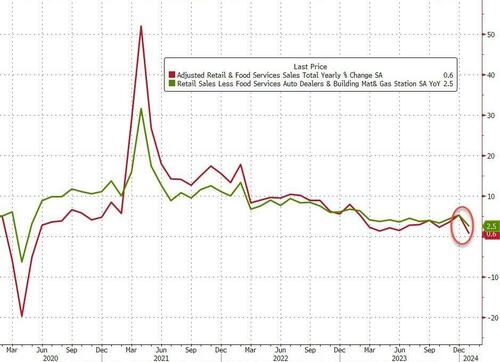

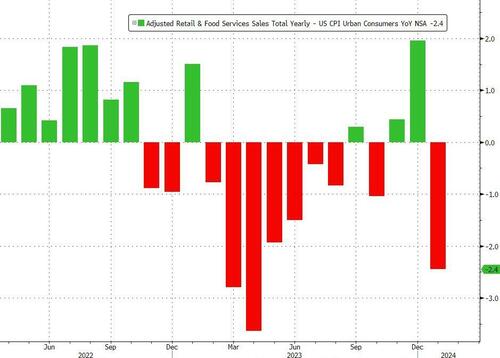

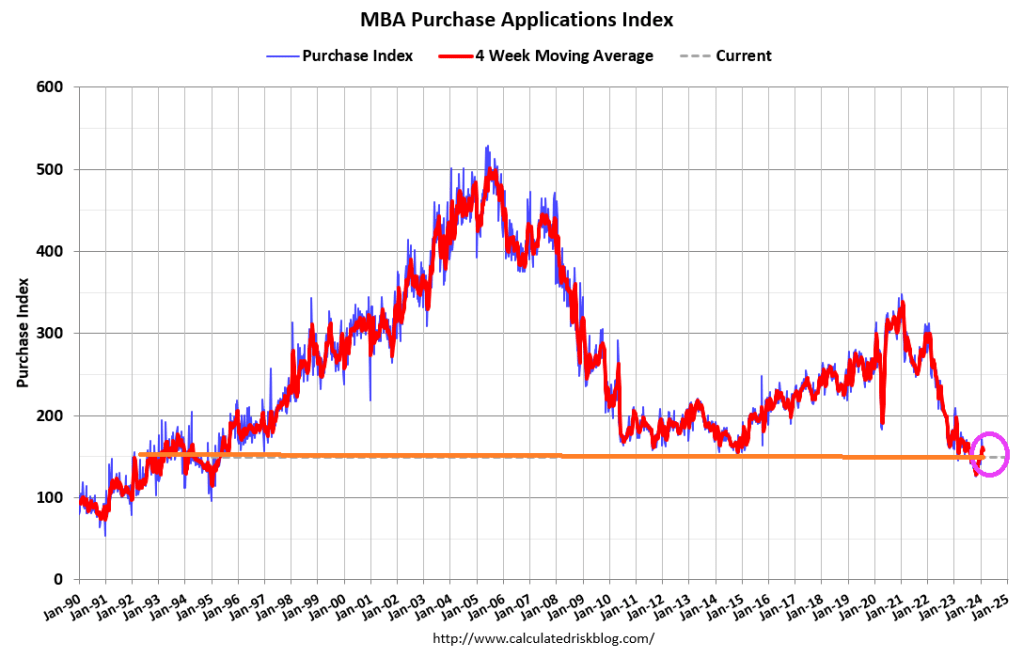

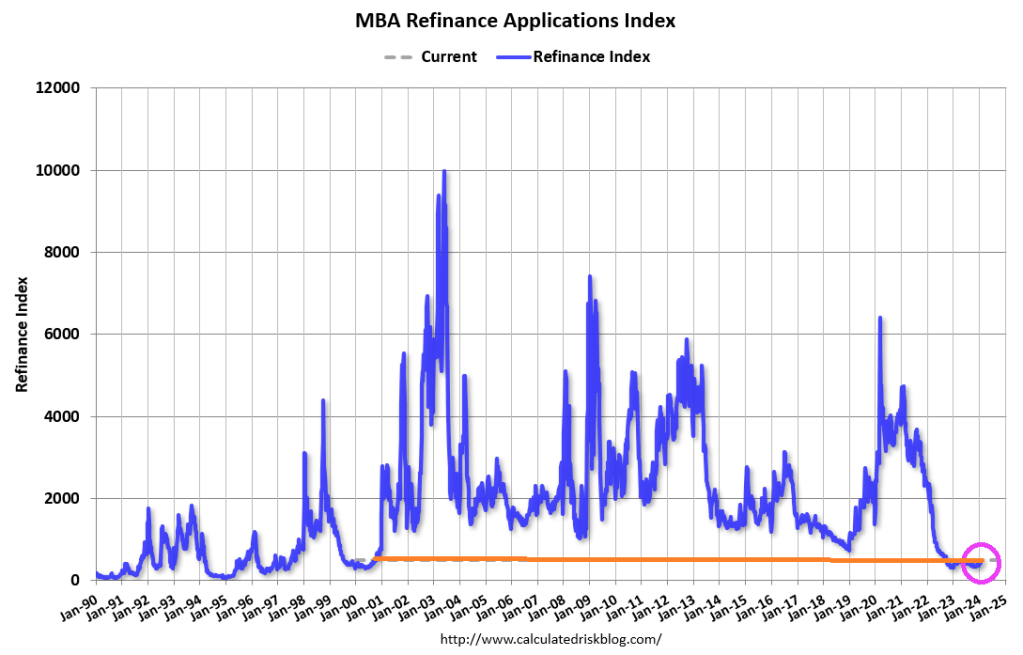

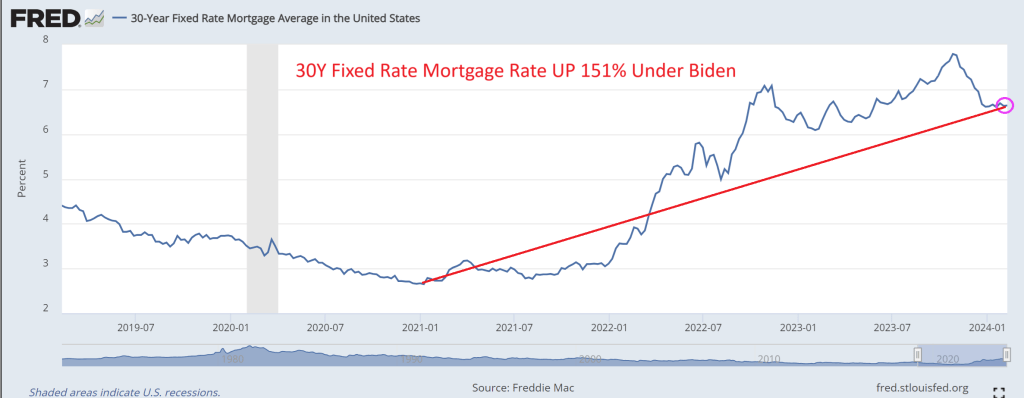

Market sentiment is now especially vulnerable to weak economic data because, as we pointed out last week, it seems everyone (and their dog) has left their recessionary worries far behind. But as my favorite bear, David Rosenberg, pointed out this week, recent weak retail sales, housing starts, and industrial production data might be setting us up for a negative US Q1 GDP print. Let’s see how the Fed reacts to that. And if you want one reliable predictor of a global recession, @PeterBerezinBCA notes that “In the history of modern finance, no single indicator has done a better job of predicting when the next global recession will start than when the Bank of Japan starts raising rates. Foolproof!”

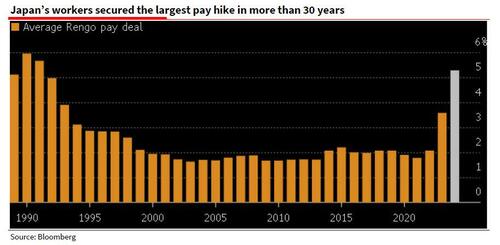

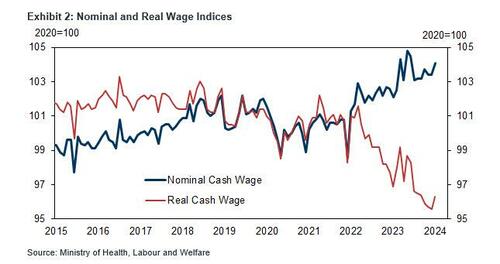

He then recaps last week’s main event, namely that after almost a decade, Japan finally exited negative interest rates and Yield Curve Control (YYC), primarily on the back of soaring (nominal, not real) wage gains: “Rengo, Japan’s largest trade union confederation, announced last Friday that its members have so far secured pay deals averaging 5.28%, far outpacing the 3.8% squeezed out a year ago — itself the highest gain in 30 years (see Bloomberg here and SG Economist Jin Kenzaki’s analysis of this data and the BoJ’s move here).“

Of course, the problem in Japan is not that nominal wages are surging: it is that in real terms they are crashing, as the next chart clearly shows, and is why the BOJ will have to dramatically tighten – certainly much, much more than the laughable “dovish hike” it delivered last week which sent the yen plunging to a multi-decade low and inviting even more imported inflation – to avoid total collapse in Japan’s economy as it gradually accelerates toward hyperinflation:

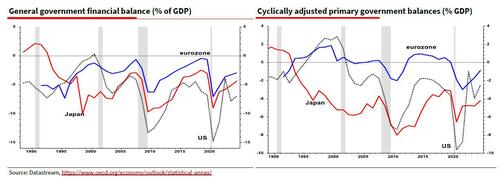

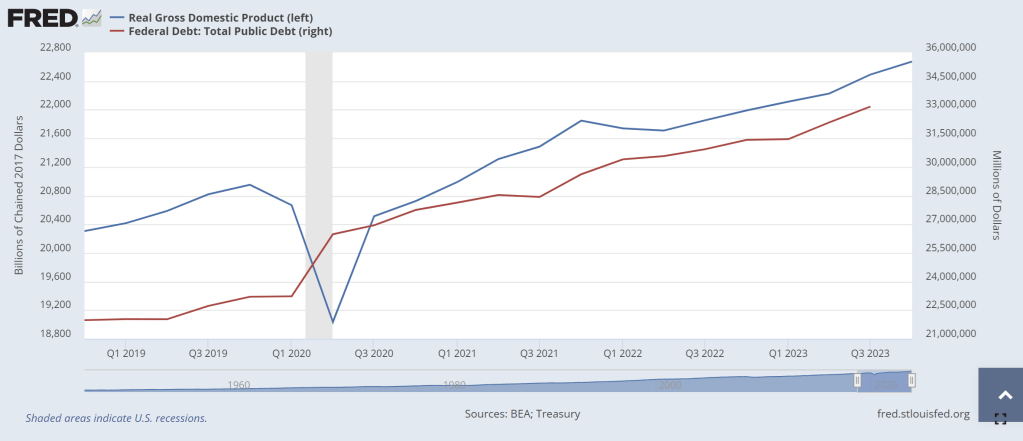

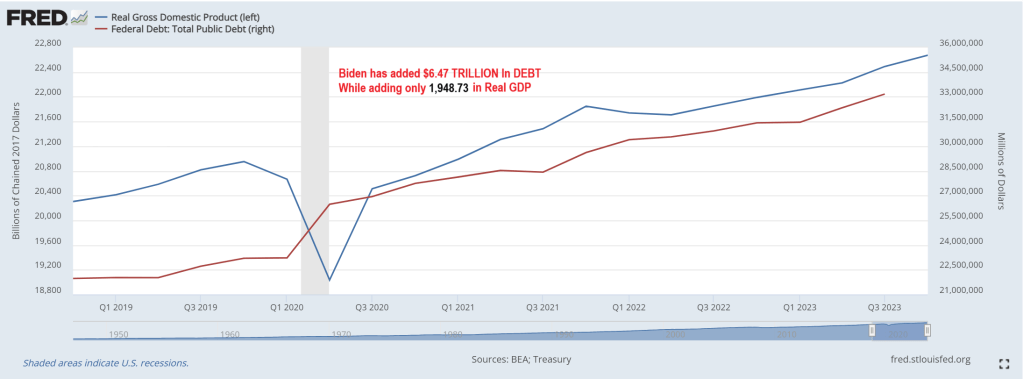

Of course, Japan can not actually tighten as that would instantly vaporize the economy and the bond market of a country whose central bank owns Japanese JGBs accounting for well more than 100% of GDP. But at least Japan has something goign for it: as Edwards notes, “the OCED estimates that interest on US debt amounts to 4½% of GDP, compared to only 0.1% of GDP for Japan (link). Hence the cyclically adjusted primary (ex-interest) deficit data show Japan as the most profligate borrower (see right hand chart). But the US still has to pay that interest somehow.” In other words, when adding interest payment, “it is the US that has been running the largest deficits since the 2008 GFC – bigger than even Japan (see left hand chart).”

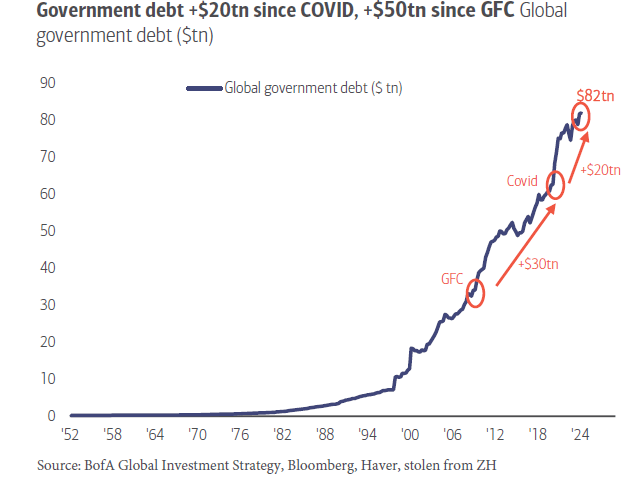

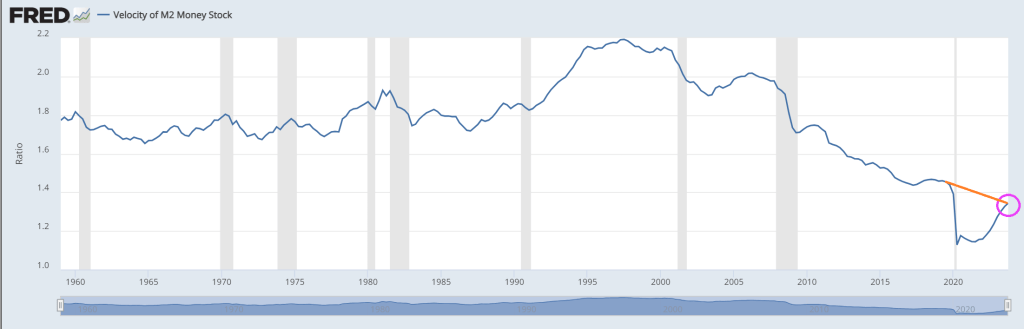

Which brings us to Edwards’ punchline: “decades of excessively loose monetary policy has allowed governments to ruin their fiscal situations to the point that public debt to GDP ratios are on wholly unsustainable trajectories. Just look at the CBO’s projections for the US here. Yet with an ever-intensifying populist backlash against high levels of inequality, I can only see one way out of this mess for western economies. Nothing less than Financial Repression including Yield Curve Control – yes, the very same YCC that Japan has just abandoned.”

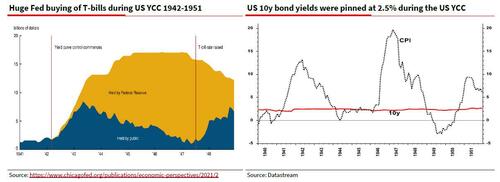

For those who may not have been around back in the 1940s when the US – and the Federal Reserve – was the first developed nation to utilize YCC to kickstart the US economy at a time of record debt to GDP, here is a quick primer from the SocGen strategist: “Financial Repression essentially entails holding interest rates below the rate of inflation for a lengthy period to allow debt to be ‘burned off’. This is a tried and trusted way for governments to wriggle free from excessive debt (eg the US after WW2). The leading economic historian Russell Napier explained how this works in an informative 2021 interview with The Market NZZ – link.”

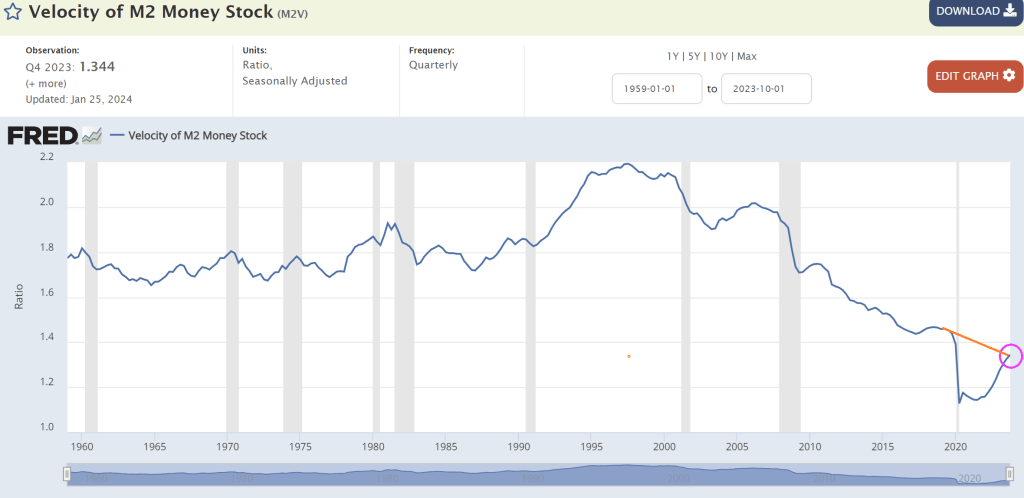

And indeed, it was only a few years ago, just before the pandemic sparked a stimulus flood of epic proportions, that western policy makers were switching to average inflation targeting and stating that they would run economies hot to create that higher inflation (they got it but not because of AIT). That was the first notable attempt to shift toward Financial Repression, but as Edwards notes, “unfortunately they were too successful and let the rampant inflation cat out of the bag.”

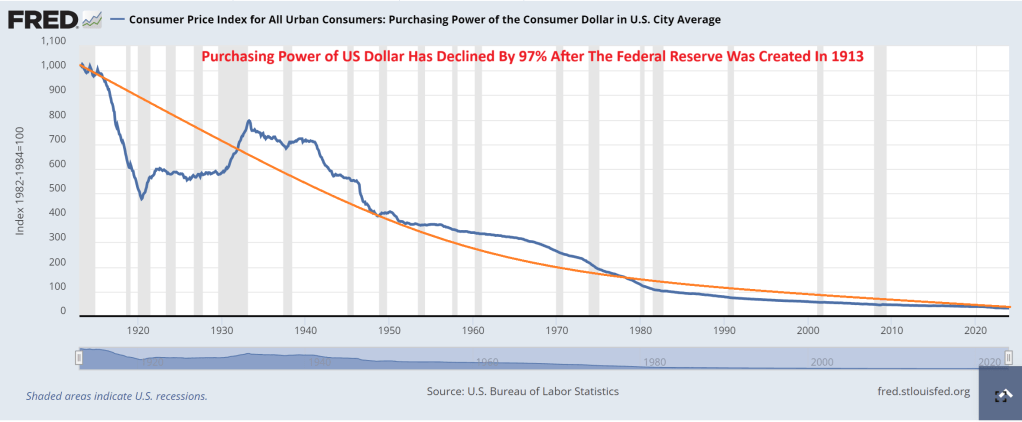

Which brings up the $64 trillion question: “Do the Fed and ECB really want inflation to return to pre-pandemic inflation lows?” Well, with global debt now about 7x higher in just the 21st century, and fast approaching $100 trillion, meaning it will all have to be inflated away somehow…

… Edwards’ answer is: “Not in my view.” And so while western economists deride Japan for its YCC policies, Albert says “that is where I think the US and Europe are heading as intractable government deficits drive up bond yields. During the next crisis, don’t be surprised to see yet more Japanification of western central bank policy. Plus ça change.” And don’t be surprised if the dollar – while appreciating against the rest of the world’s doomed currencies in the closed fiat-system loop – hyperdevalues against such finite concepts which mercifully remain out of the fiat system, such as gold and crypto.

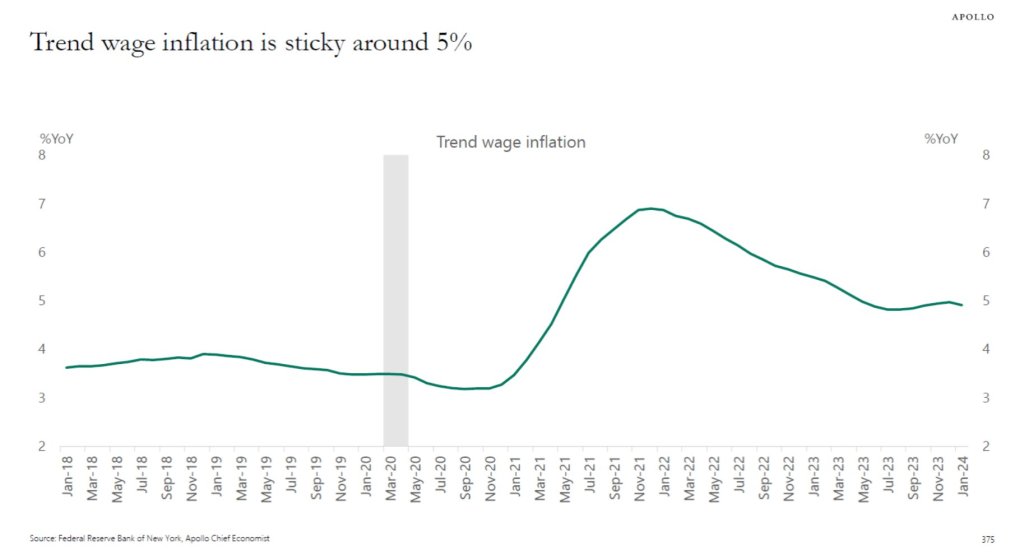

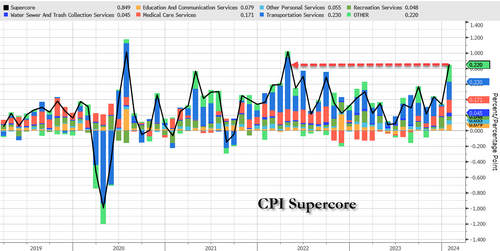

And wage inflation remains around 5%.

You must be logged in to post a comment.