The US is movin’ on up, to the dark side, while DC elites live in deluxe apartments in the sky. The US is movin’ on up to the dark side, we finally got a piece of the Banana Republic pie. … And its tastes horrible!

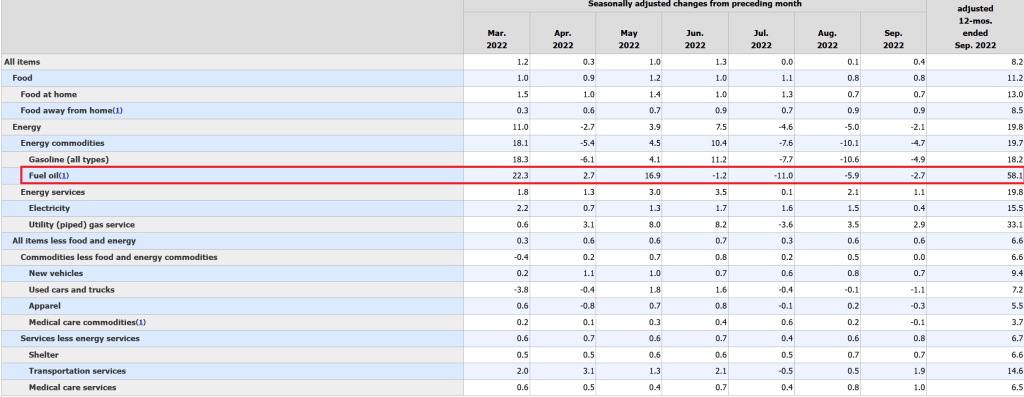

Today, the BLS released its inflation data. And it was terrible.

To begin with, headline inflation remains high at 8.2% YoY while CORE inflation (headline less food and energy) rose to 6.6% YoY.

Meanwhile, REAL average weekly earnings growth YoY further declined to -3.8% YoY.

On the bond front, the Bank of America ICE bond volatility index rose to Great Recession/banking crisis levels (also achieved during the Covid government shutdowns).

But back to the low-ball BLS inflation data. The biggest gain in price is … fuel oil at 33.1% YoY. Food at home rose 13.0% while gasoline rose 18.2%. Rent, according to the BLS, rose 6.6%.

Biden has probably been told by Ron Klain and Susan Rice that this is a good report.

You must be logged in to post a comment.