Don’t show Biden this story. Biden has never met a bad central planning scheme that he didn’t like and this one is TERRIBLE.

China’s struggling housing market is set to receive a boost from a new nationwide program funded by the People’s Bank of China to address oversupplied conditions. As a critical driver of the domestic economy, the nation’s housing market has been in a multi-year slump. This latest initiative by policymakers aims to stabilize the housing market and stimulate the broader economy.

Bloomberg reports that PBoC Deputy Governor Tao Ling announced the new 300 billion yuan ($41.5 billion) nationwide program of cheap funding to allow state-owned companies to purchase unsold homes.

Ling said the funding will be directed at 21 providers, including policy banks, state-owned commercial lenders, and joint-stock banks. A rate of 1.75% will be offered. The low-cost loans have a one-year term and can be rolled over four times.

The new program powerfully signals that policymakers are pushing for property policy easing and measures to balance the supply-heavy housing market, which casts a dark cloud over the world’s second-largest economy. This announcement appears to be a step in the right direction in a national-level policy.

Bloomberg first leaked the new rescue policies days earlier. We titled the note “Fiscal Bazooka: China Considers Buying Millions Of Homes To Save Property Market.”

Also, on Friday, policymakers eased mortgage rules and removed the mortgage rate floors for first and second homes. PBoC also lowered the minimum downpayment ratio for first-time homebuyers to 15%. The downpayment ratio for second-home purchases was lowered to 25%.

Chinese Vice Premier He Lifeng said that authorities in cities with excess home inventories should purchase unsold properties and convert them into affordable housing. He also urged local governments to repurpose inactive land parcels held by property developers to alleviate their financial troubles.

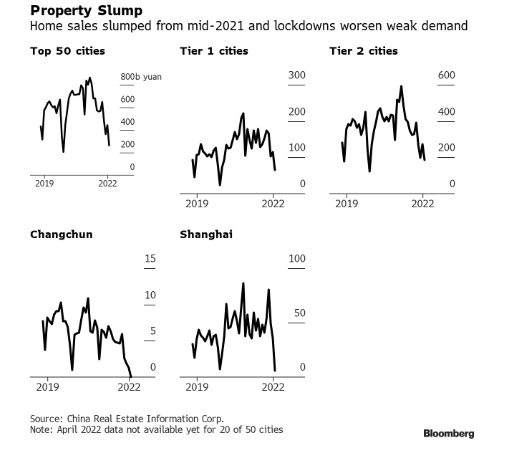

This was a very policy-heavy week to save the debt-stricken real estate market. Data showed that property investment and new home sales in April experienced larger contractions, while housing prices slid even further.

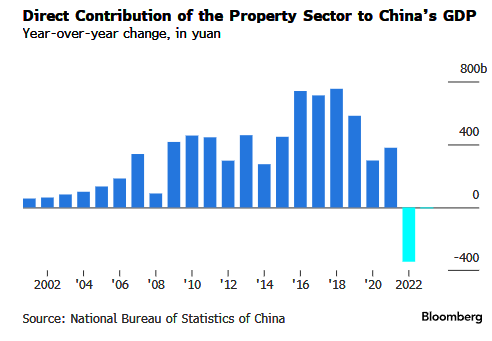

China’s ailing property sector is a drag on GDP.

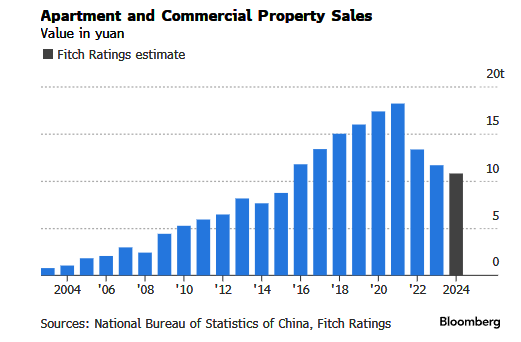

And apartment and commercial property sales are sliding.

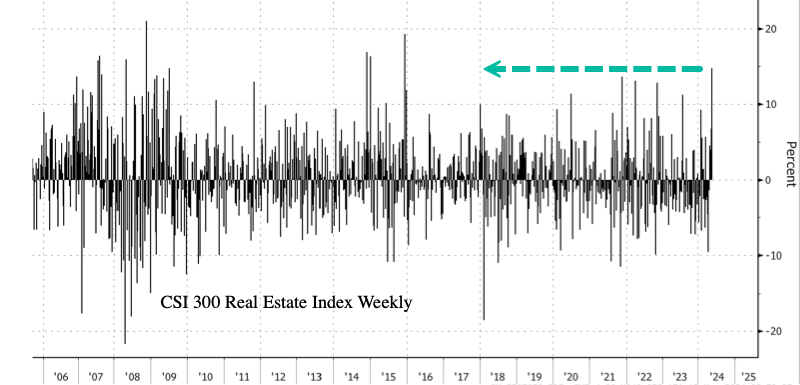

In markets, the CSI 300 Real Estate Index closed up 9%, with gains from April 24 totaling about 36%. Yet the latest gains in the property index are still 68% below the early 2018 peak.

The index’s weekly gain was the most since early December 2015.

It isn’t in a Communist countries’ DNA to let markets solve the problem … like letting prices correct no matter how painful that adjustment is. Biden and his “economic” advisor Jared Bernstein (not an economist but a public policy hack) would likely follow China’s idiotic solutions to the problem.

I debated Bernstein once at a Washington DC conference. He was arrogant but eventually confessed that he didn’t know anything about housing or mortgages. Nice economic advisor, Joe!

You must be logged in to post a comment.