Well, Kevin McCarthy (RINO-CA) and Patrick McHenry (RINO-NC) along with Jim Jordan (RINO-OH) and Marjorie Taylor Greene (RINO-GA) sold out America to Green Joe Biden (the Jolly Green Giant?) and pretty much guaranteed a Biden reelection as President and Democrats winning the House majority at the next election. Way to go McCarthy, McHenry, Jordan an Greene! You sold out America to the Progressive, destructive Left.

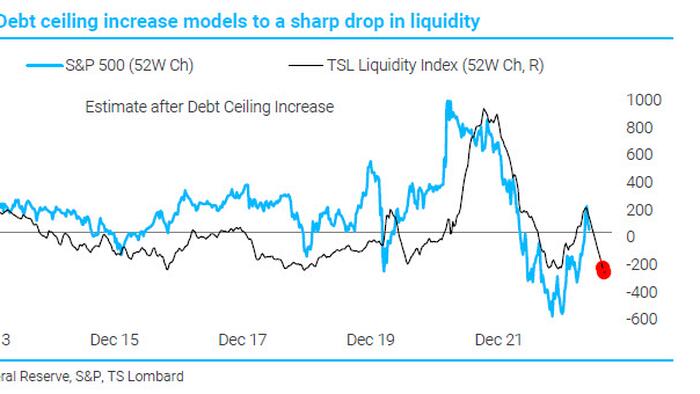

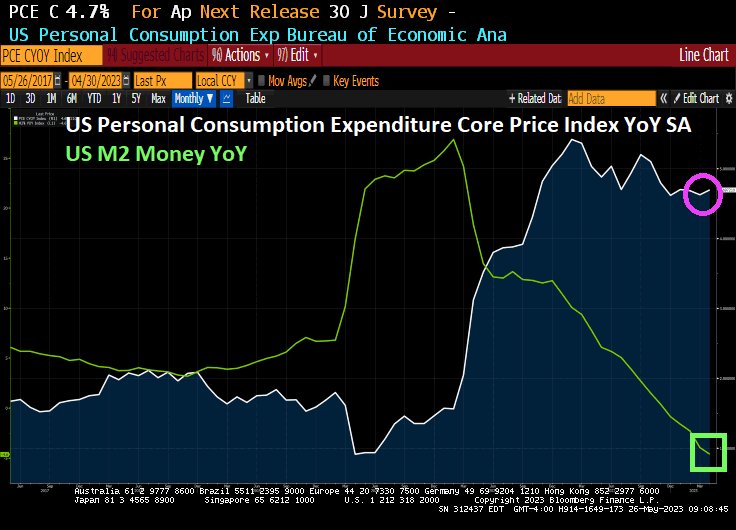

With a debt ceiling deal freshly inked, the US Treasury is about to unleash a tsunami of new bonds to quickly refill its coffers. This will be yet another drain on dwindling liquidity as bank deposits are raided to pay for it — and Wall Street is warning that markets aren’t ready.

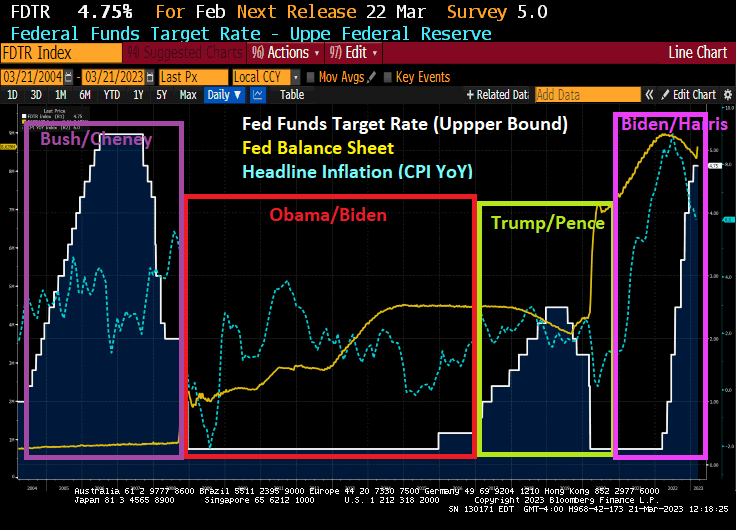

The negative impact could easily dwarf the after-effects of previous standoffs over the debt limit. The Federal Reserve’s program of quantitative tightening has already eroded bank reserves, while money managers have been hoarding cash in anticipation of a recession.

JPMorgan Chase & Co. strategist Nikolaos Panigirtzoglou estimates a flood of Treasuries will compound the effect of QT on stocks and bonds, knocking almost 5% off their combined performance this year. Citigroup Inc. macro strategists offer a similar calculus, showing a median drop of 5.4% in the S&P 500 over two months could follow a liquidity drawdown of such magnitude, and a 37 basis-point jolt for high-yield credit spreads.

The sales, set to begin Monday, will rumble through every asset class as they claim an already shrinking supply of money: JPMorgan estimates a broad measure of liquidity will fall $1.1 trillion from about $25 trillion at the start of 2023.

“This is a very big liquidity drain,” says Panigirtzoglou. “We have rarely seen something like that. It’s only in severe crashes like the Lehman crisis where you see something like that contraction.”

It’s a trend that, together with Fed tightening, will push the measure of liquidity down at an annual rate of 6%, in contrast to annualized growth for most of the last decade, JPMorgan estimates.

The US has been relying on extraordinary measures to help fund itself in recent months as leaders bickered in Washington. With default narrowly averted, the Treasury will kick off a borrowing spree that by some Wall Street estimates could top $1 trillion by the end of the third quarter, starting with several Treasury-bill auctions on Monday that total over $170 billion.

What happens as the billions wind their way through the financial system isn’t easy to predict. There are various buyers for short-term Treasury bills: banks, money-market funds and a wide swathe of buyers loosely classified as “non-banks.” These include households, pension funds and corporate treasuries.

Banks have limited appetite for Treasury bills right now; that’s because the yields on offer are unlikely to be able to compete with what they can get on their own reserves.

But even if banks sit out the Treasury auctions, a shift out of deposits and into Treasuries by their clients could wreak havoc. Citigroup modeled historical episodes where bank reserves fell by $500 billion in the span of 12 weeks to approximate what will happen over the following months.

“Any decline in bank reserves is typically a headwind,” says Dirk Willer, Citigroup Global Markets Inc.’s head of global macro strategy.

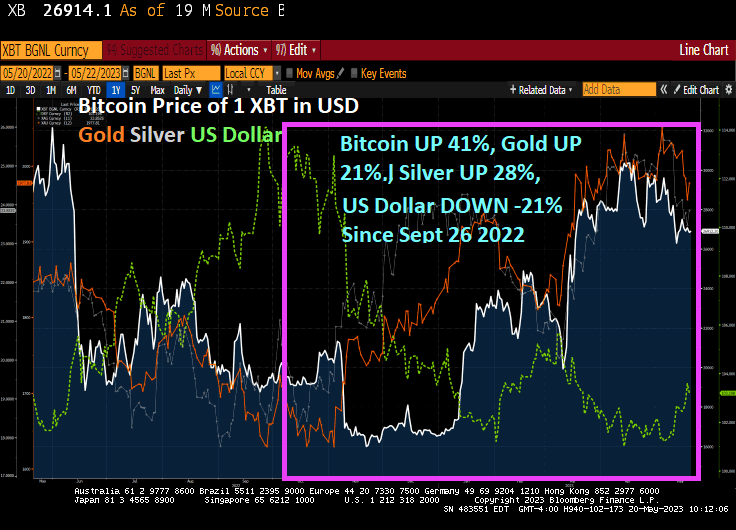

Bitcoin Faces Downside Risks After Debt Deal Moves Forward

Just when markets appear to be moving past the months-long drama around the US debt ceiling, holders of risky assets such as cryptocurrencies are likely facing a fresh challenge while the Treasury looks to rebuild its depleted cash balance with an estimated $1 trillion Treasury-bill deluge.

“The impending reserve drawdown, due to the [Treasury General Account] rebuild, may prove to be a headwind,” Citi Research strategists including Alex Saunders wrote in a note.

Citi analyzed the performance of risky assets during drawdowns and found that they were vulnerable to higher volatility and weaker returns. As such, the near-term outlook doesn’t seem too rosy for Bitcoin and Ether. “Both coins average negative returns in these scenarios, and BTC has significantly underperformed in the median case,” the strategists wrote Thursday.

The TGA, which keeps money for the Treasury, ballooned during the pandemic. It expanded again last year and is now about as low as it has ever been. Treasury, as a result, will need to replenish its dwindling cash buffer to maintain its ability to pay its obligations through bill sales, estimated at well over $1 trillion by the end of the third quarter. This supply burst may drain liquidity from the banking sector and raise short-term funding rates against an economy many say is likely to fall into recession.

This doesn’t bode well for digital-asset investors, who were just recovering from fears of a no-deal scenario for the US debt ceiling. While Bitcoin edged higher on Friday, it’s still hovering around the $27,000-mark that it has failed to break away from for several weeks.

“Crypto markets were not immune to fears of the US defaulting on its debt, selling off on negative developments and rallying on headlines suggesting progress,” the strategists said. They added that crypto has typically “fared well” amid issues concerning traditional financial institutions, citing the banking turmoil in March, a period in which Bitcoin outperformed. But perhaps risks of an institution such as the US government defaulting “doesn’t paint a favorable outlook for decentralized digital assets.”

To illustrate, the strategists used the Cboe Volatility Index, or VIX, as an indicator of the market’s fear to gauge whether a resolution would be passed before hitting the ceiling. And whenever equity market concerns were eased, that’s when Bitcoin outperformed.

“While in theory the potential default of an institution as impactful as the US government would bode well for decentralized technologies and systems, this may not currently be the case given that the crypto industry is still in its infancy and regulation has yet to be well-defined,” they wrote. “Another theory is that not raising the debt ceiling would lead to reduced US government debt and a lower fiscal deficit, and provide more credibility to fiat, particularly the dollar.”

On Friday, the Senate passed legislation to suspend the US debt ceiling and impose restraints on government spending through the 2024 election. The measure now goes to President Joe Biden, who forged the deal with House Speaker Kevin McCarthy and plans to sign it just days ahead of a looming US default.

Year-to-date, Bitcoin has rebounded some 60% after starting the year at around $16,500. Such optimism comes after 2022’s 64% drop, its second-worst year in its history. It rose about 1% to $27,178 as of 3:32 p.m. in New York, and is marginally higher from last Friday.

Bitcoin’s support hovers around $26,500, said Fiona Cincotta, senior market analyst at City Index, adding that a break below $25,000 could mean a deeper sell-off.

“The problem is the macro backdrop, which is relatively uncertain going forward with recessionary fears,” she said. “I think what will be looking for to make Bitcoin shine is a nice dovish pivot from the Federal Reserve. That might be the tide where we will see another decent leg higher.”

Range-bound trading has been Bitcoin’s defining characteristic of late, with its 30-day volatility reigning low at 1.8%, firmly staying firm within its two-month-long trading range. Despite growing short-term volatility, options implied volatility trended lower over the past week, according to K33’s Bendik Schei and Vetle Lunde. Even so, Bitcoin exchange-traded products continued to see steady outflows while Bitcoin volumes — spot and futures — are trending lower.

McCarthy, McHenry, Jordan and Greene, honorary Frenchmen!

Some content on this page was disabled on September 28, 2023 as a result of a DMCA takedown notice from Citigroup. You can learn more about the DMCA here: https://wordpress.com/support/copyright-and-the-dmca/ Some content on this page was disabled on September 28, 2023 as a result of a DMCA takedown notice from Citigroup. You can learn more about the DMCA here: https://wordpress.com/support/copyright-and-the-dmca/ Some content on this page was disabled on September 28, 2023 as a result of a DMCA takedown notice from Citigroup. You can learn more about the DMCA here: https://wordpress.com/support/copyright-and-the-dmca/

You must be logged in to post a comment.