Or as Bonnie Beecher almost sang in a Twilight Zone episode, “Come wander with China Joe Biden.” On The White House lawn. Or wander with The Federal Reserve!

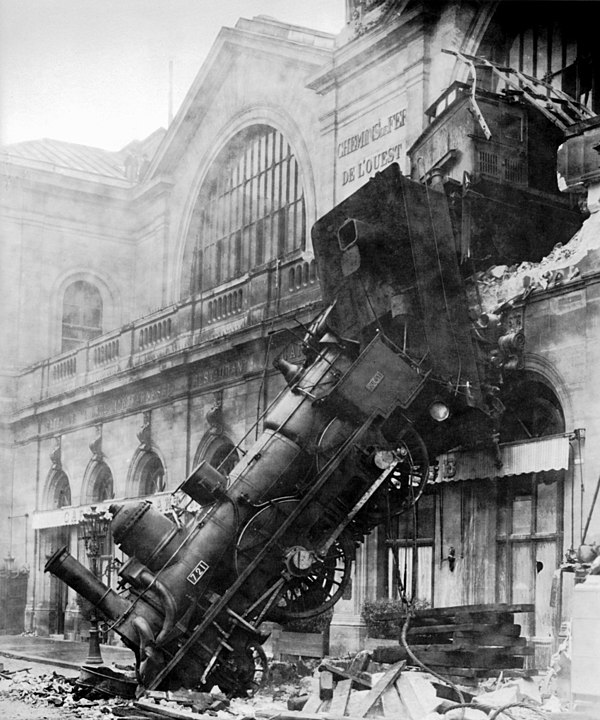

The USA is a runaway train with a dead man (China Joe is about as dead as one can be) in the engineer’s seat. The conductor goes through the cars assuring the passengers that everything is fine. . . never mind the screeching wheels on the curves. . . or the blinding strobe effect of low sunlight passing through the trees out the window at a hundred and forty mph. . . or the bump that made half the stuff in the overhead luggage rack jump out. More than half the people on-board are at tachycardia levels of fright — some are screeching — but the other less than half just remain fixed on their phones and laptop screens. They can’t be bothered to look out the window…

Okay, that’s a metaphor.

But if you’re a citizen of our country and care about it, these are the matters you’d better pay attention to, because they are all going off the rails.

The war in Ukraine. We started it in 2014 to mess with Russia and Russia is going to finish it. Who knows what our real motives were. A resource grab? A desperate ploy to erase our national debt by creating a global fiasco? Sheer psychopathic hatred of this Putin fellow? We can’t bring ourselves to acknowledge the failure of this ill-conceived venture. Instead, our feckless allies in Europe are foolishly rattling their sabers, apparently forgetting that you don’t bring a sword to a nuclear missile fight.

Mr. Macron in France affects to offer up his army for slaughter on the blood-soaked plains of Ukraine, just as the Ukrainians offered up a half a million of their young men so that Victoria Nuland could feel good about herself. Mr. Macron is insane, but the society he presides over is collectively insane, so perhaps he represents them well. Similarly, Olaf Scholz in Germany, whose top generals were caught on a leaked recording last week discussing their plan to blow up the Kerch Bridge that connects Crimea to Russia. Do you understand that this would be a direct attack on Russia, an act of War by NATO? And what the obvious consequence would be?

The phantom government of “Joe Biden” is too weak and mindless to join any negotiation. Ukraine and Russia are up to some kind of cross-talk down in Riyadh with Prince MBS. Even Mr. Zelensky went down for a day, though video appears to show him coked-up, sniffling and snarfling, not a good sign. If ever there was a time to end this stupid conflict, it’s now, before the Russian election. After that, terms will only be more difficult for Ukraine, up to direct custodial supervision instead of remaining a nation. It was never any of our business (though the Biden family, BlackRock, and the CIA saw fabulous opportunity to profit there).

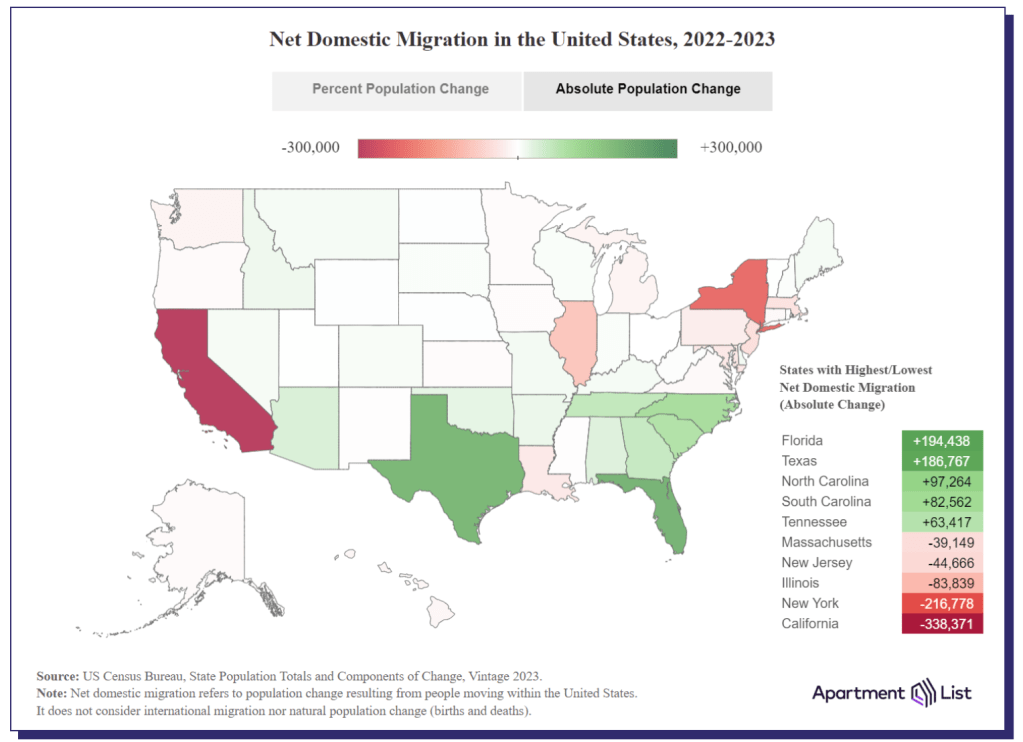

Next is the border. You saw last year how the blob elite greeted the transfer of illegal immigrants to their happy little island of Martha’s Vineyard. (They were not amused by Governor DeSantis’s prank, and off-loaded the mutts post-haste.) But that same smug demographic doesn’t care if hundreds of thousands are distributed to the big cities, which are now fiscally destabilized by them to an extreme, probably to bankruptcy.

Of course, that is not the main thing to worry about with what altogether amounts to millions of border-jumpers flooding our land. The main reason to worry is what the blob that invited them here intends for them to do, which, you may suspect, is to unleash mayhem in the streets, malls, stadiums, and upon our infrastructure just in time to derail the election — perhaps even to make war on us right in our homeland. The US government is paying for this whole operation, you understand, funneling our tax money to international cut-out orgs who set up the transfer camps in Panama, and buy the plane tickets for the mutts to cross the ocean, and coordinate with the Mexican cartels to shuttle this horde of mystery people among us to work their juju for the Democratic Party. The pissed-off-ness of the public has passed the red line on this.

A third FUBAR is the lawfare campaign of the Democratic Party and its regime in power against the citizens of this land. This folder includes overt and obvious political prosecutions by DA’s and AG’s who make election promises to “go after” individuals without such niceties as probable cause. It includes the gigantic new scaffold of inter-agency censorship and propaganda. It includes the psychopathic struggle sessions mandated by “diversity and inclusion” policy. It includes election-rigging directed by the likes of Marc Elias and Norm Eisen, getting states to fiddle laws on voter ID and mail-in ballots. It includes the political protection of rogue groups ranging from looter flash-mobs to Antifa anarchists who bust up things and people and burn buildings down. It includes state officials who peremptorily kick candidates off the ballot. It includes a nakedly biased judiciary, and especially the use of the DC federal district court to punish people extralegally, unjustly, extravagantly, and cruelly. In short, lawfare is the complete perversion of law, and we-the -people are entreated by reprobate officials such as Merrick Garland and Letitia James to accept it.

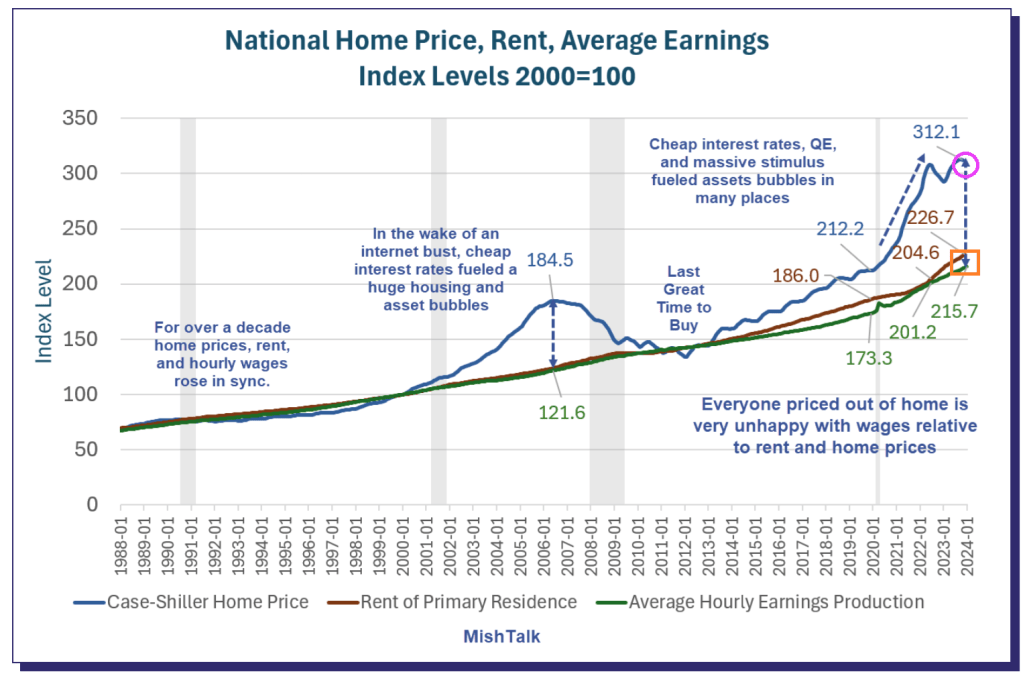

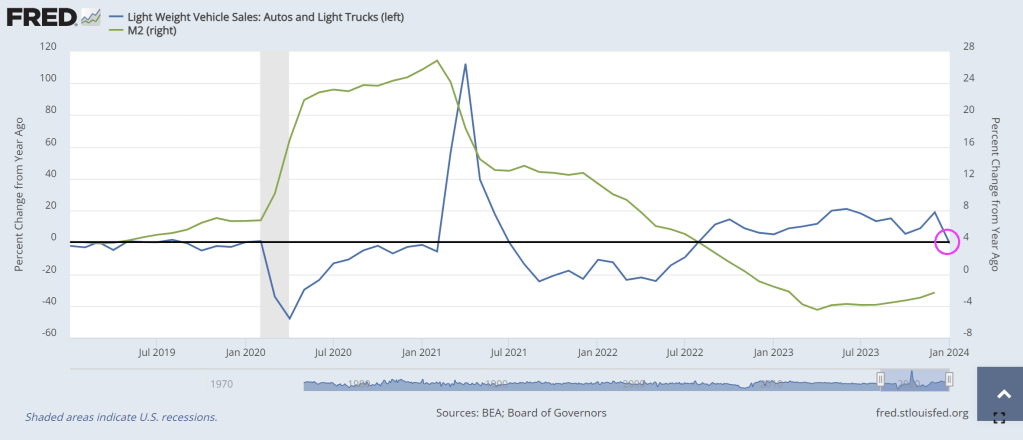

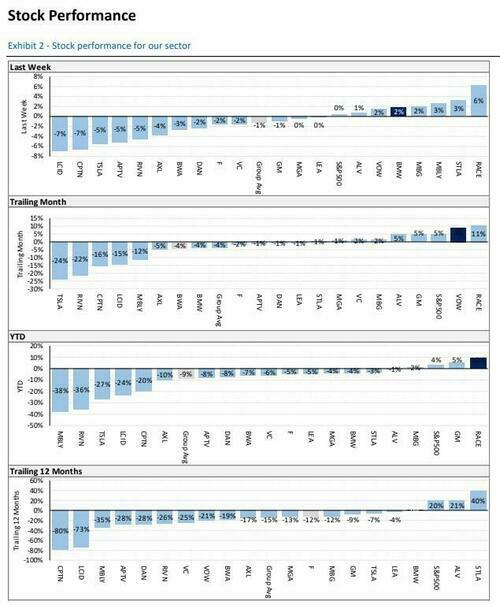

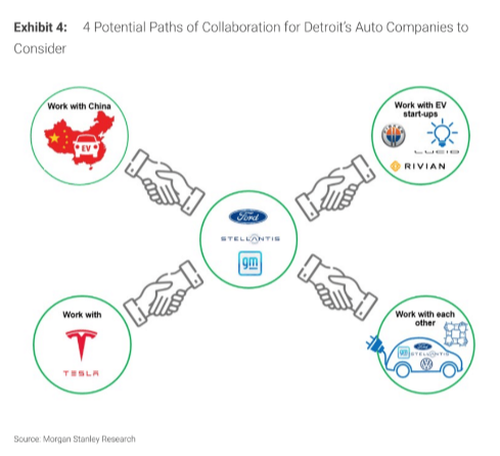

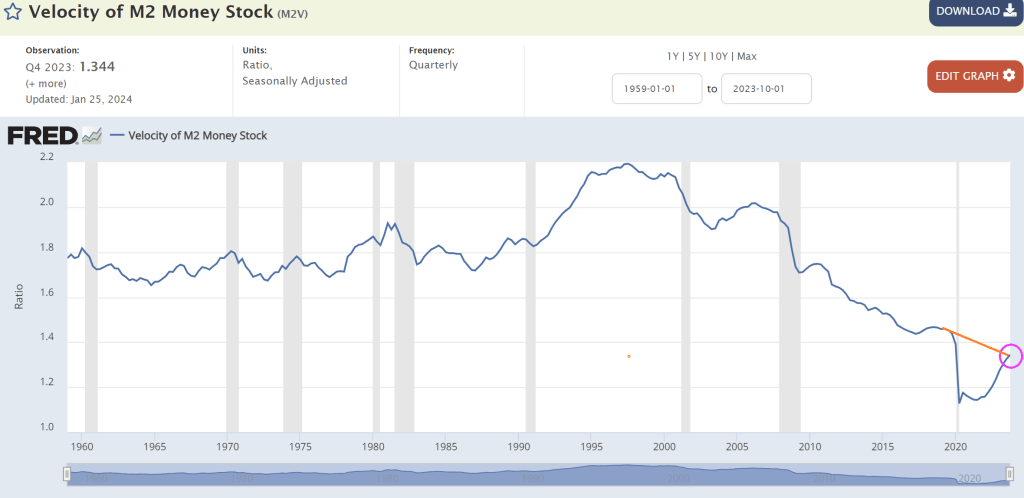

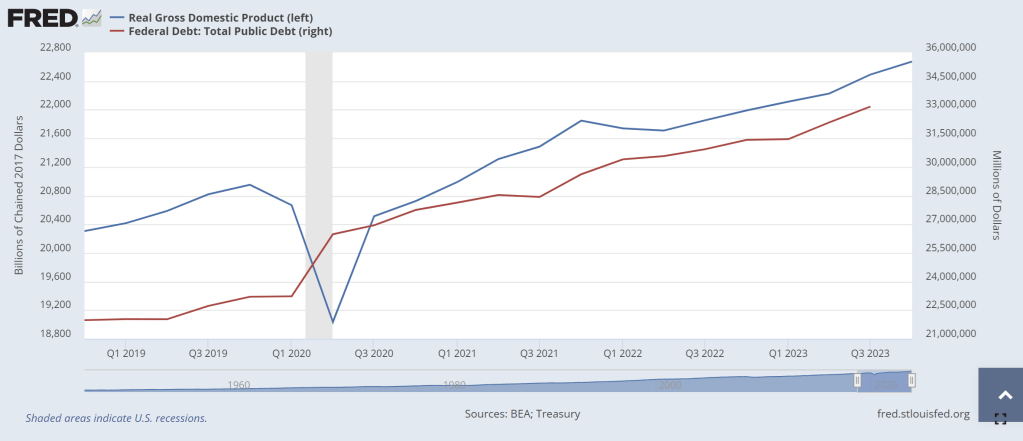

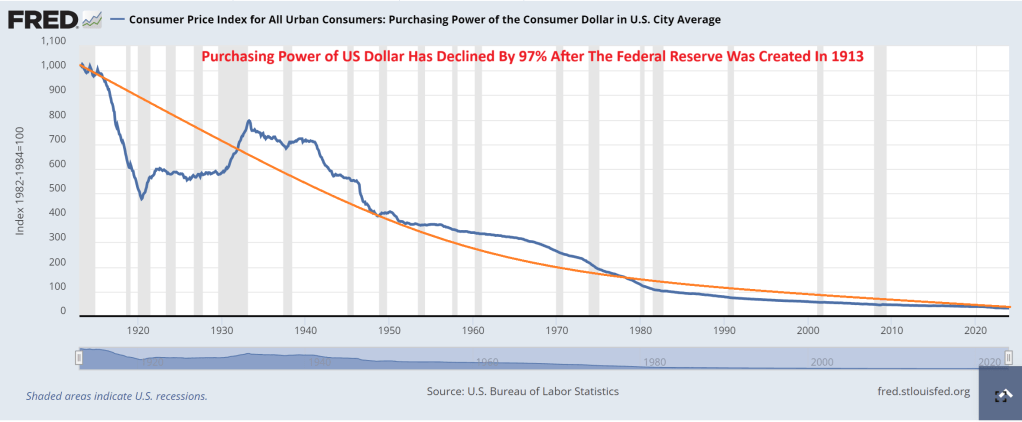

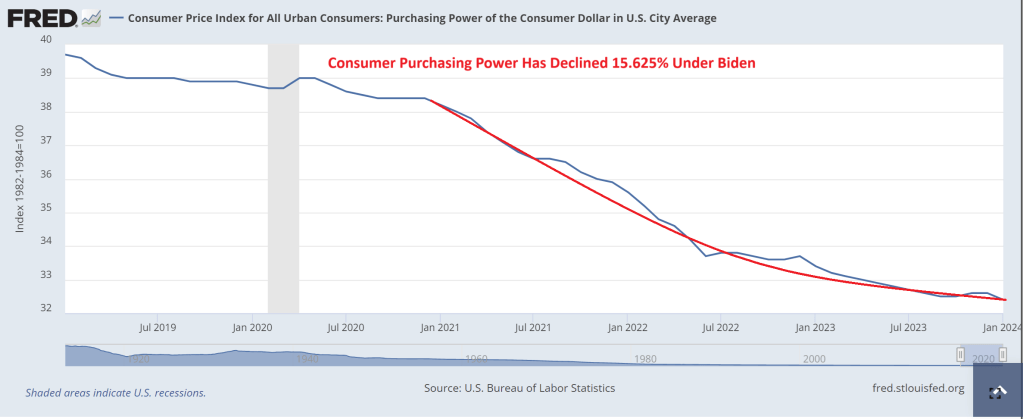

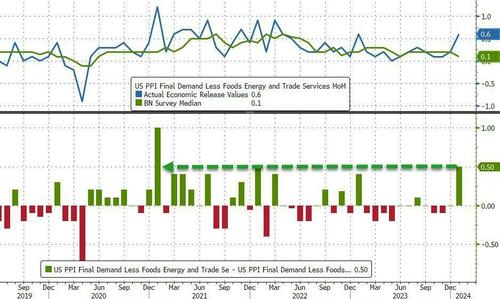

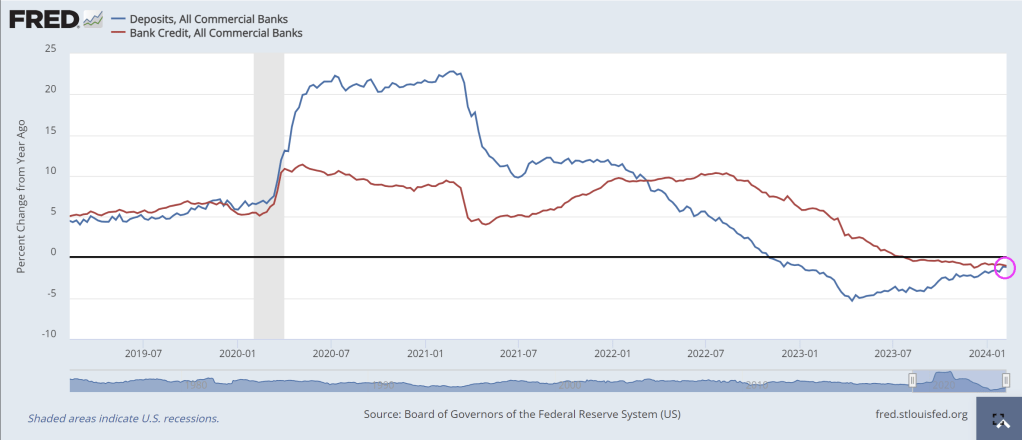

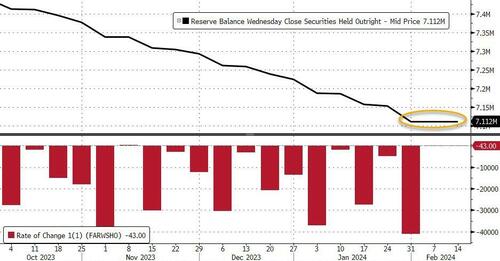

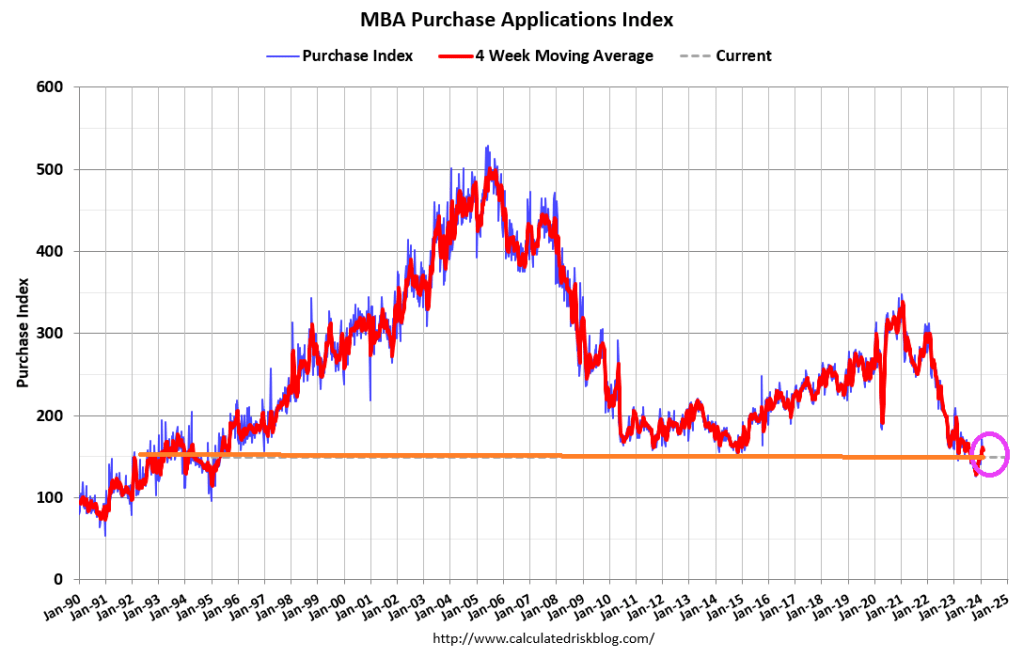

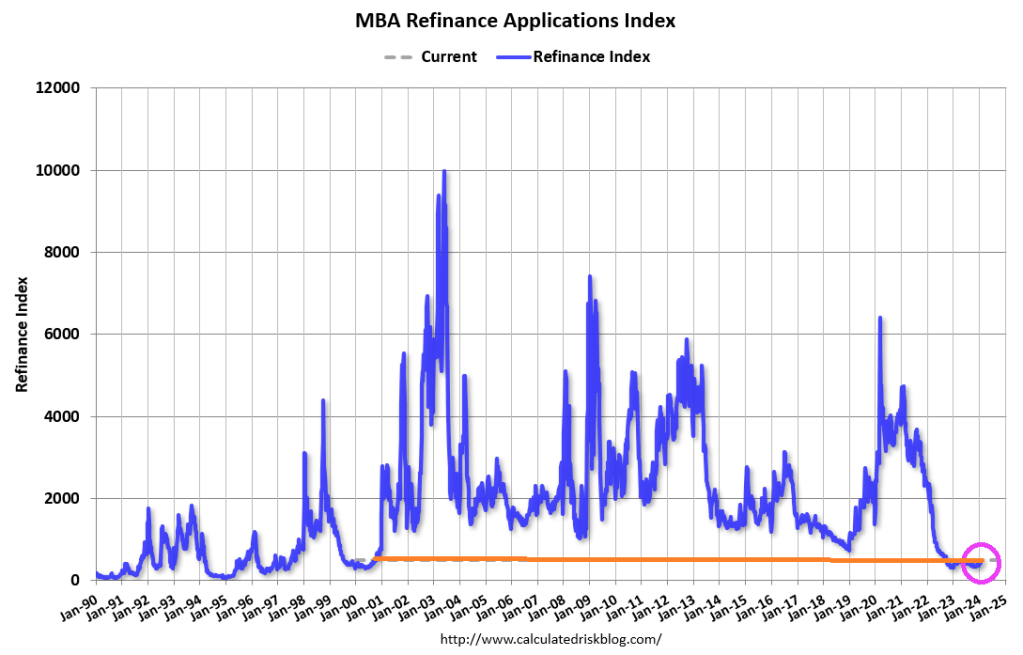

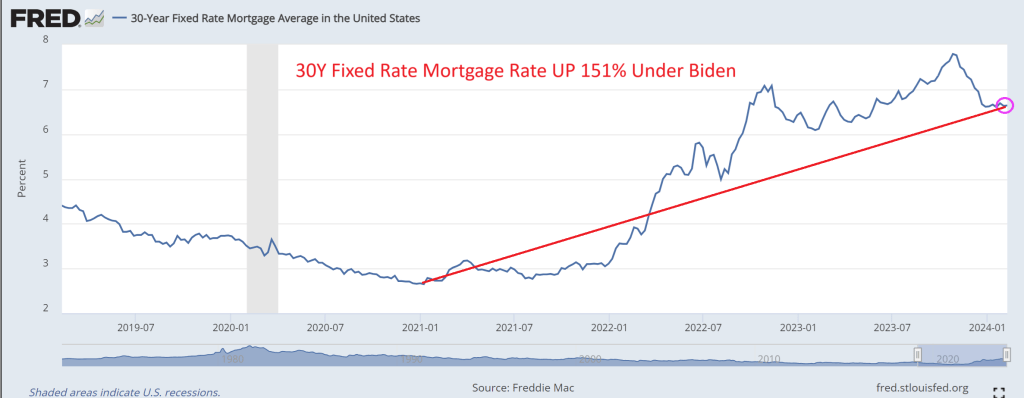

A fourth item on this list is the US economy which has been overwhelmed by maladministration of an overgrown monster bureaucracy, and the gross (perhaps fatal) mismanagement of the government’s money. The people of this land are not being allowed to do business, to find a livelihood, to transact fairly. “Joe Biden’s” shadow string-pullers are messing as badly with the oil and gas producers as they have messed with Ukraine. And they are doing it in pursuit of a laughable mirage: their “green new deal.”

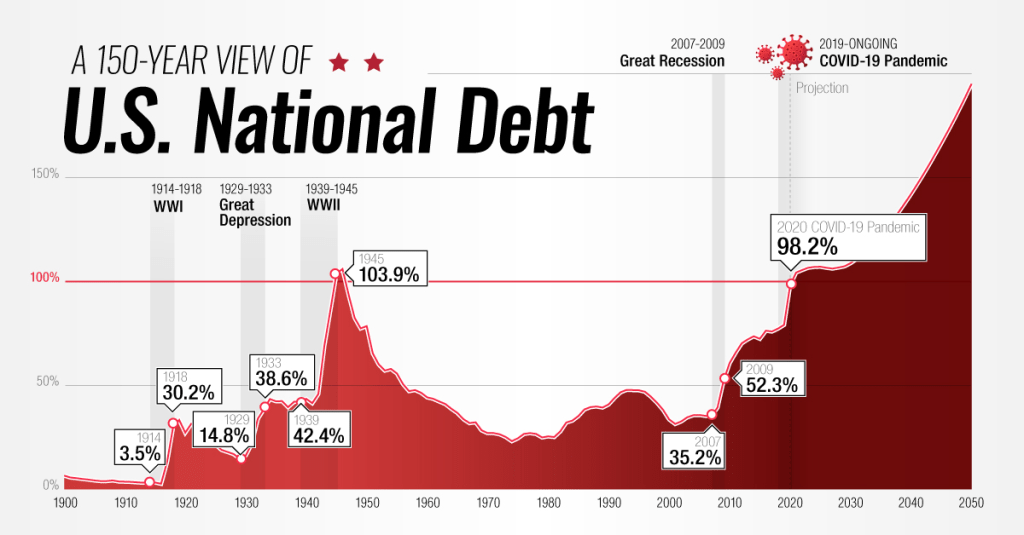

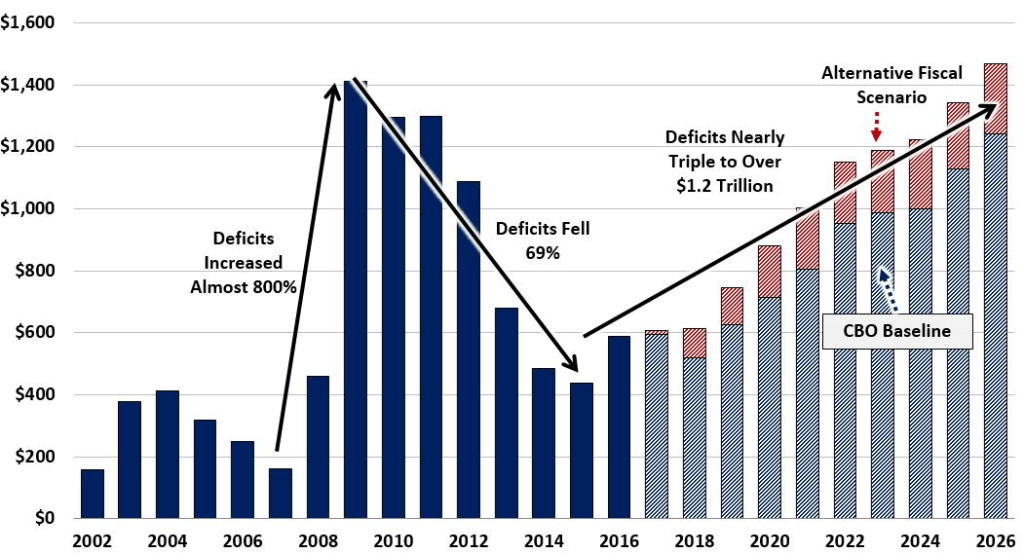

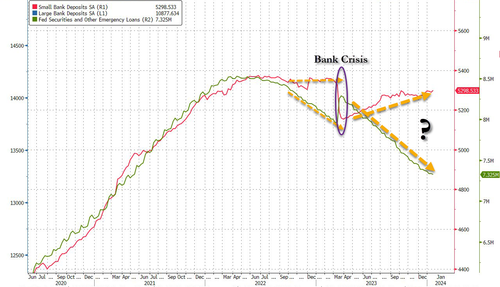

John Podesta, the “clean energy czar” who replaced the Haircut-in-search-of-a-brain called John Kerry, sits on a $370-billion slush fund that can be used to just dole out to anyone and everyone a political patronage payoff, especially to janky “community” orgs and NGOs with fake agendas. This really just amounts to an asset-stripping operation that will leave the American people busted and with broken supply chains for everything. Instead of annual budgets, Congress raises the US debt ceiling by “continuing resolutions” to keep the government from shutting down. The national debt races to the $35-trillion mark. As interest rates on debt rise, our debt payments now exceed our military spending. You can be sure that our country will break down financially very soon.

The capper on today’s list is the nation’s health, the racketeering system we’ve set up to care for it, and the public health agencies of the government that enabled the Covid-19 operation to happen. The CDC continues to push vaccines that have killed millions of Americans and more millions around the world, and has probably compromised the well-being of millions more going forward. Corporate medicine — that is, your doctor, and your hospitals — is a sinking Titanic of grift and chaos. Try to get an appointment to even see a doctor for an emergency. Try to avoid being bankrupted by your treatment. Try to get out of a hospital alive. Yeah, it’s that bad.

The doctors have surrendered your trust in them with their lying and their bullshit. The current director of the CDC, Mandy Cohen and her predecessor, Rochelle Walensky, have knowingly presided over the mass killing and injuries imposed on the mRNA vaccinated. Hundreds of their deputies should be liable for prosecution, and so should many of the other prominent characters in the Covid Saga: Fauci, Birx, Collins, Baric, Bourla, Daszak, Califf, Woodcock, Hahn, and many more.

What are we going to do about any of this? Return to the metaphor. The runaway train is still picking up speed. You can’t just jump off at 150 mph. If you’re one of the passengers watching this in horror, maybe you can decouple your car, or get the conductor to do it by any means necessary. Let’s say that each car behind the engine of this train is a state of the United States. Let the engine up front with the dead man at the controls ride that runaway to its terrible conclusion. Cut loose the cars behind it to take care of themselves, to slow down, get a grip on their situation, and make plans to find a better engine to pull the train. Decouple. Cut loose. It’s the only way.

You must be logged in to post a comment.